-

Cracks in the Economy

Posted by Eddy Elfenbein on July 25th, 2018 at 2:09 pmI want to be careful how I word this. From my view, the U.S. economy looks very good at the moment. On Friday, we’ll get our first look at Q2 GDP, and it could be a very good report. Expect to see some POTUS tweets if the report is strong.

Forecasting the economy is hard, but there are a few early warning signs. None are perfect. One of the best is the yield curve, and that’s gotten much flatter lately. Still, there have been times when the economy has jogged along for more than two years after the curve has gone negative.

Another warning sign is oil. Prices tend to spike before recessions. Or rather, the spikes may help cause the recessions. West Texas crude is down to $68 per barrel, but it was over $74 recently. That’s a big jump from last June when crude was at $42 per barrel. That eats into consumer spending.

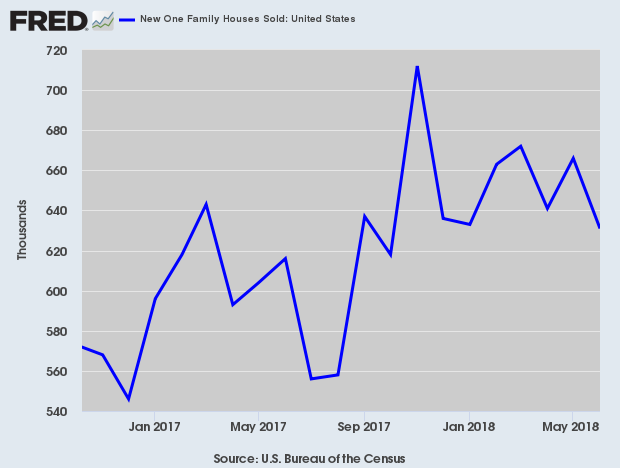

Another concern is real estate. Today’s new-homes sales report was below expectations. It was the weakest in eight months. On top of that, the previous three months were all revised lower. We’ve also seen weak housing data from certain areas. Southern California, in particular, has been quite weak.

The housing market could rebound, but I am concerned that economic growth may be peaking out right now.

-

Check Point Earns $1.37 per Share

Posted by Eddy Elfenbein on July 25th, 2018 at 9:50 amMore good earnings news. This morning, Check Point Software (CHKP) said they earned $1.37 per share for Q2. The company is also doubling its share buyback program from $1 billion to $2 billion. Here are some highlights from the quarter.

Financial Highlights for the Second Quarter of 2018:

Total Revenue: $468 million compared to $459 million in the second quarter of 2017, a 2 percent increase year over year.

GAAP Operating Income: $224 million compared to $222 million in the second quarter of 2017, representing 48 percent of revenues in the second quarter of 2018 and 2017.

Non-GAAP Operating Income: $247 million compared to $248 million in the second quarter of 2017, representing 53 percent and 54 percent of revenues in the second quarter of 2018 and 2017, respectively.

GAAP Taxes on Income: $43 million compared to $45 million in the second quarter of 2017.GAAP Net Income and Earnings per Diluted Share: GAAP net income was $198 million compared to $188 million in the second quarter of 2017. GAAP earnings per diluted share were $1.24 compared to $1.12 in the second quarter of 2017, a 10 percent increase year over year.

Non-GAAP Net Income and Earnings per Diluted Share: Non-GAAP net income was $218 million compared to $212 million in the second quarter of 2017. Non-GAAP earnings per diluted share were $1.37 compared to $1.26 in the second quarter of 2017, an 8 percent increase year over year.

Deferred Revenues: As of June 30, 2018, deferred revenues were $1,158 million compared to $1,065 million as of June 30, 2017, a 9 percent increase year over year.

Cash Flow: Cash flow from operations of $213 million compared to $226 million in the second quarter of 2017. Year over year, currency-hedging transactions had a $25 million effect on our cash flow from operations with minimal impact on our financial income as intended. This quarter includes excess payments related to our currency hedging transactions in an amount of $14 million compared to $11 million of income in the second quarter of 2017.

Cash Balances, Marketable Securities and Short Term Deposits: $4,042 million as of June 30, 2018, compared to $3,806 million as of June 30, 2017.

Share Repurchase Program: During the second quarter of 2018 we purchased approximately 2.5 million shares at a total cost of approximately $250 million.

100% Increase in the Share Repurchase Program: Today, we announced a 100 percent increase to the share repurchase program. Under the updated plan, $2 billion is allocated for share repurchase, compared to $1 billion in the previous program, with purchases of up to $325 million a quarter, compared to $250 million in the previous program.

For Q2, they expect revenues between $454 million and $474 million and non-GAAP EPS in the range of $1.30 to $1.40. There’s no change to their full-year outlook.

-

Morning News: July 25, 2018

Posted by Eddy Elfenbein on July 25th, 2018 at 7:07 amThe Oil Route That Could Be Behind the Escalating Trump-Iran Threats, Explained

Trump Wants the Fed to Roll Back the U.S. Economy

New Hampshire Fights Supreme Court Sales-Tax Ruling

Pay TV Sees Mass Exodus As Cord-Cutters Jump More Than 30% In 2018

Facebook Gains Status in China, at Least for a Moment

Tesla’s ‘Alarming’ Request for Refunds Sparks Questions about Profitability

Whirlpool Loved Trump’s Tariffs. Now It’s Struggling.

Ford Follows GM’s Cruise Move With Self-Driving Spinoff

Deutsche Bank’s Sewing Dares to Talk Growth Again After Cuts

Giving In to China, U.S. Airlines Drop Taiwan (in Name at Least)

Nick Maggiulli: The Right Place, The Right Time

Lawrence Hamtil: S&P 500: Why Sector Divergences from the Index Should Not Concern You

Howard Lindzon: Google…$900 Billion and Counting

Be sure to follow me on Twitter.

-

Stryker Earns $1.76 per Share for Q2

Posted by Eddy Elfenbein on July 24th, 2018 at 4:26 pmStryker (SYK) reported Q2 earnings of $1.76 per share. That’s above their guidance range of $1.70 to $1.75 per share. Net sales rose 10.3% to $3.3 billion.

“We continue to execute on our strategy and delivered another strong quarter of organic sales growth, adjusted operating margin expansion and adjusted net earnings per diluted share,” said Kevin A. Lobo, Chairman and Chief Executive Officer. “Our diversified and decentralized business unit model combined with strong talent and culture continue to serve us well. We have raised our guidance to reflect the strong results and positive outlook for the remainder of the year.”

For Q3, they’re looking for earnings between $1.65 and $1.70 per share. Wall Street had been expecting $1.69 per share.

For all of 2018, Stryker now expects earnings to range between $7.22 and $7.27 per share. That’s the second increase. SYK’s initial range was $7.07 to $7.17 per share. Then it went to $7.18 to $7.25 per share.

Business details:

Consolidated net sales of $3.3 billion increased 11.0% in the quarter and 9.9% in constant currency. Organic net sales increased 7.9% in the quarter including 9.0% from increased unit volume partially offset by 1.1% from lower prices.

Orthopaedics net sales of $1.2 billion increased 8.0% in the quarter and 6.6% in constant currency. Organic net sales increased 6.6% in the quarter including 8.9% from increased unit volume partially offset by 2.3% from lower prices.

MedSurg net sales of $1.5 billion increased 10.0% in the quarter and 9.2% in constant currency. Organic net sales increased 7.3% in the quarter including 7.6% from increased unit volume partially offset by 0.3% from lower prices.

Neurotechnology and Spine net sales of $0.6 billion increased 20.1% in the quarter and 18.5% in constant currency. Organic net sales increased 12.4% in the quarter including 13.3% from increased unit volume partially offset by 0.9% from lower prices.

Earnings Analysis

Reported net earnings of $452 million increased 15.6% in the quarter. Reported net earnings per diluted share of $1.19 increased 15.5% in the quarter. Reported net earnings include certain items, including charges for acquisition and integration-related activities, the amortization of purchased intangible assets, restructuring-related and other charges, compliance with European Medical Devices Regulation, Rejuvenate and other recall-related matters, regulatory and legal matters and tax matters. The effect of each of these matters on reported net earnings and net earnings per diluted share appear in the reconciliation of GAAP to non-GAAP financial measures. Excluding the aforementioned items increases gross profit margin from 65.9% to 66.1% in the quarter and increases operating income margin from 20.2% to 25.7%(1), including a 20 basis point favorable impact related to the adoption of the new revenue recognition standard(2). Excluding the impact of the items described above, adjusted net earnings(4) of $670 million increased 15.3% in the quarter. Adjusted net earnings per diluted share(3) of $1.76 increased 15.0% in the quarter.

-

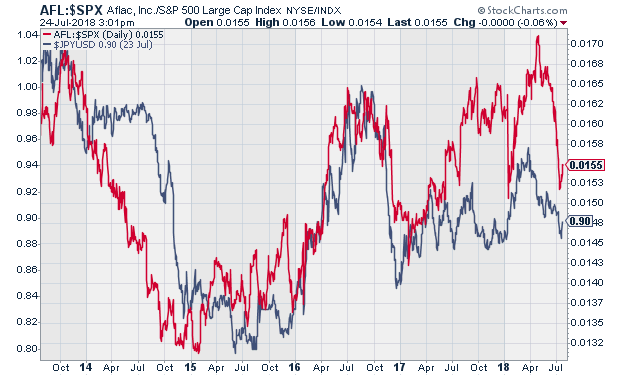

The Yen’s Impact on AFLAC

Posted by Eddy Elfenbein on July 24th, 2018 at 3:05 pmHere’s an interesting chart I wanted to show you. It shows AFLAC divided by the S&P 500 (in red) along with the yen/dollar (in blue).

The yen line is dollars per yen which is the inverse of how it’s normally discussed. I did this to show the correlation between the two.

Speaking of the correlation, the chart shows that they’re kind of related, but it’s not a very strong relationship.

In particular, the red line has dropped recently, meaning AFL has lagged. Some of this is probably due to the exchange rate, but I suspect that’s not all.

We’ll know more when AFLAC reports this week. I think the negative impact of the yen won’t dampen a solid earnings report.

-

Wabtec Earned 96 Cents per Share

Posted by Eddy Elfenbein on July 24th, 2018 at 9:27 amThe other earnings report this morning came from Wabtec (WAB). For Q2, the company made 96 cents per share. That beat estimates by three cents per share. They also increased full-year guidance.

Raymond T. Betler, Wabtec’s president and chief executive officer, said: “Our second-quarter results were on target, and with a strong backlog and the positive indicators we see in our markets we’re comfortable increasing our guidance for the year. Our freight business demonstrated strong growth in revenues and income from operations, and we expect demand to continue to improve. In transit, as expected we are managing through some lower-margin contracts in the short term while making long-term improvements in the core business. Overall, we’re pleased with our year-to-date performance, excited about the opportunities we see from our combination with GE Transportation and confident we can deliver improved earnings, margins and cash flow in the future.”

Wabtec increased its guidance for the year, with revenues now expected to be about $4.2 billion and EPS expected to be about $3.85 excluding estimated costs related to the proposed GE Transportation merger, expenses for restructuring and the effects of tax law changes. The company’s adjusted operating margin target for the full year is about 13.5 percent, and its effective tax rate for the full year is expected to be about 24 percent excluding the second quarter tax benefit.

-

Sherwin-Williams Earns $5.73 per Share

Posted by Eddy Elfenbein on July 24th, 2018 at 9:17 amThe second-quarter earnings report from Sherwin-Williams (SHW) is out. The company made $5.73 per share for Q2. That beat estimates by seven cents per share. The company is also increasing its guidance range for this year to $19.05 to $19.35 per share.

CEO John G. Morikis said, “The Company posted record results in net sales, gross profit, and profit before taxes in the second quarter, aided by the Valspar acquisition which continues to build momentum. Consolidated earnings per share expanded by 26.8% percent in the quarter, excluding acquisition-related costs and environmental expense provisions impacts in both years. Underlying demand remained solid across most of our end market segments during the quarter. At the same time, raw material costs continued to inflate during the quarter at a rate slightly higher than anticipated. We continue to focus on offsetting these escalating costs by controlling spending and implementing price increases.”

-

Morning News: July 24, 2018

Posted by Eddy Elfenbein on July 24th, 2018 at 5:07 amPortugal Dared to Cast Aside Austerity. It’s Having a Major Revival.

Trump Trade War Overshadowing Other Potentially Harmful Global Battle

Big Oil Is Raking In Cash and Investors Are Asking Now What?

Home Sales Extend Slump Despite Economic Strength

Trump Just Hijacked a Necessary Conversation About Amazon

Alphabet Gains as Google Ad Machine Powers Past Record Fine

Google Loses 2 More Cloud, AI Execs

Sergio Marchionne’s Exit Jolts Ferrari

Nike to Bump Up Pay for 7,400 Employees After Internal Review

Las Vegas Shooting Victims Speak Out Against MGM Lawsuit Against Them

GE Stock Sinks Again Despite Solid Results

Whirlpool Sinks With Raw Material Costs Climbing Around the World

Ben Carlson: How Hard is it to Become a 401(k) Millionaire?

Michael Batnick: Pick One Stock

Roger Nusbaum: Lifestyle, Investing and Gurus

Be sure to follow me on Twitter.

-

The Overrated Trade War

Posted by Eddy Elfenbein on July 23rd, 2018 at 12:51 pmGoldman Sachs said that a full-blown trade war could shave 15% off the earnings for the S&P 500.

That may be correct, but I have a few things to add. I would say that the odds of a full blown trade war are very low. The negative impact of anything that has a decent chance of happening are quite low.

“We consider adverse scenarios in which tariffs are placed on all imports from China or globally. For all US industry, roughly 15% of cost of goods sold (COGS) is imported. We assume that S&P 500 companies, which are more global in nature and have more complex supply chains, import roughly 30% of COGS. This is consistent with the 29% of S&P 500 sales is generated outside the US. Imports from China comprise 18% of total US imports. Conservatively assuming no substitution to other suppliers or pass-through of costs, and no boost to domestic revenues or change in economic activity, a 10% tariff on all imports from China would lower our 2019 S&P 500 EPS estimate by 3% to $165. If tensions spread and a 10% tariff were implemented on all US imports (highest rate since 1940s) our EPS estimate would fall by 15% to $145.”

Don’t get me wrong — a trade war is bad, but a minor skirmish won’t destroy us.

-

Morning News: July 23, 2018

Posted by Eddy Elfenbein on July 23rd, 2018 at 7:16 amBank of Japan Offers Unlimited Bond Buying After Yields Jump

Alphabet Bulls Looking for Earnings Spark From FANG Laggard

French IT Firm Expands in U.S. With $3.4 Billion Deal

Microsoft: Letting This Bull Rampage On

Sudden CEO Shift Jolts Fiat Chrysler

China Tower Seeks to Raise Up to $8.7 Billion in Hong Kong IPO

Ryanair Warns Labor Strife Is Starting to Bite as Profit Slides

Tesla Asks Suppliers for Cash Back to Help Turn a Profit

Papa John’s Board Votes to Adopt ‘Poison Pill’ Against Founder

Howard Lindzon: Another Open Letter to Twitter

Roger Nusbaum: What To Do If Sandinistas Ruin Your Retirement Plan

Jeff Miller: Weighing the Week Ahead: A Delicate (and Temporary) Balance

Be sure to follow me on Twitter.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His