-

H&R Block’s Taxes

Posted by Eddy Elfenbein on March 1st, 2006 at 11:02 amIt can’t be good news when H&R Block messes up its own taxes. Here’s the 8-K report:

The restatement pertains primarily to errors in determining the Company’s state effective income tax rate for the fiscal quarters ended October 31, 2005 and July 31, 2005, fiscal years ended April 30, 2005 and 2004 and the fiscal quarters for fiscal years 2005 and 2004. These errors resulted in a cumulative understatement of state income tax liability (net of federal income tax benefit) of approximately $32 million as of April 30, 2005.

-

SEC: Overstock Isn’t Behind Probe

Posted by Eddy Elfenbein on March 1st, 2006 at 10:57 amThe SEC has said that Overstock.com isn’t behind the investigation into a short-selling ring:

The chief executive of Overstock.com on Wednesday said federal regulators, not the online retailer, were behind the investigation into business journalists as part of a probe into alleged manipulation of the company’s stock.

Patrick Byrne told business news network CNBC that the U.S. Securities and Exchange Commission’s recent subpoenas of journalists who had criticized Overstock came at the agency’s own initiative.

The San Francisco office of the SEC took the unusual step of issuing subpoenas to two Dow Jones & Co. columnists, Carol Remond and Herb Greenberg, to demand telephone records, e-mails and other documents related to Overstock.com.

“It’s my sense that the SEC was onto Herb’s scent long before we came along,” Byrne said. “I have not orchestrated the SEC investigation.”

Byrne acknowledged speaking to SEC officials about the probe, but dismissed the notion that the subpoenas were related to a lawsuit Overstock filed in August against hedge fund Rocker Partners and research firm Gradient Analytics. -

Update on the Buy List

Posted by Eddy Elfenbein on March 1st, 2006 at 10:39 amFor the first two months of the year, the Buy List is up 2.12%. That may not sound like a lot, but it’s ahead of the long-term average, although we’re slightly behind the S&P 500 which is up 2.59% (not including dividends).

-

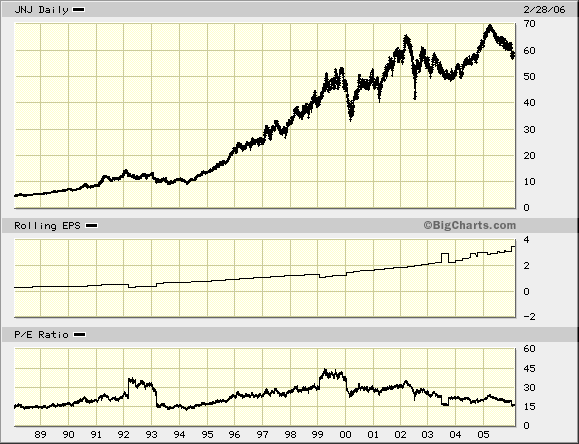

J&J Is Looking Cheap

Posted by Eddy Elfenbein on March 1st, 2006 at 10:22 amHas anyone else noticed how cheap Johnson & Johnson (JNJ) is? Good, I thought it was just me. Nearly a year ago, the stock was at $70. Today, it’s around $57.

The company dodged bullet thanks to Boston Scientific (BSX) snatching Guidant (GDT) from them. I was terrified that J&J was going to get stuck with Guidant. As you may have heard me say before, I’m not a fan of mega-mergers.

One of the best ways to find good values on Wall Street is look for the strongest stocks in the weakest sectors. Right now, that’s health care. While Merck (MRK) and Pfizer (PFE) are having their problems, the good stocks like J&J are also being punished.

I’ll give you another good example of this. In 1990, almost all financial stocks were tossed in the garbage. AFLAC (AFL) is one of the best around, and even they saw their stock plunge from (post-split) $3 a share to $1.70. To make a short story shorter, now it’s at $46.

So yes, Johnson & Johnson will manage to survive. The company is Wall Street’s version of a blue blazer. It never goes out of style. The most recent catalyst for J&J’s shares to fall was its “weak” earning report. Of course, for J&J, weak is relative. Earnings came in at 73 cents a share, which was in line with the Street’s estimate. But the surprise was that for the first time in 22 years, revenues declined. The company also guided slightly lower for this quarter.

For the year, J&J sees earnings of $3.78 to $3.85 a share, which means the shares are going for about 15 times earnings. Notice how we saw Medtronic (MDT) also fall on fundamentally good earnings. It’s just because it’s a large-cap health care stock. On Wall Street, you simply can’t argue with a mob. If they want to see bad news, they’ll find it.

I also expect J&J to raise its dividend soon from 33 cents a share to (I’m guessing) 37.5 cents, which is a yield of 2.6%.

Here’s a chart of J&J over the past 18 years. Note the P/E ratio line.

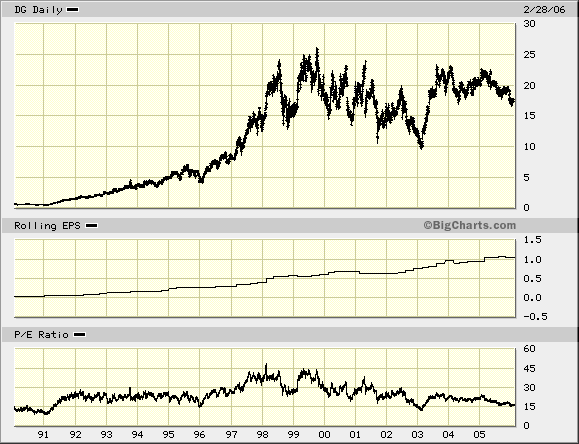

I’ve also included a chart of Dollar General (DG), another stock that’s beginning to look cheap:

-

What’s Your Wonderlic?

Posted by Eddy Elfenbein on February 28th, 2006 at 6:15 pmVince Young got a 6 on his Wonderlic test.

What’s your score? -

Donaldson’s Earnings

Posted by Eddy Elfenbein on February 28th, 2006 at 4:36 pmThe press release makes it sound great, but this was a disappointing quarter for Donaldson (DCI). The company missed the Street’s estimate by a penny a share.

Donaldson Company, Inc. today announced record second quarter diluted earnings per share (“EPS”) of $.32, up from $.31 last year. Net income was a record $26.9 million, versus $26.7 million last year. Sales were a record $392.9 million, up from $388.4 million in fiscal 2005.

For the six-month period, EPS was another record at $.69, up from $.62 last year. Net income increased 9 percent to $59.1 million compared to $54.1 million last year. Sales were a record $796.3 million, up 5 percent from $761.3 million in fiscal 2005.

“Our operating margin improved to 10.2 percent year-to-date from 9.6 percent last year, despite absorbing $2.2 million, or $.02 per share, of stock option expenses into operating profits this year,” said Bill Cook, Chairman, President and CEO. “Donaldson is running very well, with our continued focus on cost reduction efforts offsetting higher commodity prices and driving the improvement in our profit margins. We reduced our full year sales outlook mainly due to currency translation since the dollar is currently weaker against the Euro and Yen than it was in the second half of last year. However, we expect continued positive year-over-year sales growth and for operating margins to continue at these improved levels, giving us confidence in delivering our 17th consecutive year of record earnings.” -

Google Is Having Issues

Posted by Eddy Elfenbein on February 28th, 2006 at 11:28 amGoogle Inc. shares slid as much as 13 percent, their biggest-ever decline, after finance chief George Reyes said growth is slowing at the world’s most-used Internet search engine.

“We’re getting to the point where the law of large numbers starts to take root,” Reyes said today at a Merrill Lynch & Co. investor conference in New York. “Growth will slow. Will it be precipitous? I doubt it.”I wish someone had seen this coming.

More: Mark Hulbert on insider selling at Google (“off the charts”).

-

Burger King’s IPO

Posted by Eddy Elfenbein on February 28th, 2006 at 10:14 amIBD looks at Burger King’s IPO:

THE BUZZ

Unlike last year, 2006 is set to produce some massive, high-profile initial public offerings. And while the terms for Burger King’s IPO are still in the works, the deal should be — if you’ll pardon the expression — a whopper.

Burger King’s rivals have certainly been busy. McDonald’s scored a hit when it did a partial spinoff of Chipotle Mexican Grill in January.

Wendy’s is planning a similar spinoff of Tim Hortons sometime next month.

Now comes the debut of the world’s second-largest fast-food operation. The main question will be how much investors believe in the financial turnaround engineered by Burger King’s new chief executive, Greg Brenneman.

When the company filed its prospectus on Feb. 16, analysts could look at the numbers in detail for the first time.

“The balance sheet is nothing to write home about,” said Francis Gaskins, president of IPOhome.com. “But they’ve turned it around on an operating basis. That’s the interest here.”

THE COMPANY

Burger King was founded as a drive-up hamburger stand in 1954. Three years later it rolled out its trademark Whopper.

In 1967, after much growth, the company was bought by the Pillsbury Co., which in turn was bought by Grand Met in 1989.

A still bigger fish, Diageo, came in and swallowed up Grand Met. Diageo is a British beverage company that owns venerable booze brands such as Gordon’s, Smirnoff, Johnnie Walker and Jose Cuervo.

It was an odd fit for a U.S. fast-food giant, and Burger King suffered an identity crisis. Between 1989 and 2002 the chain went through eight chief executives and drifted out of the limelight.

In 2002 a group of equity investors — led by Texas Pacific Group, Bain Capital Partners and the Goldman Sachs Funds — bought Burger King. What they found was financial chaos.

More than a third of Burger King’s North American franchisees were over-leveraged, and its largest franchisee declared bankruptcy.

In 2004 the investment group tapped Brenneman, a turnaround specialist, to head Burger King.

Brenneman wasted no time shuffling the deck. On his watch Burger King has closed more than 800 underperforming restaurants, written off some $106 million in franchisee debts and experimented with aggressive discounting.

By last year Burger King’s finances were improving. -

The Derivatives Mess

Posted by Eddy Elfenbein on February 28th, 2006 at 10:02 amI meant to post this earlier. This WSJ article highlights the problems of the growth of derivatives on Wall Street.

Derivatives allow banks, companies and investors to transfer financial risk, much as homeowners buy insurance to shift the risk of repairing fire damage to an insurer. In the simplest form, Joe’s Manufacturing Inc. borrows $5 million at an interest rate that moves up and down with market rates, and then cuts a deal with Frank’s Investment Bank in which Joe promises to pay a fixed rate and Frank pays the variable rate.

The subspecies known as credit-default swaps allow banks that have lent money to, say, General Motors Corp. to shift risk of default to a risk-loving investor for a fee. As the market has evolved and drawn speculators, as well as banks looking to lay off risk, investors now place bets not only on individual firms, but on baskets of credits and on risks sliced and diced in increasingly complex ways.

You would think that Wall Street would have computerized this when the market started taking off a few years ago. But deals were, and often still are, done by telephone and fax. Detailed confirmations, important in avoiding nettlesome disputes later, weren’t completed. One firm confessed in June that it had 18,000 undocumented trades, several thousand of which had been languishing in the back office for more than 90 days. It wasn’t unusual.

That’s not all. One party to a two-party deal was routinely turning obligations over to a third party without telling the first one. It was as if you lent money to your brother-in-law and later learned that he had passed the debt to his deadbeat cousin without so much as an email. “When I realized how widespread that was, I was horrified,” says Gerald Corrigan, a former New York Fed president now at Goldman Sachs. “What it meant was that if you and I did a trade, and you assigned it without my knowing it, I thought you were my counterparty — but you weren’t.”

In LTCM’s case, each player knew the dimensions of its exposure; no one realized how exposed other firms were and how fragile LTCM’s strategy was. In the case of credit derivatives, the problem has been worse: Record-keeping, documentation and other practices have been so sloppy that no firm could be sure how much risk it was taking or with whom it had a deal. That’s a particularly embarrassing problem for an industry that has resisted regulation of derivatives by arguing that big firms would police each other.

Stocks, bonds and options traded on exchanges go through clearinghouses, which pick up the pieces when something goes awry with a trade. In this market, there’s no clearinghouse yet. Until recently, dealers didn’t even enter most credit-default-swap trades into a computer database to be sure both sides agreed on the terms.

Mr. Geithner, the Paul Revere of this story, began shouting about all of this before the end of his first year on the job. In an October 2004 speech, he noted that inadequate financial plumbing was “a potential source of uncertainty that can complicate how counterparties and markets respond in conditions of stress.” That’s central-bank speak for: The car is careening down the highway at 85 miles an hour and the lug nuts aren’t tight. If we hit a pothole, look out! -

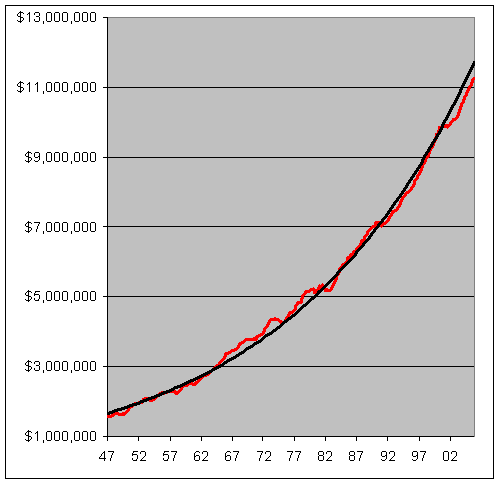

Fourth-Quarter GDP

Posted by Eddy Elfenbein on February 28th, 2006 at 9:01 amGDP growth raised to 1.6%.

You wouldn’t know this from how people talk about the economy, but GDP growth is far more stable than most people realize. I often hear that the economy is “surging” or “crashing.” In reality, economic growth is a pretty stable trend that occasionally has some minor bumps.

Here’s a graph of real GDP growth over the last 60 years (red line) with a trend line line (black line).

Here’s a look at the trailing three-quarter growth rate of real GDP. I’m not sure why, but the nine-month view seems to work the best.

Notice how over the last 20 years, the economy has become far less cyclical. The peaks are getting lower, and the valleys are getting higher.

The Stalwart has speculated that as the overall economy has become more stable, the individual pieces have become more volatile. I think he’s right. Perhaps the price for collective security is the growth of constituent risk.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His