-

Seven Possible Shorts

Posted by Eddy Elfenbein on September 18th, 2008 at 2:00 pmShort sellers are a pretty happy bunch this week. In fact, the Brits just banned short selling for the next three months. Every likes to blame shorts for things that go wrong, but shorting is really the free speech of Wall Street.

I don’t do a lot of short selling, but here’s a list of potential shorts from one of my favorite bloggers, Timmy Sykes.

American Dairy (ADY)

EPIQ Systems (EPIQ)

Tanzanian Royalty Exploration (TRE)

Converted Organics (COIN) and the warrants (COINW)

Valence Technology (VLNC)

A-Power Energy Generation Systems (APWR)

Just glancing over these stocks, they appear to be truly awful. I’m not exactly holding my breath for Converted Organics to make that big jump to the NYSE. Tim’s strategy is basically to look at crappy penny stocks and get ready to pounce when the charts look good, meaning bad.

Short sellers have one big advantage over the rest of us: When things go wrong, they go really, REALLY wrong. There are far more crappy stocks that plunge 50% in a single day than there are good stocks that double in one day. To be a good short, you need to be very patience. Also, not having a soul helps.

I should try more shorting. I look through gobs of balance sheets everyday and I’m amazed by how much garbage is out there.

You can sign up to Tim’s Alert service here. -

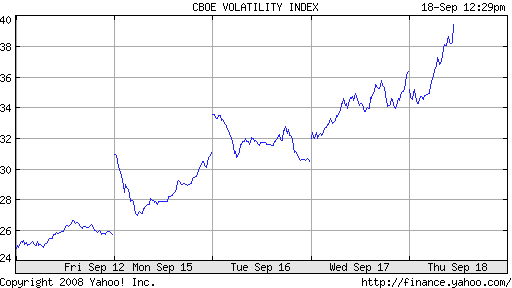

The Vix Soars

Posted by Eddy Elfenbein on September 18th, 2008 at 12:30 pmThis is getting out of a hand.

-

Kraft Will Replace AIG in the Dow

Posted by Eddy Elfenbein on September 18th, 2008 at 10:24 amSorry, Google. The winner is Kraft.

Kraft Foods Inc. will replace American International Group Inc. in the Dow Jones Industrial Average effective Monday, a further sign of the woes afflicting the insurance giant.

The change comes as the federal government late Tuesday agreed to take over the troubled insurance giant in an $85 billion bailout.

The composition of the Dow industrials was last changed in February, when Bank of America Corp. and Chevron Corp. replaced former Kraft parent Altria Group Inc. and Honeywell International Inc.

Robert Thomson, managing editor of The Wall Street Journal and overseer of the Dow’s makeup, said not adding a financial company to replace AIG is prudent at this time “because of the extremely unsettled conditions.” He added Kraft was added because the index has no food companies.Kraft was effectively a member of the Dow until last year when it was spun off from Altria.

-

The Panic of 1873 Begins 135 Years Ago Today

Posted by Eddy Elfenbein on September 18th, 2008 at 9:05 am

On Thursday, September 18, 1873, the Panic of 1873 reached crisis proportions at 11:00am on Wall Street, when H.C. Fahnstock, the New York partner of Jay Cooke (one of the leading gold market participants), announced that Cooke’s office was closed. Cooke, in his Philadelphia office, admitted it was true, and the most prominent banker in the country was suddenly bankrupt.

Robert Sobel, writing like Stephen King in Panic on Wall Street, said the “coal-black steed named Panic” quickly “thundered riderless down Wall Street,” where “a monstrous yell went up and seemed to literally shake the building in which all these mad brokers were for the moment confined.” Along with Jay Cooke, 37 other banks and two brokerage houses closed their doors on this date alone. In the ensuing days, the losses increased and the NYSE was forced to close down for over a week. With the situation growing dire, the secretary of the Treasury decided to infuse the economy with $26 million in paper money and the market eventually re-opened.

Jay Cooke failed over trying to construct a second Transcontinental Railroad, but demand could not support a second line. He was merely a symbol of gross over-speculation in land and securities, followed by the issuance of too much paper money, resulting in higher inflation. (Sound familiar?) The Panic of 1873 started with a bang, as over 5000 businesses failed in the last quarter of 1873, but the Panic lingered long, as another 5,000 failed over the next five years. Panics hit America every 17 years, on average, for about a century, from 1819 to 1920 (in 1819, 1837, 1857, 1873, 1894, 1907 and 1920). The word “panic” aroused such a negative reaction (in 1894 and 1907) that Herbert Hoover invented a less threatening word for the 1929 event—connoting a small pothole in the road. Hoover called the 1929 panic “merely a depression.”

(Via: Gary Alexander) -

Weird

Posted by Eddy Elfenbein on September 17th, 2008 at 4:25 pmOn Monday, the S&P 500 lost -4.7136%.

Today, the S&P 500 lost -4.7141%. -

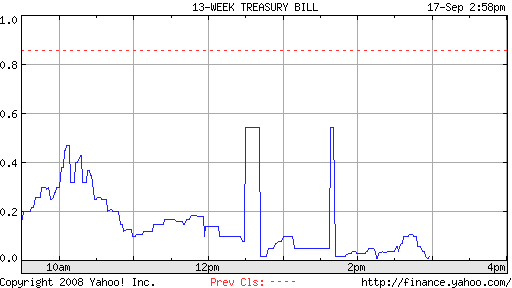

The Three-Month T-Bill

Posted by Eddy Elfenbein on September 17th, 2008 at 2:58 pmAt one point today, the yield on the three-month Treasury bill (^IRX) hit 0.01%!!

One Freakin Bip!!

This means that the risk-free rate is now in direct competition with the underside of your mattress.

-

The U.S. Government Now Sponsors Manchester United

Posted by Eddy Elfenbein on September 17th, 2008 at 1:25 pmNow that the Feds own 80% of AIG, which is one of Manchester United’s largest sponsors. So our government now sponsors Man U.

-

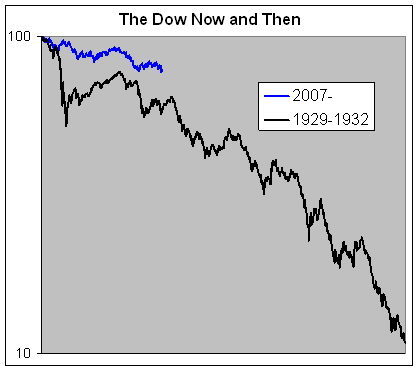

The Next Depression?

Posted by Eddy Elfenbein on September 17th, 2008 at 12:20 pmWell, I’m not convinced. Here’s a look at the Dow from its 1929 peak compared with the Dow from its 2007 peak.

-

AIG’s Advertizing…Now with Irony

Posted by Eddy Elfenbein on September 17th, 2008 at 10:35 amPart of the Fed’s deal is that AIG’s CEO had to go, but what happens to this kid?

-

Who Replaces AIG in the Dow? How about the Fed?

Posted by Eddy Elfenbein on September 17th, 2008 at 6:48 amNow that AIG (AIG) is public property, I wonder who will replace the stock in the Dow Jones Industrial Average (^DJI).

My choice: The Federal Reserve. Barring that, the Bank of China.

Over the years, the Dow has made many adjustments, but I can’t ever recall a stock being pulled because it nearly went under. AIG was added to the index in April 2004 and from the get-go, it was a drag the Dow. In fact, the last few additions haven’t helped much.

One word to add: The Dow is price-weighted which means that a stock’s weighting in the index is solely based on its price, no matter how many shares outstanding there are. To find out the index level, just add up the prices of the 30 stocks and adjust by a divisor (roughly multiply the sum of the stocks by eight).

It’s an antiquated measure, but it’s got quite a nice brand name after 112 years in business. Personally, I prefer the S&P 500 (^SPX) and that’s what I use for comparisons with my Buy List.

The last change to the Dow came in February when Bank of America (BAC) and Chevron (CVX) replaced Altria (MO) and Honeywell (HON). Since changes are pretty infrequent, I hope the gatekeepers make a few more changes along with booting AIG.

I’d vote to remove AIG, plus Alcoa (AA) and General Motors (GM). GM is frankly an embarrassment to the index.

So what should the new stocks be? I’d say the front-runners are Google (GOOG), Cisco (CSCO) and Apple (AAPL). Here’s a list of mega-cap stocks that aren’t currently in the Dow and their market caps (in billions).

Google…………………………$139.3

Cisco……………………………$134.5

Apple…………………………..$123.9

Wells Fargo…………………..$115.6

Pepsi……………………………$114.2

Philip Morris…………………..$110.8

ConocoPhillips………………..$109.8

Schlumberger…………………$104.2

Oracle……………………………$97.8

Abbott Labs…………………….$92.2

Qualcomm……………………….$78.6

Amgen……………………………$69.7

UPS………………………………..$69.4

I’d also make a case for a stock like UPS (UPS). It’s not the biggest, but its business is probably a better reflection of the larger economy than many bigger stocks.

On a side note, little changes to the Dow can have major impacts. The editors of the Wall Street Journal changed the index in 1939 by tossing out IBM (IBM). They added it back in 1979. In those 40 years, IBM gained 22,000%. If the editors had left it in, the Dow would now be about 35% higher than where it is now. All the historical benchmarks would be different. The Dow would have cracked 1,000 in 1961 instead of twelve years later.

Behold the power of one really good stock.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His