-

Morning News: October 24, 2017

Posted by Eddy Elfenbein on October 24th, 2017 at 6:59 amCutting Taxes Is Hard. Trump Is Making It Harder.

Taylor’s Walk on Supply Side May Leave Him More Dove Than Yellen

Treasury Faults Arbitration Rule Aimed at Protecting Consumers

In Washington Clash of Industries, King Corn Trounces Big Oil

Hundreds of Thousands of Snap Spectacles Are Reportedly Sitting in Warehouses Unsold

General Electric: The Time Is Now

Amazon Rivals Turn to Legal Fine Print to Stem Whole Foods Strategy

Tesla Is Setting Itself Up to Be the Apple of China’s Electric Car Market

Saudi Billionaire Prince Alwaleed Predicts Bitcoin Will ‘Implode’ Like Enron

Nike’s $50 Billion Bluster Looks Dead Just Two Years Later

Microsoft to Drop Lawsuit After Government Revises Data Request Rules

Courts Reverse Johnson’s Baby Powder Judgments for Nearly $500 Million

Cullen Roche: Is a Taylor Tantrum on the Horizon?

Jeff Carter: Dividing the Equity Pie

Roger Nusbaum: Dow 23,000 Hats For Everyone!

Be sure to follow me on Twitter.

-

Boring Markets Are the Best

Posted by Eddy Elfenbein on October 23rd, 2017 at 9:18 pmI looked at all the daily returns for the S&P 500 since 1957. If you take all the days when the S&P 500 moved more than 1.14% in a day, up or down, the combined return comes out to zero. They completely balance each other out.

The entire return, more than 55-fold over 60 years, comes on the low-volatility days (up or down less than 1.14%).

The high-volatility days happen 16.5% of the time, or roughly one day in six. (I’m just looking at capital gain and not dividends.)

Historically, it’s been to your advantage to stick with a boring, low-vol market.

-

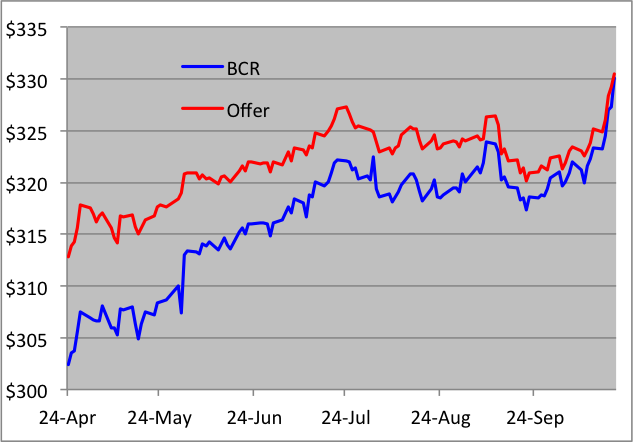

BDX’s Buyout Offer for BCR Is Up to $330

Posted by Eddy Elfenbein on October 23rd, 2017 at 2:26 pmExactly six months ago, Becton, Dickinson (BDX) offered to buy CR Bard (BCR) for $317 per share.

The deal called for BCR shareholders to get $222.93 in cash plus 0.0577 shares of BDX for each share of BCR they owned.

It’s easier for an acquiring company to offer shares to make a purchase. This is especially true if their shares are overpriced. The firm being bought, however, prefers more cash since the shares of a buying firm can go down. You always want some protection from a crash.

With this deal, it was about 70% cash and 30% stock. The $317 offer was a 25.3% premium to BCR’s previous closing price.

Shares of BCR shot up, but not to $317 per share. For one thing, shares of BDX fell a little bit. That’s natural for the stock doing the buying. Also, the market valued BCR slightly below the value of the deal because you never know if the deal will fall though. Things like this have happened before.

Just after the deal was announced, BCR was valued about 3% below BDX’s offer. Over the last six months, that discount has gradually melted away. It now seems certain the deal will happen sometime in Q4. On Friday, the discount was just 0.1%.

The good news for BCR shareholders is that BDX has rallied recently. That means the buyout price is higher. Going by Thursday’s close, the buyout price for Bard is $330.48 per share. This turned out to be a very good deal for us.

Here’s a chart of BCR (blue) along with the deal’s price (red). Note that the blue line is closing the gap even as the red line goes higher.

One minor update on BCR/BDX. The European Commission approved the deal contingent upon Becton divesting its soft tissue core needle biopsy product line. That’s no problem. Here’s the press release.

“We continue to make good progress on the Bard acquisition and the conditional clearance from the European Commission is a positive step forward,” said Vincent A. Forlenza, chairman and CEO of BD. “As expected, we have committed to divesting certain assets associated with our soft tissue core needle biopsy product line, which we acquired with CareFusion, to satisfy the conditions to closing requested by the European Commission. We continue to expect that the BD and Bard transaction will close in the fourth calendar quarter of 2017, subject to customary closing conditions and additional regulatory approvals, including the U.S. Federal Trade Commission and other regulatory bodies.”

-

Snap-on to $190?

Posted by Eddy Elfenbein on October 23rd, 2017 at 1:48 pmSo says Barrington Research via Barron’s:

We are raising our rating on Snap-On to Outperform from Market Perform based on valuation, our belief in a gradual rebound in the Tools Group results in 2018 and the company’s positive long-term outlook driven by secular trends for vehicle repair. Our price target range is $180-$190.

Based on better-than-expected third-quarter results, we raised our 2017 earnings-per-share estimate on Snap-On (ticker: SNA) to $10.09 (from $10.06) and maintained our 2018 EPS estimate at $11.00.

Snap-On’s third-quarter sales of $903.8 million increased 8.4% including an organic sales increase of 2.3% and $44.3 million of acquisition-related sales. EPS for the quarter, excluding a pretax charge of $15 million, totaled $2.45, representing a 10.2% year-over-year increase. Our estimates for the third quarter called for net sales of $867 million and EPS of $2.39. The First Call consensus estimates called for net sales and EPS of $891 million and $2.43, respectively.

Positives in the quarter included strong performances from both the Repair Systems & Information (RS&I) and Commercial & Industrial (C&I) Groups, while the Tools Group continues to exhibit sluggishness due in large part to U.S. franchise operations that registered a mid-single-digit sales decline.

RS&I Group sales of $333.5 million increased 16.6% with an 8.2% organic sales increase, $21.6 million of acquisition-related sales and $2.1 million of favorable exchange rates. Organic sales growth in the quarter was driven by high-single-digit sales gains in diagnostics and repair information products to independent repair shops, mid-single-digit growth in sales to original equipment manufacturer (OEM) dealerships and low-single-digit sales gains in undercar equipment. Operating earnings increased 16.2% to $83.4 million.

C&I Group sales increased 8.7% to $314.6 million reflecting organic growth of 0.2%, $22.7 million of acquisition-related sales and $2 million of favorable exchange rates. C&I experienced high- single-digit sales gains to customers in critical industries with mid-single-digit sales growth in the European hand tools business, offset by declines in power tool sales and Asia-Pacific operations. Operating earnings increased 14.6% to $50.1 million.

Tools Group sales of $392.7 million decreased 1.1% reflecting an organic sales decline of 1.6% driven by a mid-single-digit decline in U.S. franchise operations that was partially offset by a double-digit sales increase in European operations. Hurricanes in the U.S. during the quarter negatively impacted sales by $8 million. Operating earnings declined by 12.8% to $56.3 million.

Financial Services operating earnings increased 10.7% to $56 million on revenue growth of 10.3% to $79 million. Originations of $271.8 million increased by $2 million year-over-year.

-

General Electric Faces Reality

Posted by Eddy Elfenbein on October 23rd, 2017 at 12:07 pmGeneral Electric is not doing well. Their last quarter was a disaster. The company earned 29 cents per share. Wall Street had been expecting 49 cents. At the beginning of the year, shares of GE were around $32. Now they’re at $22.50. In 2000, GE was over $60 per share.

Frankly, I don’t have a strong opinion on GE. (I said recently on CNBC that it could be worth adding if it falls below $20 per share.) But what I find interesting is that Wall Street is thinking that GE will finally lower its quarterly dividend. A few analysts have already said to expect this.

The reason this is so important is…well, that it’s GE! This is the bluest of the blue chips. GE has been a member of the Dow for 121 years. This was the set-and-forget stock. Buying GE was for people who didn’t want to speculate in stocks. Just put your money in good ol’ GE. It’s better than a bank!

Well, now we know how safe the banks were!

To me, it has appeared that GE has been doing all it could to repel lowering its dividend. Now, they have to face reality. The current dividend is 24 cents per share. That works out to a yield of 4.2%. Of course, that assumes the dividend stays at 24 cents.

GE will make about $1.20 per share this year. So the dividend eats up a lot of money that could be reinvested in the business. For comparison, the average S&P 500 company pays out about one-third of their profits as dividends.

There’s an unstated rule about dividends. Once you set a dividend, you’re committed to raising it, or at least, maintaining it. Dividend cuts look very bad. There’s no law which says you must maintain your dividend, but it’s expected — and so much of Wall Street revolves around expectations.

The company did slash its dividend during the financial crisis, but so did tons of other companies. This is different. This a nice reminder than no one is safe. A growing economy, a bull market, low interest rates and a blue chip name still aren’t good enough.

There’s a reason why value investing had such a good track record — people are terrified of going near a troubled name.

-

The Most Chill Rally Ever

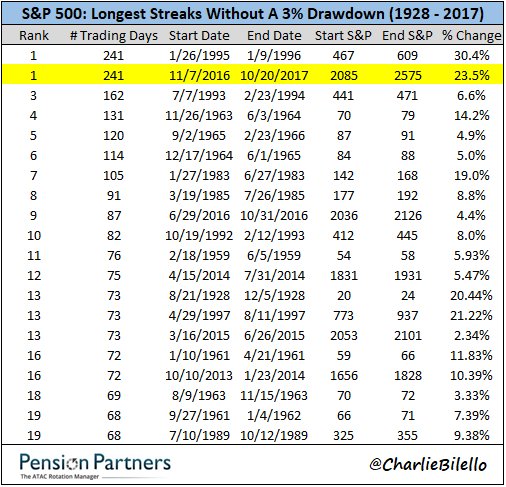

Posted by Eddy Elfenbein on October 23rd, 2017 at 11:39 amToday is the 242nd-straight day in which the S&P 500 has not had a drawdown of more than 3%. Since the election, an investor in the S&P 500 has never seen a loss of at least 3%.

Not only is this one of the most hated rallies in history, but it’s also one of the most chill rallies.

Chart via Charlie Bilello.

-

Morning News: October 23, 2017

Posted by Eddy Elfenbein on October 23rd, 2017 at 6:59 amSeen From Space, China’s Oil Demand Looks Stronger Than Expected

The Wolf of Wall Street Thinks Some ICOs Are ‘The Biggest Scam Ever’

This Tax Strategy Failed Last Year, but Should You Do It Again Anyway?

Tesla Plant in China May Be a First

Tech Giants Are Paying Huge Salaries For Scarce A.I. Talent

Noble Group Warns of Loss Topping $1 Billion

How Intuitive Surgical Turned Medical Sci-Fi Into Reality

GM Jettisons Dinosaur Image as Investors Buy Into Its Mobility Bets

Kaspersky Lab Says It Will Submit Software For Independent Review

The Finger-Pointing at the Finance Firm TIAA

Merrill Lynch Fined $45 Million by U.K. for Failing to Report Transactions

Wall Street May Have Its Own Harvey Weinstein Problem

Jeff Miller: Where Is The Fear?

Ben Carlson: What The Charts Don’t Tell You

Howard Lindzon: The Other Side of This Bull Market – Momentum Monday

Be sure to follow me on Twitter.

-

Blogger Wisdom: Changing Minds

Posted by Eddy Elfenbein on October 20th, 2017 at 2:07 pmQuestion: What is one thing you have changed your mind about recently in the investment world and why?

Here’s a sample of some answers.

Wayne Lloyd, Dynamic Hedge, @dynamichedge:

For a long time, I believed the best way to maximize returns was to increase rationality and eliminate behavioral and emotional bias. In other words, invest like a robot. Optimizing for rationality will help you with most things in the periphery of investing but when it comes time to make a decision you can live with, you need to trust your intuition. It’s messy and it doesn’t make any rational sense but offloading all that rationality to your unconscious mind pays off – if you’ve done the work. Also, understanding and working around your biases is a lot easier than eliminating them. An important book for making this connection for me was The Gift of Fear by Gavin De Becker.Jake, EconomPic Data, @econompic:

Given many investors, fund managers, and investment organizations would rather have their priors be proven right and/or look smart for marketing / fundraising purposes than make money, I’ve changed my view regarding smaller investors being disadvantaged relative to larger / institutional investors. As long as focus is on outcomes, behavioral biases are kept in check, and opportunities presented are seized, I believe even small individual investors can outperform in today’s market environment.Eddy Elfenbein, Crossing Wall Street, @eddyelfenbein:

I’ve recently changed my mind about the nature of volatility. I now believe that volatility is mostly related to what the market has just done. Bear markets cause volatility, not the other way around. Same for bull markets. People talk about the VIX as if it’s the stock market’s blood pressure. That’s just not so. Also, Tadas takes too many vacations. -

Another Look at 1987

Posted by Eddy Elfenbein on October 20th, 2017 at 11:46 amHere’s another way to look at the 1987 crash:

The closing high in August 1987 was 336.

-

CWS Market Review – October 20, 2017

Posted by Eddy Elfenbein on October 20th, 2017 at 7:08 am“Intelligent investment is more a matter of mental approach than it is of technique.”

– Ben GrahamThis week’s issue will be all about Buy List earnings reports. We had four this week, and we have eight more coming next week. Busy times! I’ll run down them all in just a bit.

Before I get to that, though, I’ll briefly touch on some market news this week. On Tuesday, the Dow broke 23,000 for the first time ever. Then on Wednesday, it closed above 23,000. In the last 20 months, the Dow has added 7,000 points.

The recent industrial production report showed an increase of 0.3%. Some of that was impacted by the hurricanes, but we now have strong evidence that the hurricanes didn’t cause as much economic damage as initially feared.

Last Friday, we learned that consumer confidence rose to a 13-year high. Also, retail sales rose by 1.6%. That was the biggest jump in 2-1/2 years, but it was largely due to the hurricanes holding back the previous month’s report.

On Thursday, the initial jobless claims report fell to a 44-1/2-year low. Reuters quoted an economist as saying, “It doesn’t take one hundred Ph.D economists at the Fed to figure out that the labor market is on the tight side of normal.” The odds for a December rate hike are now up to 88%.

Now let’s look at our earnings.

Four Earnings Reports on Thursday

We had four Buy List earnings reports on Thursday morning, and all four beat Wall Street’s expectations.

Let’s start with the best news. Danaher (DHR), the diversified manufacturer, reported Q3 earnings of $1.00 per share. That topped Wall Street’s forecast by five cents per share. Previously, the company told us to expect Q3 earnings to range between 92 and 96 cents per share.

In July, Danaher raised its full-year guidance range to $3.85 to $3.95 per share. In last week’s issue I said, “there’s a decent chance they’ll revise that higher next week.” I was right. Danaher raised its full-year guidance to a range of $3.96 to $4.00. Working out the math, that means they expect $1.12 to $1.16 per share for Q4. I’m impressed by that guidance.

This was another solid quarter for Danaher. The shares gained more than 4.7% on Thursday. Danaher remains a buy up to $90 per share.

Three months ago, Alliance Data Systems (ADS) beat quarterly estimates but lowered its full-year guidance. Frankly, I was a little nervous about this week’s report. Fortunately, ADS reported Q3 earnings of $5.35 per share which easily beat Wall Street’s forecast of $5.04 per share.

The loyalty-reward folks posted revenue of $1.91 billion which was below Wall Street’s consensus of $1.97 billion. I was pleased to see ADS reiterate its guidance of $18.10 per share for this year and $21.50 per share for 2018.

In Thursday’s trading, shares of ADS dropped more than 5% at the open. As the day wore on, buyers came back and the stock closed up 1.9%. ADS remains a buy up to $252 per share.

In recent issues, I’ve said that Signature Bank (SBNY) is one of the better bargains on our Buy List. On Thursday, the bank reported Q3 earnings of $2.29 per share. That was 10 cents better than Wall Street’s consensus.

I think Wall Street is scared of the bath Signature took on its taxi-medallion loans. The truth is that it’s bad but manageable. For Q3, the increase in profits was helped by a big decrease in the provision for loan losses. A lot of that was due to Signature’s taxi-medallion business in Chicago. The medallion loans are painful, but SBNY is moving past them.

For Q3, Signature’s net interest margin was 3.05%. Total assets rose 9.4% to $41.33 billion. Business is clearly getting better for Signature, but it will take time. The shares gained a little over 1% on Thursday. I’m keeping my Buy Below on SBNY at $130 per share.

Wall Street wasn’t exactly thrilled with Snap-on’s (SNA) results for Q2, but Q3 was better. Snap-on made $2.45 per share for Q3 which was two cents better than estimates. There’s still some lingering weakness in their tool division. All told, organic sales rose 2.3%. Not much to say on this one. Business is good, but not great. Like ADS, Snap-on dropped in early trading on Thursday. At one point, SNA was down 3.2%. By the close of trading, it was up 1.74%. I’m keeping my Buy Below on Snap-on at $161 per share.

Eight More Reports Next Week

Next week is going to be a very busy week for Buy List earnings reports. We have two reports on Tuesday, another two on Wednesday and four more on Thursday.

Let’s look at what’s in store.

On Tuesday, Sherwin-Williams (SHW) is due to report Q3 earnings. The stock has quietly turned into a big winner for us. It’s up 44.2% YTD.

Even though the stock has been rallying, the last earnings report was not very good. Sherwin badly missed analysts’ estimates, but that’s due to the costs associated with their merger with Valspar.

For Q3, Sherwin said they see earnings coming in between $3.70 and $4.10 per share. But that includes $1.10 per share in costs related to the acquisition. Wall Street had been expecting $4.91 per share.

For all of 2017, Sherwin now expects earnings to range between $12.30 and $12.70 per share. That will include $2.50 in charges related to the acquisition. Wall Street had been expecting $14.76 per share.

In July, Wabtec (WAB) had a crummy earnings report. It was their fourth miss in the last five quarters. Wall Street had been expecting 94 cents per share but WAB made just 75 cents per share.

That was just a bad report all around. For all of 2017, Wabtec now expects sales of $3.85 billion and EPS between $3.55 and $3.70. That’s a reduction from their April forecast of $3.95 to $4.15 per share. Wall Street expects Q3 earnings of 84 cents per share.

So what went wrong? Basically, the environment for their business is pretty bad right now. Wabtec said there was $250 million in sales they had expected during Q2 that never showed up. Frankly, I’m not pleased with WAB’s performance this year. Over the summer, the shares were north of $93. Now, they’re near $75.

I hope to see some improvement in this report.

On Wednesday, AFLAC and Express Script are due to report. In July, AFLAC (AFL) said to expect Q3 earnings to range between $1.51 and $1.69 per share. That assumes the yen averages between 105 and 115. Just going by the chart, the yen seemed to average about 112 or so last quarter.

For all of 2017, AFLAC expects earnings of $6.40 to $6.65 per share. That’s based on a yen of 108.7. I was a little surprised that the company didn’t raise its forecast. Maybe we’ll get it this time. On Thursday, shares of AFL closed at a new all-time high.

Express Scripts (ESRX) has been a problem for us this year. Their topic client, Anthem, just announced that they’re going to take their pharmacy business in-house. I honestly didn’t think that was going to happen, but it was always a possibility. For their part, Express isn’t keeping still. They recently said they’re buying EviCore for $3.6 billion.

This is an important earnings report for them. For Q3, Express said they expect total adjusted claims of 340 million to 350 million, and earnings of $1.88 to $1.92 per share.

In July, Express raised its full-year earnings of $6.95 to $7.05 per share. That represents an increase of 10% over last year. Unfortunately, the shares took another hit after the latest Anthem report. As a result, on a strict valuation basis, Express is pretty cheap. It’s going for about eight times this year’s estimate. Still, I’d like to see better news from them.

We have four more earnings reports next Thursday. Axalta Coating Systems (AXTA) will be interesting to watch because they bombed their last report. Some of that was due to the mess in Venezuela.

Axalta doesn’t provide per-share guidance, but for 2017, they see adjusted EBITDA between $940 million and $970 million. They expect free cash between $440 million and $480 million. Since the last earnings report, the shares have mostly been stuck between $28 and $30 per share.

Cerner (CERN) has turned into a home run for us this year. Through Thursday, Cerner is up 53.7% on the year for us. For Q3, the healthcare IT firm expects revenue between $1.265 billion and $1.325 billion and EPS between 61 cents and 63 cents. For all of 2017, Cerner sees revenue between $5.15 billion and $5.25 billion. In July, Cerner narrowed its full-year EPS guidance from $2.44 – $2.56 to $2.46 – $2.54.

Microsoft (MSFT) also just closed at a new all-time high. The software giant has been banging out solid numbers in the last few quarters. For Q2, their Azure revenue rose by 97%, and Office 365 saw revenue increase by 43%. Although LinkedIn brought $1.07 billion in revenue, it had an operating loss of $361 million. The consensus on Wall Street is for Q2 earnings of 72 cents per share which is exactly what MSFT made for last year’s Q2.

On Wednesday, shares of Stryker (SYK) briefly touched $150. For Q3 earnings, the orthopedics company sees a range of $1.50 to $1.55 per share. For full-year EPS, they expect $6.45 to $6.55.

That’s all for now. The big story next week will be about earnings. There are, however, a few economic reports to look out for. On Wednesday, we’ll get the durable goods report along with the new-home sales report. But the biggest economic report will come on Friday when the government releases its first estimate for Q3 GDP growth. Most observers expect something around 2.5%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His