-

Morning News: August 24, 2018

Posted by Eddy Elfenbein on August 24th, 2018 at 6:30 amChill Remains Between China and United States in Latest Trade Talks

As Trade War Intensifies, China Moves to Bolster Its Economy

Shelved Aramco IPO Hits at Heart of Saudi Prince’s Reforms

Powell Takes Stage as Draghi, Kuroda Sit It Out: Jackson Hole

The Fed Worries About Corporate Monopolies. Investors Should Just Buy Them.

Leveraged Loan Buyers Are Losing Patience With Riskier Deals

Microsoft Hit With U.S. Bribery Probe Over Deals in Hungary

Alibaba Sales Jump 61%, Fueled by Online Spending

Apple CEO Tim Cook is a Few Days Away From a $120 Million Payday

Target Posts Its Best Quarterly Results in More Than a Decade

Uber and Airbus Enlist in Japan’s Flying-Car Plan

Everything You Want to Know About Sony’s New $2,900 Robotic Dog Aibo

Joshua Brown: Everything You Need to Know About New All Time Highs & The Streak

Cullen Roche: Would the Stock Market Crash if Trump was Impeached?

Jeff Carter: Transition is Scary

Be sure to follow me on Twitter.

-

Ross Stores Earned $1.04 per Share

Posted by Eddy Elfenbein on August 23rd, 2018 at 4:10 pmAfter the bell, Ross Stores (ROST) reported fiscal Q2 earnings of $1.04 per share. That’s up from 82 cents per share last year. Sales were up 9%, and same-store sales were up 5%.

Barbara Rentler, Chief Executive Officer, commented, “We are pleased with the above-plan growth we delivered in both sales and earnings in the second quarter. Though better than expected, operating margin of 13.8% was down from last year as higher merchandise margin and leverage on occupancy and buying costs were more than offset by a combination of unfavorable timing of packaway-related expenses, higher freight costs, and this year’s wage investments.”

Ms. Rentler continued, “During the second quarter and first six months of fiscal 2018, we repurchased 3.2 million and 6.5 million shares of common stock, respectively, for an aggregate price of $273 million in the quarter and $529 million year-to-date. As planned, we expect to buy back a total of $1.075 billion in common stock during fiscal 2018.”

For Q3 and Q4, the company is aiming for same-store sales growth of 1% to 2%. For Q3, Ross sees EPS between 84 and 88 cents, and for Q4 between $1.02 and $1.07. That works out to full-year guidance of $4.01 to $4.10 per share.

Commenting on the Company’s future expansion prospects, Ms. Rentler said, “We are excited to announce that we have raised our long-term projected store potential to 3,000 locations, up from the previous target of 2,500. This is based on our research that indicates we can now further increase penetration in both existing and new markets. As a result, we believe that Ross Dress for Less can grow to about 2,400 locations across the country, up from our prior target of 2,000, and that dd’s DISCOUNTS can ultimately become a chain of approximately 600 stores, versus our previous projection of 500. This higher store potential provides us with a considerable amount of long-term growth opportunities given our current store base of 1,453 Ross Dress for Less and 227 dd’s DISCOUNTS.”

-

Hormel Foods Earns 39 Cents per Share

Posted by Eddy Elfenbein on August 23rd, 2018 at 8:00 amWe had another earnings report this morning, this time from Hormel Foods (HRL). The Spam people earned 39 cents per share for the quarter which was up 15% from a year ago. The results matched Wall Street’s expectations. The company reaffirmed their full-year guidance of $1.81 to $1.95 per share. Net sales were up 7% while organic sales were flat.

Overall, this was an OK earnings report, but nothing great. The downside is that Hormel trimmed its full-year sales estimate to a range of $9.4 billion to $9.6 billion.

The CEO said:

“We reported record sales and earnings for the quarter and remain on track to deliver our full year earnings guidance range amid volatility due to tariffs and broader industry dynamics,” said Jim Snee, chairman of the board, president, and chief executive officer. “We continue to execute on our strategic initiatives while investing in growth for the future.”

“Grocery Products and International delivered solid results this quarter,” Snee said. “Refrigerated Foods’ branded value-added strategy was able to offset a dramatic decline in commodity profits. We also saw a strong increase in value-added sales at Jennie-O Turkey Store.”

“We increased our advertising investment this quarter and those investments are paying off with growth from brands such as Skippy®, Natural Choice®, Jennie-O®, Applegate®, Wholly Guacamole® and Herdez®,” Snee said. “I’m also pleased to report our recent strategic acquisitions of Columbus Craft Meats, Fontanini, and Ceratti are on track with expectations.”

The story is the same and it all comes down to prices. There’s a glut of beef, chicken and pork. That’s holding down prices and that cuts into Hormel’s business. The company is forced to cut prices.

The shares looked to take a big bath in the pre-market, but HRL is currently down about 2.6%.

-

Morning News: August 23, 2018

Posted by Eddy Elfenbein on August 23rd, 2018 at 6:33 amShould You Celebrate Or ‘Fade’ The Longest Bull Market In History?

Saudi Aramco Is Said to Postpone Its Potentially Record-Breaking I.P.O.

As Trade War Intensifies, China Moves to Bolster Its Economy

U.S., China Impose New Tariffs on Each Other as Talks Resume

China’s Consumption Downgrade: Skip Avocados, Cocktails and Kids

Google Tried to Change China. China May End Up Changing Google.

Jackson Hole Gets Added Attention as Key Fed Rate Ticks Higher

Fed Debate on Risks Intensifies Around Post-September Rate Hikes

Why A Bell May Finally Toll For Housing Bears

Elon Musk and Tesla Might Not Have to Worry About the SEC

How FireEye Helped Facebook Spot a Disinformation Campaign

Nikon Takes on Sony With Mirrorless Camera

Michael Batnick: Animal Spirits: Why Andy Dufresne Would be a Good Portfolio Manager

Roger Nusbaum: Is Now The Worst Time To Retire?

Ben Carlson: Expected Returns & The 7 Year Itch

Be sure to follow me on Twitter.

-

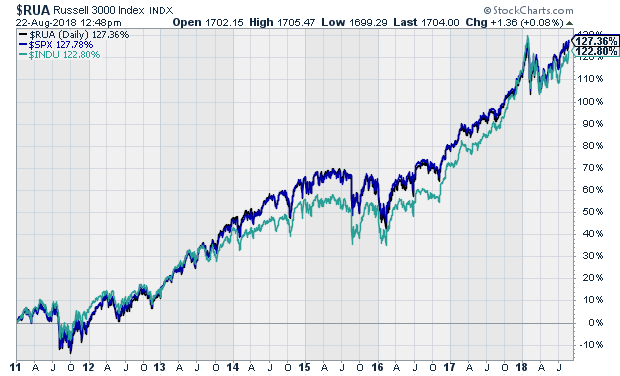

Why I Prefer the S&P 500

Posted by Eddy Elfenbein on August 22nd, 2018 at 12:46 pmI’ve written many times that the Dow Jones Industrial Average is a poor index. The stocks are weighted by price, which may have made sense 100 years ago but isn’t necessary today. That said, the Dow isn’t terrible, it’s just not what I like.

Instead, I prefer the S&P 500 which is weighted by market value. There are purists who insist that 500 stocks is too narrow and that we should look at broader options like the Russell 3000 or even the Wilshire 5000.

I get their point, but I think they’re being unnecessarily purist. The S&P 500 isn’t perfect, but it’s good enough for our purposes. To make my point, look at this chart below.

The Dow is in green (or what the drop down calls cyan) and it drifts noticeably from the other two lines. And yes, there are two more lines. Blue and black are nearly on top of each other. That’s how closely the S&P 500 and Russell 3000 track each other.

-

Morning News: August 22, 2018

Posted by Eddy Elfenbein on August 22nd, 2018 at 7:38 amS&P 500 Touches All-Time High, Ties Record for Longest Bull Market

Few Thrills Ahead for Trump from a Fed on a Mission of Its Own

SEC Could Face Backlash if Elon Musk Is Exonerated

8 Fast-Food Companies Agree To End ‘No-Poach’ Agreements Under Threat Of Lawsuit

Facebook Identifies New Influence Operations Spanning Globe

Amazon’s Ripple Effect on Grocery Industry: Rivals Stock Up on Start-Ups

Two US Airlines Cut China Routes as State-Backed Rivals Turn Up the Heat

Uber Hires CFO As It Prepares to IPO

How a Makeup Mogul Built a $1 Billion Business on Instagram

Slack Raises $427 More, at $7.1 Billion Valuation

Nick Maggiulli: Five Writing Tips to Sound More Eloquent

Cullen Roche: The Best Thing You’ll Read on Turkey

Jeff Carter: State Run Cryptocoins Don’t Work Better Than State Run Fiat Currency

Howard Lindzon: Pivoting into $7 Billion and a Free Trade Idea

Be sure to follow me on Twitter.

-

New All-Time High Today

Posted by Eddy Elfenbein on August 21st, 2018 at 1:23 pmAfter a bleak seven months of no new highs for the S&P 500, the index finally touched a brand new all-time high today.

On January 26, the S&P 500 closed at 2,872.87, which was also the high for the day, so that was both an intra-day high and the highest close.

A few moments ago, the S&P 500 got to 2,873.23.

-

Smucker Earned $1.78 per Share

Posted by Eddy Elfenbein on August 21st, 2018 at 10:42 amShares of Smucker (SJM) are pulling back this morning after the company reported fiscal Q1 earnings of $1.78 per share. That was one penny below estimates. However, that total included a charge of seven cents due to “a purchase accounting adjustment attributable to acquired Ainsworth inventory.”

“Our strong first quarter earnings reflect the execution of our strategy, aligning our portfolio for growth in pet food, coffee, and snacking,” said Mark Smucker, Chief Executive Officer. “During the first quarter, we completed the Ainsworth acquisition, which drove much of our year-over-year sales growth, and we are making significant progress toward integrating the business. We also announced a planned divestiture of our U.S. baking business, which is expected to close at the end of this month. In addition, we had strong first quarter performance for key growth brands including Dunkin’ Donuts®, Smucker’s® Uncrustables®, Nature’s Recipe®, and Café Bustelo® while continuing to execute our cost reduction programs to enhance margins and provide fuel for investments in future growth.”

Smucker also updated its guidance. They didn’t alter their full-year EPS range, which is still $8.40 to $8.65 per share. They did pare back their revenue range from $8.3 billion to $8.0 billion. Smucker also lowered its free cash range from $800 million – $850 million to $770 million – $820 million.

The updated guidance reflects “the anticipated impact from the pending divestiture of its U.S. baking business.”

From the Wall Street Journal:

Divesting the baking line, which makes Pillsbury cake mixes, and acquiring pet snack maker Ainsworth were appropriate moves to adjust Smucker’s portfolio. Ainsworth sales were up 28% from a year earlier in the July quarter, and the company said it expects this growth to be sustained for the full year.

But what Smucker really needs, like fellow struggling food giant Campbell, is a convincing plan to turn around its core brands. With respect to Folgers, Chief Executive Mark Smucker said the company is working on “longer-term initiatives to reinvigorate coffee rituals for this iconic brand.” It was unclear what he meant.

-

Morning News: August 21, 2018

Posted by Eddy Elfenbein on August 21st, 2018 at 7:01 amGold Investors ‘Give Up Hope’ as Biggest Short in History Builds

Conoco to Recover $2 Billion in Agreement With Venezuela

`We Cannot Afford This’: Malaysia Pushes Back Against China’s Vision

U.S. Stocks Poised to Enter Longest-Ever Bull Market

Trump Complains About Fed Chairman’s Raising of Interest Rates

Tesla Stock Gyrations Reignite Speculation of an Acquisition by Apple

This Is the Tesla Rival That’s Wooing the Saudis

Anthem, Walmart Partner On Senior Access To OTC Medicines

Walmart Filed a Patent for Virtual Stores, and It Could Be the Next Front In Its Battle with Amazon

Microsoft Thwarts Russia Hackers Targeting GOP Critics of Trump

U.S. Tariffs Cast a Cloud Over Huawei’s Solar Electronics Launch

Tycoon Battles Tata to Unlock $17 Billion of His Wealth in India

Lawrence Hamtil: This Tech Cycle Has Not Been Like Any Other

Joshua Brown: Advice for Young Investors

Ben Carlson: A Short History of Emerging Market Corrections & Bear Markets

Be sure to follow me on Twitter.

-

Morning News: August 20, 2018

Posted by Eddy Elfenbein on August 20th, 2018 at 7:02 amQatar and Turkey Central Banks Sign Swap Agreement

Greece’s Bailout is Ending. The Pain is Far From Over.

Venezuela’s 95% Devaluation Adds to Chaos After Drone Attack

U.S. Says Conserving Oil Is No Longer an Economic Imperative

Donald Trump’s Sudden Interest in Quarterly Earnings Reports, Explained

America’s Top Brands Sweat Over Next Step in Trade War

PepsiCo to Buy SodaStream for $3.2 Billion

Walmart Vs. Amazon: Who’s Scared Now?

Nvidia: Mr. Market Got The Story Wrong

Uber’s Vision of Self-Driving Cars Begins to Blur

Gundlach Warns Record Treasury Shorts Risk Pain on Squeeze

7 Costly Tax Mistakes to Avoid

Jeff Miller: Weighing the Week Ahead: A Message from Jackson Hole?

Roger Nusbaum: ETFs Continue To Get More Sophisticated

Be sure to follow me on Twitter.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His