-

RPM Earns 70 Cents Per Share

Posted by Eddy Elfenbein on January 4th, 2018 at 11:16 amGood news this morning for RPM International (RPM). The company reported fiscal Q2 earnings of 70 cents per share which beat the Street by eleven cents. However, that includes a tax benefit of nine cents per share. Quarterly sales rose 10.5%. Organic sales rose by 4.3% and acquisition sales were up 4.7%. Forex added another 1.6% to sales growth

RPM International today reported record sales, net income and diluted earnings per share for its fiscal 2018 second quarter ended November 30, 2017. Sales increased 10.5% and net income of $95.5 million, or $0.70 per diluted share, compared to a year-ago net loss of $70.9 million, or loss of $0.54 per diluted share. The fiscal 2017 second-quarter results included a $188.3 million pre-tax ($129.2 million or $0.97 per diluted share, after-tax) impairment charge. The fiscal 2017 second-quarter results also included a charge of $12.3 million, or $0.09 per share, which had no tax impact, related to the decision to exit an industrial segment business in the Middle East.

Second-Quarter Results

Net sales of $1.32 billion were up 10.5% over the $1.19 billion reported a year ago. Organic sales improved 4.2% and acquisition growth added 4.7%. Foreign currency translation increased sales by 1.6%. Net income of $95.5 million compares to last year’s adjusted net income of $70.5 million. Earnings per diluted share of $0.70 in the current quarter, which included a $0.09 per diluted share tax benefit relative to last year’s tax rate, compare to an adjusted $0.52 per diluted share last year. Earnings per diluted share increased 34.6% from last year’s adjusted earnings per diluted share of $0.52, and increased 17.3% excluding the $0.09 per diluted share tax benefit. Income before income taxes (IBT) of $109.2 million compares to a loss before income taxes of $106.9 million reported in the fiscal 2017 second quarter. RPM’s consolidated earnings before interest and taxes (EBIT) of $131.8 million compare to a consolidated loss before interest and taxes of $86.4 million reported in the fiscal 2017 second quarter. Excluding the year-ago charges, RPM’s consolidated EBIT for the fiscal 2018 second quarter improved 15.4% over $114.2 million in the fiscal 2017 second quarter. The EBIT improvement of 15.4% included the cost savings benefit in “Corporate/Other” expenses of $11.1 million from lower pension, healthcare, acquisition-related expenses and professional fees.

“We were very pleased with RPM’s results during the fiscal second quarter. Our strategically balanced business model performed as intended with strength in our industrial and specialty businesses offsetting weakness in our consumer segment. Sales growth was strong across all three of our business segments, with a balance of organic and acquisition growth. We are also seeing the benefits of last year’s product line acquisitions and cost reduction efforts on improved leverage, which more than offset higher raw material costs that have negatively impacted gross profit margins,” stated Frank C. Sullivan, chairman and chief executive officer.

-

The Dow By Days of the Week

Posted by Eddy Elfenbein on January 4th, 2018 at 8:46 amI was number-crunching and I came across a remarkable stat. Here are the compounded gains for the Dow by days of the week from March 1, 1986 to the end of 2017.

Mondays +94.60%

Tuesdays +259.11%

Wednesdays +107.54%

Thursdays +5.46%

Fridays -5.43That’s the compounded gain, meaning if you had solely invested on those days.

Here are the number of trading days per day of the week:

Mondays 1,517

Tuesdays 1,645

Wednesdays 1,647

Thursdays 1,614

Fridays 1,603It’s so skewed toward the start of the week. In fact, if we combine Monday, Tuesday and Wednesday, then we see that the Dow has gained 1,350.33% on 4,809 days. Meanwhile, Thursday and Friday have lost -0.27% on 3,217 days.

That means the Dow’s entire gain, excluding dividends, has come during the first three days of the week. Thursday and Friday do nothing.

If we add everything up, that’s 8,028 trading days for a return of 1,346.36%. That aligns with the Dow going from 1,709.06 on February 28, 1986 to 24,719.22 on December 29, 2017.

-

Morning News: January 4, 2018

Posted by Eddy Elfenbein on January 4th, 2018 at 7:05 amResearchers Discover Two Major Flaws in the World’s Computers

How a Secretive Conclave Decides When U.S. Recessions Happen

Commodities Are on Their Longest Winning Streak in History

Bitcoin’s Cheap Energy Feast Is Ending

U.S. Auto Sales Slump in First Since 2009, But Party Isn’t Over

Competing With the Giants in Race to Build Self-Driving Cars

Tesla Reports New Setack for Model 3, With Output Lagging

AT&T Says It Will Launch 5G in a Dozen Cities This Year

Smaller Rite Aid Plans To Grow PBM’s Medicare Prescription Business

McDonald’s New ‘Archburger’ Will Use Fresh Beef Instead of Frozen

Spotify Makes Confidential Filing for IPO

Even a Billionaire Brother’s Love Has Limits

Roger Nusbaum: Random Roger Round Up

Howard Lindzon: One Man’s Bubble is Another’s Wealth Generating Event

Josh Brown: Pro-Am & Bess Levin on the Market’s Mute Button

Be sure to follow me on Twitter.

-

Dividends Rose 6.31% in Q4

Posted by Eddy Elfenbein on January 3rd, 2018 at 12:07 pmLast quarter was another good one for dividends for the S&P 500. Dividends rose by 6.31% over Q4 2016. This is the 31st quarter in a row of dividend increases for the index.

For the year, dividends were up 7.07% over 2016. Over the last seven years, dividends are up 115%. That’s actually a tiny bit slower than the S&P 500. In other words, the index has gotten cheaper on a yield basis.

The blue is the S&P 500 and it follows the left scale. The black is the rolling 12-month dividends and it follows the right scale.

For some reason the y-axis indicators didn’t show up, but both axes are scaled at a ratio of 50-to-1. That means that whenever the lines cross, the S&P 500’s dividend yield is exactly 2%. As you can see, it’s tracked near 2% fairly well for the last 15 years.

Both axes are logarithmic. The left goes from 600 to 3,000 while the right goes from 12 to 60.

-

The S&P 500 Breaks 2,700

Posted by Eddy Elfenbein on January 3rd, 2018 at 11:17 amFor the first time ever, the S&P 500 broke 2,700 this morning. The index was last below 27 in March 1954 (it was still below its 1929 high). That’s a 100-fold gain in 64 (and 89) years.

We only have about 4% or so to go for the S&P 500 Total Return Index to be five times where it was at the March 2009 low.

Yesterday’s market was interesting because high-beta stocks did well while low vol stocks lagged along. Today’s market is more balanced but small-caps are leading the pack.

Before the market opened, we learned that the ISM Manufacturing Index was 59.7 for December. That’s a good number, and it was up from 58.2 in November. We also learned that construction spending rose 0.8% in November. In the past year, construction spending was up 2.4%.

-

Morning News: January 3, 2018

Posted by Eddy Elfenbein on January 3rd, 2018 at 7:05 amGermany’s Jobless Rate Drops to Record Low as Economy Booms

MiFID Shake-Up Gets Real as Wary Traders See Volumes Dry Up

New in the West Bank: A Credit Boom Waiting for a Real Economy

Bitcoin Loses Some Dazzle as Second-Tier Crypto Coins Catch Up

Peter Thiel Is a Bitcoin Believer

Meet The Crypto Billionaires Getting Rich From Ripple’s XRP

American and Southwest Airlines Promise ‘Tax Bill Bonus’ for Employees

Amazon Will Buy Target This Year, Gene Munster Predicts

Tesla’s Scant Disclosures on the Model 3 Leave Wall Street Guessing

McDonald’s Tests New Fresh Beef Burger

A Saucy App Knows China’s Taste in News. The Censors Are Worried.

Jeff Carter: The Next Big Thing Is Hard

Michael Batnick: The Math Doesn’t Work

Cullen Roche: The 2018 Global Financial Asset Portfolio

Be sure to follow me on Twitter.

-

The S&P 500 Sectors in 2017

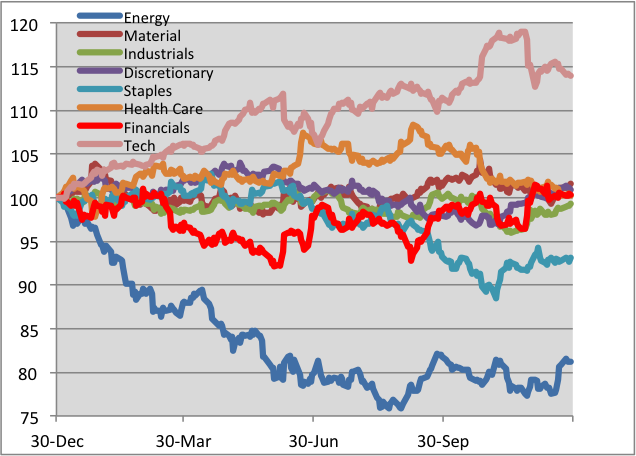

Posted by Eddy Elfenbein on January 2nd, 2018 at 8:30 amHere’s an interesting chart. This shows the relative strength of the major S&P 500 sectors during 2017.

Sorry I had to cram the legend on there.

To be clear, this isn’t how well the sectors did overall. Instead, it’s the sectors divided by the S&P 500. In other words, a rising line means the sector is beating the market while a falling line means it’s trailing. I used the total return figures.

A few things stand out. First, this was a tough year for Energy stocks. They badly trailed the market during the first part of the year. (I didn’t include Real Estate, Utes or Telecoms. The chart is crowded enough as it is.)

The Tech Sector was the big winner; however, there were two pullbacks, one in June and another in November.

Most of the other sectors could fairly be said to be market performers. Healthcare was strong during much of the year, but it tailed off after Labor Day. Financials were weak through May but picked up steam later in the year.

I think I was most surprised by the weakness in Consumer Staples from May to November.

-

Morning News: January 2, 2018

Posted by Eddy Elfenbein on January 2nd, 2018 at 7:04 amBitcoin May Be Struggling — But Ethereum Just Posted a Fresh All-Time High

Europe’s Record Factory Growth Puts the Squeeze on Resources

OPEC Deal Doesn’t Stop Russia From Record Oil Output in 2017

China Bulls Out in Force as Stocks, Yuan Start Year With Gains

LeEco’s Jia Defies China Return Order, Sends Family Instead

California Rolls Its Own Recreational Pot Sales Out For 2018

The $15 Minimum Wage Movement Is Winning, And That’s Bad News For Cashiers

BP Takes $1.5 Billion Charge Related to U.S. Tax Overhaul

With Disney Deal Looming, Murdoch’s Empire Is Fractured

UPS: If The Founders Were Alive Today

Those Seatback Screens on Planes Are Starting to Disappear

Toasts to the Deals (and Other Winners) of 2017

Ben Carlson: Upside Risk Management

Jeff Miller: What Should Worry Investors in 2018?

Howard Lindzon: I Love 2018…and Trump Made American Stocks Below Average in 2017

Be sure to follow me on Twitter.

-

Morning News: January 1, 2018

Posted by Eddy Elfenbein on January 1st, 2018 at 7:56 amHow China Will Shake Up the Oil Futures Market

Goldman Sees Crypto, Credit Shadowing Robust 2018 U.S. Economy

Wall Street Eyes 2018 Gains with a Side of Caution

Start of a New Year of Trading, and Jobs Report from December

As U.S. Budget Fight Looms, Republicans Flip Their Fiscal Script

Tax Law Offers a Carrot to Gig Workers. But It May Have Costs.

A Retailers’ Guide to Curbing Online Gift Returns

How Do You Turn an Ad Into a Meme? Two Words: Dilly Dilly

Japan’s Nippon Life Eyeing M&A for Foreign Boutique Bond and Alternative Funds

8 Changes to Social Security in 2018

Louisiana Man Charged in ‘Nigerian Prince’ Scheme

Josh Brown: Snowballing into 2018

Michael Batnick: These Are the Goods

Be sure to follow me on Twitter.

-

The 2018 Buy List

Posted by Eddy Elfenbein on December 31st, 2017 at 6:17 pmHere are the 25 stocks for the 2018 Buy List. It’s locked and sealed, and I can’t make any changes for 12 months.

For tracking purposes, I assume the Buy List is a $1 million portfolio that’s equally divided among 25 stocks. Below are all 25 positions with the number of shares for each and the closing price for 2017. Whenever I discuss how the Buy List is doing, the list below is what I’m referring to.

Company Ticker Price Shares Balance AFLAC AFL $87.78 455.6847 $40,000.00 Alliance Data Systems ADS $253.48 157.8034 $40,000.00 Becton, Dickinson BDX $214.06 186.8635 $40,000.00 Carriage Services CSV $25.71 1,555.8149 $40,000.00 Cerner CERN $67.39 593.5599 $40,000.00 Check Point Software CHKP $103.62 386.0259 $40,000.00 Church & Dwight CHD $50.17 797.2892 $40,000.00 Cognizant Technology Solutions CTSH $71.02 563.2216 $40,000.00 Continental Building Products CBPX $28.15 1,420.9591 $40,000.00 Danaher DHR $92.82 430.9416 $40,000.00 FactSet Research Systems FDS $192.76 207.5119 $40,000.00 Fiserv FISV $131.13 305.0408 $40,000.00 Hormel Foods HRL $36.39 1,099.2031 $40,000.00 Ingredion INGR $139.80 286.1230 $40,000.00 Intercontinental Exchange ICE $70.56 566.8934 $40,000.00 JM Smucker SJM $124.24 321.9575 $40,000.00 Moody’s MCO $147.61 270.9844 $40,000.00 Ross Stores ROST $80.25 498.4424 $40,000.00 RPM International RPM $52.42 763.0675 $40,000.00 Sherwin-Williams SHW $410.04 97.5515 $40,000.00 Signature Bank SBNY $137.26 291.4177 $40,000.00 Snap-on SNA $174.30 229.4894 $40,000.00 Stryker SYK $154.84 258.3312 $40,000.00 Torchmark TMK $90.71 440.9657 $40,000.00 Wabtec WAB $81.43 491.2195 $40,000.00 Total $1,000,000.00 The five new stocks are Carriage Services, Check Point Software Technologies, Church & Dwight, FactSet Research Systems and Torchmark.

Also, thanks to the recent merger, Becton, Dickinson will take the place of CR Bard.

The five deletions are Axalta Coating Systems, Cinemark Holdings, Express Scripts, HEICO and Microsoft.

Danaher is now our largest stock, with a market cap of $65 billion. The Buy List is mostly large- and mid-cap stocks. Only two are smaller than $7 billion. Continental Building Products is about $1 billion, and Carriage Services is $410 million.

Only AFLAC and Fiserv have been on the Buy List all 13 years. This is Stryker’s 11th year. FactSet is returning for the third time to the Buy List.

Here’s a brief look at our five new stocks.

Carriage Services (CSV) is a Texas-based funeral-home operator. They currently operate 178 funeral homes in 29 states, and 32 cemeteries in 11 states. Barely anyone on Wall Street follows Carriage, but the numbers look good.

Check Point Software Technologies (CHKP) is an Israeli-based computer-security firm. It’s not cheap at 19.7 times this year’s earnings, but I think that’s not a bad price considering their growth.

Church & Dwight (CHD) is a company I’ve wanted to add for many years. They’re a consumer-products stalwart. C&D owns several well-known brands like Arm & Hammer, OxiClean and, of course, Trojan.

FactSet Research Systems (FDS) is a financial-data and software company. They help provide all the numbers that investors love to crunch. The stock was previously on the Buy List from 2006 to 2009 and again in 2013. I probably should have had them on the whole time.

Torchmark (TMK) is a stock I’ve wanted to add to the Buy List for years. This is a very well-run insurance company based in Texas. Torchmark specializes in serving the middle-income market. The company almost always grows its operating income by 7% to 10% per share each year.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His