-

Alec Baldwin, Stockbroker

Posted by Eddy Elfenbein on October 10th, 2008 at 10:14 pm -

The VIX is at 75

Posted by Eddy Elfenbein on October 10th, 2008 at 2:16 pmI don’t even know what to say anymore. Hopefully, there will be a strong rally into the close. Maybe if Nouriel Roubini said he’s a buyer…ok, I doubt that will happen.

Here’s an idea: Maybe the stock market should open at 3 and close at 3:50. -

So Does this Mean We’re Not Going to Have $200 Oil?

Posted by Eddy Elfenbein on October 10th, 2008 at 1:24 pmSigh. It seems like only yesterday that everyone had a prediction for oil. Actually, it practically was yesterday…or at least, six months ago. Today oil dropped below $80.

Sooo…let’s take a walk down the memory lane, shall we?An Oracle of Oil Predicts $200-a-Barrel Crude

Arjun N. Murti remembers the pain of the oil shocks of the 1970s. But he is bracing for something far worse now: He foresees a “super spike” — a price surge that will soon drive crude oil to $200 a barrel.

Mr. Murti, who has a bit of a green streak, is not bothered much by the prospect of even higher oil prices, figuring it might finally prompt America to become more energy efficient.

An analyst at Goldman Sachs, Mr. Murti has become the talk of the oil market by issuing one sensational forecast after another. A few years ago, rivals scoffed when he predicted oil would breach $100 a barrel. Few are laughing now. Oil shattered yet another record on Tuesday, touching $129.60 on the New York Mercantile Exchange. Gas at $4 a gallon is arriving just in time for those long summer drives.

Mr. Murti, 39, argues that the world’s seemingly unquenchable thirst for oil means prices will keep rising from here and stay above $100 into 2011. Others disagree, arguing that prices could abruptly tumble if speculators in the market rush for the exits. But the grim calculus of Mr. Murti’s prediction, issued in March and reconfirmed two weeks ago, is enough to give anyone pause: in an America of $200 oil, gasoline could cost more than $6 a gallon.

That would be fine with Mr. Murti, who owns not one but two hybrid cars. “I’m actually fairly anti-oil,” says Mr. Murti, who grew up in New Jersey. “One of the biggest challenges our country faces is our addiction to oil.”

Mr. Murti is hardly alone in predicting higher oil prices. Boone Pickens, the oilman turned corporate raider, said Tuesday that crude would hit $150 this year. But many analysts are no longer so sure where oil is going, at least in the short term. Some say prices will fall as low as $70 a barrel by year-end, according to Thomson Financial. -

October 10 in Bear Market History

Posted by Eddy Elfenbein on October 10th, 2008 at 10:52 amTwo bear markets ended on October 10th. One in 1990 (at 2365) and again in 2002 (at 7,181.47).

The latter one ended at 10:10 am on 10/10. -

GM Nearing a Penny Stock

Posted by Eddy Elfenbein on October 10th, 2008 at 2:06 amThe market value of General Motors (GM) now stands at $2.7 billion, which is less than it was in 1929. By contrast, according to Forbes, Oprah Winfrey has a net worth of $2.5 billion. She also has a better book club.

-

So There’s Good News and Bad News

Posted by Eddy Elfenbein on October 9th, 2008 at 9:11 pmThe good news is that the Dow only fell 678.91 points today which is 99 points better than last Monday’s drop of 777.68.

The bad news is that since the market had fallen 10.7% in the intervening seven days, today’s sell-off is actually larger in percentage terms.

**Long Pause**

Now that I think about it, there’s no good news today.

Today was the 11th worst percentage drop in history. -

Gold Is Now Higher than the S&P 500

Posted by Eddy Elfenbein on October 9th, 2008 at 4:05 pmWow.

S&P 500 at 909.92.

Gold at $930

Update: The gold contract for December delivery closed at $886.50 today. -

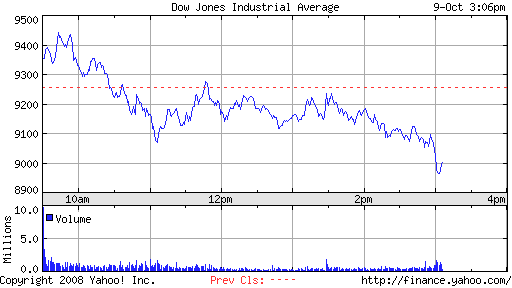

Remember Dow 9,000

Posted by Eddy Elfenbein on October 9th, 2008 at 3:06 pmWe’re now in the 8,000s.

-

Headline of the Day

Posted by Eddy Elfenbein on October 9th, 2008 at 10:40 amFrom the Register:

Oracle shareholders choke on Ellison’s package

Size an issue -

Great Moments In Government

Posted by Eddy Elfenbein on October 8th, 2008 at 9:16 pmSeptember 19, 2008:

S.E.C. Temporarily Blocks Short Sales of Financial Stocks

Financial Select Sector SPDR (XLF) closes at $22.38October 1, 2008

S.E.C. Extends Ban on Short-Selling

Financial Select Sector SPDR (XLF) closes at $20.67October 8, 2008

A Debate as a Ban on Short-Selling Ends: Did It Make Any Difference?

Financial Select Sector SPDR (XLF) closes at $15.28

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His