-

Morning News: March 15, 2018

Posted by Eddy Elfenbein on March 15th, 2018 at 7:12 amSenate Passes Rollback of Banking Rules Enacted After Financial Crisis

Toys R Us to Close All 800 of Its U.S. Stores

U.S. Fires a Warning Shot at Silicon Valley With Theranos Case

Balancing Act: Chip Giant Qualcomm Caught Between Washington and Beijing

Going Dutch: Unilever Picks Rotterdam Over London for Headquarters

Lyft Partners With Magna To Turbocharge Race For Robot Car Mobility Service

Disney Overhaul Sets Stage for Succession Race

iHeartMedia Files for Bankruptcy, Reaches Restructuring Agreement in Principle

Walmart Patents Hint at Future Where Its Drones Tend the Farms

Trump Picks CNBC’s Larry Kudlow as Top Economic Advisor

Equifax CIO Put ‘2 and 2 Together’ Then Sold Stock, SEC Says

Time for Pharma to Play Defense With Deals

Lawrence Hamtil: Capex Darlings and the Myth of Long-Termism

Cullen Roche: Three Things I Think I Think V. 1,204

Howard Lindzon: Technicals and Chart Art

Be sure to follow me on Twitter.

-

Cognizant’s $300M Accelerated Repurchase

Posted by Eddy Elfenbein on March 14th, 2018 at 10:08 amThis morning, Cognizant Technology (CTSH) said it’s buying back $300 million worth of shares in an accelerated share repurchase plan. This is part of their plan to return $3.4 billion to shareholders.

Under the terms of the ASR agreement, approximately 3.04 million of the shares to be repurchased will be received by Cognizant on March 14, 2018. The final number of shares to be repurchased will be based on the volume-weighted average stock price of Cognizant’s Class A common stock less a discount and subject to potential adjustments pursuant to the terms of the ASR agreement. Final settlement of the transaction under the ASR agreement is anticipated to occur during the second quarter of 2018. Cognizant will fund the ASR program on March 14, 2018 from cash on hand and its existing credit facility.

-

Morning News: March 14, 2018

Posted by Eddy Elfenbein on March 14th, 2018 at 7:04 amDraghi Promises to Avoid Surprises as ECB Tiptoes to QE End

As Merkel Begins New Term, Compromises Could Undo Economic Boom

EU’s Trade Chief Questions Rationale of Trump Steel Measures

Oil Halts Decline as Tillerson’s Departure Boosts Iran Risks

Broadcom Ends Bid for Qualcomm

Qualcomm Outspent Broadcom About 100 to 1 in Lobbying

How Amazon Became Corporate America’s Nightmare

Google to Ban Ads for Cryptocurrencies

Walmart to Offer Home Delivery of Groceries in 100 Cities

Dick’s Is Tumbling, and Its Woes Have Nothing to Do With Guns

China Sells Stake in Blackstone as Deal Turns Sour

Adidas Sales Growth Picks Up on China Strength, Retro Trend

Michael Batnick: The Flash Correction & Animal Spirits: Goodnight Moon

Ben Carlson: Does Economic Volatility Affect Stock Market Volatility?

Be sure to follow me on Twitter.

-

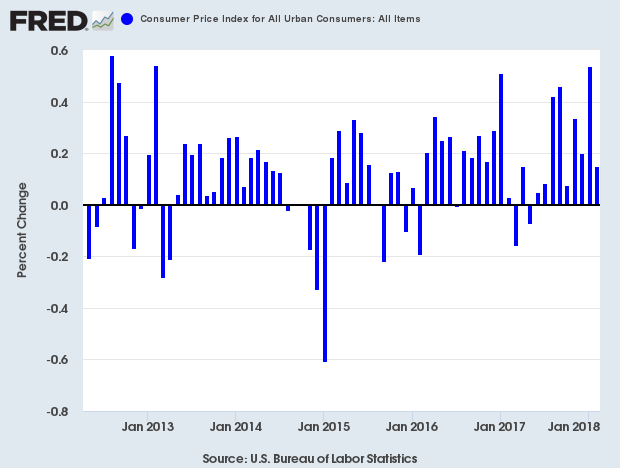

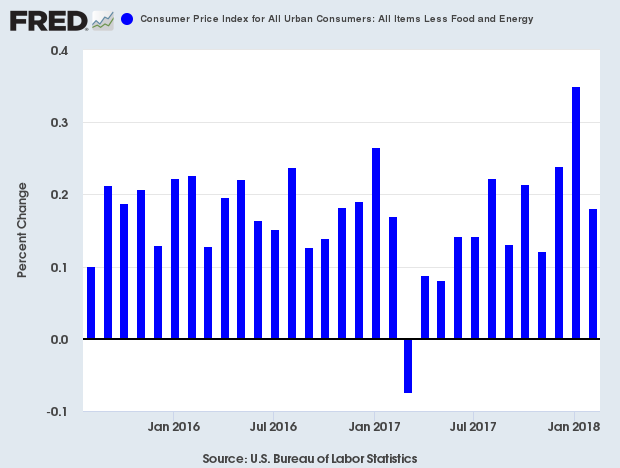

February CPI +0.2%

Posted by Eddy Elfenbein on March 13th, 2018 at 11:40 amThis morning, the government reported that the CPI rose by 0.2% last month. Splitting out the decimals, it was up 0.15005%. Thank you for rounding.

The core rate last month was +0.18176%.

In the last year, headline CPI was up 2.26012%. The core rate was up 1.85712%.

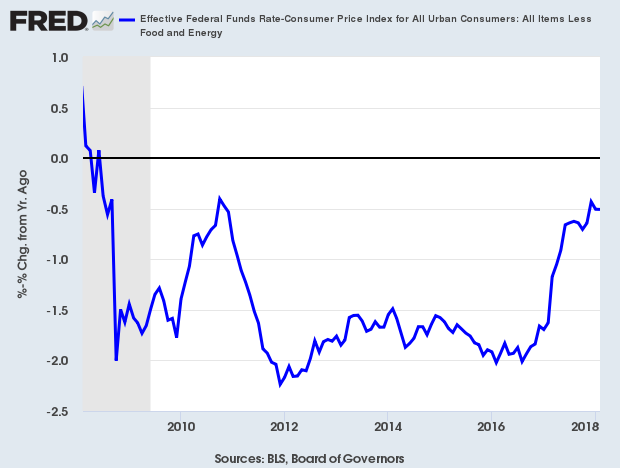

Here’s the real Fed funds rate based off core inflation. We’re getting close to 0%.

-

Morning News: March 13, 2018

Posted by Eddy Elfenbein on March 13th, 2018 at 7:05 amTrade Conflicts Threaten Global Growth, Says OECD

Central Banks Are Looking for New Ways to Meet Inflation Targets

China Merges Bank, Insurance Regulators to Tackle Risk

Saudi Aramco International Listing Looks Increasingly Difficult

Trade Wars Can Be a Game of Chicken. Sometimes, Literally.

Havens Just Aren’t Safe Anymore, Goldman Says

How China’s Huawei Killed $117 Billion Broadcom Deal

Dropbox I.P.O. Could Value Company at More Than $7 Billion

Say Hello to Cora, the New Flying Taxi From a Secretive Startup Funded by Google’s Larry Page

VW Secures $25 Billion Battery Supplies in Electric-Car Surge

Why Did Shares of Tesla Move 5% Higher Today?

New Boeing Jet to Accelerate Services Shake-Up

Roger Nusbaum: The Bull Market Turns Nine!

Michael Batnick: The Race to A Trillion

Jeff Carter: 18 Best Practices for Angel Groups

Be sure to follow me on Twitter.

-

Bloomberg Today

Posted by Eddy Elfenbein on March 12th, 2018 at 5:28 pm -

Morning News: March 12, 2018

Posted by Eddy Elfenbein on March 12th, 2018 at 7:06 amU.S. Oil Export Surge Means OPEC’s Output Cuts May Be Doomed

The Fed Must Teach Markets a Lesson on Inflation

No One’s Sure Who Qualifies for This $415 Billion Tax Deduction

Dow’s Liveris Finally Blows Out

Why Intel Is So Wary of a Broadcom-Qualcomm Merger

Toys R Us Still Sells Lots of Toys. Here’s Why It’s Going Under.

South Korea Kicks Off Due Diligence on GM’s South Korean Unit

EON-Innogy Energy Deal Could Spark Regulatory Power Struggle

Dropbox Aims to Raise as Much as $648 Million in U.S. IPO

A Heartland Company Leads the Media Race

Singapore-Based Broadcom to Redomicile to U.S. by April 3

Buffett’s March Madness Offer: $1M a Year For Life For Perfect Bracket

Cullen Roche: Passive Investors Don’t Need No Stinkin’ Votes

Howard Lindzon: March 9, 2009 ….Be Grateful and The Birth of National BTFD Day.

Ben Carlson: Making it Look Easy is Hard Work

Be sure to follow me on Twitter.

-

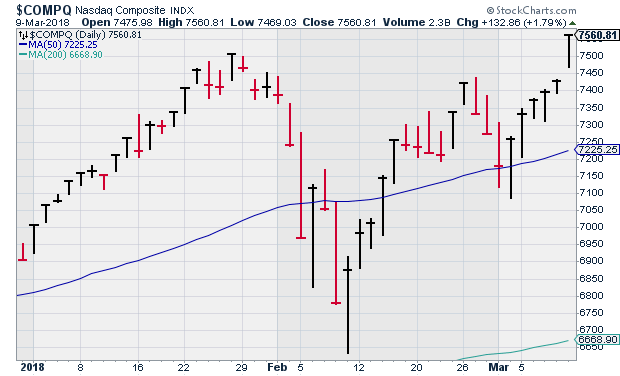

All-Time High for the Nasdaq

Posted by Eddy Elfenbein on March 10th, 2018 at 2:10 pmThe Nasdaq Composite has rallied for six days in a row and closed Friday at an all-time high.

On January 26, the Nasdaq closed at 7,505.77. Yesterday, exactly six weeks later, the index closed at 7,560.81.

If you’re into market turning points, this has been a big time of year for them:

March 9, 2009 low close

March 10, 2000 Nasdaq high close

March 11, 2003 low closeDoes anyone remember when shares of AFLAC plunged after a critical article? I do. It happened on January 12. The stock lost 7.4% in one day.

I’m pleased to report that AFLAC has made back all of its lost ground. On Friday, the stock came within three pennies of a new all-time high. Friday’s close was one penny below the close from January 11.

-

February NFP = +313,000

Posted by Eddy Elfenbein on March 9th, 2018 at 10:25 amThe U.S. economy added 313,000 net new jobs last month. The unemployment rate stayed at 4.1%.

This was the greatest number of jobs added since July 2016. There were also positive revisions to December and January.

Today’s report also had the highest jobs-to-population ratio since January 2009.

Construction firms added 61,000 workers, the biggest increase in nearly 11 years for the sector. Hiring also picked up at retailers, manufacturers and local governments, including schools. All levels of government added 26,000 workers, also the best gain since July 2016.

Better hiring was supported by Americans entering the workforce in larger numbers. The share of Americans participating in the labor force rose by 0.3 percentage point to 63.0% in February.

U.S. employers have added to payrolls for 89 straight months, extending the longest continuous jobs expansion on record.

The labor force participation rate for workers 25-54 is 82.8%. That’s the highest in several years.

-

CWS Market Review – March 9, 2018

Posted by Eddy Elfenbein on March 9th, 2018 at 7:08 am“Investing is where you find a few great companies and then sit on your ass.”

– Charlie MungerWhat if we had a trade war and no one showed up to fight? That might be what’s happening. Consider that President Trump has promised to raise tariffs on steel and aluminum over the objections of his top economic advisor. Yet as we learn the details, this may be less of a trade war and more of a trade tiff.

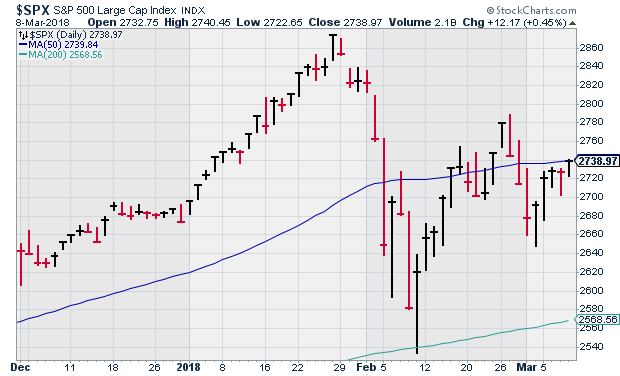

For its part, Wall Street seems to be reverting back to its previous somnolence. The VIX is back below 17. The NASDAQ Composite has rallied for five straight days, and the S&P 500 has gone the last three days without a daily change, up or down, of more than 0.5%. In the 21 days prior to that, it happened 18 times.

Let me warn you not to be complacent. I still think we’re in store for some volatility. In fact, I wouldn’t mind a little market jostle. I like it when good stocks go on sale. The past month has been pretty good for us in a relative performance sense. Over the last five weeks, the S&P 500 is down -2.94% while our Buy List is down just -0.98%.

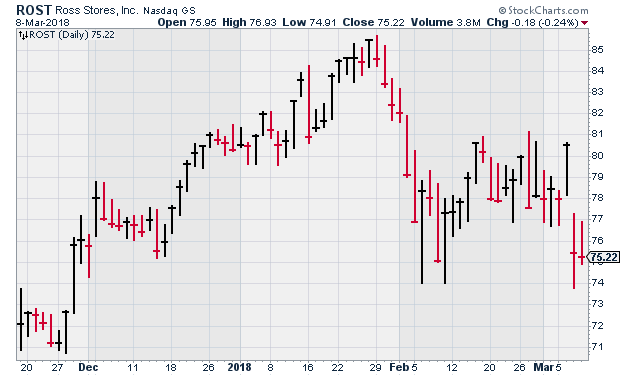

In this week’s issue, I’ll cover the earnings report from Ross Stores. The deep discounter handily beat earnings, plus they gave us a big 41% dividend increase. Still, the stock dropped afterward. I’ll explain what happened. We also had good news from Danaher. The company said it’s going to beat the top end of its earnings guidance. I love it when a plan comes together! Before I get to that, let’s look at what all this tariff talk means for Wall Street and for us.

A Trade War Would Not Be Tariffic for Wall Street

For the last 250 years, roughly 98% of economists have argued passionately for free trade. The net effect of this on public opinion is precisely zero.

As you know, I avoid political talk around here, but I’ll comment on policies and how they impact our investments. This week, President Trump has come out in favor of placing steep tariffs on foreign steel (25%) and aluminum (10%). I’ll be blunt—these tariffs would not be good for the economy nor for investing.

Perhaps the president got some back-channel pushback because he’s already agreed to exempt Canada and Mexico. Other allies, such as Australia, may eventually be exempt as well. I would expect key NATO allies to get some protection. The principal target of the president’s ire seems to be China. To be fair, I think the United States has a legitimate beef with China regarding their predatory pricing. However, the tariff policy may alienate allies we need on our side in dealing with China. The president’s policy is very controversial. On Capitol Hill, 107 Republicans sent the president a letter urging him to drop the idea.

The principal fear is that other nations might respond with their own tariffs, and that would hurt U.S. exporters. Financial markets aren’t waiting around. We’ve already seen the impact in the forex pits. For example, “safe haven” currencies like the Swiss franc and Japanese yen have rallied in recent days. (A stronger yen, by the way, is good for AFLAC.)

If you bought U.S. Steel eight months ago, congratulations-you’ve doubled your money. But other companies like Nucor and Alcoa haven’t fared especially well. What’s going on? I think Wall Street is taking a skeptical stand, and that seems right to me. A protectionist trade policy would have a very long and widespread impact. Perhaps Wall Street views the president’s plan as an opening bid where he can compromise to win concessions later. A trade war would be a terrible idea, but I’m doubtful the hostilities will get very far. Now let’s take a look at the earnings report from Ross Stores.

Ross Stores Beats Earnings and Raises Dividend by 41%

In last week’s CWS Market Review, I highlighted Ross Stores (ROST) and why I like it. This week, the company released a very good earnings report. Ross is also raising its dividend by 41%.

The stock didn’t react well to the earnings report; the shares fell more than 6.3% on Wednesday. Nevertheless, I was very pleased with the numbers. Since we have a long-term focus, how we look at an earnings report may not be the same as how traders look at it.

Let me break down what happened. After the close on Tuesday, Ross said they had earned 98 cents per share for Q4. Remember, this was for a 14-week period. The company had previously said they expected earnings to range between 88 and 92 cents per share. I was expecting something closer to 95 cents per share.

As it turns out, Ross made 98 cents per share. That includes ten cents per share thanks to the extra week. It doesn’t include another 21 cents per share thanks to tax reform. For the year, Ross made $3.55 per share.

Sales for Q4 rose 16% to $4.1 billion. The key metric to watch is same-store sales which rose 5% versus a 4% gain last year. For the year, same-store sales were up 4%. I was particularly impressed by Ross’s operating margins. That’s very important for a discount retailer.

Barbara Rentler, Chief Executive Officer, commented, “Despite our own difficult multi-year comparisons and a very competitive retail climate, sales and earnings were well ahead of our expectations for both the fourth quarter and the full year. We are pleased with these results, which reflect our ongoing success in delivering broad assortments of compelling bargains to today’s value-driven shoppers.”

Ms. Rentler continued, “Fourth quarter operating margin grew 95 basis points to 14.6%, up from 13.6% in the prior year. This improvement was driven by a combination of strong merchandise margin, expense leverage from solid gains in same-store sales, and the impact of the 53rd week. For the 2017 fiscal year, operating margin increased 50 basis points to a record 14.5%.”

Ross is raising its quarterly dividend by 41% from 16 cents to to 22.5 cents per share. In last week’s issue, I thought I was optimistic in predicting 20 cents per share. Ross has raised its dividend every year since 1994. The company is also adding $200 million to its buyback program. The authorization is now up to $1.075 billion.

Now for guidance. Barbara Rentler said they’re taking a “prudent approach to forecasting.” Well, that’s hardly new. Ross projects earnings this year to range between $3.86 and $4.03 per share. In last week’s issue, I said I was expecting something very cautious, on the order of $3.75 to $3.85 per share. Ross also said they expect same-store sales growth of 1% to 2%. Sorry, but that’s way too low. In fact, if they only got 1% to 2%, then I don’t see how they can get close to their EPS range. Realistically, Ross should earn about $4 per share this year.

For Q1, Ross projects earnings between $1.03 and $1.07 per share. That’s up from 82 cents per share last year. The company expects same-store sales growth of 1% to 2% for the first quarter. Again, in my opinion, that’s too low.

I’m guessing the stock got spooked by the low same-store sales growth forecast. Honestly, I’m not concerned about that at all. The most important takeaways are the improved operating margins, 5% same-store sales growth and the 41% dividend increase. Those three override pretty much everything.

Let’s also remember that Ross plans to open another 100 stores this year. Ross is also raising its minimum wage to $11 per hour. TJX, their main rival, has not made that pledge. Perhaps traders are concerned that higher wages will put pressure on operating margins. I’m not concerned. Higher wages can save money in the long run since you have lower turnover and a happier workforce.

The good news for investors is that the stock is a cheaper than it was last week. The stock is going for about 18 to 19 times this year’s earnings. The new dividend gives the shares a yield of 1.2%. This is a very good company. I’m keeping my Buy Below on Ross at $81 per share.

Buy List Updates

In January, Danaher (DHR) said they expected Q1 earnings to range between 90 and 93 cents per share. That was a little weaker than I had been expecting. The shares pulled back, but I told you not to worry. On Wednesday, the company said they expect Q1 earnings to exceed the top of their range:

Thomas P. Joyce, Jr., President and Chief Executive Officer, stated, “We have seen a strong start to 2018 from both a core revenue and margin perspective and based on our results through February, we now expect first quarter 2018 adjusted EPS to be above the high-end of our previously communicated guidance range. Better than expected results in our Life Sciences and Diagnostics platforms – specifically at Cepheid – are the main drivers for this performance as we continue to see positive momentum in these businesses.”

The shares rallied 3% on Wednesday. The Q1 earnings report will come out on April 19. Danaher remains a buy up to $105 per share.

Remember, we have two stock splits coming up. AFLAC (AFL) will split 2-for-1 on March 16, and Fiserv (FISV) splits 2-for-1 on March 19, so don’t be alarmed when you see the lower share prices. Our Buy Below prices will split as well.

This week, the Federal Trade Commission said it was challenging Smucker’s (SJM) plan to buy Wesson from Conagra. The reason is that Smucker already owns Crisco, and the combined businesses would give them 70% market share of the vegetable oil market. The companies quickly folded and announced that the planned deal was off.

Later, Bloomberg said Smucker is looking to sell its baking brands unit which includes Pillsbury. Smucker bought Pillsbury in 2004. According to the Bloomberg source, this move could bring in $700 million.

I also wanted to lower my Buy Below on Alliance Data Systems (ADS) to $252 per share.

Finally, I wanted to update you on Express Scripts (ESRX), a former Buy List stock. We decided to ditch Express from this year’s Buy List. I think that was the right call. In December, I said, “I suspect they’ll be bought out sometime in 2018.” Turns out, I was right. This week, Cigna announced that it’s buying Express for $52 billion.

A number of people asked me why I was getting rid of Express if I thought it was going to be bought out. The reason is that we had already gained the premium of Express being “on the market.” Shares of ESRX gained 18% during the fourth quarter of 2017. I thought that gave us a very good opportunity to exit.

I was worried about a tepid merger offer, and I think that’s what Express got. The buyout deal is about half in cash and half in Cigna stock. After the announcement, shares of Cigna took a big hit, so that means the merger price fell as well. By the time the deal happens, I don’t think it will be that great for ESRX shareholders. In other words, we got out of Express Scripts at the right time.

That’s all for now. Next Tuesday, March 13, we’ll get the CPI report for February. It will be interesting to see if there’s evidence of higher prices. Then on Wednesday, the latest retail sales report comes out. On Friday, we’ll get housing starts and the industrial production report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

The One Time Betting Against Buffett Makes All the Sense in the World

Could this be Warren Buffett’s Valentine’s Day Massacre?

On February 14, Berkshire Hathaway filed a 13-F form with the SEC, updating the market on its quarterly holdings.

It showed a surprising fourth-quarter acquisition – Israel’s Teva Pharmaceutical Industries, Ltd. (NYSE: TEVA). Berkshire bought 18.9 million shares for $358 million. Following the stock’s inevitable “Buffett Bounce,” the stake is now worth closer to $400 million. It makes Berkshire the ninth-largest shareholder in Teva (1.9%).

First of all, it’s surprising because Buffett has traditionally avoided biotech companies.

Second – and more significantly – Teva is a train wreck. Buffett loves a bargain, but the company has some big problems…

2 Stocks Winning the Cable Cutting Wars

The media wars have heated up, all thanks to a British company called Sky PLC (OTC: SKYAY). The company has three American suitors – Comcast (Nasdaq: CMCSA), Walt Disney Company (NYSE: DIS) and Twenty-First Century Fox (Nasdaq: FOX) – all vying to tie the knot with Sky.

It seemed straightforward enough… as Disney’s $66 billion offer for some of Fox’s assets that would include 39% of Sky, allowing Disney to expand its international presence. Separately, Fox is trying to buy the 61% of Sky that it does not own with an offer worth in excess of $16 billion. So eventually, it was thought, Disney would own all of Sky.

But then Comcast jumped in with a $31 billion all-cash bid for the entirety of Sky. Comcast is desperately looking for growth outside of the moribund U.S. cable business where cord-cutting by consumers makes Comcast particularly needy.

The faster-growing European market offers it an opportunity to strengthen a major weakness (little overseas exposure). Comcast currently has about 29 million U.S. customers, while Sky has about 23 million subscribers. If Comcast is successful, its international revenues will climb to 25% of total revenues from just 9% currently.

I do think this is a good attempt by Comcast to improve its fortunes. So I’ve been amused by some of the comments from U.S. analysts on the proposed offer for Sky by Comcast. As I’ve found all too often, there is a lack of understanding about businesses overseas by analysts in the U.S. Some U.S. analysts have given the deal a thumbs-down, saying why would Comcast want to buy a satellite TV company?

Sky is a whole lot more… as Comcast CEO Brian Roberts said, “There’s nothing as great in the United States.” Here’s why…

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His