-

Torchmark Earns $1.56 per Share

Posted by Eddy Elfenbein on February 5th, 2019 at 4:15 pmThis afternoon, Torchmark (TMK) reported Q4 earnings of $1.56 per share. That met expectations. For the year, Torchmark made $6.13 per share. That’s up from $4.82 per share for 2017.

Here are some highlights:

Net income as an ROE was 12.3%. Net operating income as an ROE excluding net unrealized gains on fixed maturities was 14.6%.

Life underwriting margin at Globe Life Direct Response increased over the year-ago quarter by 6% and health underwriting margin at Family Heritage Agency increased over the year-ago quarter by 15%.

Life premiums increased over the year-ago quarter by 7% at American Income Agency and health premiums increased over the year-ago quarter by 8% at Family Heritage Agency.

Net life sales and net health sales at Liberty National Agency increased over the year-ago quarter by 6% and 9%, respectively.

Average producing agent count increased over the year-ago quarter by 10% at Family Heritage Agency.

1.5 million shares of common stock were repurchased during the quarter and 4.4 million shares were repurchased during the year.

For this year, Torchmark sees earnings of $6.50 to $6.70 per share. Wall Street had been expecting $6.61 per share. That means the stock is going for about 12.5 times this year’s earnings.

-

Disney Beats Earnings

Posted by Eddy Elfenbein on February 5th, 2019 at 4:10 pmAfter the closing bell, Disney (DIS) reported very good earnings for their fiscal Q1. The company earned $1.84 per share which beat estimates by 29 cents per share. Revenue fell to $15.30 billion but that beat expectations of $15.14 billion.

Disney, whose assets include cable networks such as ESPN and film studios like Marvel, is making a push into streaming services as more consumers drop their pay-TV package in favor of cheaper options that can be watched through an internet connection. The company launched ESPN+ last year and plans to launch Disney+, a streaming service of its movies and original programming, later this year.

The company said that its direct-to-consumer and international segment posted revenue of $918 million and an operating loss of $136 million in its first quarter ended Dec. 29. due to increased costs related to ESPN+ and the upcoming launch of Disney+.

On the earnings call, Disney said that it expects investment in those ventures to negatively impact the segment’s year-over-year operating income by $200 million in the second quarter.

Revenue in Disney’s media networks business, which includes ESPN, rose 7 percent to $5.92 billion in the first quarter, compared to the year-earlier period, while its parks business was up 5 percent to $6.82 billion. Studio entertainment revenues fell 27 percent to $1.8 billion thanks to the strong performance of Star Wars: The Last Jedi and Thor: Ragnarok in the prior-year quarter compared to Mary Poppins Returns and The Nutcracker and the Four Realms this year.

The company expects its pending $71.3 billion acquisition of a majority of assets from Twenty-First Century Fox to aid its strategy in streaming. The deal is expected to provide Disney with additional media assets for its new streaming service and would also give Disney a larger stake in the streaming service Hulu.

But Disney’s direct-to-consumer push comes with risks: It’s hard to turn a profit on streaming services, which usually entail high content and technology costs but offer lower prices than traditional cable to attract consumers.

The stock rose a little bit in the after-hours session.

-

Cerner Earns 63 Cents per Share

Posted by Eddy Elfenbein on February 5th, 2019 at 4:08 pmCerner (CERN) reported Q4 earnings of 63 cents per share, up from 58 cents per share in Q4 of 2017. Cerner’s result matched Wall Street’s forecast. Q4 revenue rose 4% to $1.366 billion. For the year, Cerner made $2.45 per share and revenue rose 4% to $5.366 billion.

The healthcare IT firm also they’ll initiate a quarterly dividend of 15 cents per share starting in the third quarter.

“We finished the year on a solid note and in line with full-year expectations,” said Brent Shafer, Chairman and CEO. “After one year at Cerner, I have confirmed my initial view that we have significant opportunity to grow and create value in health care, and we are refining our operating model so we can innovate at scale, deliver value to clients faster, and grow profitably. Our confidence in Cerner’s growth outlook, combined with strong cash flow and balance sheet, put us in a position to return capital to shareholders by initiating a quarterly dividend. This move along with the existing share repurchase program underscores our commitment to delivering shareholder value.”

Cerner expects:

Q1 2019 revenue between $1.365 billion and $1.415 billion, and 2019 revenue between $5.650 billion and $5.850 billion.

Q1 EPS between $0.60 and $0.62, and 2019 EPS between $2.57 and $2.67.

First quarter 2019 new business bookings between $1.100 billion and $1.300 billion.

-

Church & Dwight Earns 57 Cents per Share

Posted by Eddy Elfenbein on February 5th, 2019 at 9:01 amChurch & Dwight (CHD) reported Q4 earnings of 57 cents per share which was a penny below estimates. For the year, CHD earned $2.27 per share. For the year, organic sales rose 4.3% which beat the company’s forecast of 4.0%.

Matthew Farrell, Chief Executive Officer, commented, “Q4 organic sales growth of 4.3% was exceptionally strong and exceeded our 3% outlook. Q4 was the third consecutive quarter of greater than 4% organic growth and the second consecutive quarter of positive price and product mix (+1.6%). The Consumer Domestic business posted strong volume growth in Q4 and positive pricing as the promotional environment continued to improve. Our categories continue to grow and our market shares are healthy. Eleven of our 14 domestic categories grew during the quarter and more than half have grown for at least 5 consecutive quarters. In the domestic business, 7 out of 11 power brands met or exceeded category growth in 2018. In the International business, we exceeded our 6% organic growth target for the fourth consecutive year in 2018.

“Compelling new product launches and investments will drive 2019 organic sales growth of approximately 3.5%. Price increases announced on approximately 30% of the portfolio contribute to gross margin expansion in 2019. These pricing actions did not hit retailer shelves until late Q4 and had minimal impact on Q4 results. Additional pricing actions are currently being discussed with retailers. The investments in our International business continue to pay off, particularly export and our Asia Pacific partnerships. We are entering 2019 with momentum.”

For Q4, organic sales rose by 4.3% which beat their outlook of 3%.

Gross margin in the fourth quarter was lower than expected due to the household business growing faster than expected and U.S. tariffs, the impact of which has been addressed with the announcement of 2019 price increases. The incremental marketing spend, higher incentive compensation, and U.S. tariffs were offset by a lower tax rate.

The company also boosted its quarterly dividend from 21.75 cents per share to 22.75 cents per share. That’s a 4.6% increase. That’s the 23rd annual dividend increase in a row.

Update: The shares fell 7.51% in today’s session.

-

Becton, Dickinson Earns $2.70 per Share

Posted by Eddy Elfenbein on February 5th, 2019 at 8:37 amThree weeks ago, Becton, Dickinson (BDX) told us they made $2.70 per share for fiscal Q1. This morning, the official earnings report came out and confirmed that. On a currency-neutral basis, that’s an increase of 14.9%.

“We are very pleased with our strong start to fiscal year 2019. As noted in our pre-announcement, results were better than expected across all three segments,” said Vincent A. Forlenza, Chairman and CEO. “It is evident that the combination of BD and C. R. Bard is delivering value to customers, patients and shareholders around the world.”

For 2019, BDX expects revenues to grow by 5% to 6%, and they see EPS ranging between $12.05 and $12.15. Shares of BDX lost about 2% today.

-

Morning News: February 5, 2019

Posted by Eddy Elfenbein on February 5th, 2019 at 6:56 amTrade Hawks Quietly Bristle as Trump’s China Deadline Approaches

How U.S. Criminal Laws Became Weapons in the China Trade War

Stop Worrying About the Fed’s Balance Sheet

Don’t Hold Your Breath for Big Stock Returns, Says Goldman Sachs

This Market’s Almost as Boring as the Super Bowl

Cloud-Computing Giants Keep Growing Despite Slowdown Fears

Tech Is Splitting the U.S. Work Force in Two

Loose Money Era Leaves Trail of U.S. Corporate Debt Junkies

Once the ‘Bond King,’ Bill Gross Is Retiring, His Star Dimmed

Alphabet’s Higher Spending Worries Investors, Shares Dip

Slack Files for Public Offering, Joining Silicon Valley’s Stock Market Rush

Crypto Exchange Customers Can’t Access $190 Million After CEO Dies With Sole Password

Ben Carlson: Simple vs. Complex, 2018 Edition

Michael Batnick: Was This a Dead Cat Bounce?

Joshua Brown: The Confidence Shock & re: the Bill Gross Retirement, Stock Buyback Laws and More

Be sure to follow me on Twitter.

-

Raytheon Breaks Above $173 per Share

Posted by Eddy Elfenbein on February 4th, 2019 at 1:27 pmRaytheon (RTN) is the latest in a trend we’ve seen a lot of.

Step 1. Stock drops on “disappointing earnings.”

Step 2. **Wait Two Days**

Step 3. Stock breaks out once people realize that the earnings weren’t that bad.

Wall Street’s first instinct is to panic. The real money is made by waiting. To quote Jesse Livermore, “It was never my thinking that made the big money. It was always my sitting.”

-

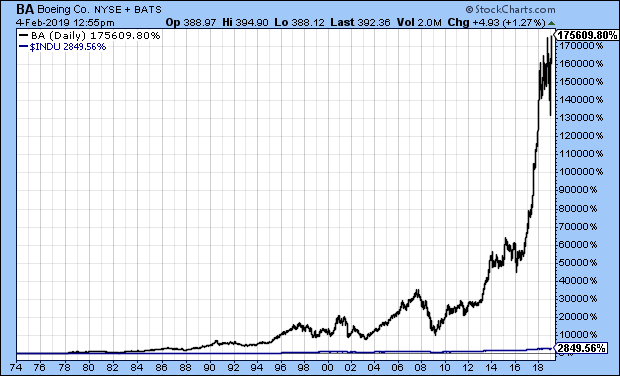

Boeing’s Amazing Long-Term Growth

Posted by Eddy Elfenbein on February 4th, 2019 at 1:07 pmI think many investors would be surprised at the long-term growth of shares of Boeing (BA). Last week, the company reported blow-out earnings.

Dow component Boeing’s stock surged Wednesday after the company reported year-end results that smashed Wall Street’s expectations, with record revenue and airplane deliveries driving the blowout.

Boeing reported a massive fourth-quarter earnings result of an adjusted $5.48 per share, beating expectations in a Refinitiv survey of analysts by 91 cents. Revenue was also strong, at $28.3 billion — more than $1 billion than analysts expected.

The aerospace giant reported $101.1 billion in annual revenue, breaking the $100 billion mark for the first time. Boeing also provided a strong 2019 forecast. Boeing expects next year’s earnings of $19.90 to $20.10 per share. Wall Street was expecting $18.31 a share for full-year 2019 earnings.

Boeing is a Dow component. In fact, it has the highest share price in the Dow which gives it the highest weighting. By market cap, it’s the 14th largest company in the index. Boeing was added to the Dow in 1987.

Since the bear market low nearly ten years ago, Boeing has crushed the Dow 1,571% to 277%. Here’s the 45-year view:

Since 1974, Boeing gained 176,000% and the Dow’s +2,842%.

-

Morning News: February 4, 2019

Posted by Eddy Elfenbein on February 4th, 2019 at 6:19 amWhy Italy’s Debts Are Europe’s Big Problem

Japan Insurers to Target China M&A in New Phase After $50 Billion Overseas Push

Australia Vows to Clean Up Financial Sector After Landmark Misconduct Inquiry

How a ‘Monster’ Texas Oil Field Made the U.S. a Star in the World Market

Behind Tech’s Shine, Some Warnings Signs Appear

Nissan Scraps Plans to Build New S.U.V. in Britain

Wirecard Sees No Conclusive Evidence of Fraud as Police Start Probe

Feared or Celebrated, Amazon Alexa Is Star of Super Bowl Ads

The $4.3 Billion Deal That Blew Up Over Shoddy Drug Production

Tencent-Backed Chinese Movie-Ticketing App Maoyan Makes Weak Hong Kong Debut

Bud Light, Big Corn Get Into Weirdest Twitter Feud Ever Over Super Bowl Ad

Howard Lindzon: Coinmine and Grinning

Jeff Miller: Looking Beyond the Obvious

Roger Nusbaum: That Bear Market Call Looks Wrong…Again! &

“No One Is Sad While They’re Deadlifting”Be sure to follow me on Twitter.

-

Hershey Fixes Kisses’ Problem

Posted by Eddy Elfenbein on February 2nd, 2019 at 1:00 pmHershey says it has solved the case of the missing tips atop its Kisses candies, after angry holiday bakers complained about imperfect points.

“We looked at the entire Kiss manufacturing process, and we made some adjustments to shaping the tips to allow us to have greater consistency,” CEO Michele Buck told CNBC on Thursday.

There was an outcry among holiday bakers in December when they discovered the tips of Kisses, which they had planned to use for baking cookies and other confections, were missing. Several took to social media to complain to the company, based in Hershey, Pennsylvania.

At the time, Hershey was largely mum on the cause. Spokesperson Jeff Beckman told The New York Times “there are many variables’” in the production process. Beckman also told the paper the company was “working to improve the appearance” of the candies.

“We were seeing some inconsistency in the tip shaping,” Buck said. She declined to provide detail regarding the manufacturing flaws that caused Kisses to arrive with broken-off tips but said changes have been made to prevent further disappointment.

Due to the volume of candy the company manufactures, there will be a period in which customers may still find Kisses with missing tips.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His