-

Morning News: December 13, 2017

Posted by Eddy Elfenbein on December 13th, 2017 at 6:59 amRising Coal Exports Give Short-Term Aid to an Ailing Industry

South Korea Seeks Measures to Curb Bitcoin Frenzy

What Is Litecoin, and Why Is It Beating Bitcoin This Year?

Bitcoin Arbitrage and Tax Math

U.S. SEC Stops ‘Munching’ Munchee’s ICO After Reg Concerns Raised

Fed 2018 Dots in Focus for Yellen Swan Song: Decision Day Guide

Trudeau Snubs Boeing, Unveils Plan to Buy Used Australian Jets

How 2017 Became a Turning Point for Tech Giants

Disney’s Deal for 21st Century Fox Is Said to Be Close

Google Is Opening A New AI Research Centre in China

Tesla Semi: Total Addressable Market And Incremental Value

Toshiba and Western Digital Make Peace, Clearing Major Hurdle for Chip Deal

Jeff Miller: Goldman Speaks! Should You Listen?

Michael Batnick: Lessons From the General

Ben Carlson: 2017 Has Been a Remarkable Run For Stocks

Be sure to follow me on Twitter.

-

Morning News: December 12, 2017

Posted by Eddy Elfenbein on December 12th, 2017 at 6:57 amCarney to Put Pen to Paper as U.K. Inflation Climbs Above 3%

Sri Lanka Hands Major Port to China to Ease Its Debt

Trump’s Criticism of W.T.O. Hurts America First

Tax Plan’s Biggest Cuts Could Be in Living Standards

FCC, FTC Announce Partnership to Police Internet After Net Neutrality Repeal

Want to Issue a Red-Hot ICO? Rule No. 1 Is Do Very Little Work

Bitcoin Frenzy Poses No Threat to Bullion, Goldman Sachs Says

There’s a Medical ‘Land Grab’ Underway as Hospitals Try to Get Larger

American Express As A Dividend Income Investment

Comcast Drops Bid for Fox Assets, Leaving Disney in Pole Position

Westfield, Owner of World Trade Center Mall, to Be Sold for $15.7 Billion

Cullen Roche: Elasticity of Money is a Feature, not a Bug

Josh Brown: Investors Will Never Get the Answer to “Why Now?”

Howard Lindzon: 2017 – The Year of the Comeback

Jeff Carter: The Free Market In Bitcoin

Be sure to follow me on Twitter.

-

The New Yorker Profiles Jim Simons

Posted by Eddy Elfenbein on December 11th, 2017 at 8:48 pmThe New Yorker profiles math-hedge-quant-gabillionare Jim Simons. He’s very, very, very smart.

Simons, a noted mathematician, is also the founder of Renaissance Technologies, one of the world’s largest hedge funds. His income last year was $1.6 billion, the highest in the hedge-fund industry. You might assume that he had to show up every day at Renaissance in order to make that kind of money, but Simons, who is seventy-nine, retired eight years ago from the firm, which he started in the late seventies. His Brobdingnagian compensation is a result of a substantial stake in the company. He told me that, although he has little to do with Renaissance’s day-to-day activities, he occasionally offers ideas. He said, “I gave them one three months ago”—a suggestion for simplifying the historical data behind one of the firm’s trading algorithms. Beyond saying that it didn’t work, he wouldn’t discuss the details—Renaissance’s methods are proprietary and secret—but he did share with me the key to his investing success: he “never overrode the model.” Once he settled on what should happen, he held tight until it did.

The Flatiron Institute can be seen as replicating the structure that Simons established at Renaissance, where he hired researchers to analyze large amounts of data about stocks and other financial instruments, in order to detect previously unseen patterns in their fluctuations. These discoveries gave Simons a conclusive edge. At the Flatiron, a nonprofit enterprise, the goal is to apply Renaissance’s analytical strategies to projects dedicated to expanding knowledge and helping humanity. The institute has three active divisions—computational biology, computational astronomy, and computational quantum physics—and has plans to add a fourth.

Simons works out of a top-floor corner office across the street from the institute, in a building occupied by its administrative parent, the Simons Foundation. We sat down to talk there, in front of a huge painting of a lynx that has killed a hare—a metaphor, I assumed, for his approach to the markets. I was mistaken, Simons said: he liked it, and his wife, Marilyn, did not, so he had removed it from their mansion in East Setauket, on Long Island. (Marilyn, who has a Ph.D. in economics, runs the business side of the foundation, and the institute, from two floors below.) An Archimedes screw that he enjoyed fiddling with sat on a table next to a half-filled ashtray. Simons smokes constantly, even in enclosed conference rooms. He pointed out that, whatever the potential fine for doing so is, he can pay it.

-

Should investors beware a stock surging on bitcoin mania?

Posted by Eddy Elfenbein on December 11th, 2017 at 6:33 pmShould investors beware a stock surging on bitcoin mania? from CNBC.

-

Airline stocks fly high

Posted by Eddy Elfenbein on December 11th, 2017 at 6:31 pm -

Morning News: December 11, 2017

Posted by Eddy Elfenbein on December 11th, 2017 at 7:03 amOnce the W.T.O.’s Biggest Supporter, U.S. Is Its Biggest Skeptic

Turkey’s 11% Economic Growth Fuels Expectations of Rate Hike

U.A.E., Kuwait Target June for Talks on Phasing Out Oil Cuts

Bitcoin Futures Start With a Bang as 26% Rally Triggers Halts

Hackers Linked to Russians Target Banks From Moscow to Utah

Net Neutrality’s Holes in Europe May Offer Peek at Future in U.S.

Mobile-Wireless Market Might Be Our Post Net-Neutrality World

Ascension and Providence St. Joseph in Talks to Form U.S.’s Largest Hospital Operator

HSBC to Be Released From U.S. Deferred Prosecution Agreement

Steinhoff Calls in Moelis and AlixPartners to Advise Ahead of Lenders’ Meeting

Bangladesh Minister Says Wants to ‘Wipe Out’ Manila Bank for Heist Role

Africa’s Richest Woman Prepares New Deals After Losing Her Job

Jeff Miller: Plenty of Cross-Winds for Santa

Michael Batnick: These Are the Goods

Ben Carlson: What a Complacent Investor Looks Like

Be sure to follow me on Twitter.

-

Josh Brown Explains How to Buy Bitcoin

Posted by Eddy Elfenbein on December 8th, 2017 at 10:09 am -

November NFP = 288K

Posted by Eddy Elfenbein on December 8th, 2017 at 8:32 amThe November jobs report is out.

The U.S. economy created 228,000 net new jobs last month. The unemployment rate stayed at 4.1%. The private sector added 221,000 jobs. Average hourly earnings rose by 0.2%. In the last year, AHE is up 2.5%.

The labor force participation rate was 62.7%. U6, which is a broader measure of unemployment, came in at 8%.

Here’s the monthly change in nonfarm payrolls:

Here’s the unemployment rate:

-

CWS Market Review – December 8, 2017

Posted by Eddy Elfenbein on December 8th, 2017 at 7:08 am“People calculate too much and think too little.” – Charlie Munger

Before I get to today’s newsletter, I wanted to let you know that I’ll be announcing the 2018 Buy List in the December 22nd newsletter. That’s in two weeks.

The new Buy List will have 25 stocks. I’ll be adding five new stocks and deleting five old ones. We like to keep our turnover low. The new list won’t take effect until the start of trading in the new year. I like to let investors know what the changes are a few days before they go into effect. I’m very excited for our new Buy List (our 13th!).

Now let’s turn to this week’s newsletter. On Thursday, the S&P 500 finally halted its four-day losing streak. The damage was very minor, and the major indexes are still very close to all-time highs. I have to say that the recent market environment has been nearly picture-perfect; interest rates and inflation are low, corporate profits are growing and consumer confidence is soaring. The S&P 500 has traded above its 200-DMA continuously for 18 months. I’ll warn you—this won’t last!

Lately, some big-name tech stocks have been getting knocked about. At the same time, Wall Street has been favoring cyclical stocks. The Dow Transports, for example, recently broke 10,000 for the first time ever. This could be the start of a major rotation. I’ll tell you what it all means.

We also have a big Fed meeting coming our way next week. Expect another rate hike. I think it’s a mistake, but alas, they didn’t ask me. Later on, I have some Buy List updates for you. Stryker, one of our stalwarts, just raised its dividend as it has every year since 1993. But first, let’s see what this rotation is all about.

Wall Street Turns from Tech to Cyclicals

While the stock market has remained strong, quietly there’s been a changing of the guard. Recently, big tech stocks have been lagging the market. Bear in mind what a good year it’s been for them. The tech sector has made up nearly half the S&P 500’s gains this year. If you lump Amazon in with the techs, then it’s more than half.

Tech first started to lag the market last Tuesday, November 28. It then got much worse for tech on Wednesday, November 29. After that, tech stocks appeared to stabilize, but they lagged again this past Monday. On our Buy List, Microsoft (MSFT) has been a victim of this shift. We can’t say yet if the trend is over.

Overall, the impact hasn’t been earth-shaking, but it’s interesting because it’s been so new. For so long, large-cap tech was such an easy trade. (There was a brief hiccup in June, but that didn’t last long.)

Here’s what’s important: The flip side of lagging tech is a buoyant environment for cyclical stocks. By Cyclicals, I mean stocks whose businesses are heavily tied to the economic cycle. You may own a wonderfully-run homebuilder or chemical maker, but their prospects are always at the mercy of where we are in the cycle. Investors need to understand that.

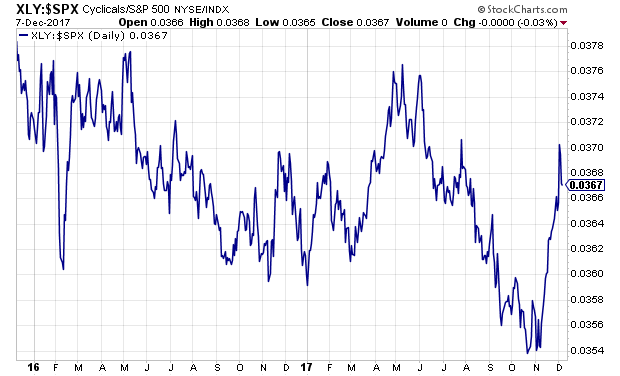

We can see a good example of this by looking at the Consumer Discretionaries ETF (XLY). This sector was a giant winner at the start of this bull market. Their outperformance lasted for years, but starting about two years ago, the Consumer Discretionaries started to lag. Not badly, but they did fall behind. Lately, however, they’ve been rock stars.

Similarly, the Dow Transports (^DJT) have been popping. This is an old-time index of 20 stocks involved in the business of moving people and things about. For the first time ever, the Transports broke 10,000. I wonder how many investors are aware that CSX Corporation (CSX), a boring old railroad, is up 56% this year. That’s more than all the FAANG stocks.

If we drill down a little, one of the best-performing sectors of the Cyclicals has been the homebuilders. NVR (NVR), for example, is a $3,400 stock that’s more than doubled this year. After a long brutal stretch, things are finally looking up for the housing market. Home prices are rising at their fastest pace in three years. Last week, we learned that new-home sales jumped to a 10-year high. It’s all about the cycle.

We’re also seeing new-found strength in financial stocks. On our Buy List, you can see that in stocks like AFLAC (AFL) and Signature Bank (SBNY). The theme seems to be stocks that do the financing, and stuff that’s bought via financing.

What Does This Rotation Mean for Us?

What does this shift to Cyclicals mean? I suspect that this is the market’s confirmation of some recent good news for the economy. As we’ve noted before, consumer confidence is at a 17-year high. Inflation is still low. Housing is coming back. GDP growth for Q2 and Q3 were pretty good, and it looks like Q4 may even top those two. Simply put, the economy is doing well, and the market’s rotation is reflecting that.

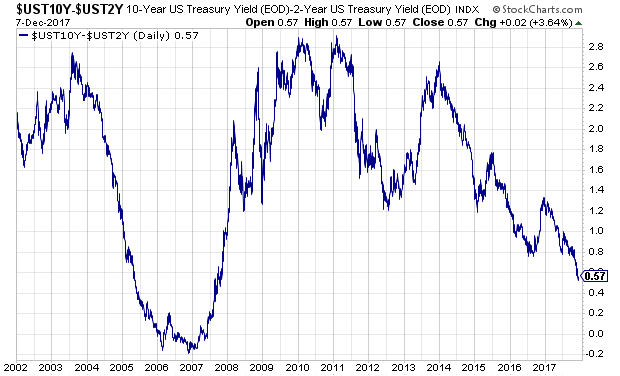

Another reflection of the improving economy is the flattening of the yield curve. The spread between the 2- and 10-year Treasury yields recently fell to just 57 basis points. That’s down from 130 basis points less than a year ago and 260 basis points four years ago.

The yield curve is going to get flatter soon. The Federal Reserve is getting together next week, and it seems certain that they’ll raise interest rates again. The central bank has said it sees three more rate hikes next year, plus another three in 2019. I think three hikes in 2018 has a good chance of happening, but I’m not so sure about 2019. At the upcoming Fed meeting, the Fed will update its projections. I won’t be surprised if they walk back their 2019 forecast.

The reason is the key part of the flattening yield curve—long-term rates aren’t moving that much. In fact, long-term yields are lower than where they were at the start of the year. Frankly, I’m not sure why that is.

Fortunately, we’re not economists and we don’t have to overly concern ourselves with why something is happening. As investors, it’s good enough to know that it’s happening. Shortly after the election, we saw a similar rotation away from tech and towards Cyclicals. However, that move was matched by a sharp drop-off in long-term bonds. We’re not seeing that this time.

This means that bonds are still pretty weak competition against stocks. While stock valuations are elevated (but not extreme), you can still find good deals. On our Buy List, there are several stocks poised to benefit from a continued rotation into Cyclicals. For example, I like Sherwin-Williams (SHW), the paint people. Also, Signature Bank (SBNY) continues to look good. Another Cyclical that looks good now is Wabtec (WAB). Now let’s look at a nice dividend boost from Stryker.

Buy List Updates

We got some good news this week from Stryker (SYK). The orthopedics company said it’s raising its quarterly dividend by 11%. The payout will rise from 42.5 to 47 cents per share.

With all those artificial hips and limbs, Baby Boomers are gradually turning bionic. This is great news for Stryker. The company has raised its dividend every year since 1993.

“Our financial strength is reflected in the 11% increase in our dividend for 2018 as we continue to execute on our capital-allocation strategy,” said Kevin A. Lobo, Chairman and Chief Executive Officer. “With strong organic sales growth and leveraged adjusted-earnings gains, we believe we are well positioned to continue to deliver dividend increases in line with our adjusted earnings growth.”

The new dividend will be payable on January 31 to shareholders of record on December 29. Based on Thursday’s closing price, SYK yields 1.24%.

Shares of Express Scripts (ESRX) have been acting much better recently. Since mid-October, the stock is up nearly 19%. The company is benefiting from an improved environment. Someone could make an offer for ESRX. Thanks to the CVS-and-Aetna deal, there’s a belief that Amazon may jump in, or possibly, Walgreens Boots Alliance. Bernstein recently upgraded the stock and raised its target price from $51 to $65 per share. It also said that Express could greatly benefit from tax reform.

Shares of Cinemark (CNK) got some welcome news this week. First, Cineworld said it’s buying Regal Entertainment for $3.6 billion. Whenever there’s one buyout in an industry, it usually bodes well for other companies. Perhaps someone will make an offer for CNK. The theater chain also announced it’s jumping into the subscription business.

For $8.99 per month, you’ll be able to see one film per month, plus get a 20% discount on concessions, and bring a friend along for $8.99 for a movie. I think this is a good idea. It’s probably not a game-changer, but it fights back against services like Movie Pass.

That’s all for now. The big news next week will be the Federal Reserve meeting. It will be a two-day meeting, on Tuesday and Wednesday. After the meeting, Janet Yellen will be holding a press conference. The Fed will also update its economic projections for the next few years. Then on Thursday, we’ll get the retail-sales report, and on Friday, the industrial-production report comes out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Here’s an interview I did this past week on Bloomberg TV. I thought it went well.

-

Morning News: December 8, 2017

Posted by Eddy Elfenbein on December 8th, 2017 at 7:03 amSoutheast Asia’s Ride-Hailing War Is Being Waged on Motorbikes

Companies Prepare for Disorderly Brexit as Talks Stall

The Bitcoin Whales: 1,000 People Who Own 40 Percent of the Market

More Than $70 Million Stolen in Bitcoin Hack

AT&T Commits to Time Warner Deal Even as Judge Delays Deadline

Ford Will Build Electric Cars in Mexico, Shifting Its Plan

Boeing CEO: We’re Going to Beat Elon Musk to Mars

WestJet Has a Radical Plan to Get You on Its Planes

Spotify Could Get a Little Wild When It Goes Public

JPMorgan’s Dimon Taking Customer Pricing Hints from Amazon

Alibaba Redraws Retail Fault Lines with Bricks-and-Mortar Push

GE’s Power Missteps Take a Human Toll

Cullen Roche: Why Fed Narratives Can Be Dangerous For Your Portfolio

Joshua Brown: Crypto Shorthand

Mark Hines: Stock Exchange: Going Beyond Fundamentals, 3 Attractive Ideas

Be sure to follow me on Twitter.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His