-

Marvell Warns

Posted by Eddy Elfenbein on October 3rd, 2006 at 9:24 amJust seven shopping days until earnings season starts. The traditional first major announcer is Alcoa (AA), which should have outstanding earnings.

We’re also getting cautionary announcements of what to expect this season. Today’s earnings bomb is brought to you courtesy of Marvell Technology Group (MRVL). The company anticipates that its revenues will fall 10% from last quarter’s total of $574 million.The anticipated decline in net revenue is largely due to lower than expected demand from a number of the Company’s hard disk drive customers. The Company believes the shortfall of demand is primarily due to a combination of weaker than normal seasonal shipments in the personal computer market as well as excess inventory held by some of its significant storage customers.

If that’s not enough, the company is also looking at its options practices.

-

Wachovia Closes Golden West Purchase

Posted by Eddy Elfenbein on October 2nd, 2006 at 9:38 amBanking and financial services company Wachovia Corp. said Monday it closed its acquisition of Golden West Financial Corp. and named three new board members, two of them Golden West officials.

Oakland, Calif.-based Golden West, which operates as World Savings Bank, is one of the largest thrifts in the U.S. Its shareholders will receive 1.051 shares of Wachovia stock and $18.65 cash for each Golden West share they own.

Of the new board members, Jerry Gitt, 63, and Maryellen Herringer, 62, had been directors of Golden West. Timothy Proctor, 56, is the general counsel of Diageo PLC, a London-based beverage company.

Herbert and Marion Sandler, the husband-and-wife team who ran Golden West for much of their 45-year marriage, will continue to advise the new management.Wachovia (WB) will now appear on the Buy List in place of Golden West Financial. For Buy List tracking purposes, we have to make some changes (someone please double-check my math!).

At the beginning of the year, we added 757.5758 shares of Golden West at $66 each. With the merger, we now have 796.2122 shares of WB, plus $14,128.79 in cash. Going by Friday’s closing price of $55.80 for WB, that cash is being exchanged for another 253.2041 shares. So now we have a total position of 1049.4163 shares of WB with a cost basis of $47.64554. -

The Housing Bust–Not So Easy Investing

Posted by Eddy Elfenbein on October 2nd, 2006 at 9:22 amHenny Sender notes in today’s WSJ that the long-awaited housing bust isn’t developing into a good investing there:

Playing the housing slowdown in financial markets is proving tougher than anyone expected.

Some obvious bets against housing haven’t been working out. Even though housing statistics are sinking, home-builder stocks have risen since July and demand for mortgage-backed securities has held up.

Just last week, the National Association of Realtors made the case for housing bears stronger by reporting that prices of existing homes had fallen for the first time in 11 years.

The Federal Reserve is working against the bears by pausing its campaign of short-term interest-rate rises.

If the Fed were to allow interest rates to get too high, that would raise mortgage costs and could tip the economy into a serious slowdown. That is why some investors believe the Fed might cut rates next time it meets. Long-term interest rates already are falling, which is holding down mortgage costs at a critical time.New Century Financial (NEW) paid out a dividend of $1.85 a share in September. The company has raised its dividend by a nickel a share for the past several quarters.

To give you an idea of how negative the market is on housing, if we assume that New Century doesn’t cut its dividend, that means that the stock is indicating a dividend yield of close to 19%, which is the equivalent of 2,200 Dow points. -

Steve Wozniak on CNBC

Posted by Eddy Elfenbein on September 29th, 2006 at 10:56 amIf you’re getting bored with New High Watch on the Dow, here’s an interesting interview CNBC had with Steve Wozniak this morning.

-

No Go for MVNO

Posted by Eddy Elfenbein on September 29th, 2006 at 9:18 amI was curious if Mobile ESPN was going to have an impact. Apparently not.

ESPN is closing down its cell phone company for sports fans after less than a year, planning instead to forge deals in which it provides content to other wireless operators.

The planned shutdown of Mobile ESPN marks the first major bust in a rush of specialized wireless ventures targeting niche audiences they contend are underserved by the Cingulars and Verizons of the world.

ESPN was quick to stress that its change in strategy had no bearing on Disney Mobile, another ambitious foray into the cellular market by parent company Walt Disney Co. that was officially launched just recently.

Disney has so far invested a combined $150 million in developing Mobile ESPN and Disney Mobile, two of the highest-profile and most-heavily marketed efforts to create an “MVNO,” or mobile virtual network operator.

An MVNO doesn’t have its own wireless network. Instead, it puts its brand on another wireless operator’s service — whose name is hidden from the customer — and offers its own lineup of handsets and calling plans.

Going forward, Mobile ESPN will cease being an MVNO and instead seek to provide its sports scores, news and video highlights to other wireless companies with large customer bases. -

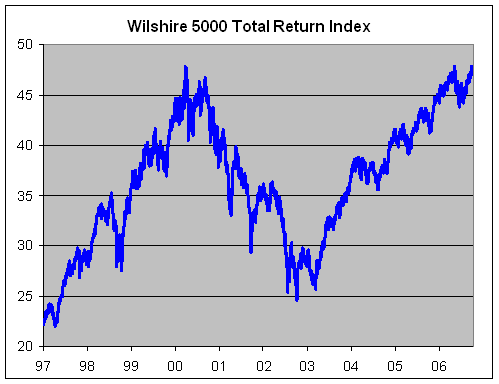

The Market Reaches All-Time High

Posted by Eddy Elfenbein on September 28th, 2006 at 4:25 pmNot the Dow. Not the S&P 500. But the Wilshire 5000 Total Return Index (^DWCT).

This is the broadest measure of the stock market’s total retun. It includes several thousand stocks, and it’s adjusted for dividends.

On March 24, 2000, the index closed at 47.84098. Today, it closed at 47.86562.

For the record, the Dow closed at 11,718.45, which is just 4.53 points below its all-time high close from January 14, 2000. We did, however, peak into record territory during the day.

The S&P 500 closed at 1,339.15 which is 12.3% below its record close. Adjusting for dividends, it’s down about 2.5%.

-

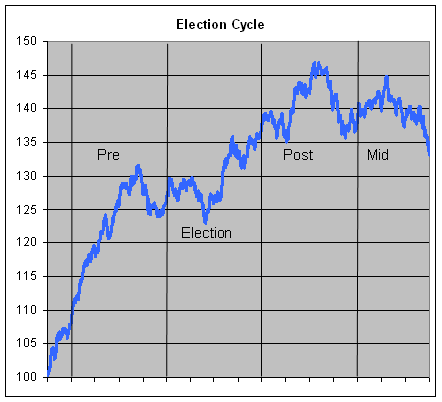

The Election Cycle Begins

Posted by Eddy Elfenbein on September 28th, 2006 at 3:01 pm

You only have one shopping day left to take advantage of the four-year Election Cycle. Major caveat: I don’t put much faith in any of this, but here’s what the data says.

Going back to 1930, the Dow reaches its average bottom on September 30 of the mid-term election year. From that point until September 13 of the pre-election year, the Dow gains an average of 31.6%.

That means that over 95% of the Dow’s four-year gain comes within the first 12 months of the Election Cycle.

After that, the market then gets a bit dicey until May 25 of the election, losing 6.6%. But then things start heating up. The market puts on an impressive 19.4% rally to August 2 of the post-election year.

Then all the troubles start. After August 2 of the post-ection year, the market slides an average of 9.4% until we’re home again–September 30 of the mid-term. -

Danaher Hits All-Time High

Posted by Eddy Elfenbein on September 28th, 2006 at 2:20 pmForget the Dow, look at Danaher (DHR)! After a few days of heavy fighting, the stock finally took out its May high. Shares of DHR are up 23% for us year-to-date.

From August 9 through yesterday’s close, our Buy List was up 10% compared with 5.6% for the S&P 500. -

Second-Quarter GDP Revised to 2.6%

Posted by Eddy Elfenbein on September 28th, 2006 at 9:10 amThe initial estimate was for 2.5%, then it was revised up to 2.9%. Now it’s been cut back down to 2.6% growth.

-

The Dow & Terrell Owens

Posted by Eddy Elfenbein on September 27th, 2006 at 3:39 pm

December 7, 1973: Owens born in Alabama. Dow rises 3% to 838.05.

October 14, 2002: Sharpie Incident. Dow rises 27 points to 7,877.40.

November 15, 2004: Desperate Housewives Incident. Dow rises 11 to 10,550.24.

September 27, 2006: Owens denies suicide attempt. Dow rises 20 points to 34 points shy of an all-time high.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His