-

Sherwin-Williams Earns $5.68 per Share

Posted by Eddy Elfenbein on October 25th, 2018 at 7:36 amSherwin-Williams (SHW) made $5.68 per share for Q3. That’s seven cents below Wall Street’s estimate.

Consolidated net sales increased 5.0% in the quarter to $4.73 billion.

Net sales from stores in U.S. and Canada open more than twelve calendar months increased 5.2% in the quarter.

Diluted net income per share increased 11.7% to $3.72 per share in the quarter compared to $3.33 per share in the third quarter of 2017. Third quarter 2018 included a charge for the California public nuisance litigation and acquisition-related costs of $1.09 and $0.87 per share, respectively, and third quarter 2017 diluted net income per share included acquisition-related costs of $1.42 per share.

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) from continuing operations increased 16.9% in the nine months to $1.99 billion.

Narrowing FY18 adjusted EPS guidance to $19.05 to $19.20 per share, excluding acquisition-related costs, the charge for the California litigation and environmental provisions, compared to $15.07 per share on a comparable basis in FY17.

Commenting on the third quarter, John G. Morikis, Chairman, President and Chief Executive Officer, said, “We continue to make great progress on the integration of Sherwin-Williams and Valspar into a faster growing, more profitable enterprise, but our results in the third quarter don’t fully reflect that progress. Revenue growth slowed from the pace set in the second quarter, due primarily to slower growth in some North American architectural businesses, a sequential slow-down in some of our industrial businesses in China and Europe and unfavorable currency translation rate changes. The price increases implemented over the past 12 months have largely kept pace with accelerating raw material inflation on a consolidated basis, but some of our Performance Coatings businesses continue to lag in that effort. During the quarter, our Global Supply Chain team incurred incremental costs in an effort to keep pace with load-in demand during what is traditionally our peak sales volume quarter. These unfavorable impacts were mostly offset by a lower than anticipated effective tax rate on both a reported and adjusted basis. Our effective tax rates on reported net income and adjusted net income were 14.9 percent and 18.5 percent, respectively. While our results in the quarter fell short of our initial expectations, we remain confident in, and excited about, the long term value created by the combination of these two great companies.

“For the fourth quarter, we anticipate our consolidated net sales will increase a mid-single digit percentage compared to last year’s fourth quarter. For the full year 2018, we expect our consolidated net sales will increase by a high teen percentage, including incremental Valspar sales of $1.85 billion for the first five months of 2018, compared to the full year 2017. With annual sales at this level, we are updating our full year 2018 diluted net income per share to be in the range of $13.85 to $14.00 per share, including charges of $3.86 per share for acquisition-related costs, $1.09 per share for the California litigation, and $.25 per share for environmental expense provisions. Diluted net income per share in 2017 was $18.67 per share, including a one-time benefit of $7.04 per share from deferred income tax reductions, a one-time charge of $.44 per share for discontinued operations and a charge of $3.00 per share for acquisition-related costs. The incremental supply chain costs incurred in the third quarter make it unlikely we will reach the higher end of the full year adjusted diluted net income per share range provided last quarter. We are therefore narrowing our full year 2018 adjusted diluted net income per share to be in the range of $19.05 to $19.20 per share, excluding acquisition costs, the charge for the California litigation, and environmental expense provisions, compared to $15.07 per share on a comparable basis in 2017. We now expect our 2018 effective tax rate to be approximately nineteen to twenty percent.”

-

Morning News: October 25, 2018

Posted by Eddy Elfenbein on October 25th, 2018 at 7:01 amEurope Stocks Climb With U.S. Futures Ahead of ECB

U.S. Dairy Farmers Get Little Help From Canada Trade Deal

How Trump’s Attacks on Powell Are Helping the Fed

Comcast Beats Profit Estimates as Broadband Growth Accelerates

Tesla Profit Blowout Reverses Much of Musk’s Damage to Stock

Ford Motor Company Profit Slips 37% on China Woes

AB InBev Plunges as Brewer Cuts Dividend Payout in Half

Apple’s Radical Approach to News: Humans Over Machines

Twitter Monthly Usage Drops, Company Warns It Will Fall Again

UBS Targets American Wealth for Growth as Investment Bank Shines

Microsoft Rides Cloud to Impressive Earnings Beat; Markets Focus on Amazon Q3

AT&T Stumbles in Its First Quarter With Time Warner

Michael Batnick: Seven Minute Charts

Ben Carlson: Can the Stock Market Predict The Next Recession? & The Next Subprime

Blue Harbinger: Will You Adjust Your Strategy, Or Go Down With The Ship?

Be sure to follow me on Twitter.

-

Torchmark Earned $1.59 per Share for Q3

Posted by Eddy Elfenbein on October 24th, 2018 at 4:18 pmAfter the close, Torchmark (TMK) reported Q3 operating earnings of $1.59 per share. That beat Wall Street’s forecast of $1.53 per share. That’s up from $1.23 one year ago.

Here are some highlights from the quarter:

Net income as an ROE was 12.4%. Net operating income as an ROE excluding net unrealized gains on fixed maturities was 14.7%.

Life underwriting margins increased over the year-ago quarter by 10% and health underwriting margins increased over the year-ago quarter by 8%.

Life premiums increased over the year-ago quarter by 8% at American Income and health premiums increased over the year-ago quarter by 8% at Family Heritage.

Net health sales increased over the year-ago quarter by 15%.

Average producing agent count increased over the year-ago quarter by 6% at Family Heritage.

Approximately 877,000 shares of common stock were repurchased during the quarter.

Now for guidance. Torchmark sees 2018 earnings between $6.08 and $6.14 per share. That implies Q4 earnings of $1.51 to $1.57 per share. Wall Street had been expecting $1.56 per share.

Torchmark also gave initial guidance for next year. Torchmark sees 2019 ranging between $6.45 and $6.75 per share. The consensus on Wall Street was for $6.56 per share.

-

AFLAC Earns $1.03 per Share

Posted by Eddy Elfenbein on October 24th, 2018 at 4:13 pmAFLAC (AFL) just released its Q3 earnings report. For the quarter, the duck stock made $1.03 per share which was four cents better than estimates. The yen averaged 111.48 during the quarter, so thankfully, the exchange rate didn’t have a big impact on their numbers.

For Q3, AFLAC had been expecting earnings of 87 cents to $1.02 per share (a wide range), which assumed an exchange rate of ¥110 to ¥115 to the dollar. So far this year, AFLAC has made $3.11 per share. That’s a 19.6% increase over last year.

Now for guidance. AFLAC sees itself coming in at the “high end” of its previous guidance which was $3.90 to $4.06 per share. That assumes an exchange rate of ¥112.16 to the dollar.

If by “high end” AFLAC means $3.98 to $4.06 per share, then that means they see Q4 coming in between 87 cents and 95 cents per share. Wall Street had been expecting 96 cents per share. I think the Street expected them to raise guidance. The shares lost 3.5% today.

-

Check Point Software Earns $1.38 per Share

Posted by Eddy Elfenbein on October 24th, 2018 at 8:10 amWe have three Buy List earnings reports today. Before the bell, Check Point Software (CHKP) reported Q3 earnings of $1.38 per share. That’s two cents above Wall Street’s estimates. Revenues were $471 million. The company told us to expect earnings between $1.30 and $1.40 per share and revenue between $454 million and $474 million.

“Third quarter results reached the top end of our projections, with better than anticipated strength coming from the US and Europe,” said Gil Shwed, Founder and CEO of Check Point Software Technologies. “Today we announced the acquisition of Dome9. This new addition to Check Point’s Infinity architecture delivers enhanced Cloud Security with advanced active policy enforcement and multi-cloud protection capabilities. The combination of Dome9 and Infinity CloudGuard product family further differentiates Check Point in the rapidly evolving Cyber Security environment,” Shwed concluded.

Here are some quarterly highlights:

Total Revenue: $471 million compared to $455 million in the third quarter of 2017, a 4 percent increase year over year. Revenues were above the midpoint of our guidance.

GAAP Operating Income: $226 million compared to $225 million in the third quarter of 2017, representing 48 percent and 49 percent of revenues in the third quarter of 2018 and 2017, respectively.

Non-GAAP Operating Income: $250 million compared to $251 million in the third quarter of 2017, representing 53 percent and 55 percent of revenues in the third quarter of 2018 and 2017, respectively.

GAAP Taxes on Income: $45 million compared to $44 million in the third quarter of 2017.GAAP Net Income and Earnings per Diluted Share: GAAP net income was $198 million compared to $193 million in the third quarter of 2017. GAAP earnings per diluted share were $1.25 compared to $1.16 in the third quarter of 2017, a 7 percent increase year over year.

Non-GAAP Net Income and Earnings per Diluted Share: Non-GAAP net income was $219 million compared to $215 million in the third quarter of 2017. Non-GAAP earnings per diluted share were $1.38 compared to $1.30 in the third quarter of 2017, a 6 percent increase year over year.

Deferred Revenues: As of September 30, 2018, deferred revenues were $1,148 million compared to $1,036 million as of September 30, 2017, an 11 percent increase year over year.

Cash Flow: Cash flow from operations of $249 million compared to $260 million in the third quarter of 2017.

Cash Balances, Marketable Securities and Short Term Deposits: $4,072 million as of September 30, 2018, compared to $3,865 million as of September 30, 2017.

Share Repurchase Program: During the third quarter of 2018, we purchased approximately 2.6 million shares at a total cost of approximately $300 million.

Check Point also said it bought Dome9 in order to boost its position in cloud security.

On the earnings call, the company said they expect Q4 earnings of $1.56 to $1.67 per share on revenue of $500 million to $528 million. Wall Street had been expecting $1.65 per share on revenue of $515.29 million.

Previously, Check Point had given full-year guidance of $5.45 to $5.75 per share. Today’s guidance effectively narrows that range to $5.60 to $5.71 per share since CHKP has earned $4.04 per share for the first three quarters.

-

Morning News: October 24, 2018

Posted by Eddy Elfenbein on October 24th, 2018 at 7:05 amE.U. Rejects Italy’s Budget, and Populists Dig In

Trump Threats, Demands Spark ‘Existential Crisis’ at WTO

Trump Says He ‘Maybe’ Regrets Picking Fed’s Powell

Trump Is Not Going to Cut Middle-Class Taxes This Year, Despite What He Says

Here’s How $260 Billion of Tariffs Are Biting Third-Quarter Profit

Mom and Pop Are Buying the Dip in Stocks While the Pros Stay Put

When Sears Flourished, So Did Workers. At Amazon, It’s More Complicated.

Tesla’s Third Quarter Earnings: The Brass Ring Is Within Grasp

GM’s Driverless Car Bet Faces Long Road Ahead

Dunkin’ Takes Shot at Starbucks With Less-Expensive Espresso

Ford Hires New China Chief to Tackle Daunting Turnaround Task

In A Bid to Fill Office Buildings, Landlords Offer Kegs and Nap Rooms

Nick Maggiulli: A Change in Perspective

Roger Nusbaum: Further Defensive Action Initiated

Jeff Carter: Seed Investing Is Human Investing

Be sure to follow me on Twitter.

-

Turnaround Tuesday

Posted by Eddy Elfenbein on October 23rd, 2018 at 11:39 pmThe Dow opened today 279 points lower. It then dropped another 270 points. The index reached a low during the 10 o’clock hour. Then the Dow rallied back 423 points to close down just 126 points.

The internals of the market were weak. In the S&P 500, there were three new highs and 85 new lows. The index fell as low at 2,691.43. That’s 8.5% below the intra-day peak from September 21.

Our Buy List trailed the market today: -0.62% for us compared with -0.55% for the S&P 500. Obviously, Ingredion (INGR) hurt us a lot. INGR finished the day down -7.6%. At one point, it was down more than 11%. Without Ingredion, our Buy List would have lost -0.42%. That one stock cost the whole portfolio 20 basis points.

-

Ingredion Down 9%

Posted by Eddy Elfenbein on October 23rd, 2018 at 9:14 amShares of Ingredion (INGR) are currently down about 9% today. The company warned that Q3 earnings will be about $1.70 per share. Wall Street had been expecting $1.96 per share.

Previously, Ingredion had stood by its full-year guidance of $7.50 to $7.80 per share. Now INGR expects $6.80 to $7.05 per share.

From the press release:

During the third quarter, the Company experienced significant FX headwinds caused by weakening foreign currencies primarily in Argentina, Brazil and Pakistan, as well as the impact of Argentine peso devaluation with the adoption of hyperinflation accounting. In North America, the Company experienced several unplanned power outages at Argo, its largest sweetener plant, and these operating events resulted in unforeseen higher manufacturing and supply chain costs.

“Our performance this quarter was impacted in part by the rapid pace and magnitude of FX currency devaluations in Argentina and Pakistan. As a result we expect our business model will require more than a quarter to recover,” said Jim Gray, executive vice president and chief financial officer.

Jim Zallie, president and chief executive officer, said, “We are disappointed with the impact these unexpected circumstances had on our results during the latter half of the quarter, and remain focused on aggressively driving operational improvements and structurally reducing supply chain costs. We are making steady progress in addressing production and supply chain challenges while delivering on our customer experience commitments.”

Ingredion also announced that its Board of Directors has authorized the repurchase of up to an additional 8 million shares of the Company`s common stock from November 5, 2018 through December 31, 2023. Zallie said, “The Board`s increased share repurchase authorization reflects its confidence in the Company`s ability to generate strong cash flow from operations, support strategic investments, and fulfill its commitment to return capital to shareholders.”

-

Morning News: October 23, 2018

Posted by Eddy Elfenbein on October 23rd, 2018 at 7:07 amOlympic Steel Is Overlooked And Undervalued

Saudi Sees Deals Worth $50 Billion at Investment Conference Despite Boycotts

Paul Volcker, at 91, Sees `a Hell of a Mess in Every Direction’

Stocks Deepen Losses as Investors Flock to Havens

Unemployment Looks Like 2000 Again. Wage Growth Doesn’t.

Trump’s Tax Push to Help Middle Class Could Help Top Earners Too

What Happens When Banks Smear Their Exiting Brokers

Apple Supplier AMS Plummets Most in a Decade

Judge Denies Monsanto’s Request to Scrap $250 Million Punishment — But There’s a Catch

Why Goldman Sachs’s Marriage Of Marcus And Investment Management Makes Sense

Johnson & Johnson Makes $2.1 Billion Offer to Buy Out Japan Cosmetics Firm Ci:z

The Trade War’s Latest Casualties: China’s Coddled Cats and Dogs

Lawrence Hamtil: Global Discounts By Region & Sector

Michael Batnick: Higher Highs and Lower Lows

Momentum Monday – Lower Prices Ahead

Be sure to follow me on Twitter.

-

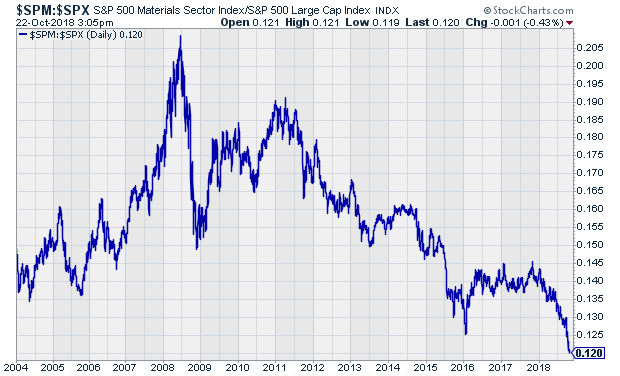

Crumbling Materials

Posted by Eddy Elfenbein on October 22nd, 2018 at 3:39 pmThe Materials sector has lagged the S&P 500 for more than ten years. Lately, however, it’s really gotten hammered.

In the last year, the S&P 500 is up just over 7% while the Materials are down 10%.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His