-

Morning News: October 11, 2017

Posted by Eddy Elfenbein on October 11th, 2017 at 7:06 amIMF Warns Against Complacency Even as Global Growth Gains Steam

Japan Shares Rise With Nikkei 225 Closing at Highest Since 1996

Japan’s Quality Control Is Out of Control

Why Chicago’s Soda Tax Fizzled After Two Months — And What It Means for the Anti-Soda Movement

P&G May Have Beaten Peltz, But Shouldn’t Spike the Ball

Apple Joins Forces With Steven Spielberg’s Amblin Television

Amazon’s Clever Solution to Stolen Deliveries: Your Trunk

Walmart Announces Speedy Returns Program

Hyundai Mounts Charm Offensive at U.S. Dealers to Stem Slump

Asset Manager BlackRock’s Profit Beats Wall Street View as Fees Rise

Joshua Brown: Where Have All The Cowboys Gone?

Cullen Roche: Congratulations Richard Thaler!

Michael Batnick: The Price of Progress

Jeff Carter: Where Disagreement is Embraced

Be sure to follow me on Twitter.

-

Dow to 1,000,000 in 100 Years?

Posted by Eddy Elfenbein on October 10th, 2017 at 2:22 pmWarren Buffett recently said that the Dow Jones Industrial Average will get to 1,000,000 in 100 years. To be fair, he said “over” 1,000,000.

That may sound incredible, but he was actually being conservative. Let’s get mathy.

Yesterday, the Dow closed at 22,761.07. To get to 1,000,000 it will need to grow by 3.855% per year for the next 100 years.

Contrast that to the last 100 years. The Dow closed at 79.26 on October 9, 1917. That works out to CAGR of 5.823%. So Buffett was assuming a growth rate of one-third less than before.

If we’re able to maintain the same rate of growth as the last century, then we’ll hit 1,000,000 in no time.

Just 2084.

-

Express Scripts Buys EviCore Healthcare

Posted by Eddy Elfenbein on October 10th, 2017 at 2:16 pmExpress Scripts (ESRX) said they’re buying EviCore Healthcare for $3.6 billion.

Buying EviCore will help Express Scripts broaden its reach beyond prescription drugs into being a gatekeeper for insurance companies for a wider range of medical services. Health plans hire EviCore, which manages medical benefits for 100 million people, to help reduce medically unnecessary imaging and other expensive tests.

The purchase will complement Express Scripts’ main business of managing prescription-drug benefits for health plans, employers and unions. The combination provides “significant opportunities for cross-selling to both client bases,” Express Scripts said in a statement.

Express Scripts said that the deal, which must be approved by regulators, is expected to close in the fourth quarter of 2017. EviCore will be run as a standalone business unit within Express Scripts, the company said.

Express Scripts is down about 1.8% today.

-

Stock Returns and TIPs Yields

Posted by Eddy Elfenbein on October 10th, 2017 at 9:40 amI recently looked at the relationship between stock market returns and TIPs yields. I found that 1.10% on the five-year TIP is a good tipping point for the stock market.

When the five-year TIP has been yielding 1.1% or more, the stock market (as measured by the Wilshire 5000 Total Return) has lost 2.1% annualized.

But when the five-year TIP has been 1.09% or less, then the market has gained 17.1% annualized.

The data goes back to January 2003 so we almost have 15 years of data. I wish we had more. I suspect that over time, we’ll see a tipping point yield around 1% to 1.5%.

On Friday, the five-year TIP closed at 0.19%. So going by that, we’re still a long way from bonds being competitive against stocks.

Here’s the five-year TIPs yield along with its tipping yield in red. The blue line hasn’t been above the red line in over eight years.

-

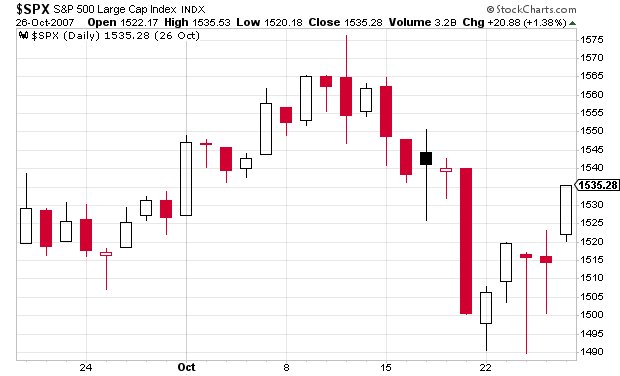

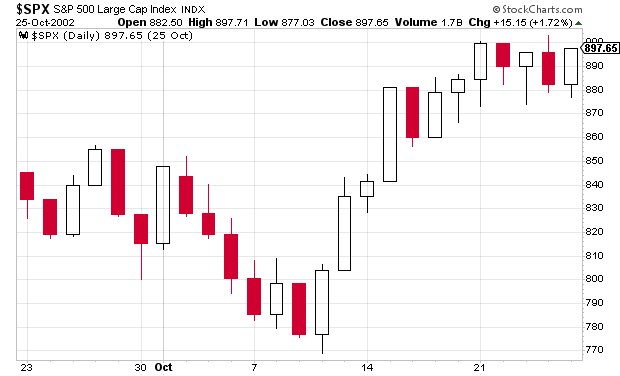

The Stock Market Bottomed Out 15 Years Ago Today

Posted by Eddy Elfenbein on October 10th, 2017 at 9:13 amThe S&P 500 reached its intraday low exactly 15 years ago today. At 10:10 am on 10/10/2002, the S&P 500 got down to 768.63.

Later that day, the market would rally to close over 800 so the lowest close came the previous day on October 9 when the S&P 500 closed at 776.76. Weirdly, that number is very close to the Dow’s lowest number during the bear market that ended 20 years before (776.92).

The bull market would last exactly five years. Or almost exactly. The highest close would come on October 9, 2007 at 1,565.15. The intra-day high (1576.09) came on October 11. Those days perfectly bookend the fifth birthday of the rally.

Basically, the stock market doubled in five years.

-

Morning News: October 10, 2017

Posted by Eddy Elfenbein on October 10th, 2017 at 6:47 amOil Rises to $56 on Saudi Export Cut

Elon Musk’s Offer to Rebuild Puerto Rico’s Electricity Grid is a Game-Changer

Thank Richard Thaler for Your Retirement Savings

How Does Cryptocurrency Fit Into a Portfolio?

BAE to Cut Almost 2,000 Jobs as Eurofighter Backlog Dwindles

GE Just Caved and Put One of Nelson Peltz’s Colleagues on its Board

Walmart’s E-Commerce Business Is Battling Target and Costco as Much as Amazon

G.M. Acquires Strobe, Start-Up Focused on Driverless Technology

Alphabet Launches U.S. Ad Campaign to Promote Driverless Car Safety

China Hastens the World Toward an Electric Car Future

Google, Facebook and Twitter Scramble to Hold Washington at Bay

Kobe Steel Faked Data for Metal Used in Planes and Cars

Howard Lindzon: The Bull Market In Everything?

Ben Carlson: Worst Practices in Institutional Asset Management

Roger Nusbaum: Jobs Weak, Market Doesn’t Care

Be sure to follow me on Twitter.

-

Barron’s on Cognizant

Posted by Eddy Elfenbein on October 9th, 2017 at 3:38 pmBarron’s highlights the Cognizant Technology Solutions (CTSH) shift to digital consulting. Five years ago, it was barely a speck within CTSH’s business, but today, digital consulting accounts for 25% of their revenue. Cognizant has been having a very good year.

Last year, revenue rose 8.6%, the smallest increase ever, and net income fell 4%, to $1.6 billion, or $3.39 a share, as certain health-care clients postponed spending due to merger-related activity. This year, things are going better; Cognizant beat estimates in the first and second quarters, as client spending resumed. Full-year earnings are expected to rise more than 30%, to $2 billion, or $3.71 a share, fueled by profit-margin expansion and stock buybacks, on a 10% jump in revenue, to $14.8 billion.

The stock still isn’t expensive.

Even after the stock’s latest rally, shares trade for 17 times next year’s expected earnings, below their five-year average of 17.5 and at a steeper-than-usual discount to rival Accenture (ACN), which sports a price/earnings ratio of 19. “They are running and chewing gum at the same time by trying to grow their digital business and improve margins,” says Lisa Ellis, a senior analyst at Bernstein, who says the market is skeptical, given the stock’s depressed P/E. “I see this as a straightforward execution story over the next several quarters. They have talked about their plans with a high level of specificity.”

Ellis thinks Cognizant’s stock could hit $84 in the next year, 15% above last week’s level, based on her view that earnings will grow at a midteens rate in the near term, helped by margin improvement. Additionally, large banks could begin spending on technology again after years on the sidelines, and clients could speed the growth of their digital businesses. In that case, Cognizant’s shares could earn a higher multiple. Ellis has above-consensus earnings estimates of $4.52 a share for next year and $5.33 for 2019.

-

Human Progress Is Lower Transaction Costs

Posted by Eddy Elfenbein on October 9th, 2017 at 2:01 pmHere’s an interesting article about one of the great, unacknowledged aspects of history: the reduction of transaction costs. Most people don’t give it a moment’s thought, but exchange is how we acquire things that we want. For much of history, there have been all sorts of hurdles impeding exchanges. The more we have reduced the hurdles, the better it has been.

Or consider the great economic transaction cost reducer, money. When we say that the problem with barter is that we cannot find someone who both has what we want and wants what we have, we are making a claim about high transaction costs. By being a generally accepted medium of exchange, money assures buyers that the seller will always want what they have and assures sellers that the other party will have what they want. It dramatically reduces the transaction costs of economic exchange, promoting more trade and greater wealth.

One can also point to a whole variety of other economic and social institutions that reduce the costs of engaging in exchange. The major institutions of a liberal society that do so are clearly defined and well-enforced property rights, the rule of law, and stable money. The market as a whole, and especially market prices, reduce transactions costs as well.

-

Axalta Cuts Its 2017 Outlook

Posted by Eddy Elfenbein on October 9th, 2017 at 11:12 amThis morning, Axalta Coating Systems (AXTA) updated its Q3 guidance in light of the hurricanes. The company now sees Q3 and full-year EBITDA in the range of $205-$215 million and $870-$900 million, respectively.

Sales for Q3 should be between $1.08-$1.10 billion while full-year sales are to expected to grow between 6% and 7%.

Charles W. Shaver, Axalta’s Chairman and CEO, commented that “We have seen and expect moderate effects on our business from recent hurricanes and the earthquake in Mexico, largely in terms of lost near-term volume opportunity. We believe that much of this impact will be made up during the course of 2018, and hence see these impacts as largely transitory.” Mr. Shaver continued, “After recent discussions with certain Performance Coatings distribution partners, we are incorporating the expected impact of a focused reduction in distributor working capital levels for the balance of the year. Following this adjustment, we expect volumes for the segment to return to more normal levels during the fourth quarter.” Mr. Shaver further commented that “We also continue to see impacts across coatings markets from tight supply conditions for raw material inputs, and given time lags to recovery via pricing adjustments, we have factored in a wider price-cost gap into our 2017 outlook. We expect to close the gap caused by raw material price pressure over the coming year.”

Robert W. Bryant, EVP and CFO, added, “Although we never like to see business impacts of these sorts, we believe the majority of the effects we have described are largely one-time in nature, and much of these are expected to be recovered through the course of 2018. We continue to have confidence in the underlying business climate, and note that the economics in each of our end-markets remain stable as we look forward. We are also revisiting and will increase our plans for cost reduction and productivity measures that should incrementally benefit Axalta in 2018.”

The stock is down about 4.4% this morning.

-

Richard Thaler Wins the Nobel Prize

Posted by Eddy Elfenbein on October 9th, 2017 at 10:04 amRichard Thaler has been awarded this year’s Nobel Prize for Economics. He is the 29th winner from the University of Chicago over the last 47 years.

Here’s Thaler’s scene with Selena Gomez in The Big Short:

Here’s “A Dozen Things I’ve Learned from Richard Thaler About Investing” by Tren Griffin.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His