-

LoveLEHGirl Is Watching

Posted by Eddy Elfenbein on January 30th, 2007 at 1:24 pmThe Wall Street Journal profiles Yolanda Holtzee, an “Internet investigator in sweatpants.”

Wall Street is full of corporate gadflies, many of whom agitate for corporate-governance reform or focus on arcane bylaw changes. Ms. Holtzee, a self-styled Internet investigator in sweatpants, focuses on exposing out-of-bounds behavior and catching bad guys. And after pointing regulators in the right direction more than once, Ms. Holtzee has achieved two things every gadfly craves: attention from those she targets — and action.

“I think people take her seriously because she has good instincts and actually produces cases,” says former senior SEC official Ari Gabinet, now an executive at Vanguard Group Inc., the fund management giant. “If I could have hired her, we would have had an endless stream of cases.” -

The Biomet CD?

Posted by Eddy Elfenbein on January 30th, 2007 at 11:18 amFirst let me state clearly that I’m not recommending this as a fixed-income investment, but let’s consider what the market is saying about Biomet (BMET).

Assuming all goes smoothly, the company is to be bought by a private equity consortium in nine months at $44 a share. Yesterday’s close was $41.90 a share. That translates to a gain of 5.01% over the next nine months. That’s not a bad return. Think of it in Dow terms—it would be like bringing the index to over 13100.

On an annualized basis, the Biomet investment is about 6.7% which beats almost any CD you can find. On top of that, the stock could pay another annual dividend this summer. Last year’s was for 30 cents a share, which is another 0.7% return. I don’t see why they’ll cut out the dividend this year.

Of course, the stock isn’t exactly like a bond. The deal still needs to be approved by shareholders and regulators (incidentally, I oppose the deal). But the stock is starting to behave like a fixed-income investment.

If I were a CFO and I needed to park some cash for the next nine months, picking up shares of Biomet could be a shrewd low-risk investment. -

Davos Is for Wimps

Posted by Eddy Elfenbein on January 30th, 2007 at 8:57 amMichael Lewis nails the professional worriers who gather every year in Davos:

Davos is where people with no talent for risk-taking gather to imagine what actual risk-takers might do. Davos Man needs to sit in judgment; Davos Man needs to brood. So great is this need that he will brood about virtually anything, no matter how little he knows about it.

It’s only January, but I’m ready to name that, the Paragraph of the Year.

He’s exactly right. When analyzing the market or the economy, it’s easy to fall into the “over-worrying trap.” I’m often surprised by how many otherwise intelligent people can fall into this trap and wind up saying silly things. I mean, there’s always something to worry about.

The professional worriers remind me of the Major General in HMS Pinafore who knows many “cheerful facts about the square of the hypotenuse.” They know the facts, but they can’t see them in proper context.

The free market is a highly complex system. It simply has a way of working things out. Naturally there are crises which always seem to be “looming,” but people are surprisingly good about mastering them.

A few years before Y2K, I remember reading a story about a power plant that ran a drill to prepare for the new millennium. The plant failed and everything went to pieces. So a quick-thinking engineer jumped in and reset all the plant’s clocks to 1972, which had the same day and date alignment of 2000 (28 years is seven days of the week times four years in a leap cycle). Presto. The plant was up and running and they had time to fix the bugs.

But in the minds of the professional worriers, that scenario could never happen. They think if some problem comes along, people will never adapt. They assume market participants will run head-first into a brick wall, then pick themselves up, and do it again.

Lewis writes:Thailand installs capital controls and the markets force it to reverse its policy, virtually overnight — again with nary a ripple. The Brazilian real is now less volatile than the Swiss franc; Botswana’s debt is now more highly rated than Italy’s. Oil prices double, the U.S. housing market tanks — no matter what happens, financial markets adjust quickly and without hysteria.

There are obviously a few things to worry about just now in the world, but the inability of traders to find a sensible price for the spread between European junk and European Treasuries isn’t one of them.That problem will also be solved. And the answer won’t come from Davos.

-

Graco 4Q Profit Rises 10 Percent

Posted by Eddy Elfenbein on January 30th, 2007 at 8:44 amFrom the AP:

Graco Inc. (GGG), which makes pressure washers and pumps for industrial uses, on Monday said fourth-quarter profit increased 10 percent as growth in its industrial and lubrication equipment segments offset slightly lower sales of contractor products.

Net income grew to $35.6 million, or 52 cents per share, from $32.3 million, or 46 cents per share, a year earlier.

Sales expanded 10 percent to $203.4 million from $185.6 million.

By segment, fourth-quarter contractor equipment sales fell 2 percent to $71 million. While the segment’s sales in Europe and Asia rose, sales in the Americas fell, reflecting a weak U.S. housing market. Sales of industrial equipment rose 14 percent at the same time to $110.6 million. Lubrication equipment sales jumped 40 percent to $21.8 million.

Analysts polled by Thomson Financial forecast earnings of 52 cents per share and sales of $205.8 million.

Graco said that a weaker U.S. dollar in 2006 compared with 2005 boosted sales and earnings.

For the full year, net income increased to $149.8 million, or $2.17 per share, from $125.9 million, or $1.80 per share. Sales rose to $816.5 million from $731.7 million a year earlier. -

The Money Honey Brand

Posted by Eddy Elfenbein on January 29th, 2007 at 4:18 pmBloomberg looks at the fallout of Todd Thomson’s dismissal at Citigroup (C). Journalism professors are criticizing the relationship Thomson had with Maria Bartiromo. Last year, she traveled with him to Asia on a company jet. He also approved $5 million for a show she was to co-host.

The article includes this nugget:On Jan. 16, Bartiromo sought to trademark her “money honey” moniker for use on children’s television shows, games, T-shirts, dishes and bookbags, according to the U.S. Patent and Trademark Office’s Web site.

Bookbags?

The New York Post, naturally, has more. -

Milton Friedman Day

Posted by Eddy Elfenbein on January 29th, 2007 at 12:35 pmToday is Milton Friedman Day. The economist died two months ago at the age of 94. Tonight, PBS (note irony) will premiere “The Power of Choice: The Life and Ideas of Milton Friedman.” Check your local listings.

-

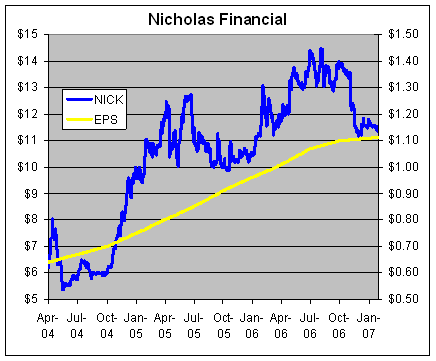

Nicholas Financial’s Earnings

Posted by Eddy Elfenbein on January 29th, 2007 at 12:29 pmOur smallest stock on the Buy List, Nicholas Financial (NICK), reported earnings of 27 cents a share:

Nicholas Financial, Inc. announced that net income increased 2% to $2,770,000 for the three months ended December 31, 2006 as compared to $2,718,000 for the three months ended December 31, 2005. Diluted earnings per share increased 4% to $0.27 for the three months ended December 31, 2006 as compared to $0.26 for the three months ended December 31, 2005. Revenue increased 6% to $11,730,000 for the three months ended December 31, 2006 as compared to $11,107,000 for the three months ended December 31, 2005. The Company has reported record same quarter increases in revenues and earnings for 66 out of the past 67 quarters.

Net income increased 12% to $8,568,000 for the nine months ended December 31, 2006 as compared to $7,621,000 for the nine months ended December 31, 2005. Diluted earnings per share increased 14% to $0.83 for the nine months ended December 31, 2006 as compared to $0.73 for the nine months ended December 31, 2005. Revenue increased 14% to $34,666,000 for the nine months ended December 31, 2006 as compared to $30,506,000 for the nine months ended December 31, 2005.

-

Sysco Earns 38 Cents a Share

Posted by Eddy Elfenbein on January 29th, 2007 at 9:58 amThat’s in line with estimates:

Food-services provider Sysco Corp. said Monday fiscal second-quarter net income grew 16 percent, helped by business reviews of customers.

Quarterly earnings totaled $236.7 million, or 38 cents per share, from $204.2 million, or 33 cents per share during the same period last year.

Revenue grew 8 percent to $8.57 billion, from $7.97 billion last year.

Analysts polled by Thomson Financial expected net income of 38 cents per share on revenue of $8.6 billion.

Sysco said it conducted 10,000 business reviews at its U.S. broadline operations during the quarter, and sales to customers who participated in the business-review process were “solid.” -

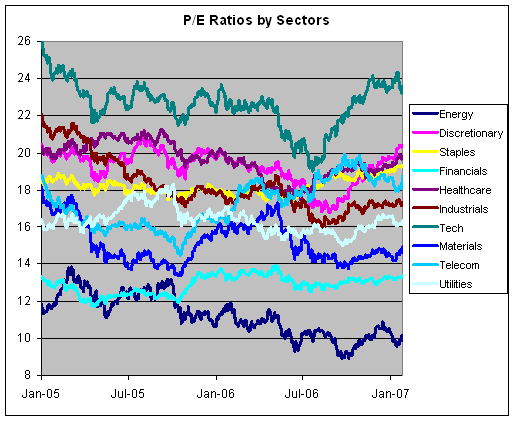

P/E Ratios by Sector

Posted by Eddy Elfenbein on January 26th, 2007 at 6:09 amHere’s a look at the P/E Ratios of the ten sectors of the S&P 500:

The P/E ratio of the overall S&P 500 is about 16.2. This is slightly distorted due to the low P/E ratio of the energy sector (9.6% of the index).

Since energy stocks have been generating very healthy profits, and the market doesn’t believe the good times will last, or least, not at this pace, that gives them a low P/E ratio. That’s pretty common for cyclical stocks. Ignoring energy, I see that five sectors have P/E ratios greater than 18.7.

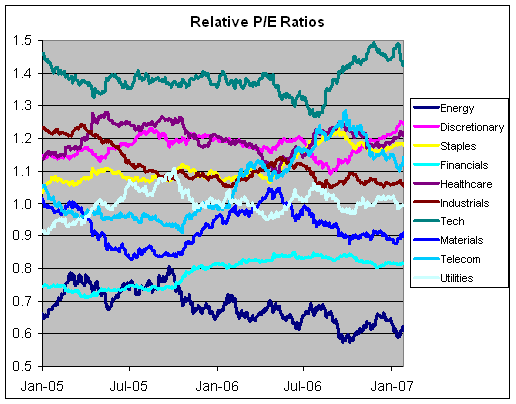

Here’s a look at each sector’s Relative P/E Ratio, which is their P/E compared with the overall S&P 500.

Although Relative P/E’s are far from perfect, they’re a good measures of value. You can see that only the cyclical sectors like energy and industrials show any noticeable downtrend. Even though tech stocks haven’t done very well, by this metric, it doesn’t appear that tech has become any less expensive. -

Today’s Investing Lesson: Diversify

Posted by Eddy Elfenbein on January 25th, 2007 at 4:50 pmThe S&P 500 had a big up day yesterday, and a big down day today. It’s almost back where it started, yet our Buy List managed to beat the index on both days.

What’s particularly impressive is that we were able to stay ahead of the market today even though shares of Varian Medical Systems (VAR) got a super atomic wedgie. The stock dropped 8.6% today. The 11.4% jump in Respironics (RESP) helped ease the pain.

Too many investors never give a thought about diversifying across industries. Or they think diversity means owning several tech stocks. You can own only a few stocks and track the market very closely. Also, you can own hundreds of stocks and have a very low correlation to the rest of the market.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His