-

Danaher Sees Q1 Beating Guidance

Posted by Eddy Elfenbein on March 7th, 2018 at 1:05 pmA few items today.

Danaher (DHR) said to expect Q1 earnings to be above the high-end of their guidance. Thomas Joyce, the CEO said:

“We have seen a strong start to 2018 from both a core revenue and margin perspective and based on our results through February, we now expect first quarter 2018 adjusted EPS to be above the high-end of our previously communicated guidance range. Better than expected results in our Life Sciences and Diagnostics platforms – specifically at Cepheid – are the main drivers for this performance as we continue to see positive momentum in these businesses.”

When their Q4 earnings came out, Danaher said they expected Q1 earnings between 90 and 93 cents per share. For all of 2018, they’ve projected $4.25 to $4.35 per share. The stock is up about 3% today.

The NYSE (owned by ICE) agreed to paid $14 million to settle investigations into market malfunctions in 2015. From the WSJ:

Tuesday’s fine won’t have a big financial impact on NYSE parent Intercontinental Exchange Inc., a global exchange operator that had profits of $2.5 billion last year. But it is a black eye for the Atlanta-based firm, known as ICE, which has a reputation for bringing cutting-edge technology to the exchange industry. ICE completed its acquisition of NYSE in 2013.

Here’s how Ross Stores is faring after earnings:

Here’s MarketWatch on Ross:

Despite the Ross Stores investment plan, Wells Fargo analysts are bullish on the stock.

“All in, Ross Stores continues to outperform the broader retail market and we remain upbeat on their outlook,” analysts wrote.

Wells Fargo rates Ross Stores shares outperform with an $86 price target, down from $91.

Susquehanna analysts said investors are focusing too much on the operating margin pressure resulting from investments that the company is making in wages.

“They are missing the continued comparable-store sales gains off some of the strongest compares that we saw in FY17,” Susquehanna analysts led by Bill Dreher wrote in a note.

Dreher said Ross Stores’ fundamentals are “intact” and encouraged investors to “take advantage of any near-term weakness.”

Susquehanna rates Ross Stores shares as positive with a $95 price target, down from $100.

Bloomberg is reporting that Smucker is looking to sell off its baking brands unit which includes Pillsbury. The deal could be worth $700 million.

-

Morning News: March 7, 2018

Posted by Eddy Elfenbein on March 7th, 2018 at 7:11 amWall Street Alarmed as Cohn Departure Fires Up Trade War Angst

Rolls-Royce Surges as Turnaround Plan Boosts Profits

Something’s Brewing: Coca-Cola Plans Its First Alcoholic Drink

Top Prize in U.S.-China Rivalry is Technology Dominance

Amazon Prime Veteran Heads to Airbnb

Coinbase Offers Index Fund Tracking Cryptocurrencies on Exchange

Target’s Recovery Looks Like the Real Thing

Apple’s Fourth U.S. Campus: Handicapping Where It Will Go

Your Data Is Crucial to a Robotic Age. Shouldn’t You Be Paid For It?

Self-Driving Cars Are Here. But Shouting Californians Are Attacking Them, DMV Says

Ben Carlson: Short-Term Outperformance Vs. Long-Term Outperformance

Joshua Brown: Is Trump Winning the Korean Conflict?

Howard Lindzon: The Freedom to Change My Mind & Passive My Ass!

Be sure to follow me on Twitter.

-

That Didn’t Last Long

Posted by Eddy Elfenbein on March 7th, 2018 at 1:42 amThe Smucker deal for Wesson is off:

J.M. Smucker and Conagra Brands have called off a deal over the Wesson cooking-oil brand after federal regulators said it could lead to higher prices for consumers.

The Federal Trade Commission filed an antitrust lawsuit on Monday, saying that by buying the Wesson brand, Smucker would control at least 70% of the market for branded canola and vegetable oils sold to grocery stores and other retailers.

Ohio-based Smucker, which reached a tentative deal last May to buy Wesson from Conagra for $285 million, already owns the Crisco brand

I guess the FTC’s challenge was more serious than I realized.

-

Ross Stores Earns 98 Cents per Share

Posted by Eddy Elfenbein on March 6th, 2018 at 4:10 pmRoss Stores‘s (ROST) Q4 earnings are out. The company made $1.19 per share, and 21 cents of that was due to tax reform. Let’s say it’s 98 cents per share on a continuing basis.

Earlier, Ross said they were looking for 88 to 92 cents per share. The consensus on Wall Street was for 93 cents. I said I was expecting 95 cents per share.

For the year, Ross made $3.55 per share. This was a 53-week fiscal year. The company said the extra week added 10 cents per share. Same store sales rose by 4% on the year.

Barbara Rentler, Chief Executive Officer, commented, “Despite our own difficult multi-year comparisons and a very competitive retail climate, sales and earnings were well ahead of our expectations for both the fourth quarter and the full year. We are pleased with these results, which reflect our ongoing success in delivering broad assortments of compelling bargains to today’s value-driven shoppers.”

Ms. Rentler continued, “Fourth quarter operating margin grew 95 basis points to 14.6%, up from 13.6% in the prior year. This improvement was driven by a combination of strong merchandise margin, expense leverage from solid gains in same store sales, and the impact of the 53rd week. For the 2017 fiscal year, operating margin increased 50 basis points to a record 14.5%.”

Ross is raising its dividend by 41% to 22.5 cents per share from 16 cents per share. I thought I was optimistic with 20 cents per share. Ross has raised its dividend every year since 1994.

The company is also adding $200 million to their buyback program. The authorization is now up to $1.075 billion.

Now for guidance. Ross projects earnings this year to range between $3.86 and $4.03 per share. The CEO said they’re taking a “prudent approach to forecasting.” For Q1, Ross sees earnings between $1.03 and $1.07 per share.

Update: The shares are down about 3% after hours. Some news sources are saying the results are disappointing. Not to me! We’ll see what happens in tomorrow’s session.

-

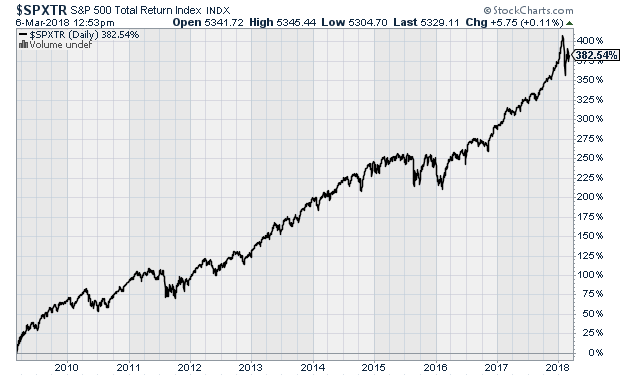

Nine Years Ago Today

Posted by Eddy Elfenbein on March 6th, 2018 at 12:53 pmThings were a little…gloomy.

Stocks staged a comeback late Friday afternoon, with the Dow and S&P 500 bouncing after hitting 12-year lows on a bleak February jobs report and more worries about the bank sector.

The Dow Jones industrial average (INDU) rose 32 points, or 0.5%. During the session, the Dow briefly touched 6469.95, the lowest intraday level since April 15, 1997. The Dow has fallen in 14 of the last 19 sessions.

The S&P 500 (SPX) index added less than 1 point, or 0.1%. Earlier, the S&P fell to 666.79, its lowest point during a session since Sept. 11, 1996.

Here’s how the market has done since.

-

Morning News: March 6, 2018

Posted by Eddy Elfenbein on March 6th, 2018 at 7:09 amEU Raises Stakes for Trump With Tariffs Targeting GOP Heartland

Where Will Bitcoin Be in a Decade? $100 Is More Likely Than $100,000, Says Harvard Economist

Why Are Democrats Helping Trump Dismantle Dodd-Frank?

The FCC’s Net Neutrality Repeal: The End of the Internet Or A Path To A Legislative Compromise?

Amid Optimism, Automakers Pack Geneva With What’s Next

Kobe Steel’s Chief to Step Down as It Discloses Wider Quality Problems

Lego CEO Says He’s ‘Not Satisfied’ With Results Achieved in 2017

United Airlines Pauses Lottery for Bonuses After Employees Rebel Online

Next Up for Amazon: Checking Accounts

Walmart’s Meal Kits Are Not The Solution To Fight Amazon

Nordstrom’s Spurned $8.4 Billion Buyout Sends Family Scrambling

Just Eat Is In a Bit of a Pickle

Cullen Roche: Why Does Money Make Some People Miserable?

Roger Nusbaum: Trade Wars! Give Me Those Trade Wars!

Jeff Carter: The Problem of Product Market Fit in Crypto

Be sure to follow me on Twitter.

-

Is Smucker Cornering the Oil Market?

Posted by Eddy Elfenbein on March 5th, 2018 at 9:45 pmThe Federal Trade Commission is challenging Smucker’s purchase of Wesson from Conagra Brands. Smucker already owns Crisco. The government claims the deal would give Smucker 70% of the cooking oil market.

“Cooks across the U.S. benefit from the competition between the staple brands Wesson and Crisco. We are taking this action to preserve the benefits of that competition,” said FTC lawyer Ian Conner.

The FTC said each brand attempted price increases over the last two years but was constrained by the presence of the other. With that restraint no longer in place, Smucker could raise prices on both brands, the commission alleged.

Smucker Chief Executive Mark Smucker said the company was disappointed in the FTC’s conclusion and believed the acquisition “would benefit all of our constituents.”

I honestly don’t know if this is a strong case or not. The news came out after the close. Many times, deals like this can get approval if the company agrees to certain limitations.

-

Inflation and the Stock Market

Posted by Eddy Elfenbein on March 5th, 2018 at 2:09 pmHere’s an update to a study I’ve done before. I wanted to see what’s been the impact of inflation on the stock market.

I have the monthly stock market performance and inflation data going back 92 years, which is 1,104 months. I sorted the months by inflation, low to high. I then separated the data into eight buckets of 138 months each.

This is how the stock market has performed at different levels of inflation. To make it easier to read, the stock market’s return is annualized and adjusted for inflation.

Here’s what I got:

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His