-

Let’s Have a Commission

Posted by Eddy Elfenbein on September 16th, 2008 at 11:38 amGood news! John McCain has a plan to fix the credit crisis, let’s form a commission!

We need to set up a 9/11 Commission in order to get to the bottom of this and get it fixed, and act to clean up this corruption…They’ve violated the social contract that capitalism and the citizen have, and we can’t ever let this happen again. I’ll make sure it never happens again.

Commissions are basically community organizers, but for nicer communities.

-

By the Way

Posted by Eddy Elfenbein on September 16th, 2008 at 11:23 amMy Buy List is up 0.58% today.

-

S&P 500 Daily Changes

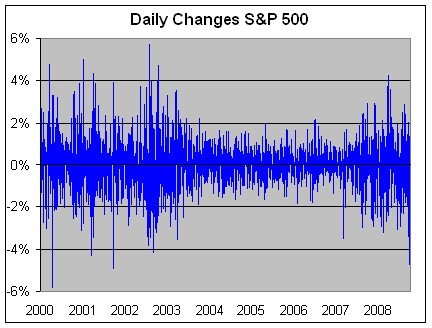

Posted by Eddy Elfenbein on September 16th, 2008 at 11:17 amYesterday was the biggest sell-off since 9/11. Here are the daily changes for this decade.

The worst day came on April 14, 2000 when the S&P 500 lost -5.83%. The Monday after 9/11 (September 17, 2001), the market dropped -4.92%. Yesterday, the market lost -4.71%.

The best day came on July 24, 2002 when the market jumped 5.73%. The second-best day came five days later when the market rose 5.41%. -

Barclays seals Lehman deal

Posted by Eddy Elfenbein on September 16th, 2008 at 10:40 amFrom the FT:

Lehman Brothers on Tuesday reached a deal to sell certain parts of its business to Barclays, which had been in talks over the weekend to buy the entire investment bank before it filed for bankruptcy protection on Monday.

The two parties reached a deal in the early New York morning, though the exact Lehman businesses involved, and the price at which they will be sold, remained unclear. A deal could be accompanied by a small capital raising by the UK lender.

People close to the matter said it was likely that the deal centered around Lehman’s core US broker-dealer operations, which perform securities underwriting tasks, provide merger advice to lucrative clients, and conduct trading. -

Thanks Eliot

Posted by Eddy Elfenbein on September 16th, 2008 at 10:29 amLarry Ribstein has a great post on the failure of SOX. Weren’t all those controls there to protect us?

Remember when SOX was supposed to, at enormous cost, expose the weaknesses and risks lurking in companies so they could be addressed to avoid another Enron? As Tom Kirkendall and I have been observing for awhile: fat lot of good SOX did. Could we please think about that when we try to regulate in the wake of this catastrophe?

And while we’re at it, let’s think about yesterday afternoon’s market plummet. That happened (and it’s likely to continue this morning) because AIG, facing catastrophic downgrades of its securities, needs 70 billion by tomorrow to avoid bankruptcy.

Should we worry about that? Here’s what the WSJ has to say:

The company, whose stock fell 61% yesterday, is such a big player in insuring risk for institutions around the world that its failure could shake the global financial system. much of its exposure is related to credit default swaps, insurancelike contracts tied to corporate defaults. * * * The market for credit default swaps is immense, trading against about $62 trillion of debt. Some participants in the largely unregulated market worry that the default of a major player such as AIG could trigger chaos. * * *

[T]he firm is used by many companies world-wide to manage a range of risks, including exposure to investments in subprime mortgages. Its demise would potentially make it harder or more expensive for businesses to control their risks.

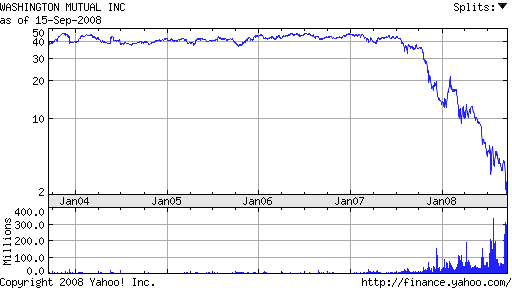

How did this happen? Well it’s worth speculating that it had something to do with AIG being left without its long-time leader, Hank Greenberg, for which we can thank Eliot Spitzer. As I’ve noted, per the WSJ (last May):

A careful and lengthy look at the evidence available so far . . . suggests that the AIG case, like so many others that Mr. Spitzer brought, was an example of prosecutorial excess. Instead of uncovering some great fraud by a titan of industry, its main result has been to damage the company, and harm innocent managers and shareholders. * * *Trading above $72 in February 2005 before it was Spitzerized, AIG shares closed yesterday at $39.57. The company’s directors defend themselves by saying Mr. Spitzer gave them little choice but to dismiss Mr. Greenberg. Whether that was true at the time, they – and Mr. Spitzer – owe an apology to AIG shareholders. -

In Retrospect

Posted by Eddy Elfenbein on September 16th, 2008 at 10:25 amThe $10 BSC got in March is looking pretty good. Lehman’s big mistake was being too small and too late. If they blew up bigger and earlier, they’d probably be in much better shape today. (It would be hard to be in worse shape.)

-

Now They Tell Us

Posted by Eddy Elfenbein on September 16th, 2008 at 10:15 am

-

The Bubble Isn’t All Bush’s Fault

Posted by Eddy Elfenbein on September 16th, 2008 at 10:08 amI just don’t get the argument that the credit bubble is the fault of George Bush, or free market ideology. People toss around the words “more regulation” as if that’s the obvious cure. Sure, if we restricted the number of people who got mortgages, I assume the bubble would have been averted. But who would have been the first person barred from getting a mortgage? The message I’m getting from this crisis is not that government should do more, but it’s really how little the government can do.

-

Oil is Down Again

Posted by Eddy Elfenbein on September 16th, 2008 at 9:51 amAs far as impacting the overall economy, Lehman’s downfall doesn’t mean very much. In the larger scheme of things, Lehman was never really a big company. The media always like to use the, how will this effect Main Street angle. Simply put, it won’t.

But what will impact Americans is the plunge in oil. I see that oil is down sharply again and is now below $92. I remember way, way back when we would have thought $92 for oil was expensive. For example, the beginning of the year.

In my very unsophisticated analysis, I think gold is due for a big fall. -

Goldman’s Net Plunges

Posted by Eddy Elfenbein on September 16th, 2008 at 9:44 amThe market is rattled again this morning as Goldman Sachs (GS) reported a major earnings decline. For their third quarter, Goldman earned $1.81 a share which beat Wall Street’s consensus of $1.73. This is a major shortfall compared with the $6.13 a share it made for last year’s third quarter.

I’m seeing a lot of scary headlines (Goldman Sachs net plunges 70 percent) but some perspective is needed. Goldman is still making a lot of money, just not the absurd amounts seen in 2006 and 2007. GS’s profits are up 25% in the last three years. Annualized, that’s not a huge increase, but it’s still up.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His