-

Morning News: February 22, 2018

Posted by Eddy Elfenbein on February 22nd, 2018 at 7:07 amGerman Court to Decide on Fate of 15 Million Diesel Cars

Fed Gives Bullish Signals on Economy

U.S. Government Bonds Fall After Fed Minutes

Bond Market Guide to Trading When 10-Year Treasury Yields Hit 3%

Home Sales Post Their Sharpest Drop in Three Years

In an Era of `Smart’ Things, Sometimes Dumb Stuff is Better

JPMorgan Plan for Soaring Tower Signals Midtown’s Alive and Well

Broadcom Retaliates Against Qualcomm for Raising Its NXP Bid

Buffett Letter May Tout Optimism as Broader Market Worries Ebb

Roku Shares Plunge on Weak Forecast

Furious Investors Dump Shares of Angry Birds Game Maker

Ford North America President Leaves Following Misconduct Allegations

Joshua Brown: Discipline Equals Freedom

Howard Lindzon: Revenge Trading and Portfolio Cleaning

Be sure to follow me on Twitter.

-

Morning News: February 21, 2018

Posted by Eddy Elfenbein on February 21st, 2018 at 7:03 amThe Euro Zone Needs More Risk Sharing, But Fewer Risks

U.K. Eyes Longer Brexit Transition and Asks EU to Talk Dates

Venezuela Launches Virtual Currency, Hoping to Resuscitate Economy

AT&T Names First Three Cities to Get Its Ultra-Fast 5G Network

Walmart Stumbles in Shift to Web Selling

Apple in Talks to Buy Cobalt Directly From Miners

Good News: A.I. Is Getting Cheaper. That’s Also Bad News.

Qualcomm, Moving to Fend Off Broadcom, Raises Bid for NXP to $44 Billion

Dish Network Profit Surges on $1.2 Billion U.S. Tax Law Benefit

Nobody Wants to Let Google Win the War for Maps All Over Again

Amazon Prime Card Has the Same Pitfalls as Every Other Brick-and-Mortar Store Card

3M Settles Minnesota Lawsuit for $850 Million

Ben Carlson: Inequality in the Stock Market

Roger Nusbaum: There Are Multi-Factor Sector ETFs?

Jeff Carter: When Confirmation Bias Shapes Your Knowledge

Be sure to follow me on Twitter.

-

The Market Goes for Seven in a Row

Posted by Eddy Elfenbein on February 20th, 2018 at 12:22 pmThe futures market looked ugly before the open, but the market is up for the day (at the moment I’m writing this.) If we stay green, this would be the seventh-straight up day for the market.

I should mention that Friday was a very good day for our Buy List. The portfolio was up 0.66% while the S&P 500 was up 0.04%. Carriage Services was a big help. The stock gained 3.2% on Thursday ahead of their earnings report. Then on Friday after the report, CSV rose another 5.3%.

We have two earnings reports on Thursday; Continental Building Products (CPBX) and Hormel Foods (HRL). Even though they report on the same day, CBPX is for the December quarter while Hormel’s is for the quarter ending in January.

After that, Ross Stores (ROST) will report their fiscal Q4 earnings ON March 6, two weeks from today. After that, there’s not going to be much earnings news for some time. Two stocks on the Buy List are on the February cycle. Factset Research Systems (FDS) will probably report in mid-to-late March, and RPM International (RPM) will report sometime in early April. After that, the Q1 earnings season starts up in mid-April.

-

Wabtec Earned 90 Cents per Share for Q4

Posted by Eddy Elfenbein on February 20th, 2018 at 8:24 amThis morning, Wabtec (WAB) reported Q4 earnings of 90 cents per share. That’s not much of a surprise since that’s what they had told us to expect. For the year, WAB made $3.43 per share.

Last year was a tough one for Wabtec, but it was also promising considering the integration of Faiveley.

Raymond T. Betler, Wabtec’s president and chief executive officer, said: “After a year of transition in 2017, during which we made excellent progress on the Faiveley integration and continued to invest in our worldwide growth opportunities, we are confident the company is positioned for improved performance in 2018. We have a record backlog, we’re seeing improvements in the freight aftermarket, and our Wabtec Excellence Program provides the fuel to increase margins over time. We are committed to achieving our 2018 plan and excited about Wabtec’s long-term growth prospects.”

For 2018, Wabtec expects sales to be about $4.1 billion and adjusted EPS to be about $3.80. They said they expect Q1 to be about the same as Q4, meaning 90 cents per share.

Update: Wall Street seems happy with the report. At mid-day, WAB is up about 4.7%.

-

Morning News: February 20, 2018

Posted by Eddy Elfenbein on February 20th, 2018 at 7:04 amEgypt’s Potential Natural Gas Surplus Could Feed Global LNG Glut

Bank at Center of $2 Billion India Fraud Heads for 13-Month Low

Latvia Central Banker Fires Back in Deepening Corruption Scandal

Qualcomm Set to Raise Bid for NXP to $44 Billion

Albertsons Swoops for Rite Aid as Retailers Face Online Threat

Home Depot Fourth-Quarter Sales Growth Surpasses Estimates

KFC’s British Restaurants Have a Serious Problem: They Don’t Have Chicken

Amazon Just Announced a New Whole Foods Perk for Some Users

HSBC Misses Profit Target as Bad Loan Charges Weigh on Results

GM Offers $2.2 Billion Debt for Equity Swap in Return for Seoul’s Support

BHP Willing to Talk About Activist’s Overhaul Plan

South Korean Cryptocurrency Regulator Found Dead at Home

An Idea: Banks Could Control Gun Sales if Washington Won’t

Michael Batnick: Seeing Your Blind Spots

Joshua Brown: Barry and Professor Scott Galloway on Market Volatility

Be sure to follow me on Twitter.

-

Morning News: February 19, 2018

Posted by Eddy Elfenbein on February 19th, 2018 at 7:06 amBoom Turns to Bust for Millennials Across Advanced Economies

Japan Exports Grow, Manufacturers Mood Sours as Yen Rise Clouds Outlook

Richard Branson Unveils Hyperloop Plans for India

For Timing of Aramco IPO, Watch Forward Oil Price Curve

‘No Cash’ Signs Everywhere Has Sweden Worried It’s Gone Too Far

How One of the Most Profitable Trades of the Last Few Years Blew Up in a Single Day

Alibaba, Tencent Rally Troops Amid $10 Billion Retail Battle

Daimler Drops on Report Software Affected U.S. Emissions Tests

Qualcomm Should Negotiate With Broadcom on a Deal, ISS Says

Noble Group Flags $5 Billion Loss as Debt-Deal Endgame Nears

We Have Streaming Revenue, Too, Says NBC. And We Can Prove It.

Bitcoin Thieves Threaten Real Violence for Virtual Currencies

Cullen Roche: How Worrisome is Future Inflation?

Howard Lindzon: The End of The Low Volatility Regime?

Michael Batnick: These Are the Goods

Be sure to follow me on Twitter.

-

The Tulip Myth?

Posted by Eddy Elfenbein on February 17th, 2018 at 7:36 pmAnne Goldgar writes that the classic Tulip Bulb Bubble story needs to be corrected:

Tulip mania was irrational, the story goes. Tulip mania was a frenzy. Everyone in the Netherlands was involved, from chimney-sweeps to aristocrats. The same tulip bulb, or rather tulip future, was traded sometimes 10 times a day. No one wanted the bulbs, only the profits – it was a phenomenon of pure greed. Tulips were sold for crazy prices – the price of houses – and fortunes were won and lost. It was the foolishness of newcomers to the market that set off the crash in February 1637. Desperate bankrupts threw themselves in canals. The government finally stepped in and ceased the trade, but not before the economy of Holland was ruined.

Yes, it makes an exciting story. The trouble is, most of it is untrue.

My years of research in Dutch archives while working on a book, Tulipmania: Money, Honor and Knowledge in the Dutch Golden Age, told me a different story. It was just as illuminating, but it was different.

Tulip mania wasn’t irrational. Tulips were a newish luxury product in a country rapidly expanding its wealth and trade networks. Many more people could afford luxuries – and tulips were seen as beautiful, exotic, and redolent of the good taste and learning displayed by well-educated members of the merchant class. Many of those who bought tulips also bought paintings or collected rarities like shells.

Prices rose, because tulips were hard to cultivate in a way that brought out the popular striped or speckled petals, and they were still rare. But it wasn’t irrational to pay a high price for something that was generally considered valuable, and for which the next person might pay even more.

Tulip mania wasn’t a frenzy, either. In fact, for much of the period trading was relatively calm, located in taverns and neighbourhoods rather than on the stock exchange. It also became increasingly organised, with companies set up in various towns to grow, buy, and sell, and committees of experts emerged to oversee the trade. Far from bulbs being traded hundreds of times, I never found a chain of buyers longer than five, and most were far shorter.

-

Newsletter Feedback

Posted by Eddy Elfenbein on February 17th, 2018 at 9:35 amIt’s been a while since I’ve done this. I’d like to ask you for feedback about the newsletter, CWS Market Review. Tell me what you like about it and what you don’t like. Is it too short? Too long? Too in-depth or not deep enough? Should it come more often or on different days of the week? Is it too expensive? Let me know! I want to hear from you.

Just send me an email with “Feedback” in the subject line. Also, don’t be shy in saying that it’s fine as is. That’s important feedback as well. Thanks!

-

Smucker Earned $2.50 per Share

Posted by Eddy Elfenbein on February 16th, 2018 at 10:06 amThis morning, JM Smucker (SJM) released fiscal Q3 earnings and they were quite good. The jelly company earned $2.50 per share, but 35 cents was due to tax reform. Wall Street had been looking for $2.12 per share, so in real terms, we’re talking about a three-cent beat.

CEO Mark Smucker said:

“We had a strong third quarter, with sales growth for key brands in every business and strong earnings per share growth fueled by the benefits of U.S. income tax reform and ongoing cost discipline,” said Mark Smucker, Chief Executive Officer. “These results reflect our commitment to delivering top and bottom line growth and supporting our portfolio of iconic and emerging brands. In addition, the benefits of income tax reform provide incremental fuel to invest in our growth initiatives and support our employees and communities as well as opportunities to increase cash returned to shareholders.”

Thanks to tax reform, Smucker increased its full-year guidance. The company now sees adjusted EPS for this year ranging between $8.20 and $8.30 per share. That’s a big increase from the previous guidance of $7.75 to $7.90 per share. Smucker also gave a one-time bonus of $1,000 to nearly 5,000 employees.

Smucker has four divisions. Their coffee group, which is the largest group, saw profit growth of 6%. Consumer foods was up 2%. Pet food was down 7%. International was up 16% thanks to forex.

-

CWS Market Review – February 16, 2018

Posted by Eddy Elfenbein on February 16th, 2018 at 7:08 am“Sometimes the hardest thing to do is to do nothing.” – David Tepper

Don’t be fooled, the storm hasn’t passed. Sure, stocks bounced back this week, and that’s nice to see. But mark my words–the bears will be back.

The big news this week, outside the stock bounce, was the CPI report. On Wednesday, we learned that January had the largest increase in “core” prices in nearly 13 years. Is inflation finally on its way back? For now, call me a doubter, but we’ll look at what this means for us and our portfolios.

The bond market seems to be taking inflation seriously. This week, the 10-year yield broke above 2.9% for the first time in four years, and the one-year came close to cracking 2% for the first time in nearly a decade. Do you realize what this means? Things are starting to look…normal. Dear Lord! Compared to where we’ve been, normal is downright strange. Consider that in October 2014, the one-year was yielding a microscopic 0.09%.

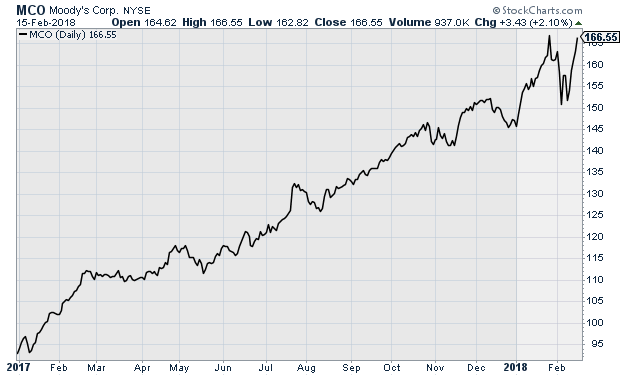

In this week’s issue, we’ll look at the market’s impressive recovery. We’ll also discuss good earnings from Moody’s and Carriage Services. Moody’s is already a 13% winner for us this year. I’ll also preview next week’s earnings report. We also got news that AFLAC is splitting its stock for the first time in 17 years. But first, let’s look at the five-day bounce.

Stocks Rally Back but the Storm Hasn’t Passed

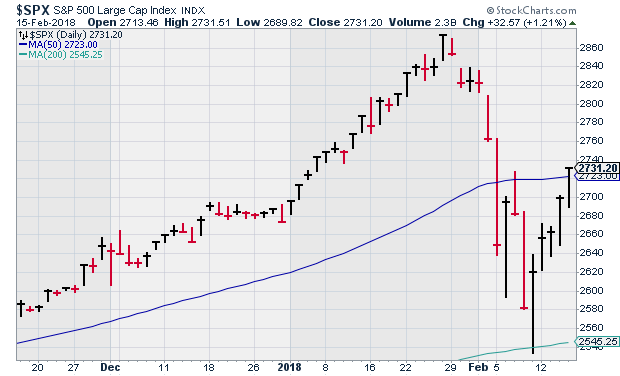

This was the first time in more than six years that the S&P 500 gained more than 1% four times in five days. So far, the S&P 500 has made back half of what it lost. We had nine rough days followed by five good ones.

Still, we have to be aware of a few things. The bears knocked the market hard. That’s something they haven’t done in years. Bears are easily startled, but they’ll be back—and in greater numbers. The recent low came last Friday when the S&P 500 bounced off its 200-day moving average (see the lower right corner in the chart below). I think it’s very likely the index will “test” that support level again. Maybe a few times. That’s just how markets work.

The difference between this latest downturn and the previous drops like Brexit is that this one involves something far more important to the stock market, rising interest rates.

As I’ve said before, the odd thing wasn’t the market drop. That happens all the time. The odd thing was the long period of very low volatility combined with very, very low interest rates. Now rates have been on the rise and the Fed appears determined to hike rates three times this year. Some Wall Streeters think a fourth is a real possibility.

The yield on the one-year Treasury bill is now more than the dividend yield of the S&P 500. Sure, in an absolute sense, yields are still quite low, but they’re much higher than they’ve been in years. The higher yields provide more competition for investors’ money vis-à-vis stocks. That puts the squeeze on equity valuations.

We also have to remember that by most metrics, stocks are on the pricey side. According to the latest numbers, the S&P 500 is going for 17.7 times this year’s estimated earnings and 16.1 times 2019’s. This doesn’t portend a crash, but if equity prices flat-line for a few months, it would help bring valuations down.

The higher bond yields aren’t just about inflation. Some of the increase is due to the stronger economy. Just look at the yield on the five-year inflation-protected note. It recently hit 0.74%, which is an eight-year high. In an absolute sense, bonds are becoming better values.

Inflation is still a big issue for the bond market. This week, we got the inflation report for January, and it came in above expectations. The headline rate showed prices rose by 0.5% last month. That was the highest jump in five years. The core rate, which excludes food and energy prices, rose by 0.3% (0.349% to be precise), the highest increase since March 2005. I’ll caution you that this is one number. We need to see more data before we can call it a trend.

So we have a paradox. The stronger economy is lifting profits, which helps stocks, but it’s also causing bond yields to rise, which hurts valuations. So what’s an investor to do? The key is to remain calm and not let short-term events scare you. I suspect we’re going to see more volatility spikes over the next few weeks. If we’re lucky, that will give us some very good buying opportunities.

Stay focused on our Buy List stocks. Pay attention to our Buy Below Prices, and make sure you’re well diversified. Now let’s look at our recent earnings reports.

Good Earnings from Moody’s and Carriage Services

Last week, we had a stack of earnings reports to cover. Fortunately, this week was a lot lighter. In last week’s CWS Market Review, I said I expected Moody’s (MCO) to beat Wall Street’s estimates. I was right. Last Friday, the credit-ratings agency reported Q4 earnings of $1.51 per share. That was six cents better than estimates. Moody’s had quarterly revenue of $1.17 billion which topped expectations of $1.08 billion.

For the year, Moody’s made $6.07 per share which is a nice increase over the $4.94 they made in 2016. For 2018, Moody’s expects earnings to range between $7.65 and $7.85 per share. That’s quite good.

From their press release:

Moody’s expects full-year 2018 revenue to increase in the low-double-digit percent range. Operating expenses are also expected to increase in the low-double-digit percent range.

Moody’s projects an operating margin of 43% to 44% and an adjusted operating margin of approximately 48%.

The effective tax rate is expected to be 22% to 23%.

Full-year 2018 diluted EPS is expected to be $7.20 to $7.40. The company expects full-year 2018 adjusted diluted EPS to be $7.65 to $7.85. Both ranges include an approximate $0.65 benefit resulting from U.S. tax reform, as well as an estimated $0.20 benefit related to the tax accounting for equity compensation, in line with the benefit recognized in 2017. The majority of the latter benefit is expected to be recognized in the first quarter of 2018.

After some initial turbulence along with the rest of the market, shares of MCO responded well. The stock has rallied for five days in a row. Moody’s is now our second-biggest winner this year with a gain of 13.1%. MCO came close to making a new high on Thursday. This week, I’m raising my Buy Below to $172 per share.

After the closing bell on Wednesday, Carriage Services (CSV) reported Q4 earnings of 39 cents per share. Technically, this was a penny below expectations, but since only two analysts cover the stock, it can hardly be called “a consensus.”

Carriage Services is our funeral-home stock. Yeah, I know, but somebody has to do it. I have to explain that value investing oftentimes means buying “dented merchandise.” That’s the case with Carriage. The company didn’t have a good year last year, and the good news for us is that that brought down the share price. As investors, the key question is “how serious are the problems?” For Carriage, I believe they can move past them.

The CEO addressed these concerns in the press release:

Mel Payne, Chief Executive Officer, stated, “After eight consecutive years of record performance, our 2017 consolidated operational and financial performance did not meet our reported high-performance expectations, as adjusted diluted earnings per share declined 14.2% to $1.39, adjusted consolidated EBITDA declined 6.8% to $68.7 million, adjusted consolidated EBITDA margin declined 310 basis points to 26.6% and adjusted free-cash flow declined 21.4% to $37.4 million.

Many of the reasons behind the decline in our operating performance were addressed in our second- and third-quarter earnings releases, e.g. weak cemetery preneed sales, lower field EBITDA margins of funeral-home acquisitions made in 2016 not yet integrated under our standards operating model and investment in overhead infrastructure and people. However, beneath the covers of the reported performance, our company was continuously improving in many areas during the year. We were encouraged by the fourth-quarter results from our acquisition funeral-home and cemetery segments as these businesses achieved year-over-year improvement in both organic revenue growth and field EBITDA margins. The momentum shown in these segments in the fourth quarter has accelerated into 2018.

Carriage is in a much better position. For the year, EPS fell 14.2% to $1.39, but for the quarter, EPS rose 8% to 39 cents. The best news is that Carriage is increasing its outlook:

We are increasing our rolling four-quarter ‘roughly right outlook range’ of adjusted diluted EPS to $2.00 – $2.05, a 16% increase compared to the previous outlook. The rolling four-quarter outlook includes the impact from the recently enacted tax-reform legislation and a continuation of the positive operating momentum we experienced in the latter part of 2017 that has continued into 2018. The outlook does not include any future acquisition activity, although we are more excited than ever about the industry consolidation landscape and the pipeline of high-quality candidates produced by our corporate-development team. We expect our effective GAAP tax rate to be in a range of 26%-28% in 2018, compared to our historic rate of 40%.

Carriage sees earnings of $2.00 to $2.05 per share for 2018. (I’m not aware of other stocks that provide rolling four-quarter guidance, but I like the idea.) Shares of CSV gained 3.2% on Thursday. The stock is now going for about 13 times projected earnings. That’s a good deal. Have patience with this one. Carriage remains a buy up to $28 per share.

Earnings Next Week from Wabtec, Hormel Foods and Continental Building

Still more earnings reports to come. Later today, JM Smucker (SJM) will report its fiscal Q3 earnings. This is for their quarter ending January 31. The jelly folks now expect full-year earnings of $7.75 to $7.90 per share. For the quarter, Wall Street expects $2.12 per share.

Now let’s look ahead to next week. We’ll get earnings reports from Wabtec, Hormel Foods and Continental Building Products.

Wabtec (WAB) is due to report before the bell on Tuesday, February 20. Two weeks ago, the stock took a tumble. The rail equipment company released preliminary results for Q4, saying they made 90 cents per share. If that’s accurate, it means WAB made $3.42 per share for the whole year which is below their previous guidance range of $3.45 to $3.55 per share. The company said they’ll provide updated guidance next week. This could be a good year for WAB.

Continental Building Products (CBPX) is due to report on Thursday, February 22. The results may be distorted due to last year’s hurricanes. The company estimates that the hurricanes pushed about 15 to 17 million square feet of wallboard into future quarters. Continental provides guidance for several metrics except earnings per share. Busting out some math, I estimate they made about 35 cents per share for Q3. The Street’s consensus is for 33 cents per share.

Hormel Foods (HRL) will also report its results on Thursday. Like Smucker, Hormel is off-cycle; their fiscal Q1 ended at the end of January.

Frankly, the Spam people didn’t have a good year in 2017, but I thought it’s worthwhile keeping them on our Buy List. They made $1.57 per share last year which was down seven cents from 2016. For fiscal 2018, Hormel sees earnings between $1.60 and $1.70 per share. The consensus for Q1 is for 43 cents per share. The stock is down from where it was two years ago.

AFLAC Announces 2-for-1 Stock Split

On Tuesday, AFLAC (AFL) announced it will be splitting its stock 2-for-1. Technically, the split will come in the form of a 100% stock dividend. What this means is that shareholders will have twice as many shares and the share price will drop in half.

A stock split doesn’t add any value in itself, but it’s usually the sign of a thriving enterprise. Some people claim that splits increase liquidity, but that seems like a stretch to me. This is AFLAC’s first split in 17 years. The new shares are payable on March 16 to shareholders of record as of March 2. Our Buy Below price will split along with the stock.

If you recall, the duck stock recently increased its dividend by 15.6%. The company has been benefiting recently from the strong Japanese yen. I don’t recommend AFLAC due to the yen, but I’m pointing out that forex fluctuations can help or hurt their bottom line. Recently, it’s been helping. On a final note, Fortune named AFLAC as one of its Best Places to Work for the 20th year in a row. Not bad.

That’s all for now. The stock market will be closed on Monday for President’s Day. (Technically, the NYSE recognizes this as Washington’s Birthday and not President’s Day.) It’s a fairly light week for economic news. On Wednesday, we’ll get the existing-home-sales report for January. We’ll also get the minutes from the last Fed meeting. These might contain clues as to more rate hikes this year. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with the folks at Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Buy This Stock Profiting From Out of Control Government Spending

To avoid near term chances of a government shutdown, last week the U.S. Senate and House passed a two-year spending plan, which the President signed. The new plan significantly boosts government spending over the next two years compared to the previously in effect sequestration plan.

No matter what your thoughts are on the big vs. smaller government debate, the fact is that government spending and government buying is a growth industry. In the spirit of “if you can’t beat them, join them”, one way to participate in the growth of the federal government is to invest in properties leased to government agencies.

There are just two real estate investment trusts that focus on owning properties leased to government entities. Read more to find out what they are.

2 High Yield Stocks to Buy When the “Experts” Are Wrong (Hint: It’s Right Now)

Less than one month ago, bond “experts” were all over the financial news networks predicting the yield curve would invert in 2018. An inverted curve, where short-term rates are higher than long-term rates, is a reliable indicator that the economy will go to negative growth – a recession. At that time the stock market was setting new records higher, even as the fears of a recession grew. Now interest rates are rising, the yield curve is turning more positive, and the “experts” claim it is due to stronger economic growth and rising inflation.

This most recent interest rates news has pushed the stock market into a steep decline. So, what is it to be? An economic recession with higher stock prices or a strong economy with lower stock prices? Will the yield curve flatten or steepen? What will they say next week?

The point is that an investor who invests based on the latest “expert” opinions is likely to get whipsawed into losing money in the stock market. We are now in a stock market correction. It has been about two years since the last one. In the second half of 2015 through mid-February 2016 the S&P 500 declined in a double-dip correction by 13%. It then took five months for the index to recover from the correction.

If you are an investor, and not a trader, and want to grow your portfolio value, you need an investment strategy that accounts for market corrections.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His