-

Blogger Wisdom Questions

Posted by Eddy Elfenbein on October 16th, 2017 at 4:44 pmTadas Viskanta is on a well-deserved vacation. He asked some finance bloggers a few questions. Here’s Monday’s query with a sample of some answers:

Question: Let’s say Warren Buffett re-ups his famous decade-long bet. (He’s not.) He takes the S&P 500. What would you take (and why)?

Jeffrey Miller, A Dash of Insight, @dashofinsight:

I would take a group of managers with a proven method as well as good results. Eddy Elfenbein and Bill Miller are examples, but there are others. The fees must be modest – no 2 and 20. I would also favor managers who pay attention to risk. There will be another recession in the next ten years. Anything you can do to avoid it will help a lot.Eddy Elfenbein, Crossing Wall Street, @eddyelfenbein:

I would still take the S&P 500. Fees are obviously an issue but another reason is that it’s basket of five hedge funds. I believe that plain old stock-picking can beat the market, but I don’t trust five managers making macro bets inside a black box to beat the index.Cullen Roche, Pragmatic Capitalism, @cullenroche:

This is a more interesting bet now. In the 5 years prior to the 2008 bet the US markets had only compounded at about 9% vs the 13% rate of the last five years. But I’d throw in a caveat. Comparing the nominal returns of the S&P 500 to a hedge fund index over 10 years is stupid. The Protege team should have known better than to take that bet. Given how stable the equity market has been in the last 8 years I’d require that we split the bet into two separate bets. Half the pot goes to the nominal return winner and the other half goes to the risk adjusted return winner based on Sharpe ratio. That way we’re creating a bit more balance with the bet since hedge funds are judged in large part not by how much return they generate but by how they generate it. Interestingly, with low yields, stretched stock valuations and excessive fees in hedge funds I have to admit that neither the hedge fund nor the 100% S&P 500 portfolio looks all that great to me if you’re putting your money where your mouth is….So, if I were making this bet with Buffett – well, over a ten year time horizon I’d feel pretty comfortable taking the S&P 500 with 10% leverage. Over any 10 year period the high probability bet is that the stock market will rise so if you want to beat Buffett then just beat him with a higher beta bet than he has going on. Lame, yes? Smart, Yes. -

Forbes: Cerner’s CIO Helped Quintuple Revenue

Posted by Eddy Elfenbein on October 16th, 2017 at 10:48 amPeter High of Forbes interviews Cerner’s CIO, Bill Graff.

High: How has the business grown in the time that you have been with Cerner?

Graff: When I joined Cerner, in early 2005, revenue was right around $1 billion dollars. Today, we are a nearly $5 billion revenue company. In 2005, our associate count was around 6,000. Now we are at a little over 25,000 people, worldwide. One of the reasons I came to Cerner was because I had spent a lot of time working at startups, and Cerner felt like a startup company. You were expected to be entrepreneurial and to deliver results. The exciting thing about Cerner was we had good business leaders and the funding to do entrepreneurial things. Through US legislation and hard work on our part to deliver, the company has grown dramatically. I have had a great career over the last 13 years.

Check out the whole thing.

-

Morning News: October 16, 2017

Posted by Eddy Elfenbein on October 16th, 2017 at 7:03 amChina’s Factory Inflation Rebounds Amid Capacity Cuts

Saudi Aramco Needs Private Money

A NAFTA Battleground on the Shores of Canada

As The Quartet Breaks Up, Central Banking Leadership Flux Looms

Yellen Calls Inflation the ‘Biggest Surprise’ in the Economy

Trump’s Top Economist Says Corporate Tax Cuts Will Lift Workers’ Wages

IBM and Stellar Are Launching Blockchain Banking Across Multiple Countries

Russia May Soon Issue Its Own Official Blockchain-Based Currency, the CryptoRuble

A ‘Crazy’ Stock Market Is Punishing Sellers

Aramark to Buy Avendra and AmeriPride in Separate Deals

Tesla Slides Amid Reports of Performance-Related Job Cuts

Kobe Steel Shares Hit Near Five-Year Lows as Cheating Scandal Raises Financial Risks

Mark Hines: Can Model-Based Trading Beat the Market?

Cullen Roche: Donald Trump is Wrong About the National Debt (Again)

Be sure to follow me on Twitter.

-

Next Week’s Industrial Production Report

Posted by Eddy Elfenbein on October 14th, 2017 at 4:30 pm -

Friday Items

Posted by Eddy Elfenbein on October 14th, 2017 at 12:20 pmI was on CNBC on Friday and that usually takes up a good part of the afternoon. There were, however, a few items from Friday that I wanted to highlight.

First up, the September retail sales report showed the biggest increase in 2.5 years. Much of this is due to bouncing bank from the hurricane-impacted data. Retail sales rose 1.6% in September, which was 0.1% below estimates. If we exclude autos and gas, then retail sales rose by 0.5%.

Secondly, consumer confidence rose to a 13-year high. The University of Michigan report showed a reading of 101.1. That’s the highest since January 2004.

We also got the CPI report on Friday. Consumer prices rose by 0.5% last month. Although it was 0.1% below expectations, this was the largest rise for inflation since January. In the last year, inflation is up 2.2%.

The core rate, however, rose by just 0.1%. In the last year, core inflation is running at 1.7%. Despite whatever the Fed fears, inflation is still not a problem.

-

Wal-Mart’s incredible week

Posted by Eddy Elfenbein on October 13th, 2017 at 4:17 pm -

CWS Market Review – October 13, 2017

Posted by Eddy Elfenbein on October 13th, 2017 at 7:08 am“In business, competition is never as healthy as total domination.” – Peter Lynch

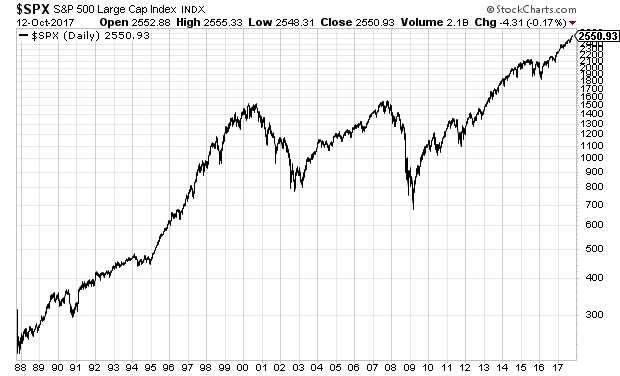

This Thursday will mark the 30th anniversary of the 1987 stock market crash, or “Meltdown Monday” as it’s come to be known. On October 19, 1987, the Dow plunged 508 points. In percentage terms, this was a loss of 22.61%. In today’s terms, that would be like a loss of more than 5,000 points!

Three decades later, the 1987 crash still ranks as the biggest one-day percentage loss in history. It’s nearly double the second-biggest loss, which came in October 1929. With the modern “circuit breakers,” this record may never be broken. If the S&P 500 falls by 20% nowadays, the exchanges shut down for the day.

I often hear stock market “experts” predicting that another 1987 is about to come our way. I always think to myself, “oh, so you’re predicting another 1,000% return over the next 30 years.” Yes, that’s what the Wilshire 5000 did measuring from the market close on the day of the crash. And if we include dividends, then the index is up more than 2,000%. The fact is that the 1987 panic was a great time to buy.

That’s an interesting lesson to ponder as we start the third-quarter earnings season. Over the next few weeks, a large majority of our Buy List stocks will tell us how business was during the summer. I’m expecting good results for our stocks. In this week’s CWS Market Review, I’ll highlight our first earnings reports coming next week. I’ll also bring you up to speed on the latest news on our Buy List stocks. Later on, I’ll share with you some names I’m considering for next year’s Buy List.

Three Buy List Earnings Reports Next Week

There’s an interesting twist to this earnings season. Companies that generate most of their revenue from outside the U.S. are expected to see earnings growth of 7.9%. Yet firms that get most of their revenue inside the U.S. are expected to see earnings fall by 0.1%.

The big winner of this earnings season is expected to be the energy sector, but that’s really because the comparisons with a year ago were so poor. The market is quietly changing before our eyes. For example, intra-market correlations are the lowest they’ve been since the financial crisis. In simpler terms, the different market sectors have lately been doing their own thing. Normally, they tend to move together. This probably means that investors are willing to shoulder more risk.

Another example of this can be seen in the junk bond market. It’s amazing how much things have changed since the financial crisis. Earlier this week, junk bond yields in Europe dropped to 2.29%. That’s an all-time low. Eight years ago, junk bonds in Europe were yielding close to 26%.

Here in America, a Federal Reserve interest rate hike in December now seems like a certainty. The release this week of the minutes from the Fed’s last meeting showed that the central bank is dedicated to raising rates. Still, the Fed members seem puzzled why inflation is still so low.

Now let’s take a look at an earnings calendar for the third quarter. Let me caution that I haven’t heard back from all the companies about when they’ll report. (Some companies are better at this than others.) I’ve also listed Wall Street’s consensus for each stock. Bear in mind, these can change.

Company Ticker Date Estimate Alliance Data Systems ADS 19-Oct $5.02 Danaher DHR 19-Oct $0.95 Snap-On SNA 19-Oct $2.43 Sherwin-Williams SHW 24-Oct $4.70 Wabtec WAB 24-Oct $0.84 Aflac AFL 25-Oct $1.63 Express Scripts ESRX 25-Oct $1.90 Axalta Coating Systems AXTA 26-Oct $0.32 Cerner CERN 26-Oct $0.62 Microsoft MSFT 26-Oct $0.72 Stryker SYK 26-Oct $1.50 Fiserv FISV 31-Oct $1.30 Cognizant Technology Sol CTSH 1-Nov $0.95 Ingredion INGR 1-Nov $2.02 Becton, Dickinson BDX 2-Nov $2.37 Intercontinental Exchange ICE 2-Nov $0.70 Moody’s MCO 3-Nov $1.37 CR Bard BCR NA $2.94 Cinemark CNK TBA $0.35 Continental Building Products CBPX TBA $0.30 Signature Bank SBNY TBA $2.20 I’ve included Becton, Dickinson on the earnings calendar since the CR Bard acquisition will be completed this quarter.

We have three earnings reports next Thursday. Leading off will be Danaher (DHR), the diversified manufacturer. DHR’s last report was just fine in my eyes, but the shares took a dive. A few days later, DHR made a U-turn and rallied to a new high. Once again, there’s a lesson in a little patience.

Danaher told us to expect Q3 earnings to range between 92 and 96 cents per share. That was a tad light, but it’s nothing to be concerned about. In July, the company raised its full-year guidance range to $3.85 to $3.95 per share. There’s a decent chance they’ll revise that higher next week. Danaher is an 11.8% winner YTD for us.

Alliance Data Systems (ADS) has not been the easiest stock to own. Shares of the loyalty-rewards stock were crushed in 2016, and they started to recover. That is, until this past summer. In July, ADS reported better-than-expected Q2 earnings, but the company lowered its full-year guidance by 40 cents to $18.10 per share. The company said their brand-loyalty business “produced soft results.” At the same time, ADS increased its revenue guidance from $7.7 billion to $7.8 billion.

ADS also said it’s “comfortable” in giving initial 2018 guidance of $21.50 per share in core earnings. The consensus on Wall Street was for earnings of $21.42 per share. Still, that wasn’t enough to appease the market gods. ADS dropped nearly 10% after the Q2 report. For Q3, Wall Street expects earnings of $5.02 per share. I think we’ll see that ADS is back on track.

Snap-on (SNA) was another one of our stocks that got dinged after reporting better-than-expected results. The CEO mentioned “headwinds” in their tool group. The good news is that the shares seem to have found a base two months ago, and the stock has been creeping higher lately. I’m looking for more good results. The consensus on Wall Street is for Q3 earnings of $2.43 per share.

Let me also add a quick word on Signature Bank (SBNY). The bank hasn’t said yet when they’ll report Q3 earnings. However, going by previous quarters, I assume it will be close to the 19th, so I’ll include it here. I also want to highlight SBNY because the stock is a very good bargain at the moment.

In July, SBNY met Wall Street’s earnings expectations of $2.21 per share. However, that excluded the bank’s write-down for the bath they took on their medallion loans. Frankly, they got creamed in that business. Outside that, Signature’s business is moving along. For Q2, their net interest margin was 3.11%. That’s pretty good.

The shares have drifted from $150 in June to below $125 recently. It’s very reasonable for Signature to earn $10 per share this year. I’m sticking with SBNY.

Some Candidates for Next Year’s Buy List

The rules of the Buy List stipulate that all 25 stocks are held for the entire calendar year. I can’t make any changes until the end of the year. However, I’ve been looking at some candidates for possible inclusion on the 2018 Buy List. I wanted to share some of these names with you.

Let me make it clear that this is by no means a guarantee that a stock listed here will be on next year’s Buy List. I still have two months to finalize my decisions, but I wanted you to know what I’m looking at.

Church & Dwight (CHD)

Check Point Software (CHKP)

Colgate-Palmolive (CL)

Torchmark (TMK)

FactSet Research (FDS)

Kellogg (K)

Atrion (ATRI)

ADP (ADP)

Clorox (CLX)

Broadridge Financial Solutions (BR)

Mesa Labs (MLAB)If you’ve been with us for a long time, these stocks ought to resemble for you the kinds of stocks we normally favor (strong businesses, solid financials). My plan was to give you seven names, and I just listed 11. That tells you how difficult it is for me to narrow down my selections.

Making changes once a year is tough, but it’s probably for the best.

Buy List Updates

Here are some brief updates on some of our Buy List stocks.

Express Scripts (ESRX) said they’re buying EviCore Healthcare for $3.6 billion. ESRX reports again on October 25.

Cinemark (CNK) dropped this week after reports that the new Blade Runner isn’t such a hit at the box office. The selling hit all the movie chains.

On Monday, Axalta Coating Systems (AXTA) updated its Q3 guidance in light of the hurricanes. The company now sees Q3 and full-year EBITDA in the range of $205-$215 million and $870-$900 million, respectively. Sales for Q3 should be between $1.08-$1.10 billion while full-year sales are to expected to grow between 6% and 7%. The stock dropped 3.8% on Monday. Earnings are due out on October 26.

Barron’s ran a nice feature on Cognizant Technology Solutions (CTSH). They noted that the firm is making inroads in digital consulting.

That’s all for now. Next week will be dominated by earnings reports, but there will be some key economic reports as well. On Tuesday, the industrial production report comes out. Then on Wednesday, the housing starts report comes out as well as the Beige Book. On Friday, Janet Yellen will be speaking, plus the existing homes report comes out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: October 13, 2017

Posted by Eddy Elfenbein on October 13th, 2017 at 7:03 amGlobal Demand for Bitcoin Shifts Wildly in Response to Regulation

Japan Inc. Scandals Build a Case for Corporate Reform

U.S. Corporate Tax Shake-Up Could Fuel Tension With Allies

Curtain Falls on a Great Tech Rivalry

Equifax Takes Down Webpage After Report Of New Cybersecurity ‘Situation’

JPMorgan And Citi: 2 Peas In A Pod

Richard Branson’s Virgin and Hyperloop One Transit Pods Become Fast Friends

AT&T: This Is the Real Storm Crushing the Stock

Google Unveils Job Training Initiative With $1 Billion Pledge

Amazon Is Making It Easier For Teens to Use Their Parents’ Credit Cards

Uber Launches Appeal Against London License Ban

Tech Giants, Once Seen as Saviors, Are Now Viewed as Threats

Ben Carlson: Bond Market Bubbles Are Not What You Think

Howard Lindzon: Bitcoin…FOMO or Foist

Be sure to follow me on Twitter.

My Watch List

Posted by Eddy Elfenbein on October 12th, 2017 at 1:06 pmHere’s my latest Watch List. This is my unofficial list of high-quality stocks I like to follow. If a stock is on this list, then there’s a very good chance that it’s in the upper 5% of well-run companies on Wall Street. This is the elite.

I’m often asked how I go about selecting the stocks for my Buy List. It’s actually very simple. I have this Watch List of stocks and if one of them falls down to a very attractive price, then it becomes a contender for the new Buy List. I like to think of the Watch List as the minor leagues for the Buy List. Strong prospects earn their way up the ladder.

The Watch List is very informal. Unlike the Buy List, I’m constantly adding and deleting names. In fact, I have a bad habit of letting the Watch List grow too large. I often find myself adding three names for every one I delete. Ideally, I like to keep the Watch List below 100 names.

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His