-

Bitcoin Sinks Below $30,000

Posted by Eddy Elfenbein on June 22nd, 2021 at 12:52 pmSuddenly, cryptos have become unpopular. I don’t know why anyone’s waited this long, but here we are.

Bitcoin just dropped below $30,000. At one point, it was negative for the year. At its low today, Bitcoin got down to $28,993.67. That’s less than half of the all-time high of $64,863.10 reached on April 13.

Dogecoin, which I find completely baffling, dropped below 17 cents. It peaked last month at 73 cents.

Cryptos tend to move so quickly that they all may be rallying by the time you read this.

This morning’s existing-homes sales report fell 0.9% to an annualized rate of 5.8 million. That’s for April.

At the end of May, total housing inventory was 1.23 million units. That’s down 20% from a year ago.

On our Buy List, Danaher (DHR) and Moody’s (MCO) are both at new highs. Hershey (HSY) and Zoetis (ZTS) are close to new highs.

The troublesome stock lately has been Miller Industries (MLR). It just dropped below $40 per share. The stock pays a quarterly dividend of 18 cents per share. That now yields about 1.7%.

-

Morning News: June 22, 2021

Posted by Eddy Elfenbein on June 22nd, 2021 at 7:09 amChina Crypto Clampdown Sends Bitcoin Closer to Key $30,000 Level

Key Oil Spread Jumps to Seven-Year High in Sign of Supply Crunch

Even After Biden Tax Hike, US Firms Would Pay Less Than Foreign Rivals

U.S. Lawmakers Likely to Press Powell on Fed’s ‘Hawkish’ Turn

‘Roller-Coaster Ride’ in Bonds Puts Onus on Powell to Bring Calm

The Pandemic Stimulus Was Front-Loaded. That Could Mean a Bumpy Year.

The World’s Financial Centers Struggle Back to the Office

Banks Slowly Offer Alternatives to Overdraft Fees, a Bane of Struggling Spenders

Google Executives See Cracks in Their Company’s Success

Google Faces EU Antitrust Probe of Alleged Ad-Tech Abuses

Nvidia Hedges Against Crypto Hangover With Chips Just for Miners

The Problem With the Genius Billionaire Philanthropist Superhero

The Hedge Fund that Bet Against GameStop is Closing Down, Report Says

U.S. Supreme Court Tosses Class Action Ruling Against Goldman Sachs

Be sure to follow me on Twitter.

-

CWS Market Review – June 21, 2021

Posted by Eddy Elfenbein on June 21st, 2021 at 6:20 pm(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. The premium version contains more detailed analysis and I cover our Buy List stocks in greater depth. Join us today!)

Raven Industries Soars 50% on Buyout Offer

In our newsletter from two weeks ago, I featured the company Raven Industries (RAVN). I’ve been a fan of Raven for many years. The company has been a remarkable performer for decades, yet it’s virtually ignored by Wall Street.

Well, that was very fortuitous timing. Today, CNH Industrials (CNHI) offered to buy out Raven for $58 per share. That’s a 50% premium from Friday’s closing price. Raven’s stock has shot up 49% in today’s trading.

CNH Industrial is the world’s second largest agricultural equipment maker. The deal values Raven at $2.1 billion. The company already has plans to spin off its truck, bus and engine business sometime next year.

The deal is going to be funded with cash on hand. They hope to finish the merger by the end of this year. From the press release: “The transaction is expected to generate approximately US$400 million of run-rate revenue synergies by calendar year 2025, resulting in US$150 million of incremental EBITDA.”

I tend to cringe whenever I hear about these “expected synergies” from companies. I’m sure they mean well, and they’re trying to justify a big-ticket purchase, but reality has a habit of prevailing over forecasts.

I’m very happy for Raven. Here’s some of what I said about Raven two weeks ago:

If I told you about a stock that’s up 750-fold over the last 40 years, you’d probably assume that it’s very well-known on Wall Street. Instead, Raven Industries (RAVN) is barely a speck on the canyons of Wall Street. The stock has been an amazing winner, yet it’s virtually ignored. Only a handful of Wall Street analysts bother covering it.

What do they do? Raven has picked up where the Montgolfier brothers left off. Raven specializes in balloons. Or to be more specific, as Dun & Bradstreet describes them, “a diversified technology company that caters to the industrial, agricultural, energy, construction, military, and aerospace sectors.”

The company has a few divisions, but what most gets my attention is Raven’s Aerostar division. This group sells high-altitude research balloons as well as parachutes and protective wear used by U.S. agencies. (See this video.)

Raven’s Engineered Films Division makes reinforced plastic sheeting for various applications. Their Applied Technology Division manufactures high-tech agricultural aids, from GPS-based steering devices and chemical spray equipment to field computers.

I said that if Raven were to fall to a decent valuation, then it would make an attractive addition to our Buy List. Apparently, CNH agreed! (Maybe they’re subscribers!)

This is a reminder that there are lots of great little companies out there that few people know about.

Why Value Isn’t Exactly Value

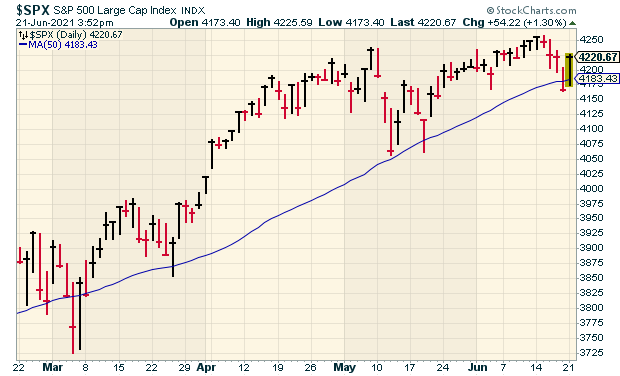

On Friday, the stock market fell for the fourth day in a row. The S&P 500 closed below its 50-day moving average for the first time since March.

The selling didn’t continue into today. In fact, today was a pretty strong day for the stock market. But what struck me was the strength in value stocks. The value stock index more than doubled the growth stock index. Typically, value underperforms on strong up days. Of course, anything typical on Wall Street has plenty of exceptions.

I think today’s action highlights a problem with these categories like growth and value. The problem is that the sectors are based on very mechanistic rules. The value portfolio is based on stocks with low price-to-book ratios. As a result, the value indexes are crowded with many bank and energy stocks.

Due to the particulars of those industries, it’s very likely that any stock operating in those fields will have an unusually low price-to-book ratio. That’s just part of the business.

Classically, when I think of a value stock, I think of a Ben Graham-type company that’s going for a decent price. Now, when I see there’s been a big move in value, I assume it’s been a good day for cyclicals. That’s what today was.

I’ll give you some eye-opening stats. The S&P 500 Value Index is 21.4% Financials and 5.6% Energy. Compare that with the S&P 500 Growth Index which is 2.8% Financials and 0.1% Energy. I think they need to rework these indices to get a better idea of how growth and value are behaving.

The twitter handle SentimenTrader had a fascinating observation. Despite the S&P 500 being close to a new high, many stocks are near their one-month low. By ST’s count, more than 40% of stocks in the S&P 500 are at their one-month low which is an all-time record when (importantly) the overall index is so high.

There are a few things that could be causing this. One is that this rally isn’t as broad as it appears. But I think the more likely scenario is that this rally has already been so broad and stable. As a result, dropping to a one-month low ain’t that big a deal.

Think of it this way. Imagine if the stock market were a single stock and that stock had been trading between $99 and $100 per share every day for a month. Then suddenly it dropped to $98. That’s basically what last week was. Sure, that’s a one-month low but only because the market had been so stable.

New High Today for Zoetis

We added Zoetis (ZTS) to our Buy List this year. I really like this animal-healthcare stock. Despite my optimism, the stock was an immediate flop.

In mid-February, the Q4 earnings report was pretty good. Zoetis beat by four cents per share. The company also said it expected full-year earnings between $4.36 and $4.46 per share. Wall Street had been expecting $4.26 per share.

Still, Wall Street didn’t seem to care. By early March, we were sitting on a 13% loss. Slowly, the stock started to turn around for us. A few weeks ago, Zoetis reported Q1 earnings of $1.26 per share. That was 23 cents more than expectations.

The company also lifted its full-year outlook. The new guidance is for $4.42 to $4.51 per share. Again, the stock took a short-term hit after the earnings report.

Here we are a few weeks later and Zoetis hit a new high today. The stock is up close to 30% from its March low. We didn’t do anything other than buy and then hold onto a good stock.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

-

Morning News: June 21, 2021

Posted by Eddy Elfenbein on June 21st, 2021 at 7:05 amCargo Is Piling Up Everywhere And It’s Making Inflation Worse

Treasury, U.K. Yield Curves Weighed Down by Rethink on Reflation

Fed’s “Big Tent” Framework May Fray Under Inflation Surge

Powell Heads to Capitol Hill as Market Churns on Dot Shock

The New Test for Central Bankers’ Cool: Booming House Prices

Investment Firms Aren’t Buying All the Houses. But They Are Buying the Most Important Ones.

As Lumber Prices Fall, the Threat of Inflation Loses Its Bite

Bitcoin Falls to Two-Week Low as China Cracks Down on Crypto

Wall Street Banks Struggle to Cash In on China Hiring Binge

U.S. Employers Wrestle with COVID Vaccine Requirements in Regulatory “Hairball”

How Do They Say Economic Recovery? ‘I Quit.’

Worker Shortage Has Sparked a Rent-A-Staffer Boom in the Food Industry

Big U.S. Retailers Line Up Deals to Take on Amazon Prime Day Frenzy

New York Faces Lasting Economic Toll Even as Pandemic Passes

Vivendi Agrees to Sell 10% of Universal Music Group to Ackman’s SPAC

Be sure to follow me on Twitter.

-

Morning News: June 18, 2021

Posted by Eddy Elfenbein on June 18th, 2021 at 7:02 amChina Growth Decouples From Credit, With Global Implications

China’s Steps Turn Iron Into World’s Most Volatile Commodity

As China Scrutinizes Its Entrepreneurs, a Power Couple Cashes Out

A Huge Backlog at China’s Ports Could Spoil Your Holiday Shopping This Year

Venezuela’s Maduro Pleads for Foreign Capital, Biden Deal in Caracas Interview

As Fed Wakes Sleeping Dollar, Jolted Bears May Bolster Gains

Investors Dump Hedges on Junk Bonds Even as Europe Defaults Loom

Mortgage Rates Shoot Higher After Fed Chairman Powell’s Comments

The Problem With El Salvador’s Bitcoin Law

Mark Cuban ‘Hit’ by Titan Crypto Crash As Coin’s Price Falls to Near Zero

Wall Street Wrestles With Abrupt Arrival of Juneteenth Law

There’s a New Duo That Could Help Rein In Amazon

Nielsen Now Knows When You Are Streaming

Facebook’s ‘Neighborhoods’ Faces Crowded Niche Market, Profiling Concerns

Ben Carlson: How To Prepare For a Lengthy Bull Market

Be sure to follow me on Twitter.

-

Morning News: June 17, 2021

Posted by Eddy Elfenbein on June 17th, 2021 at 7:09 amRace for a Global Tax Revolution Faces Hurdles in Final Stretch

How Will EU Ban on 10 Banks from Bond Sales Impact Markets and Banks?

Bitcoin Beach: What Happened When an El Salvador Surf Town Went Full Crypto

‘Financial Surrealism’: Lebanese Opt for Beer Over Banks

Fed Officials Rattle Rate-Hike Saber as Price Pressures Surprise

The Economic Gauges Are Going Nuts. Jerome Powell Is Taking a Longer View.

The U.S. Averted One Housing Crisis, but Another Is in the Wings

The Commodities Boom Is Luring Criminals to Make Bigger and Bolder Scores

Stung By Pandemic and JBS Cyberattack, U.S. Ranchers Build New Beef Plants

He Warned Apple About the Risks in China. Then They Became Reality.

Microsoft Names Satya Nadella as Chairman

GM Raises Electric-Car Bet, Will Add More Battery Factories

Older Americans Are on the Front Line of the Student Debt Crisis

Joshua Brown: This Is Bad News How?

Michael Batnick: Animal Spirits: Fed Apologist

Be sure to follow me on Twitter.

-

CWS Market Review – June 16, 2021

Posted by Eddy Elfenbein on June 16th, 2021 at 7:07 pm(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. The premium version contains more detailed analysis and I cover our Buy List stocks in greater depth. Join us today!)

I wanted to send you an update on today’s Federal Reserve meeting. This was an important meeting and the stock market dropped for the second day in a row. This was actually the largest daily drop for the S&P 500 in a month. That probably says more about the placidity of the last month than it does about today.

As I’ve discussed before, the Fed’s decisions are becoming increasingly important to us as investors. That’s because during the pandemic, the central bank took extraordinary measures to help the economy. Not only are interest rates near 0% but the Fed has been buying $120 billion in bonds every month.

Now that the economy is improving and life is returning to something resembling normal, there’s growing pressure on the Fed to pare back its enormous stimulus. Adding to this has been higher inflation which hasn’t been a major factor in the U.S. for 40 years.

I should warn you that central bankers aren’t big fans of plain English. They prefer to speak in the arcane language of Fedspeak. Fortunately for us, dear reader, your humble editor is well-versed in Fedspeak and I’ll help translate for you.

Having said that, here’s today’s statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

Progress on vaccinations has reduced the spread of COVID-19 in the United States. Amid this progress and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

My Take on Today’s Fed Meeting

So, what the heck does all this mean? Let’s start at the top. First, the Fed said that economic activity has strengthened. The Fed also didn’t make any changes to interest rates. The target for the Fed funds rate is still near 0%. The Fed is also going to continue to buy $80 billion a month in Treasuries and $40 billion a month in mortgage-backed securities. That’s a gigantic amount. By the way, the vote today was unanimous.

I think it’s likely that at some point soon, the Fed will start tapering its bond buying. Meaning, they’ll still be raking in bonds but at gradually smaller amounts.

Here’s the problem: this is what the Fed did eight years ago. The Fed Chief at the time was Ben Bernanke and he mentioned tapering en passant at a Congressional hearing. The bond market totally freaked out. Bonds dropped and yields soared. This become known as the infamous “Taper Tantum.” The Powell Fed wants to avoid that.

That’s why the Fed said it won’t make any changes to its bond buying until “substantial further progress has been made.” The Fed is trying to send a message that they’re not about to cut and run. Of course, this starts another debate of what exactly “substantial” means. Still, I think there’s a good chance that the Fed will announce its tapering plans in late summer. At the end of August, the Fed will host its annual shindig at Jackson Hole, WY. That might be the best opportunity.

About inflation, the Fed noted that inflation is rising but reiterated that it thinks it is “transitory.” That’s basically what it said last time. I hope the Fed is right about that. We’ve seen prices for some commodities start to fall. Lumber, in particular, has been dropping hard.

It looks like a meme stock!

Now let’s turn to the Fed’s economic projections. The Fed increased its forecast for inflation for this year from 2.4% to 3.4%. That’s a big increase considering the year is nearly half over. By 2022, the Fed sees inflation falling back to 2%.

The Fed raised its GDP outlook for this year from 6.5 to 7%. The forecast for unemployment at the end of this year is unchanged at 4.5%. Frankly, I think that’s way too optimistic, but I hope it’s correct. The Fed even sees unemployment dropping to 3.5% by 2023. In other words, we’ll have steady inflation and low unemployment. So the Fed think its policies will be a roaring success!

Now here’s the big change. Seven of 18 Fed officials see a rate hike coming sometime next year. That’s up from four at the last meeting. Specifically, five voters see one hike this year and two see two hikes. Previously, three saw one hike and one saw two.

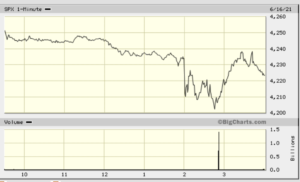

The market took this as a hawkish statement. Almost immediately, the Dow fell 200 points. At its low, the S&P 500 was down more than 1% and the yield on the 10-year Treasury rose seven basis points.

Here’s a minute-by-minute chart of the S&P 500 today. You can tell the Fed released its statement at 2 p.m.

I should explain that there are currently 18 members on the Federal Open Market Committee. However, not all of them are currently voting members. The regional bank presidents rotate as voting members. As a result, those seven votes probably overstate the desire of the Fed to hike rates. Bear in mind, we’re debating a 0.25% rate increase coming 18 months from now. I just don’t think that’s something to worry about.

Jerome Powell even said in his press conference to not read too much into the economic projections. I would go even further. I question the usefulness of the Fed releasing its economic projections. If you release them, then the market will take it seriously. That’s how markets act. But don’t release the projections and then say “well, it’s no big deal.”

The bottom line is that the Fed is still on the side of investors. Rates will stay low and the bond buying will continue. This has been good for stock investors and I expect it will continue to be. At some point, the Fed will “take away the punchbowl from the party,” but we’re not there yet.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

-

The Federal Reserve’s Policy Statement

Posted by Eddy Elfenbein on June 16th, 2021 at 2:00 pmHere’s the Fed’s statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

Progress on vaccinations has reduced the spread of COVID-19 in the United States. Amid this progress and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

Here are the economic projections.

My Comments

Bottom line. The Fed didn’t make any changes to interest rates. The Fed will continue to buy $120 billion in bonds each month. The Fed didn’t make any changes regarding the language of its bond buying.

The central bank noted that inflation is rising but reiterated that it thinks it is transitory. That’s basically what it said last time. The Fed also said that economic activity has strengthened. The vote today was unanimous.

Now let’s turn to the Fed’s economic projections. The Fed increased its forecast for inflation for this year from 2.4% to 3.4%. That’s a big increase considering the year is nearly half over.

The Fed raised its GDP outlook for this year from 6.5 to 7%. The forecast for unemployment is unchanged at 4.5%. I think that’s too optimistic, though I hope it’s correct.

Now here’s the big change. Seven Fed officials see a rate hike coming sometime next year. That’s up from four at the last meeting. (Specifically, five see one hike and two see two hikes. Previously, three saw one hike and one saw two.)

The market is taking this as a hawkish statement. Almost immediately, the Dow fell 200 points. At its low, the S&P 500 was down more than 1%. The yield on the 10-year Treasury rose about four basis points.

-

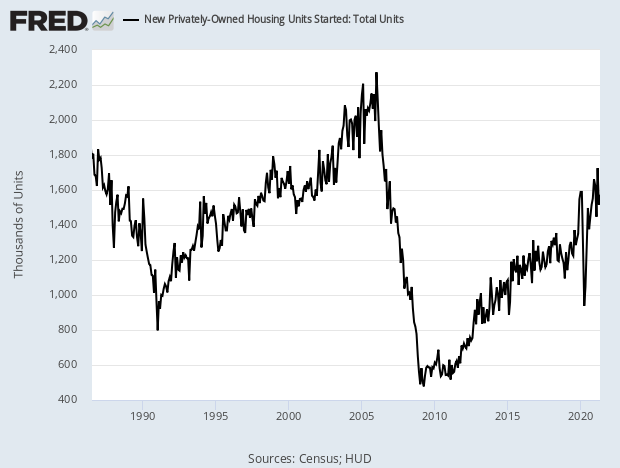

Home Construction Rose 3.6% in May

Posted by Eddy Elfenbein on June 16th, 2021 at 10:48 amFed Day is here. The Federal Reserve’s policy statement is due out at 2 pm ET. The statement will include updated economic projections. Jerome Powell will also hold a press conference.

This morning’s housing report showed that home construction rose by 3.6% last month. That was below expectations.

It appears that the soaring cost of lumber is having an impact. Interestingly, lumber has been falling sharply for the last few days.

Applications for building permits dropped by 3% in May. That’s often an indicator of future construction.

Here’s an interesting fact: the IPO market for this year is already on pace to break last year’s record, even though this year isn’t quite half over.

The IPO gold rush is set to reach new heights in the second half of 2021, as a number of high-profile startups such as China’s largest ride-sharing company Didi Chuxing Technology Co Ltd, online brokerage Robinhood Markets Inc and electric-vehicle maker Rivian Automative LLC prepare to launch multi-billion dollar share sales.

“If the markets hang in anywhere near where they are right now, we are going to be incredibly busy this summer, and into the fall with IPOs,” said Eddie Molloy, co-head of equity capital markets for the Americas at Morgan Stanley.

-

Morning News: June 16, 2021

Posted by Eddy Elfenbein on June 16th, 2021 at 7:00 amCheer Over Boeing, Airbus Deal Belies Cracks in EU, U.S. Trade Relationship

Crypto Lode of $100 Billion Stirs U.S. Worry Over Hidden Danger

Record Run in Emerging-Market Currencies Is Now Stirring Worry

Is the Fed Planning an Escape Route?

How to Have a Roaring 2020s (Without Wild Inflation)

Biden Names Lina Khan, a Big-Tech Critic, as F.T.C. Chair

Retail Sales Fell in May, in Latest Sign of a Bumpy Recovery

Amazon Will Open the Doors to a Grab-and-Go, Checkout-Less Grocery Store on Thursday

Can A $110 Million Helmet Unlock the Secrets of the Mind?

Girl Scouts Stuck With Over 15 Million Boxes of Unsold Cookies

Ben Carlson: Predicting Inflation is Hard

Nick Maggiulli: Don’t Win the Game Too Early

Michael Batnick: The Sleeping Giants & Animal Spirits: Fed Apologist

Joshua Brown: IT LITERALLY GROWS ON TREES & Why JPMorgan’s Stockpiling Half a Trillion in Cash

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His