-

Morning News: January 9, 2019

Posted by Eddy Elfenbein on January 9th, 2019 at 7:15 amItaly’s Populist Revolution Is Gone in 480 Seconds

U.S.-China Trade Talks Conclude on Optimistic Note

Bond-Market Warning Seen in Weakest Treasuries Demand Since 2008

Feeling the Bite of the Government Shutdown

PayPal Quietly Took Over the Checkout Button

China’s Approval of DowDuPont Soy Poses Challenge to Bayer

Saudi Private Jet Industry Stalls After Corruption Crackdown

New Documents Link Huawei to Suspected Front Companies in Iran, Syria

Sears to Stay Open Another Week; Auction Set for Monday

Verizon and T-Mobile Bash AT&T Over ‘Fake 5G’

Goldman’s $500 Million Lawyer Is Ready to Call It Quits

Google’s CES Ride is a Strange, Strange Trip

Nick Maggiulli: The Price of Greed

Joshua Brown: Could A Falling Stock Market Create Its Own Recession? & Good Riddance

Ben Carlson: Updating My Favorite Performance Chart for 2018

Be sure to follow me on Twitter.

-

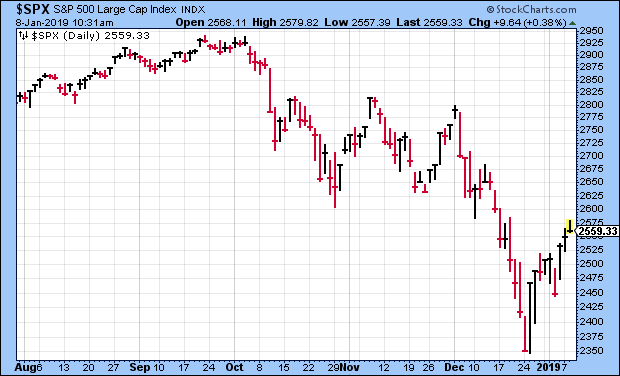

What If the Bear Market Is Already Over?

Posted by Eddy Elfenbein on January 8th, 2019 at 10:37 amHere’s a radical idea — what if the bear market has already passed? Since we don’t know the future, we can never say for certain, but let’s consider some evidence.

The S&P 500 made its intra-day low on Boxing Day. From there to this morning’s high, the index has gained nearly 10%.

People assume they’ll know the low when it happens, but markets don’t work that way. Or more specifically, people don’t work that way.

Fourth-quarter earnings season starts soon, and it should be a good one for Wall Street. If the market continues to rally, then the downdraft of late 2018 will look pretty silly.

-

Morning News: January 8, 2019

Posted by Eddy Elfenbein on January 8th, 2019 at 7:29 amGermany’s Industry Shock Raises Specter of Economic Recession

These Could Be the World’s Biggest Economies by 2030

Goldman Lifts Outlook for Global Bonds in Face of Slowing Growth

Flipping the Economics of Paying for Education, Because They’re Upside Down

Samsung Electronics Says Weak Chip Demand Sent Fourth-Quarter Profit Well Below Market Estimates

China’s HNA Touts Assets for Sale as Funding Crunch Intensifies

S&P Cuts PG&E Ratings to Junk, Warns of Further Downgrade

Oracle’s Ellison Reveals $1 Billion Stake in Tesla

‘She Literally Never Stops.’ CBS News, in Need of Fixing, Turns to Susan Zirinsky.

Edward Lampert Scrambles to Keep Sears Alive

Carlos Ghosn Emerges to Say He Was ‘Wrongly Accused and Unfairly Detained’

Howard Lindzon: Momentum Monday – Did We Bottom in December?

Michael Batnick: The Next 20 Years

Roger Nusbaum: Early Retirement & Personal News

Be sure to follow me on Twitter.

-

The Members Exchange

Posted by Eddy Elfenbein on January 7th, 2019 at 11:20 amThe Wall Street Journal reports that a new exchange is being launched, the Members Exchange.

A group of financial heavyweights including Morgan Stanley , Fidelity Investments and Citadel Securities LLC plans to launch a new low-cost stock exchange to challenge the New York Stock Exchange and Nasdaq Inc., the companies said.

The creation of the new venue, called Members Exchange or MEMX, comes after years of frustration among Wall Street brokers and traders with the fees charged by U.S. stock exchanges.

MEMX will be controlled by the nine banks, brokerages and high-frequency trading firms funding it, according to a news release viewed by The Wall Street Journal. Such an arrangement harks back to the era when exchanges were owned by their members, typically stockbrokers.

MEMX investors also include investment banks Bank of America Merrill Lynch and UBS AG, high-speed trader Virtu Financial Inc. and retail brokers Charles Schwab Corp., E*Trade Financial Corp. and TD Ameritrade Holding Corp., according to the news release.

I’m conflicted because on one hand this is a challenge to NYSE and ICE. On the other hand, I like ICE because I recognize its monopoly-like hold.

It will still take some time before any challenger can get established.

New York-based MEMX is set to make its plans public on Monday. Representatives of the investor group said they would seek to apply for exchange status with the Securities and Exchange Commission early this year. SEC approval for a new exchange is a drawn-out process that can take 12 months or longer, meaning it may be 2020 or later before MEMX is up and running.

A launch would inject new competition into the heavily concentrated stock-exchange business. Today, all but one of the 13 active U.S. stock exchanges is owned by three corporations: NYSE parent Intercontinental Exchange Inc., known as ICE for short, Nasdaq and Cboe Global Markets Inc. Between them they handle more than three-fifths of U.S. equities trading volume.

It’s not easy to challenge the king.

Despite its prominent backers, there is no guarantee that MEMX will succeed. New exchanges often struggle to attract trading activity away from established markets. IEX Group Inc., a startup that was founded in 2012 and now runs the only independent exchange not owned by the big three, handles 2.5% of U.S. equities trading volume.

But brokers looking to save costs could be drawn to MEMX’s low fees. ICE, Nasdaq and Cboe have faced criticism for raising fees for services such as the data feeds that brokers use to monitor moves in stock prices. The three big exchange groups say their prices are fair.

-

Morning News: January 7, 2019

Posted by Eddy Elfenbein on January 7th, 2019 at 7:08 amXi’s Top Trade Official Unexpectedly Attended China-U.S. Talks

Trump Has Promised to Bring Jobs Back. His Tariffs Threaten to Send Them Away.

Chinese Tech Investors Flee Silicon Valley as Trump Tightens Scrutiny

Housing Bear Who Called 2018 Slowdown Says Worst Yet to Come

Apple: 3 Things Tim Cook Didn’t Tell You

Apple’s Biggest Problem? My Mom

Lilly to Buy Loxo Oncology For About $8 Billion in Cancer Bet

Kroger, Microsoft Create Futuristic Grocery Store. Amazon, Take Note

Tesla CEO Musk Breaks Ground at Shanghai Gigafactory to Launch China Push

Sony’s Chief Plans to Make Entertainment Assets a Priority

Richer Americans Are Skipping SUVs for Station Wagons

Activist Investor Starboard Seeks Changes at Dollar Tree

Lawrence Hamtil: The Recession Portfolio

Ben Carlson: 10 Things Investors Can Expect in 2019

Jeff Carter: To Make Huge Gains, You Have To Be a Warrior

Be sure to follow me on Twitter.

-

RPM International Earned 52 Cents per Share

Posted by Eddy Elfenbein on January 4th, 2019 at 9:33 amThis morning, RPM International (RPM) reported fiscal Q2 earnings of 52 cents per share. Sales rose 3.6% to $1.36 billion. This was not a good report. Wall Street had been expecting 68 cents per share.

“We achieved solid top-line improvement with sales growth of 3.6%, despite the unfavorable foreign currency translation effect of 2.0%,” stated Frank C. Sullivan, RPM chairman and chief executive officer. “Like many manufacturers, our bottom line was impacted by a continued rise in costs for raw materials, freight, labor and energy, as well as adverse foreign exchange translation. SG&A improved by 30 basis points, and adjusted SG&A, excluding restructuring expenses, improved by 100 basis points versus last year’s second quarter. Restructuring activities related to our MAP to Growth operating improvement plan, the details of which we shared at an investor day on November 28, are well under way. Our plan is focused on driving greater efficiency and long-term profitability of the business to enhance shareholder value.

For Q3, RPM expects earnings between 10 and 12 cents per share.

-

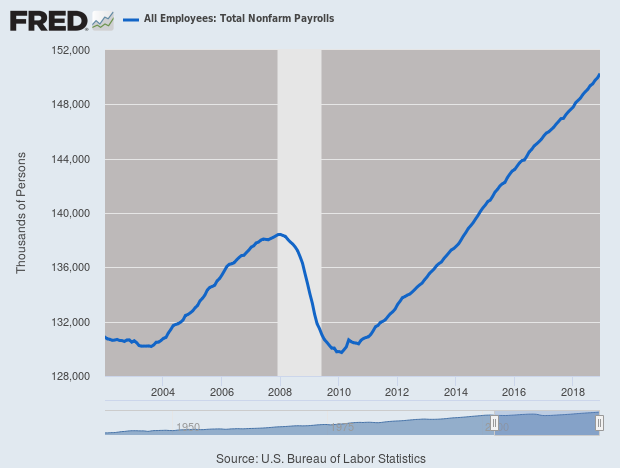

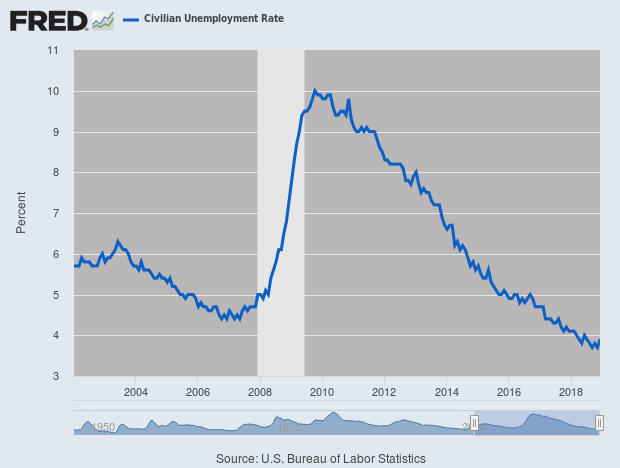

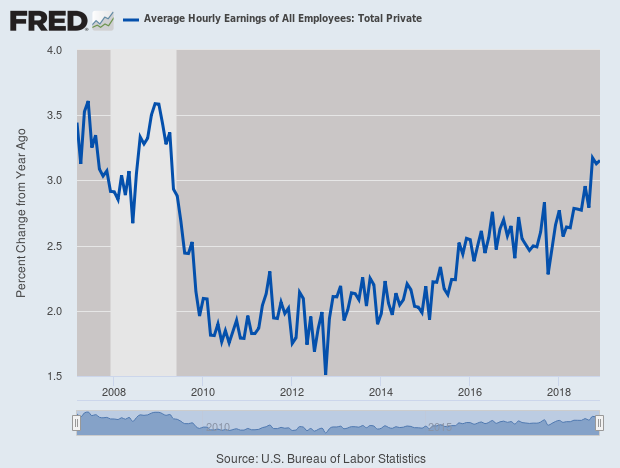

December NFP +312,000

Posted by Eddy Elfenbein on January 4th, 2019 at 8:54 amToday’s jobs report was a blow-out. The US economy added 312,000 net new jobs last month. The unemployment rate ticked up to 3.9% thanks to more people entering the labor force. Interestingly, today’s jobs report had the highest jobs-to-population ratio in exactly 10 years.

The jobless rate, which was last higher in June, rose for the right reason as 419,000 new workers entered the workforce and the labor force participation rate increased to 63.1 percent. The participation level was up 0.2 percentage points from November and 0.4 percentage points compared with a year earlier.

A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons held steady at 7.6 percent.

In addition to the big job gains, wages jumped 3.2 percent from a year ago and 0.4 percent over the previous month. The year-over-year increase is tied with October for the best since April 2009. The average work week rose 0.1 hour to 34.5 hours.

Economists surveyed by Dow Jones had been expecting job growth of just 176,000, though they projected the unemployment rate to fall to 3.6 percent. The wage number also was well above expectations of 3 percent on the year and 0.3 percent from November.

The report for November was revised higher by 21,000, and the one for October was revised upward by 37,000.

Here’s a look at the growth in non-farm payrolls:

Here’s the unemployment rate:

In the last year, average hourly earnings are up 3.2%.

-

Morning News: January 4, 2019

Posted by Eddy Elfenbein on January 4th, 2019 at 7:37 amOil Rises to $57 on China-U.S. Trade Talks, OPEC Cuts

Chinese Consumers’ Confidence Sags, Casting a Pall Over the Global Economy

China Cuts Banks’ Reserve Ratio to Ratchet Up Support for 2019

Jerome Powell Pledged Allegiance to Data and Some of It Looks Grim

Leveraged Loan Investors Worry Good Times Will Soon Haunt Them

Last Month, Investors Seemed Too Pessimistic. Now, They Seem Prescient.

Forget Fed Hikes, Traders Are Now Fully Pricing a Cut by April 2020

Bristol-Myers: Analysis On Celgene Deal

Audits Reveal Deutsche Bank’s Links to Tax Trade Scandal

Pioneering Southwest Airlines Co-Founder Herb Kelleher Dies At 87

Mountain for Rent: $4,500 a Day

Joshua Brown: On A Dime & What Are Your Thoughts: Is Apple Going to Zero?

Ben Carlson: 2017 vs. 2018 in the Stock Market

Blue Harbinger: How Much Cash Are You Keeping On The Sidelines?

Be sure to follow me on Twitter.

-

Morning News: January 3, 2019

Posted by Eddy Elfenbein on January 3rd, 2019 at 7:16 amE.C.B. Takes Reins of Italian Bank to Prevent Wider Crisis

Chinese Companies Flocked to U.S. Markets in 2018. The Trade War May Have Had a Role.

Powell and Trump Are Locked in a Battle for Wall Street’s Trust

‘Flash-Crash’ Moves Hit Currency Markets

Bristol-Myers and Celgene to Merge in $74 Billion Equity Value Deal

Apple Cuts Outlook as Chinese Slowdown Hits iPhone Demand

Apple’s Warning a Bad Omen for Wall Street Bulls

Tesla Cuts U.S. Prices on All Vehicles, Shares Drop

New Netflix CFO to Tackle Cash Flow Conundrum

Cullen Roche: Is This The Worst Thing The WSJ Has Ever Published?

Nick Maggiulli: The Rise After the Fall

Ben Carlson: Animal Spirits: The Market Swoon

Jeff Carter: The Margin of Safety

Roger Nusbaum: The Benefits Of Nonconformity

Joshua Brown: The Fed Could be Completely Out Of The Game in 2019

Be sure to follow me on Twitter.

-

Dividend Champs on the Buy List

Posted by Eddy Elfenbein on January 2nd, 2019 at 7:52 amI don’t purposely seek out Dividend Aristocrats for the Buy List (meaning stocks that have raised their dividends for more than 25 years in a row), but we tend to have a few. Rather, I think it’s because we focus on the qualities that many long-term dividend-raisers have.

We currently have ten Buy List stocks that have raised their dividend for at least 20 years in a row:

Hormel Foods (HRL) 53 years

Becton Dickinson (BDX) 47 years

RPM International (RPM) 45 years

Sherwin-Williams (SHW) 40 years

AFLAC (AFL) 36 years

Stryker (SYK) 25 years

Ross Stores (ROST) 24 years

Church & Dwight (CHD) 22 years

JM Smucker (SJM) 21 years

Factset Research System (FDS) 20 yearsOf our new stocks, Raytheon (RTN) is at 14 years and Broadridge Financial Solutions (BR) is at 12. Both Disney (DIS) and Hershey (HSY) are at nine. Eagle Bancorp (EGBN) doesn’t currently pay a dividend.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His