-

Morning News: October 31, 2017

Posted by Eddy Elfenbein on October 31st, 2017 at 7:02 amIs The UK About To Have Its First Rate Rise In A Decade?

Japan Central Bank Keeps Policy Intact, Cuts Price Outlook

Trump Is Expected to Name Jerome Powell as Next Fed Chairman

Xi Jinping Tells Apple and Facebook CEOs His Plans for Reforming China

Homebuilders’ Record Deal Belies Industry’s Anxiety About Taxes

Amazon.com’s Advertising Business Just Had Its Best Quarter Ever

FCC Clears CenturyLink-Level 3 Combination

CVS-Aetna Deal Could Have Same Result as Telecom Mergers — Higher Prices

Burberry’s Christopher Bailey to Leave Before 2019

This Is the Tunnel Elon Musk Is Building Under Los Angeles

Roger Nusbaum: Get Ready For #MACtion

Michael Batnick: 10 Questions I’m Pondering At The Moment

Joshua Brown: QOTD: Vanguard in Defense of 401(k)s

Be sure to follow me on Twitter.

-

The Growing Gap On Wall Street

Posted by Eddy Elfenbein on October 30th, 2017 at 4:32 pmThere’s been a growing gap on Wall Street lately between the winners and losers. The market has been driven by a very small number of stocks doing very, very well. Everybody else is just bouncing along. This phenomenon was especially acute on Friday, but we saw it again today.

By my count, 311 stocks in the S&P 500 underperformed the index today. On Friday, more than 71% of the stocks in the index couldn’t keep up.

Check out this chart between the S&P 500 (gold line) and the S&P 500 equal weighted index (black line):

The wider the gap, the greater the dispersion. In other words, a rising tide is not lifting all boats.

-

WSJ: “Akzo Nobel, Axalta Confirm Merger Talks”

Posted by Eddy Elfenbein on October 30th, 2017 at 1:37 pmThey’re really talking. Again, this doesn’t guarantee a deal will come. But they are serious.

Akzo Nobel, Axalta Confirm Merger Talks

Akzo Nobel NV and U.S. rival Axalta Coating Systems Ltd. AXTA said Monday they are in talks to join forces in a merger of equals that would create a multibillion-dollar coating and paints giant.

The deal would involve the Dutch paint company first proceeding with its existing plan to spin off its specialty chemicals business and distribute the bulk of the proceeds to shareholders. Akzo said that plan, which is unaffected by the Axalta talks, remains on track for April 2018.

The announcement of a potential merger of equals of Akzo’s paints and coatings business with Axalta’s operations confirms a Wall Street Journal article on the possible deal structure.

The combined company would have added scale to generate better pricing for raw materials, eliminate overlapping operations and gain new customers to help revive profit growth. Coatings are used to prevent corrosion and improve durability across sectors including the automotive, electronics, mining and marine industries.

Axalta cautioned that the talks might not lead to completion of a deal.

A merger of equals typically involves companies with a similar market value. The deals are structured through a share swap and shareholders of the companies don’t receive any significant premium for their stock. This type of structure would be crucial for Akzo’s attempt to win support from its shareholders, some of whom have been concerned that the Amsterdam-based company could seek a large acquisition, potentially paying a significant premium, to protect itself against an unwanted suitor.

Earlier this year, Elliott Management Corp., a well-known activist investor and one of Akzo’s biggest shareholders, mounted a public-relations and legal campaign to force Akzo into unwanted sale talks with its U.S. paints rival PPG Industries Inc. The $28 billion takeover attempt ultimately failed. In August, Elliott and Akzo reached a truce over the Dutch company’s alternative plan to separate its specialty-chemicals business and distribute the proceeds to shareholders to generate value for investors.

An Elliott spokeswoman declined to comment on Monday.

Currently, Akzo has a market value of about $22.6 billion, compared with Axalta’s value of about $8.1 billion. That gulf in valuation precludes a merger of equals and would instead require Akzo paying a takeover premium to acquire Axalta. By selling or spinning off the specialty chemicals business first as a condition to a deal with Axalta, Akzo’s market value would likely fall more closely in line with its Philadelphia-based rival. Some analysts estimate the specialty-chemicals business could be valued at as much as $10 billion, which would no longer be reflected in Akzo’s market capitalization after the spinoff.

Even with the spinoff of the specialty-chemicals business, Akzo could face difficulty getting its shareholders to support an Axalta deal because the merger would make it more expensive than it otherwise would be for a potential suitor.

On Friday, Swiss chemicals company Clariant AG and U.S.-based Huntsman Corp. ended their proposed $15 billion merger after Clariant’s largest shareholder, activist investor White Tale Holdings, opposed the deal. That led some analysts to speculate that Clariant is now a prime takeover target in the consolidating chemicals sector.

That said, talks of a possible merger between Akzo and Axalta might appeal to shareholders as the companies seek ways to boost slumping profits, allowing a combined company to cut costs and potentially broaden its customer base.

For the third quarter, Akzo reported a 13% drop in adjusted operating profit, hurt in part by higher raw-material costs and sluggish demand from the marine industry. Axalta’s adjusted net income fell 20% over the same period amid lower volumes in North America and higher raw-material costs.

-

Consumer Spending Biggest Jump Since 2009

Posted by Eddy Elfenbein on October 30th, 2017 at 11:45 amToday we got the personal income and spending reports for September. These reports usually come the business day after the GDP report. This is a key report since consumer spending represents about two-thirds of the U.S. economy.

The report said that consumer spending rose 1% last month. That was the biggest monthly increase since August 2009. Personal income rose by 0.4%.

This report also includes an inflation report. The core version of this report, the core PCE, is the Fed’s favorite inflation measure. It’s risen by 0.1% for the last five months in a row.

-

Morning News: October 30, 2017

Posted by Eddy Elfenbein on October 30th, 2017 at 7:04 amA Missing Piece of the Global Growth Jigsaw Starts to Fall Into Place

Party’s Over? Chinese Markets Battered After Bout of Artificial Calm

France, Land of Croissants, Finds Butter Vanishing From Shelves

Russia Uses Its Oil Giant, Rosneft, as a Foreign Policy Tool

Bitcoin Just Reached Another New All-Time High

The Biggest Stock Collapse in World History Has No End in Sight

In Choice of Fed Chairman, Trump Downgrades Deregulation

U.S. Regulator Wants to Loosen Leash on Wells Fargo

Akzo Rebuffed PPG’s Advance—Now It Wants to Take Over Axalta

Strayer Education, Capella Education Near Merger Deal

HSBC’s Asia Push Bearing Fruit for Gulliver Before Hand-Off

Kobe Steel Seeks Loan, Shareholder Offers Support After Data Scandal

Jeff Miller: Fed Chair, Tax Proposal, Data Avalanche, Earnings – A Pundit’s Paradise

Cullen Roche: Vegas Presentation – The State of the Markets

Be sure to follow me on Twitter.

-

WSJ on Axalta/Akzo Nobel

Posted by Eddy Elfenbein on October 28th, 2017 at 2:22 pmFrom the WSJ:

Akzo Nobel NV and U.S. rival Axalta Coating Systems Ltd. are considering a possible merger of equals that would create a multibillion-dollar coating and paints giant, according to a person familiar with the matter.

The possible deal under consideration would involve the Dutch paint company first proceeding with its existing plans to spin off its speciality chemicals business and distributing proceeds to shareholders, the person said.

While preliminary talks about a possible deal have previously been reported, it wasn’t clear that they centered on structuring the deal as a merger of equals.

The combined company would have added scale to generate better pricing for raw materials, eliminate overlapping operations and gain new customers to help revive profit growth. Coatings are used to prevent corrosion and improve durability across a range of sectors such as the automotive, electronics, mining and marine industries.

The talks are at an early stage and could collapse before a deal is reached, according to the person familiar with the matter.

A merger of equals typically involves companies with a similar market value. The deals are structured through a share swap and shareholders of neither company receive any significant premium for their stock. This type of structure would be crucial in an attempt by Akzo to win support from its shareholders, some of whom have been concerned that the Amsterdam-based company could seek a major acquisition, potentially paying a big premium, to protect itself against an unwanted suitor.

Earlier this year, Elliott Management Corp., the well-known activist investor and one of Akzo’s biggest shareholders, mounted a bold public-relations and legal campaign to force Akzo into unwanted sale talks with its U.S. paints rival PPG Industries Inc. The $28 billion takeover attempt ultimately failed. In August, Elliott and Akzo reached a truce over the Dutch company’s alternative plan to separate its specialty-chemicals business and distribute the proceeds to shareholders to generate value for investors.

Currently, Akzo has market value of about $22.6 billion, compared with Axalta’s value of about $8.1 billion. That gulf in valuation precludes a merger of equals and would instead require Akzo paying a takeover premium to acquire Axalta. By selling or spinning off the specialty chemicals business first as a condition to a deal with Axalta, Akzo’s market value would likely fall more closely in line with its Philadelphia-based rival. Some analysts estimate the specialty chemicals business could be worth up to $10 billion, which would no longer be reflected in Akzo’s market capitalization after the spinoff.

Akzo has stressed that its plan to spin off the chemicals business and distribute the proceeds to shareholders remains on track.

Even with the spinoff of the specialty chemicals business, Akzo could face difficulty getting its shareholders to support an Axalta deal because the merger would make it more expensive than it otherwise would be for a potential suitor.

On Friday, Swiss chemicals company Clariant AG and U.S.-based Huntsman Corp. ended their proposed $15 billion merger after Clariant’s largest shareholder, activist investor White Tale Holdings opposed the deal. That led some analysts to speculate that Clariant is now a prime takeover target in the consolidating chemicals sector.

That said, talks of a possible merger between Akzo and Axalta may appeal to shareholders as the companies seek ways to boost slumping profits, allowing it to cut costs and potentially broaden its customer base.

For the third quarter, Akzo reported a 13% drop in adjusted operating profit, hurt in part by higher raw material costs and sluggish demand from the marine industry. Axalta’s adjusted net income fell 20% over the same period amid lower volumes in North America and higher raw material costs.

-

Axalta Soars 17% in Crazy Day

Posted by Eddy Elfenbein on October 27th, 2017 at 7:07 pmToday was a very unusual and highly dramatic day for the stock market. The S&P 500 gained 0.81% to close at an all-time high of 2,581.07. However, a very large portion of those gains were driven by a very small group of stocks.

Consider that the median stock in the S&P 500 gained just 0.10%. Less than 30% of the stocks in the index outperformed the index today. The Dow only gained 0.14%. That’s an unusually wide spread between the two indexes.

The equally-weighted ETF rose just 0.16% today.

The big winners were largely focused on mega-cap tech stocks.

Amazon gained 13.2%.

Microsoft gained 6.4%.

Facebook gained 4.2%.

Apple gained 3.6%.

Google gained 4.8%.

Intel rose 7.4%.The S&P 500 Tech Sector ETF rose 2.69%, while nine of the other ten sectors lagged the market. The S&P 500 Value Index lost 0.13% while the tech-heavy S&P 500 Growth gained 1.55%.

The S&P 100 gained 1.12% and the Nasdaq Composite rose 2.20%.

Amazon added $61 billion in market value. That’s more than the market value of 400 stocks in the S&P 500. Jeff Bezos is now the richest man in the world with a fortune of $90 billion. He made close to $7 billion today.

Now let’s look at our Buy List today. The good news is that we gained 1.04% and beat the overall market, but 17 of our 25 stocks lost to the S&P 500 today.

The bad news was Cerner, which we knew was going to happen. CERN dropped 8.4% on the day. At one point, it was down nearly 12%.

Fortunately, we have one of the big tech stocks in the form of Microsoft. Thanks to the good earnings report, the software giant jumped 6.4% today. At one point, MSFT was up over 9.4%.

The strong report from Stryker helped that stock jump 7.4% today.

Express Scripts rose 5.5% on the news that CVS is bidding to buy Aetna for $66 billion. Maybe someone will bid for them.

That brings us to the biggest news of the day. Akzo Nobel, a Dutch company, said that it has approached Axalta about a merger offer.

Let me be clear that there’s no deal. They’re just talking.

Shares of AXTA exploded higher.

In March, PPG tried to buy Akzo but the company said no. At the time, I thought PPG might then go after Axalta. Now we know it was Akzo that was interested.

During the day Axalta soared as much as 21% before closing up 17% on the day.

What a crazy day!

-

Akzo Nobel approaches Axalta about possible merger

Posted by Eddy Elfenbein on October 27th, 2017 at 12:50 pmFrom Reuters:

Dutch paints and coatings giant Akzo Nobel NV has approached U.S. rival Axalta Coating Systems Ltd to talk about a possible merger that would create a global coatings group, according to sources familiar with the matter.

Axalta is in the early stages of considering a deal and there is no certainty that the two companies will agree to a merger, one of the sources said on Friday.

Neither company immediately responded to requests for comment.

Axalta is up 21% today.

-

First Estimate of Q3 GDP = +3.0%

Posted by Eddy Elfenbein on October 27th, 2017 at 10:25 amThis morning, we got the government’s first estimate of Q3 GDP growth, and it was 3.0%. That’s an annualized figure and it’s adjusted for inflation.

Three percent is a good number, and Q2 was 3.1%. Still, I’m far from convinced that we’ve broken from our 2% trend in this recovery. In expansions, the economy has normally grown at 4% or more. Everything seems to have changed with the turn of the new millennium.

With this recovery, we seem to have a very hard time stringing together three or four quarters in a row of above-trend growth.

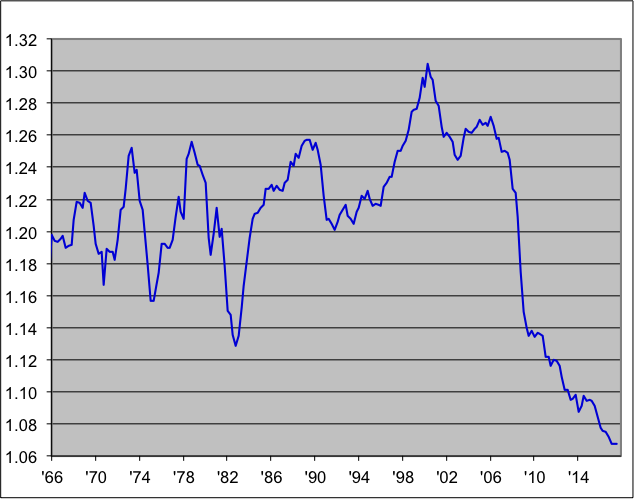

Here’s an unusual chart but I think it makes an important point. This is real GDP divided by a 3% trend line. In other words, if the line is rising, then the economy is growing by more than 3%. If it’s falling, it’s growing by less than 3%. (Don’t worry about the y-axis numbers.)

What this shows is that starting in 2007, the entire trend of GDP changed. We used to expect 3% growth. Now that’s closer to 2%.

-

CWS Market Review – October 27, 2017

Posted by Eddy Elfenbein on October 27th, 2017 at 7:08 am“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” – Peter Lynch

We’re now at the high tide of earnings season, and it’s been a good one for us. So far, we’ve had 13 Buy List earnings reports, and 12 have beaten Wall Street’s estimates.

This week, we had nine earnings reports. I’ll summarize them all in this week’s newsletter. I’ll also preview five more earnings reports coming next week. There’s a lot to get to, so let’s dive right in.

Sherwin-Williams Beat and Raised Guidance

Let’s start with Tuesday. We had two earnings reports on Tuesday morning. The earnings report from Sherwin-Williams (SHW) is a bit confusing, so I’ll try to clear it up. For Q3, the company earned $3.33 per share, but that figure includes $1.42 per share in acquisition costs. That means Sherwin made $4.75 per share from continuing operations, which beat Wall Street’s estimate of $4.67 per share. Sherwin’s EBITDA from continuing ops is up 9.6% this year to $1.70 billion.

Sherwin previously said to expect adjusted earnings between $4.80 and $5.20 per share. However, the company estimates that the hurricanes dinged last quarter’s sales by $50 million and EPS by 27 cents per share. Considering all that, this was a decent quarter.

Now for guidance. SHW sees Q4 ranging between $1.97 and $2.27 per share. Adding back 98 cents in acquisition costs, that comes to $2.95 to $3.25 per share.

For all of 2017, Sherwin expects earnings between $11.20 and $11.50 per share. Adding in costs, the range is $14.85 to $15.15 per share. That’s an increase of five cents per share at both ends from their previous guidance. Overall, this was a good quarter for Sherwin. The stock broke out to a new high on Thursday. This week, I’m raising my Buy Below on Sherwin-Williams to $417 per share.

For Q3, Wabtec (WAB) earned 88 cents per share. That beat Wall Street’s estimate of 84 cents per share. I said before that I wanted to see signs of improvement here, and it looks like we got them. Some stats:

Cash from operations was $40 million for the third quarter. For the first nine months of 2017, cash from operations decreased compared to the same period of 2016, mainly due to an increase in working capital.

At Sept. 30, the company had cash of $228 million and debt of $1.9 billion. Total debt was 6 percent lower than at the end of the second quarter.

Wabtec’s multi-year backlog rose 2% to a record $4.5 billion. Their 12-month backlog is up 5% to $2.2 billion, also a record.

Wabtec now expects full-year revenue of $3.8 billion and EPS between $3.45 and $3.50 per share. That’s a reduction from their previous guidance of $3.55 to $3.70 per share, but I believe the newer figure includes a charge of 18 cents per share.

Shares of WAB gapped up to $82 on Tuesday, but they pulled back to $76 later this week. I’m relieved by this report. The stock remains a buy up to $81 per share.

In last week’s issue, I said that Express Scripts (ESRX) was due to report on Wednesday. I got that wrong. Express Scripts reported after the close on Tuesday. My apologies for the error.

Obviously, the big issue with Express is the loss of Anthem as a client. Still, things are going well for Express. The pharmacy-benefits manager reported Q3 earnings of $1.90 per share which was three cents better than estimates.

Express also nudged up its 2017 range from $6.95 – $7.05 per share to $6.97 – $7.05 per share. The midpoint represents 10% growth over last year. For Q4, Express expects $2.03 to $2.11 per share. Express Scripts is doing well. I still like the stock but there are a lot of challenges ahead of them.

AFLAC Raised Its Dividend for the 35th Year in a Row

On Wednesday, AFLAC (AFL) beat earnings, raised guidance and increased its dividend for the 35th year in a row. Then on Thursday, the stock touched a new all-time high. Not bad.

The duck stock reported Q3 operating earnings of $1.70 per share. (Remember, with insurance stocks, we always want to look at operating earnings instead of net.) That number includes an after-tax benefit of four cents per share. Also, the yen/dollar exchange rate knocked off seven cents per share last quarter.

AFLAC raised its quarterly dividend by two cents to 45 cents per share. This is the 35th year in a row in which AFL has raised its dividend. Going by Thursday’s close, the new dividend yields 2.15%. AFLAC also raised full-year guidance to $6.75 to $6.95 per share. That’s a big increase over the previous range of $6.40 to $6.65 per share. Those numbers don’t include the impact of the yen.

The CEO said that if the yen averages between 110 and 115 to the dollar, then they expect Q4 earnings between $1.42 and $1.66 per share. On Thursday, AFL got to a new all-time high of $85.70 per share. For now, I’m keeping our Buy Below at $86 per share.

We had five more reports on Thursday. First up was Axalta Coating Systems (AXTA). The company earned 26 cents per share for Q3. That’s down from 33 cents per share last year, but it beat estimates by two cents per share. If you recall, a few weeks ago, the company pared back its Q3 guidance due to the hurricanes. To be fair, that’s not a reflection of Axalta’s business execution.

Axalta provided guidance on several metrics except EPS. For 2017, they see net sales growth of 6% to 7%, adjusted EBITDA of $870 million to $900 million and diluted shares outstanding of 246 million. Despite the difficulties Axalta faced, these are good numbers. I’m keeping our Buy Below price at $33 per share.

We got our first earnings miss this season, and it was from Cerner (CERN). The company earned 61 cents per share instead of the 62 cents expected by Wall Street. If a miss had to come from somebody, I guess it can be from our #1 stock this year.

So what happened? Cerner blamed it on several large contracts that were expected to be signed in Q3 but were pushed to Q4. I’m not at all worried about a miss of one penny. I’m writing this to you before the market opens on Friday, but shares of CERN got hit by 7% in Thursday’s after-hours market. Of course, that’s traders being traders. Don’t let the selling rattle you. Cerner is doing just fine.

For Q4, the company expects revenue between $1.3 billion and $1.35 billion and EPS between 60 and 62 cents. They also provided some preliminary numbers for 2018. Cerner sees 2018 sales between $5.5 and $5.7 billion. The midpoint is a 9% increase over this year. For EPS, Cerner sees $2.52 to $2.68. That midpoint would be an increase of 7% over this year. Wall Street had been expecting $2.78 per share.

Expect to see a short-term hit, but remember that Cerner has been a big winner for us this year. I still like this company a lot.

Microsoft Crushes Earnings Again

After the closing bell on Thursday, Microsoft (MSFT) reported fiscal Q1 earnings of 84 cents per share. That easily beat Wall Street’s estimate of 72 cents per share. This was a very good report; Mr. Nadella and his team continue to deliver outstanding results.

Let’s dig a little deeper. Total revenue came in at $24.5 billion, nearly $1 billion more than expected. Revenue from Microsoft’s intelligent cloud business rose 14% to $6.92 billion. The Street had been expecting $6.70 billion. Revenue from Azure rose 90%. Gross margins at Microsoft’s cloud business are running at 57%. That’s very good.

Two years ago, Nadella set a goal for the company of $20 billion in cloud revenue by 2018. They’re very close to hitting that now. At the time Nadella set the goal, Microsoft was doing a little over $6 billion in cloud revenue. This week, I’m raising our Buy Below on Microsoft to $85 per share.

Also on Thursday, Stryker (SYK) reported Q3 earnings of $1.52 per share, two cents better than estimates. That’s an increase of 9.4% over last year. For Q4, they expect $1.92 to $1.97 per share. Wall Street has been expecting $1.93 per share. Stryker sees full-year earnings in the range of $6.45 to $6.50 per share. Forex costs will be about 10 cents per share for the year. SYK was up nicely in Thursday’s after-hours trading.

Lastly, we also got an earnings report from CR Bard (BCR). I wasn’t sure if they were planning on reporting this season because the merger with BDX should happen soon.

This was another good report for Bard. For Q3, BCR earned $3.02 per share which was seven cents more than expectations. This is Bard’s last earnings report as an independent company. The company also raised its full-year range to $11.86 to $11.90 per share. That’s an increase of 15 cents to the low end.

Thanks to the rally in BDX, the buyout price for BCR is up to $329.47 per share (based on Thursday’s closing price). The original buyout price in April was $317.

Six Buy List Earnings Reports Next Week

On Tuesday, Halloween, Fiserv (FISV) is set to report. The company missed earnings last time, which is very rare for them. Their full-year 2017 guidance is still $5.03 to $5.17 per share, which is an increase of 14% to 17% over last year. Wall Street is looking for $1.31 per share for Q3.

On Wednesday, Cognizant Technology Solutions (CTSH) and Ingredion (INGR) are scheduled to report. This summer, Cognizant raised its guidance. For Q3, they see earnings of at least 94 cents per share, and full-year earnings of at least $3.67 per share. They should be able to reach both. The stock is up 33% YTD.

Last month, Ingredion gave us a 20% dividend increase. The company sees full-year earnings of $7.50 to $7.80 per share. Wall Street expects $2.02 per share for Q3. They should beat that.

Shares of Intercontinental Exchange (ICE) have drifted lower recently. This may come to an end on Thursday when ICE reports earnings. In their last report, ICE missed by a penny, but it was their 17th-straight quarter of revenue growth. The consensus on Wall Street is for Q3 earnings of 70 cents per share.

I’m also going to mention Becton, Dickinson (BDX) which reports on Thursday. This will be for the fourth quarter of their fiscal year. Three months ago, BDX said they expect quarterly earnings of $2.33 to $2.38 per share.

Full-year earnings should be between $9.42 and $9.47 per share. Not including currency, that would be $9.70 to $9.80 per share.

On Friday, Cinemark (CNK) and Moody’s (MCO) will report earnings. In August, one of Cinemark’s competitors bombed its earnings report, so traders feared the same for CNK. Instead, Cinemark missed by just a penny per share. I’ll note that concession revenue per person, which is the real moneymaker, rose by 8.9%. There have been a lot of stories about low sales at the box office for Hollywood. Wall Street expects 35 cents per share.

In July, Moody’s reported very good earnings, plus they raised guidance. For Q2, the ratings company earned $1.51 per share which was a 16% increase over last year. That beat expectations by 17 cents per share. Quarterly revenues were up 8% to $1 billion, and operating income rose 12% to $457.5 million.

More importantly, Moody’s raised its full-year guidance range to $5.35 to $5.50 per share. The previous range was $5.15 to $5.30 per share. The consensus is for Q3 earnings of $1.37 per share.

That’s all for now. I’m going to be on the road next week. I hope to get the newsletter out at the regular time, but it may be delayed a day or two. I can’t say yet. Next week we will have more earnings news. There will also be a Fed meeting on Tuesday and Wednesday. Don’t expect any movement on interest rates. At least, not yet. Also, the big jobs report will be out next Friday. The unemployment rate is currently at a 16-year low. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His