-

Buy List Update

Posted by Eddy Elfenbein on November 28th, 2007 at 7:28 amThe Buy List continues with a very impressive fourth-quarter rally in terms of relative performance. Through yesterday, the Buy List was down 0.32% for the year while the S&P 500 is up 0.70%. That’s a gap of just 1.02%.

But on October 18, the Buy List was getting creamed by the S&P 500, 8.59% to 1.77%. That’s a gap of 6.82%.

It looks like we have an outside chance of catching the index before the year is out. That was something I wouldn’t have believed just five weeks ago.

Yesterday, the Buy List jumped 1.93% compared with 1.49% for the S&P 500. The big help came from Donaldson (DCI) which jumped 8.5%.

Donaldson announced earnings of 53 cents a share for its fiscal first quarter compared with 43 cents last year. Analysts were expecting 48 cents a share. The company also said it expects full-year earnings (their fiscal year ends in July) of $1.97 to $2.07 a share. That would make their 19th straight record year. -

The Plunge of the 10-Year Yield

Posted by Eddy Elfenbein on November 27th, 2007 at 11:49 amYesterday was the 11th largest fall in the 10-year T-bond rate since 1962. (Note: I’m referring to the percent change in the rate.)

Date……………………..Change

10/20/1987……………..-7.39%

4/16/1980……………….-5.79%

10/7/1982……………….-5.13%

3/5/2004…………………-4.96%

9/17/2001………………..-4.75%

12/19/1980………………-4.39%

6/6/1986………………….-4.33%

8/6/2004………………….-4.09%

8/16/1971…………………-4.04%

2/28/1980…………………-4.01%

11/26/2007……………….-3.99% -

Wall Strip Looks at Fair Isaac

Posted by Eddy Elfenbein on November 27th, 2007 at 10:31 am -

An Official Correction

Posted by Eddy Elfenbein on November 26th, 2007 at 4:51 pmThe Dow is now down 10% from its all-time high close. On October 9, the Dow closed at 14,164.53. Today’s close of 12743.44 makes for a drop of 10.03%. The S&P 500 is down 10.09%.

-

Bed Bath & Beyond Is Now Below $30

Posted by Eddy Elfenbein on November 26th, 2007 at 12:37 pmShares of Bed Bath & Beyond (BBBY) are now trading at $29.72. This is the lowest the stock has been in the last five years.

I’m not a believer that the housing market is having a severe impact on its business. There is some impact, but it’s easy to overstate.

The company’s quarterly sales growth numbers have been pretty stable for the past three years, each quarter coming in around 10%-14%.

BBBY is a remarkably efficient company. Gross margin usually run in the low 40% range. Operating margins have slipped a bit from 15% to 13%, but that’s to be expected. Net margins are down from 10% to about 8.5%. Both are higher than they were during the run-up in housing prices.

There’s a big difference is a slowdown in earnings growth and losing a lot of money. Now let’s look at some of the homebuilder.

Lennar (LEN) will see its EPS drop from $8.32 two years ago to $-4.90 this year. DR Horton (DHI) will drop from $4.62 to $-2.27. KB Home (KBH) will drop from $9.53 to $7.61.

Basically, BBBY’s return-on-equity has fallen from about 24% to around 20%, yet their shares have fallen by one-third. Compare 20% ROE to the 10-year T-bond that’s now paying about 4%. -

Cyber Monday Myth and Reality

Posted by Eddy Elfenbein on November 26th, 2007 at 9:50 amDon’t get too worked up about Black Friday or Cyber Monday. They’re not the busiest days of the year.

While not as famous as Black Friday, retailers just a few years ago invented Cyber Monday as a way to create buzz around online shopping.

The National Retail Federation’s online division, Shop.org, coined the term in November 2005.

Some retailers had noticed an uptick in online sales, and the federation decided to brand it. Now, two years later, more and more stores are playing off the Cyber Monday theme and offering sales.

“It’s a starting point. It’s a kickoff point where many retailers have special deals and bargains,” said Scott Krugman, spokesman for the National Retail Federation. “Retailers are having special Cyber Monday sales, and the way I see it, if retailers are attaching a sale and calling it Cyber Monday, it’s true.”

Shop.org said that 72 percent of online retailers are planning a special promotion for Cyber Monday this year, up from nearly 43 percent just two years ago.

But don’t confuse the name with big purchases. Cyber Monday is by no means the busiest day for online sales, just as Black Friday is not the biggest day of sales for most stores.

“Black Friday is a great day for creating energy, buzz and excitement about the holiday season,” Krugman said.

So, what is the busiest shopping day of the year?

The Saturday before Christmas. -

Barron’s on Harley-Davidson

Posted by Eddy Elfenbein on November 24th, 2007 at 7:50 pmYet when the Street throws in the towel on Harley-Davidson — as it seems to do every few years — that is usually the best time to buy the shares. Harley has fallen 30% to 40% ahead of previous U.S. recessions, only to rebound when the economy perks up. This time, the stock could top 60, although that is unlikely to happen tomorrow, or the day after.

-

Web Freebies

Posted by Eddy Elfenbein on November 24th, 2007 at 4:33 pmThis is cool. Business Week has listed 101 freebies on the Web.

-

The World’s Largest Outlet Mall

Posted by Eddy Elfenbein on November 24th, 2007 at 3:53 pmIn the eyes of Europeans, the United States has become one enormous outlet mall:

Hours after her flight from Dublin landed in Boston on Thanksgiving, Alice Kinsella headed in a white van with a dozen relatives and friends to Wrentham Village Premium Outlets. The 36-year-old has never visited Boston, but she is bypassing the sights for an extended weekend of binge shopping that started at midnight yesterday.

For Kinsella and other Europeans, America is one big discount bin, thanks to a weak dollar that slid this week to another record low against the euro. As a result, tourists are spending thousands to travel to the United States to snag blockbuster bargains on everything from iPods to designer clothes and handbags.

By 4 a.m. yesterday, Kinsella had rung up nearly $2,000 in Christmas presents and winter clothes, including a $79 black leather jacket at Guess that she estimated would cost more than $250 in Ireland.

“The bargains for us are so great,” said Kinsella, who paid $1,000 for a flight and hotel but expects to save even more on purchases here. -

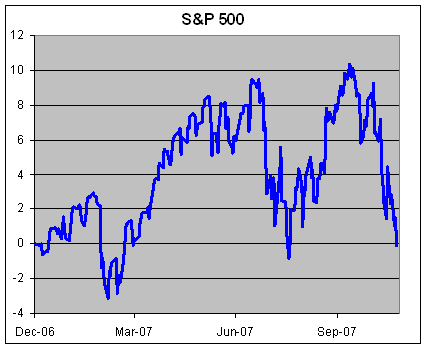

The S&P 500 Is Down for the Year

Posted by Eddy Elfenbein on November 22nd, 2007 at 12:10 pmSince the start of 2007, the S&P 500 is down 0.11%.

Including dividends, the index is up 1.56%. The Wilshire 5000, which is the broadest index, is up 0.22% for the year. With dividends, it’s up 1.72%

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His