-

Morning News: September 17, 2024

Posted by Eddy Elfenbein on September 17th, 2024 at 7:05 amJapan Halts Removal of Melted Fuel at Fukushima on Camera Outage

Biden Struggles to Refill Oil Reserve on the Cheap

US Allies Struggle to Break China’s Dominance of Rare Earths

China’s ‘Silver Economy’ Is Thriving as Birthrate Plunges

German Economic Expectations Darken Further

DP World Teams With Nedbank to Finance More Africa Trade

Workforce Dropouts Make UK ‘Sick Man of Europe,’ Report Says

Banking’s New Era of Capital Puts Watchdogs on the Spot

Bank Mergers May Get Tougher to Do

Banking Deal Oversight Expected to Get a Major Revamp

Hong Kong’s Biggest Listing in Years Lures Back Global Investors

Bets Are In, But the Fed’s Still Running the Casino

Markets Hinge on Powell Emulating Greenspan’s Soft Landing

Will Lower Rates Unleash a Business Boom? It’s Complicated.

What Fed Rate Cuts Will Mean for Five Areas of Your Financial Life

Trump’s Banker Brawls With Whistleblowers, Marxists and Shorts

Business Schools Are Undergoing Unusual Change

A Decade After ‘Lean In,’ Progress for Women Isn’t Trickling Down

Biggest Question from Kroger-Albertsons Trials: What’s a Grocery Store?

Kroger Antitrust Case Could Open Up New Bag of M&A Possibilities

Microsoft Plans New $60 Billion Buyback, Raises Dividend 10%

Amazon’s Five-Day Office Mandate Isn’t as Strict as it Sounds

Meta Plans to Bar the Russian TV Network RT From Its Apps

Instagram, Facing Pressure Over Child Safety Online, Unveils Sweeping Changes

Instagram’s New ‘Teen Accounts’: What Parents and Kids Need to Know

Sony Is Rethinking the Console Business Model With PS5 Pro

Universal Music Banks on Subscriptions, Partnerships to Drive Revenue Growth Through 2028

PGA Tour’s Saudi Deal Drags On With Players Arguing Over Pay

Be sure to follow me on Twitter.

-

Morning News: September 16, 2024

Posted by Eddy Elfenbein on September 16th, 2024 at 7:03 amUK Targets London Outpost of Iran Oil Kingpin ‘Hector’

Why Washington and Big Oil Are Investing Billions in Ammonia

The Power Grid Has Withstood the Heat, but Electric Supplies Are Tight

Big Energy Issue in Pennsylvania Is Low Natural Gas Prices. Not Fracking

Saipem Shares Rise on $4 Billion Contract From QatarEnergy

Nigeria Set to Pause Rates as Inflation Slows to Six-Month Low

Why Europe Is Embracing the New American Growth Model

Fed Ready to Unshackle US Economy With Soft Landing at Stake

Fed Enters Tricky Terrain: Rate Cuts in a Decent Economy

The Fed Is Still Banking on a Labor Market Miracle

Bill Dudley: The Fed Should Go Big Now. I Think It Will

S&P 500 Is Surviving Big Tech’s Slide as ‘Other 493’ Catch Up

Ten Money Managers Exit Eisler as Hedge Fund’s Gains Stall

Hedge Funds Switch to Buying Banks, Insurance and Trading Firms, Says Goldman Sachs

UniCredit, Commerzbank Merger Could Add Shareholder Value, Orcel Tells Paper

Private Equity’s Insurance Bets Raise Risks, BIS Researchers Say

A $33,000-a-Year Child Care Burden Vexes Harris, Trump Campaigns

TikTok Fights US ‘Sale-or-Ban’ Law in Key Appeals Court Faceoff

China Claims Chipmaking Gear Advance Despite Tightening US Curbs

AI Boom Is Driving a Surprise Resurgence of US Gas-Fired Power

Waymo Sets Its Sights on ‘Premium’ Robotaxi Passengers

After Layoffs, Tesla’s Supercharger Expansion Slows

‘Buy America’ Feud Risks 200 Mile-an-Hour Rail From Vegas to LA

Tencent’s Pony Ma Reclaims Title of China’s Richest Person

These Millionaires Can Afford Their Dream Home. They’re Renting Instead

Rupert Murdoch is Set to Face His Kids in Court, with Fox News’ Fate in the Balance

The Customized Drink Is Out of Control

Be sure to follow me on Twitter.

-

Morning News: September 13, 2024

Posted by Eddy Elfenbein on September 13th, 2024 at 7:02 amUK’s Approval of First Coal Mine in Three Decades Unlawful, Court Rules

The Hague Is World’s First City to Ban Oil and Air Travel Ads

Truck Maker Volvo Delays Construction of Battery Plant in Sweden

Stoppage at China Lithium Mine Won’t Be Enough to Ease Supply Glut

China Internal Passport Revamp Could Fuel New China Growth

U.S. Moves to Block a Popular Tariff-Free Path for Chinese Goods

Dejected Social Media Users Call ‘Garbage Time’ Over China’s Ailing Economy

China Is Risking a Deflationary Spiral

Russia Hikes Key Rate, Might Do So Again as War Fuels Price Rises

Fed to Pursue Three Quarter-Point Cuts This Year, Economists Say

The Fed Has No Choice But to Assume the Worst

Behind the Trump Crypto Project Is a Self-Described ‘Dirtbag of the Internet’

HSBC Said in Talks to Sell South African Unit to FirstRand

US Driving and Congestion Rates Are Higher Than Ever

US Housing Market Awaits Boost After Worst Key Season in Years

China Fines PwC $62 Million for Botching Its Work for Evergrande

China’s First Retirement Age Hike Since 1978 Triggers Discontent

Stranded in the CrowdStrike Meltdown: ‘No Hotel, No Food, No Assistance’

Boeing’s Seattle Workers Walk Out in First Strike Since 2008

United Airlines Taps Elon Musk’s Starlink for In-Flight Wi-Fi

Inside Elon Musk’s Mushrooming Security Apparatus

Intel Needs to Rethink What Leadership Means in New Chip World

Future of Murdoch Empire Comes Down to a Court in Nevada

AstraZeneca’s CEO Isn’t Distracted by the Race to Tackle Obesity

Luxury Brands’ New Snag? Handbag Arbitrage

A Stake in the Miami Dolphins Is Back on the Block

College Football Players Learn an Ugly Truth About Getting Paid

The Vegas Sphere’s First Live Sporting Event Will Be an Expensive One

Be sure to follow me on Twitter.

-

Morning News: September 12, 2024

Posted by Eddy Elfenbein on September 12th, 2024 at 7:07 amPakistan Cuts Rates To Revive Economy as Inflation Cools

Hawkish BOJ Board Member Says Rates Should Be Raised to at Least 1%

Bank of England Eyes Growth with Lighter Bank Capital Reforms for UK Lenders

ECB Cuts Interest Rates for Second Time in Three Months

Germany Lobbies EU to Help More Industries With Power Bills

Broken Blades, Angry Fishermen and Rising Costs Slow Offshore Wind

Wall Street Quietly Turns Tail on Its Sustainability Commitments

From Fed to Elections, FX Turbulence Buffets Dollar Investors

JPMorgan to Cap Junior Banker Hours, BofA Monitors Workloads

Mastercard to Acquire Insight Partners’ Recorded Future for $2.65 Billion

Inflation Numbers Resolve What the Debate Couldn’t

Layoffs Are Low. That Doesn’t Mean the Labor Market Is Strong.

Young Chinese Émigrés Confront America’s Brutal Visa Lottery

How America Became a Republic of Distrust

Homebuyers Hit by Price Surge, Supply Crunch Rock 2024 Election

Madison Realty Capital Closes $2 Billion Property Debt Fund

What US and EU Crackdowns on Big Tech Mean for Apple, Google, X

OpenAI Aims for a $150 Billion Valuation

Intel Has Only Tough Options After Its Long and Stinging Fall From Grace

How the Election Is Sinking a $15 Billion Business Deal

Stellantis to Suspend e-Fiat 500 Output on Poor Europe Demand

G.M. and Hyundai Plan to Work Together on New Vehicles

Boeing Workers Cast Crucial Strike Vote Amid Contract Backlash

SpaceX Astronauts Conduct Spacewalk, Putting New Spacesuits to Test

Norfolk Southern’s CEO Survived an Activist Attack. Then Came Talk of an Affair

General Mills to Sell North American Yogurt Business for $2.1 Billion

Ozempic Is Selling So Well an Insurer Wants $1 Million in Payments Back

Be sure to follow me on Twitter.

-

Morning News: September 11, 2024

Posted by Eddy Elfenbein on September 11th, 2024 at 7:05 amUK Eyes More Exports to French-Speaking Africa

Prices at the Pump Fall, a Win for Efforts to Fight Inflation

Is the Oil Price Slide a Red Flag or a Small Mercy?

Trader Hartree Sees Policy Reforms Lifting Asia’s Carbon Markets

Yen Strengthens After BOJ Board Member Signals More Rate Hikes to Come

A Recession Signal Is Flashing Red. Or Is It?

US CPI to Show Another Muted Rise as Fed Debates Rate-Cut Size

Details of New US Bank Capital Rules Still Uncertain with Election Looming

UniCredit Makes Move on Commerzbank as Germany Starts Exit

HSBC Signals Maltese Exit Days After New CEO Takes Charge

Murdoch’s $7.3 Billion Takeover Bid Rebuffed by Rightmove

US Crypto Stocks Fall on Rising Bets on Harris’ Win After Presidential Debate

The Big Takeaways for Business from Debate Night

Taylor Swift’s Harris Endorsement Turns Tables on AI Abusers

Shortfall in Young Engineers Threatens Nuclear Renaissance

Europe Confronts Its Tech Dilemma: Regulate or Innovate

China Wants to Replace Jeff Bezos as Musk’s Greatest Space Threat

How Memphis Became a Battleground over Elon Musk’s xAI Supercomputer

When Self-Driving Cars Don’t Actually Drive Themselves

McDonald’s Rolls Out Kiosks That Take Cash, Pushing Diners Away From Cashiers

Campbell Drops Soup From Its Name, Not Its Plans

Topgolf Sent Callaway Into the Rough

LVMH Close to F1 Sponsorship Deal for Range of Luxury Brands

Lululemon Is Seeing a Slowdown in Its Women’s Business. Has It Reached Its Ceiling?

Kevin Plank Broke Under Armour. Can He Fix It?

Be sure to follow me on Twitter.

-

CWS Market Review – September 10, 2024

Posted by Eddy Elfenbein on September 10th, 2024 at 6:03 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.” – Jack Bogle

The Market Stumbles Into September

How things change after Labor Day! In last Tuesday’s issue, I told you that Labor Day has often marked a tone shift on Wall Street, Historically, September and October have been tough times for the market. Well, we certainly learned that lesson again this year.

Presidential election years have been especially difficult for the stock market. From September 7 to October 12 in presidential election years, the Dow has lost an average of 2.72%.

On the Friday before Labor Day, the S&P 500 closed very close to a new all-time high, but last week, the index had its worst week of the year. That’s even more impressive when you recall that last week only had four trading days. The S&P 500 fell lower on all four days, and it culminated in last Friday’s underwhelming jobs report (more on that in a bit).

The market rebounded nicely yesterday and today. The market’s thinking seems to have shifted from, “Good news! The Fed will soon be cutting rates,” to “Bad news, the economy is getting weak, and the Fed will soon be cutting rates.”

The next test for the market will be tomorrow’s CPI report. The inflation numbers have been getting better but at a very slow pace. The consensus on Wall Street is that the headline and core rate of inflation increased by 0.2% last month.

Weak Jobs Report Drags Down Stocks

On Friday, the government said that the U.S. economy created 142,000 net new jobs last month. That’s not that good. It missed consensus by 19,000. For July, the economy created 89,000 new jobs.

The unemployment rate dropped by 0.1% to 4.2%, but the broader U-6 rate increased to 7.9% which is close to a three-year high.

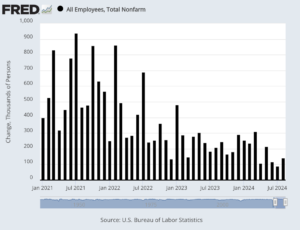

The government also revised previous jobs reports lower. The total for July was cut by 25,000, and the June number was lowered by 118,000. Here you can see the steady decline in non-farm payrolls gains.

One bright spot in the report was average hourly earnings. That increased by 0.4% last month while the estimate was for a gain of 0.3%. Over the last year, average hourly earnings are up by 3.8%. That’s good to see, but it’s nearly in line with inflation.

The labor force participation rate was unchanged at 62.7%. It seems that more workers are shifting from full-time work to part-time. The household survey said that part-time employment increased by 527,000 and full-time decreased by 438,000.

From a sector standpoint, construction led with 34,000 additional jobs. Other substantial gainers included health care, with 31,000, and social assistance, which saw growth of 13,000. Manufacturing lost 24,000 on the month.

The Federal Reserve meets again next week. The policy statement will be released on Wednesday, September 18. According to the futures market, there’s a 100% chance that the Fed will cut rates. The only question is by how much.

Currently, the market thinks there’s a 67% chance of a 0.25% cut and a 33% chance of a 0.50% cut. Going by what Jerome Powell has said, I think the Fed is leaning towards a 0.25% cut. The futures market thinks there will be a 50 basis-points cut at the November meeting which will be two days after the election.

Investors should understand that the market is becoming more conservative. Value stocks and low-volatility stocks has been leading the market while many of the growth names have been lagging. Several prominent stocks are more than 20% off their highs. This will probably continue as rates head lower. I’m pleased to see that our Buy List has outperformed by a wide margin over the last two months. (It hasn’t always been that way!)

Stock Focus: Cass Information Systems

This week, I want to tell you about Cass Information Systems (CASS). Cass is a business services company based in St. Louis, Missouri. You probably have not heard of them, but Cass is crucial to many companies. Cass processes and pays 50 million invoices each year.

Cass wants to pay your company’s bills. The information services firm provides freight payment and information processing services to large manufacturing, distribution, and retail companies across the U.S.

Its offerings include freight bill payment, audit, and rating services as well as outsourcing of utility bill processing and payments. Its telecommunications division manages telecom expenses for large companies. Cass grew out of Cass Commercial Bank (now a subsidiary), which provides banking services to private companies.

The company’s international reach is truly impressive. Cass pays invoices in 185 countries and in 114 different currencies. Cass lets companies have complete visibility into every detail of their transportation spending with total trust in the data.

Cass helps save millions in telecommunications costs thanks to an expense management partner who studies the data and recommends savings initiatives. Cass helps pay utility bills reliably on time. Cass can also leverage benchmarking data for waste removal costs to negotiate new contracts. This helps save time and money.

This is a superb company that is largely ignored by Wall Street. This is an especially good time to look at Cass because it’s operating in a difficult environment.

In July, Cass reported Q2 earnings of 32 cents per share. That’s down from 52 cents for last year’s Q2. According to the company, Cass lost over “$100 million of non-interest-bearing funding due to a cyber event at a client and incurring an aggregate of $3.4 million of one-time expenses.”

CEO Martin Resch said, “We successfully onboarded several large facility clients, increasing year over year facilities transactions by 25.1%, with a full queue of additional signed deals still to implement.”

Now here are some important details on why I like Cass. The dividend currently yields close to 3%. That’s not bad in a lower-rate environment. Cass has very little long-term debt, and it’s sitting on a mountain (well, small hill) of cash. At last count, Cass’s cash comes to $223 million. That works out to $16.41 per share. This is important because it tells us that Cass is more efficient than it initially appears to be.

The stock hasn’t performed very well recently which catches my attention. By conventional metrics, Cass is reasonably priced. However, if Cass can return to the kind of growth it used to have, then this could be a very profitable position.

Historically, Cass has favored doing several small stock splits every few years. That may lead people to think that Cass hasn’t done as well as it has. Cass currently has over 1,000 employees and a market cap of $550 million.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. There will be no Tuesday issue next week. I’m going to be at the Future Proof Conference in Huntington Beach, CA. If you’re around, please come by and say hello. We’ll be at booth #702.

-

Morning News: September 10, 2024

Posted by Eddy Elfenbein on September 10th, 2024 at 7:05 amJapan Must Curb Clean Power Reliance, Warns Leadership Candidate

Side Hustles on eBay Gain Popularity in Japan as Inflation Bites

China’s $6.5 Trillion Stock Rout Worsens Economic Peril for Xi

China’s Continuing Export Surge Likely to Invite More Pushback

Edgy Traders Brace for Potentially ‘Pivotal’ Trump-Harris Debate

What Wall Street Wants to Hear at the Debate

For Trump, Tariffs Are the Solution to Almost Any Problem

Trump Is the Only One Threatening the Dollar

He Scammed People for Their Money. He Was Also a Victim.

Criminal Charge Against Outspoken Short Seller Unsettles Wall St.

Goldman Sachs to Post $400 Million Hit to Third-Quarter Results as It Unwinds Consumer Business

Bank of America Raises Minimum Wage to $24 on Way to $25 an Hour

Private Equity Fights Insurance for $15 Trillion Retirement Prize

This Global Financial Capital Is an AI No Man’s Land

Apple, Google Lose Multibillion Dollar Court Fights With EU

The College Dropout Who Invested Billions to Cozy Up With Elon Musk

Just Miles from Kroger’s Court Battle, a Food Desert Shows What’s at Stake

How a Japanese Suitor Misread Politics with U.S. Steel Bid

Bankers Ratcheting Up Oil Deals Drive a Deepening Market Split

OPEC Trims Oil Demand Outlook Further Amid Price Slump

Big Oil Faces a ‘Good Sweating.’ Some Aren’t Fit

Brookfield Invests $1.1 Billion Into Green Fuel Maker Infinium

It’s the Airplane of the Future. It’s Still Grounded

Southwest Airlines Chairman to Step Down Amid Elliott Battle

BMW Cuts Guidance After Faulty Brake Systems Prompt Recall

Jorge Ramos to Leave Univision After 40 Years at the Network

Hedge Fund Pushes for End of Murdochs’ Control at News Corp

U.K. Competition Watchdog to Probe Carlsberg’s Acquisition of Britvic

Be sure to follow me on Twitter.

-

Morning News: September 9, 2024

Posted by Eddy Elfenbein on September 9th, 2024 at 7:07 amKenya Struggles to Stabilize Public Finances After Tax Protests

China’s Deflationary Spiral Is Now Entering Dangerous New Stage

Europe’s ‘Reason for Being’ at Risk as Competitiveness Wanes, Report Warns

Draghi Says EU Itself at Risk Without More Funds and Joint Debt

The Bond Market Rally Rides on How Fast the Fed Cuts Rates

Jobs Don’t Justify a Half-Point Cut. Will Inflation?

Stock-Selloff Fears for September Are Overblown

Biden and Trump Are Both Eyeing a Sovereign-Wealth Fund. Why?

More Cash for Kids Is Popular. It Might Not Be Wise.

How Americans Voted Their Way Into a Housing Crisis

Americans Face Credit Hit as Student Debt Goes Delinquent Again

Are Greedy Companies to Blame for Grocery Inflation? We Looked at the Data

B. Riley in Talks to Sell Majority Stake in Great American Group

PayPal Teams Up With Shopify in CEO’s Latest Partnership Deal

How Trump Could Turn a $400 Billion Green Bank Into a Fossil Fuel Lender

The Texas Billionaire Who Has Greenpeace USA on the Verge of Bankruptcy

China’s EV, Hybrid Sales Maintain Momentum

U.S. Prepares to Challenge Google’s Online Ad Dominance

Japan’s Rapidus Seeks Another $700 Million in Chipmaking Push

Boeing Reaches Tentative Deal With Workers to Avert Strike

Starbucks’ New CEO Made Shares Soar. Now He Has to Prove His Worth

Big Lots Files for Bankruptcy, Agrees Sale to Nexus Capital

Greed, Gluttony and the Crackup of Red Lobster

The Palace Coup at the Magic Kingdom

Ubisoft Shares Slump After Investor Urges Assassin’s Creed Maker to Go Private

Be sure to follow me on Twitter.

-

Morning News: September 6, 2024

Posted by Eddy Elfenbein on September 6th, 2024 at 7:02 amSeven & I Reply to Couche-Tard Shows Japan’s M&A Era Has Arrived

U.S. Blowback to Steel Merger Vexes Japan

Japan Tries to Reclaim Its Clout as a Global Tech Leader

China’s $100 Billion Short Against Dollar Enriches Hedge Funds

Russian Court Freezes Raiffeisen Shares in Local Bank, Blocking Sale

Eurozone Economy Weaker Than Previously Estimated as ECB Prepares to Meet

ECB’s Lagarde Set to Skip Budapest Ecofin, Only Attend Eurogroup

German Recession Fears Mount as Industry Slump Endures

Warren Buffett’s Haul From Bank of America Stock Sales Nears $7 Billion

Investor Dash to Cash Continues Ahead of Fed Rate Cut, BofA Says

The Yield Curve Is Disinverting. Why Should I Care?

US Jobs Report May Show Hiring Bounce, Decide Size of Fed Cut

The Downside of Falling Interest Rates

US Bonds Climb as Traders Look to Jobs Data to Back Big Fed Cuts

Breaking Down Trumponomics 2.0

America Has a Gender and Racial Pay Gap That Just Won’t Go Away

Federal Judge Temporarily Blocks Another Pillar of Biden’s Student Debt Plan

Voters Love No Tax on Tips, But Split Over $25,000 Housing Help

Australia Gave People a Right to Log Off, and Bosses Are Unhappy

Companies Finally Find a Use for Virtual Reality at Work

Yondr Finds Business Success in School Phone Bans

A.I. Isn’t Magic, but Can It Be ‘Agentic’?

Larry Ellison Will Control Paramount After Merger

Americans Eat 42 Pounds of Cheese a Year. $4 Billion Says They Want More

The 35-Year-Old CEO Plotting Red Lobster’s Comeback

Jean Paul Gaultier Owner Puig Shares Drop After Warning on China Challenges

On N.B.A. Player Podcasts, There’s the Star and Then the Other Guy

Be sure to follow me on Twitter.

-

Morning News: September 5, 2024

Posted by Eddy Elfenbein on September 5th, 2024 at 7:05 amChina’s Central Bank Sees Room to Lower Banks’ Reserve-Requirement Ratio

BOJ Board Member Takata Sees Need to ‘Shift Gears’

Meloni Officials Aim for Italy Deficit Below 3% Within Two Years

Leaked Reports and Political Heat Are Testing Trust in Economic Data

Investor Bets Shift as Dollar Weakens with Looming Fed Rate Cuts

Why This Jobs Report Could Be the Most Pivotal One in Years

The Hot Labor Market Has Melted Away. Just Ask New College Grads

Private Equity’s Favorite Borrowing Tool Sparks Fresh Scrutiny

Jane Street and Citadel Won’t Devour All of Wall Street’s Revenue

Affirm to Profit Soon From Buy Now, Pay Later

Tax Policy Becomes a Fault Line for Harris

Howard Lutnick Emerges as Trump’s No. 1 Salesman on Wall Street

Ex-Discover Star Sues Over Pay Clawback Before $35 Billion Deal

Verizon to Buy Frontier for $9.6 Billion in Broadband Push

UK May Allow Amazon’s Starlink Rival to Offer Broadband Services

Blackstone Deal Unlocks $670 Million Fortune for AirTrunk Founder

As Crackdown Deepens in Venezuela, Chevron Says Keep the Oil Flowing

Delaying Oil Output Return Won’t Fix OPEC+ Problems

Nippon Steel Left Hunting Next Step as US Takeover Flounders

Electric Vehicles No Longer Need Subsidies, Indian Minister Says

NIO’s Second-Quarter Net Loss Narrowed on Sales Boost

Why Public EV Chargers Almost Never Work as Fast as Promised

Cures for Rare Diseases Now Exist. Employers Don’t Want to Pay

Investor Who Risked It All on ‘Wukong’ Scores Another Sales Win

Billionaire Sports Family Revels in Wall Street Money, World Cup and Taylor Swift

NFL Invades Soccer-Crazed Brazil in Push to Go Global

Leaked Disney Data Reveals Financial and Strategy Secrets

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His