-

CWS Market Review – December 1, 2017

Posted by Eddy Elfenbein on December 1st, 2017 at 7:08 am“Time is on your side when you own shares of superior companies.” – Peter Lynch

The month of November has come to a close, and it was another good one for stocks. In fact, this was the 13th month in a row of gains for the S&P 500 Total Return Index.

Not only is the bull still running, but he’s getting stronger. On Thursday, for the first time ever, the Dow closed above 24,000. The S&P 500 is now up 18.26% for the year. Our Buy List is also doing quite well. Since August 28, it’s beating the S&P 500 by a margin of 11.37% to 8.32% (not including dividends), and it’s been happening despite some unsettling headlines.

"Stocks Soar to All-Time High on Threat of Nuclear Annihilation"

— Eddy Elfenbein (@EddyElfenbein) November 28, 2017

Even though daily volatility remains quite low, there’s been a lot of drama in our Buy List. This is especially true for Axalta Coating Systems, a company which is playing a billion-dollar version of “hard to get.” I’ll go over the details in a bit.

Just before Thanksgiving, we got a very nice earnings report from Hormel Foods. The Spam stock is up over 20% in the last month. It also looks like Cerner is partnering with Amazon. That was enough to give the stock a jolt. Also, Express Scripts is looking a lot like a company that’s putting itself up for sale. I’ll explain it all. Plus, I have some new Buy Below prices for our Buy List. Before we get to that, let’s look at the soap opera that’s better known as Axalta Coating Systems.

High Drama at Axalta

The WSJ recently ran an article titled, “Who Knew the Paint Industry Could Be this Exciting?” Man, oh man, I have to echo those thoughts when discussing the wild ride for Axalta Coating Systems (AXTA).

Let’s start at the beginning with the initial news that Axalta said they were in merger talks with Akzo Nobel. I was careful to say that they were simply talking and that no deal had been accepted. The market responded by shooting up shares of AXTA by 17% in one day. That was the good news.

Let me explain. What’s going on is a global rush to consolidate in the paint industry, and AXTA finds itself in the middle of all this. Later, on the Wednesday before Thanksgiving, we got the news that Axalta and Akzo Nobel had broken off their merger talks. (Oh no!) This news came after the market had closed. In the after-hours market, AXTA was down 17%.

Moments later, we got the news that the reason they had ended merger talks is that they had received another offer from Nippon Paint, a Japanese company. One difference was this offer was all in cash. Thought we don’t have proof, I think we can infer that Nippon’s offer was higher than Akzo Nobel’s. Then in the after-hours market, AXTA did a massive U-turn and made back everything it lost. (By the way, this is a good reason why I’m leery of using stop-losses. You can find yourself tossed out of good stocks just because everyone freaks the hell out. Take note of this week’s epigraph.)

That brings us to Thursday. Shares of AXTA were halted when we learned that Axalta had rejected Nippon’s offer. According to reports, the deal on the table was for $37 per share. Some analysts think AXTA could have gotten $40, maybe more.

I think this was a big mistake for Axalta not to accept. In my mind, it doesn’t make sense to walk away from a very good deal in hopes of getting an amazing deal. I would have especially granted Nippon some latitude since they were offering all cash.

When trading resumed around 1 p.m., AXTA had crashed to $30 per share. It eventually closed Thursday at $31.66. That’s a drop of $15.69% from Wednesday’s close. That hurts, but I suspect other companies will give Axalta a look. Maybe even our own Sherwin-Williams (SHW) will do so.

What to do now? Nothing. Let’s just wait this out. I suspect more news will be forthcoming.

The Recent Economic News Has Been…Not Bad

I like to joke that nothing upsets some people as much as good economic news. Yet it’s true: the sky is not always falling. Over the past few days, we’ve gotten some encouraging economic news.

Let’s start with the GDP report. The government revised higher its estimates for Q3 GDP growth. They now say the economy grew in real terms by 3.3% last quarter. This comes on the heels of 3.1% growth in Q2.

During this recovery, the economy has had a hard time stringing together more than three quarters in a row of robust growth. Q4 might do it for us. The Atlanta Fed currently expects Q4 growth to come in at 3.4%.

On Monday, the existing-home sales report came out, and it was the best in ten years. Then on Tuesday, the Conference Board reported that consumer confidence is at a 17-year high. (My preference is to report consumer humility as being at a 17-year low.)

Next Friday, we’ll get the jobs report for November, and I expect to see more job growth. The unemployment rate is currently at 4.1%, and it could drop below 4% for the first time since 2000.

The Federal Reserve will be getting together again on December 12-13. This will be one of their two-day meetings, which will be followed by a press conference by Janet Yellen. This will be her final presser before Jay Powell takes over early next year. The Fed will also update its economic projections, also known as the blue dots for the scatterplots.

The Fed seems almost certain to raise rates at this meeting. The futures market has it pegged at 100%, which is pretty darn certain. As I’ve said before, I think this would be a mistake, but I can’t say it’s a gigantic mistake.

After December, the outlook gets a little muddy. The futures market expects another rate hike in March, but that’s by a close margin. A hike by June is seen as much more probable (81%). That would be followed by another hike by September (55.7%).

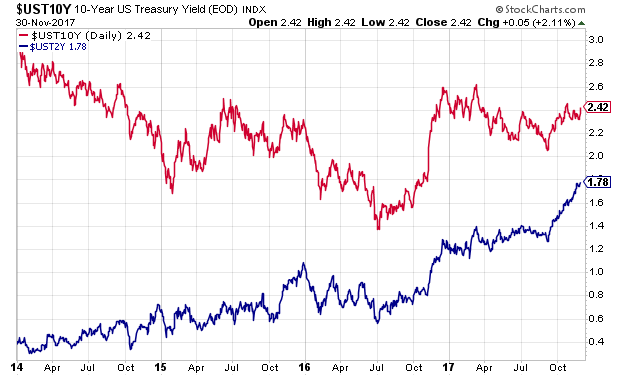

My fear is that the Fed is moving too fast too soon. There’s very little evidence of inflation. I’m also concerned that long-term bond yields are still rather low. To me, this suggests the Fed has a lower “ceiling” for rate hikes than it may realize. I want to be clear that this isn’t a problem yet, but it could be one in the coming months.

The spread between the 2- and 10-year Treasuries recently dropped as low as 58 basis points. That means the yield curve could invert with just a few more rate hikes. I just don’t see the need for that. Now let’s look at the good earnings news from Hormel.

Hormel Foods Earns 41 Cents per Share

Last Wednesday, Hormel Foods (HRL) reported fiscal Q4 earnings of 41 cents per share. That beat the Street by a penny. I was very relieved to see this report because it’s a big improvement over their previous earnings report.

This was not an easy year for the Spam people. For the year, Hormel made $1.57 per share which was down from $1.64 in 2016. The company had sales of $2.5 billion, which was down 5%, although organic net sales were up 5%. Cash flow from operations totaled $499 million. That’s up 34%. Operating margins were 13.2%.

For fiscal 2018, Hormel sees earnings between $1.60 and $1.70 per share.

“Fiscal 2018 represents a return to growth with the addition of three strategic acquisitions and contributions from innovative new items such as HORMEL® BACON 1TM fully cooked bacon and SKIPPY® PB BITES,” said Jim Snee, chairman of the board, president and chief executive officer. “The earnings power we are creating with acquisitions, major capital investments in value-added capacity, a supply chain reorganization, the union of the Grocery Products and Specialty Products segments, and an intense focus on strategic cost management sets us up for renewed earnings growth in 2018 and beyond.”

“We expect Refrigerated Foods, Grocery Products and International to drive growth as Jennie-O Turkey Store continues to navigate difficult industry conditions,” Snee said.

Net-Sales Guidance (in billions)

$9.40 – $9.80

Earnings-per-Share Guidance

$1.60 – $1.70Fiscal 2018 net-sales and earnings-per-share guidance exclude the pending acquisition of Columbus Craft Meats, which is expected to close in December. Total sales are approximately $300 million, and the transaction is expected to be 2-3 cents per share accretive to earnings in fiscal 2018.

Hormel responded very favorably to the earnings news. The stock gapped up the day before the earnings report and then pulled back only to gap up even higher. HRL is now a 4.7% winner on the year for us. Sure, that’s not great for this market, but remember that at one point, HRL was a 14% loser for the year. Thanks to the recent rally, I’m raising my Buy Below on Hormel Foods to $39 per share.

Update on Cerner and Express Scripts

I also wanted to update you on two fast-moving stories. I’ll say up front that we don’t know all the details just yet. Let’s start with Cerner (CERN). Shares of CERN got a big lift last Wednesday on the news of a potential partnership with Amazon (AMZN). The Bezos Behemoth is so big that any hint of news can move a stock.

We don’t know much about their partnership, but it appears that Amazon Web Services will be involved with Cerner’s HealtheIntent. This is a product that helps analysts predict outcomes within a certain population. I think of it as the marriage of Big Data and healthcare. We’ll get more details soon.

The other news comes from Express Scripts (ESRX). The stock has rebounded some in recent weeks as the company appears to be readying itself for a buyout. I don’t know if they’re talking with anyone (Amazon?), but they’re certainly acting like they’re on the market. Express has been selling off different units and subsidiaries that would probably be sold in any merger.

With CVS hitching up with Aetna, the writing’s on the wall for this industry: make a move, and do it soon. On top of that, Express is still reeling from the loss of Anthem. I wish I had more news at the moment, but we simply don’t know. It appears that something is going to happen, at some point.

Before I go, I want to raise our Buy Below prices on three of our stocks (in addition to Hormel). This week, I’m raising the Buy Below on Signature Bank (SBNY) to $150 per share. I’m also raising Ross Stores (ROST) to $81 per share. Finally, I’m raising Snap-on (SNA) to $181 per share.

That’s all for now. There are some key economic reports next week. On Monday, the factory-orders report comes out. On Wednesday, we’ll get a look at the ADP payroll report. That’s often a preview for the official jobs report. Speaking of which, the November jobs report will come out on Friday morning. The report for October showed an increase of 261,000. The unemployment rate fell to 4.1%, which is a 17-year low. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: December 1, 2017

Posted by Eddy Elfenbein on December 1st, 2017 at 7:03 amAll You Need to Know About Bitcoin’s Rise, From $0.01 to $11,000

OPEC’s Easy Win Masks Tougher Oil-Market Choices Still to Come

The Repeal Of Net Neutrality Is A Bad Thing (But Not For The Reasons You Think)

Mick Mulvaney is Now One of the Most Powerful Bureaucrats in the Country

Trump Says G.O.P. Tax Bill Wouldn’t Benefit Him. That’s Not True.

Score One for Corn: In Battle Over Biofuel, a Rare Setback for Big Oil

Tesla Just Switched On the World’s Biggest Lithium-Ion Battery in Australia

CVS Nears Deal to Acquire Health Insurer Aetna

GM Wants to Bring an Uber-Like Self-Driving Car Service to Big Cities in 2019. Will It Work?

Why Barnes & Noble Wants Smaller Stores

Tencent Music, Spotify in Talks to Swap Stakes Ahead of Planned Listings

Too Cold for a Theme Park, Disney Looks to Toy Stores in Russia

The Unlikely Strategy Behind Buffett’s Investments in Encyclopedias

Ben Carlson: The Curse of the Young Millionaire

Mark Hines: Is It Time To Be Contrarian?

Be sure to follow me on Twitter.

-

Me on the Bespokecast

Posted by Eddy Elfenbein on November 30th, 2017 at 5:20 pmGeorge Parkes was nice enough to invite me on the latest Bespokecast.

-

Barron’s: “Does Express Scripts Clean Up Nicely?”

Posted by Eddy Elfenbein on November 30th, 2017 at 12:31 pmFrom Barron’s:

Shares of pharmacy benefit manager Express Scripts (ESRX) are up about 4% since last week, as the company reiterated its desire to adapt to healthcare industry upheavals.

On CNBC this morning, the PBM’s chief executive Tim Wentworth said he’d be happy to partner with a health insurer or with Amazon.com (AMZN), if that e-commerce giant jumped into the pharmacy business.

(…)

On Monday, Express Scripts announced a move that will get it out from under one of the clouds hanging over its business practices. It agreed to sell its United BioSource business to the New York private equity firm Avista Capital Partners, for an undisclosed sum. Drug makers hire United BioSource to facilitate prescriptions for high-priced drugs — an activity that appeared to conflict with Express Scripts’ cost-containment mission. United BioSource was named in a price-fixing class action suit last month, as well as a whistleblower suit that alleged it helped defraud government health plans (“Two Lawsuits Hit Express Scripts Unit on Pricing,” November 15, 2017). Express Scripts and its co-defendants denied the allegations in both suits. Concerns about United BioSource’s activities were first reported in Barron’s (“Express Scripts Unit’s Connection to High Priced Specialty Drugs,” November 21, 2015).

-

Morning News: November 30, 2017

Posted by Eddy Elfenbein on November 30th, 2017 at 7:04 amOPEC Signals Oil Supply Cuts Will Be Extended Until End of 2018

Europe’s Bond Investors Are Cruising for a Bruising

U.S. Joins Europe in Fighting China’s Future in W.T.O.

Agreeing to Misconduct Probe, Australian Banks Seek to Cut Risk

Fed Reports Economic Gains, Strengthening Price Pressures

FCC Chairman Pai Defends His Attack on Net Neutrality by Substituting Ideology for History

Bitcoin’s Price Swings Have Been Especially Crazy in the Last 24 Hours. Here’s Why

This Is What Could Pop the Bitcoin Bubble

Uber Lawyer Says Ex-Employee’s Payout Was an ‘Extortionist’ Move; Judge Disagrees

AT&T-Time Warner Will Close; Time Warner Is Valuable Regardless

Amazon Trumpets Its Cloud Lead With N.F.L. and Other Deals

Sears Comp Sales Continue to Fall In Line with Forecast

Josh Brown: Tales From The Crypt

Cullen Roche: How Will the Bitcoin Mania End?

Be sure to follow me on Twitter.

-

Good Day for Us

Posted by Eddy Elfenbein on November 29th, 2017 at 4:31 pmToday was a good day for our Buy List. Our Buy List gained 0.71% while the S&P 500 lost 0.04%.

Of course, we get bad days as well, and I like to take each day with a grain of salt. Around here, we’re always focused on the long run.

Still, we’re human and it’s nice to see us do well. In fact, we’ve been in a bit of a hot streak lately. We’ve outperformed the S&P 500 10 times in the last 13 days. All three underperforming days were quite modest.

For the year, we’re now up 19.40% compared with 17.30% for the S&P 500 (not including dividends).

Here’s how each of our 25 stocks did today. You’ll notice that several really creamed the market.

Symbol Gain/Loss ROST 4.31% HRL 4.05% ADS 3.37% AXTA 3.33% SBNY 3.25% WAB 2.86% SJM 2.38% ESRX 2.31% CNK 2.24% SNA 1.92% AFL 1.07% RPM 0.74% ICE 0.65% INGR 0.49% FISV 0.24% BCR 0.11% CERN 0.03% CBPX -0.18% DHR -0.40% MCO -0.69% SHW -0.90% CTSH -1.04% SYK -1.08% MSFT -1.81% HEI -3.16% What made today’s trading interesting was the wide divergence between sectors. For example, the S&P 500 Financials were up 1.77% today while the S&P 500 Techs were down -2.56%.

The Dow Jones Transports gained 3.30% today to close over 10,000 while the Nasdaq lost -1.27%. The Nasdaq 100 lost -1.73%. We haven’t seen that kind of divergence in awhile.

The small-cap Russell 2000 rose 0.38% while the mega-cap S&P 100 fell -0.03%.

The S&P 500 Value Index rose 0.86% and the S&P 500 Growth Index fell -0.73%.

Express Scripts and Axalta News

Posted by Eddy Elfenbein on November 29th, 2017 at 10:12 amFrom Forbes:

Humana has been cutting costs, employees and selling non-core assets as rivals in the health and drug benefit management business clean up their balance sheets for possible sale. Others shedding non-core assets include Aetna, which announced plans to sell its group life insurance business and Express Scripts, which this week said it would sell a pharmaceutical support services business to a private equity firm.

(…)

Meanwhile, other healthcare concerns are taking steps to be more nimble should the buyout wave continue. Express Scripts on Monday said it has signed a deal to sell its pharmaceutical support business, United BioSource Corporation, to private equity firm Avista Capital Partners for an undisclosed amount.

Express Scripts and its standalone business model are under pressure as rivals form closer ties with health insurers. UnitedHealth Group has its OptumRx PBM under the larger insurer’s umbrella and, of course, there’s the rumored Aetna sale to CVS Health, which operates the large Caremark PBM.

From Benzinga, an analyst says Axalta could fetch $40 to $45 per share.

KeyBanc Capital Markets analyst Michael Sison discussed the M&A possibilities in a Monday note, reiterated his Overweight rating on shares of Axalta and upped his price target from $36 to $40.

The analyst attributed the price target revision to the takeover potential following Nippon Paint’s interest in Axalta.

The Thesis

The price range needed to clinch a deal would be 13-15 times P/EBITDA or $40-$45, Sison said.

Antitrust isn’t likely to a big issue in the combination of the No. 4 and No. 5 companies in the industry, the analyst said.

The analyst estimates about 12 percent year-over-year EBITDA growth for Axalta in 2018, with 40 percent coming from organic initiatives and a lack of hurricane and customer issues at Refinish.

“We believe pricing will catch up to offset higher raw materials costs experienced in 2017.”

Following 2017’s negative pricing and flattish organic growth performance, Sison said he expects the transportation coating business to rebound in 2018. Axalta’s top-line is projected to grow in the mid-single digits and EBITDA is expected to grow near double-digits as further cost savings initiatives help margins expand by 110 basis points, Sison said.

For the performance coatings segment, KeyBanc sees mid-teens growth in EBITDA, thanks to acquisitions and a more normalized refinish product mix. A 110 basis-point improvement in EBITDA margins is also expected, Sison said.

The Price Action

After Axalta confirmed it’s in discussions with Nippon Paint for over $8.25 billion following the breakdown of its merger talks with Akzo Nobel, the shares of the company rallied about 5 percent Nov. 22.

The shares are up about 31 percent year-to-date.

Q3 GDP Revised up to 3.3%

Posted by Eddy Elfenbein on November 29th, 2017 at 10:06 amThis morning, the government revised its estimate for Q3 GDP up to 3.3% from the initial estimate of 3.0%. Q2 grew by 3.1% so we’ve now had back-to-back quarters of more than 3% growth.

Can we make it three in a row? Maybe. The Atlanta Fed’s forecast for Q4 is now at 3.4%. We won’t see the government’s first report on Q4 until late January.

Morning News: November 29, 2017

Posted by Eddy Elfenbein on November 29th, 2017 at 7:00 amECB Says Low Interest Rates Aid Debt Resilience But Risks Remain

Bitcoin Futures Draw Push Back, Not Stop Light From Market Cops

The Internet is Dying. Repealing Net Neutrality Hastens That Death.

Robots Are Coming for Jobs of as Many as 800 Million Worldwide

Trump Starts Probe Into Aluminum That China Calls Protectionist

Trump’s Tax Promises Undercut by CEO Plans to Reward Investors

Jerome Powell Shows Mastery of Central Bank Arts

AT&T Responds to Justice Department Lawsuit

Rebuking Uber Lawyers, Judge Delays Trade Secrets Trial

Uber’s Q3 Loss Widens as SoftBank Makes First Offer on Shares

What We Learned From Retailers’ Five-Day Scramble for Shoppers

Daimler Rebuffs Geely Offer to Buy Stake; Geely Still Hopeful of a Deal

Michael Batnick: This Is Not Normal

Jeff Carter: Can You Short Bitcoin?

Howard Lindzon: Who Do You Trust?… and Live Light and Mobile

Be sure to follow me on Twitter.

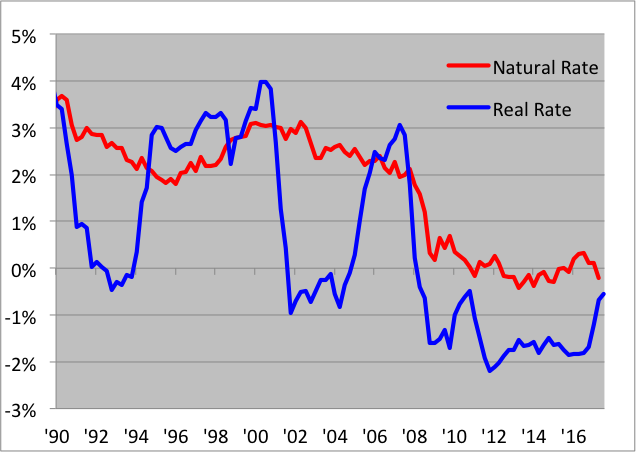

The Decline in the Natural Interest Rate

Posted by Eddy Elfenbein on November 28th, 2017 at 1:10 pmI’ve written before about the natural interest rate. This is the idea that there’s a magic real interest rate that hangs over the entire globe. When the Fed goes below it, it’s pumping up the economy. When it goes above, it’s pulling the economy back.

The problem is that we never know exactly where the natural rate is. There are, however, some clues. Although we can’t see it, we can see its effects.

Mind you, there are plenty of economists who think all this is for the birds. But John Williams, top dog at the San Francisco Fed, takes it very seriously. He believes that since the recession, the natural rate has plunged, and I’m inclined to agree.

Williams and Thomas Laubach have teamed up to — what else do economists do — make a model of natural rates. Here’s a link to their paper on the subject. Here’s a spreadsheet of their data.

Remember that the natural rate is a real interest rate, meaning adjusted for inflation. I took the data from Williams and Laubach and added the real Fed fund rate. I based mine on core inflation which I think shows the trends better, though I understand some may disagree.

Notice how sharply the red line has plunged since 2008. If that’s right, that means the Fed hasn’t been pushing the economy as hard as you might think. The chart also shows just how aggressive Alan Greenspan was in the period after 9/11. He took the blue line well below the red line. Finally, you can see that the Fed is close to being neutral (meaning, red and blue are the same).

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His