-

Morning News: August 9, 2017

Posted by Eddy Elfenbein on August 9th, 2017 at 7:08 amU.S. Seeks Import Duties on Chinese Aluminum Foil

As Stocks Reach New Heights, What’s Trump Got to Do With It?

No-Name U.S. Oil Driller Gets Shot at World’s Biggest Reserves

These Sugar Barons Built an $8 Billion Fortune With Washington’s Help

Vantiv and Worldpay Just Agreed Terms for Their $10 Billion Merger

NEO Completes Rebranding; Announces Blockchain Partnerships

Mazda’s New Invention: Diesel Without The Diesel

5 Principal Reasons Why I’m Still Short Tesla

Priceline Tumbles as a Weak Outlook Overshadows Better-Than-Expected Earnings

Uber Employees Fear Layoffs as the Company Plans to Shut Down Its 500-Employee Car Leasing Unit

McDonald’s, Walgreens Sued Over Sweetened Beverage Tax

How Disney Wants to Take on Netflix With Its Own Streaming Service

Damore Went From Intern to Pariah in Google Tenure Ended by Memo

Joshua Brown: Nope., So You Want To Be a Rap Superstar and Dream Hoarders: My Reaction

Be sure to follow me on Twitter.

-

Cramer Talks to Snap-on’s CEO

Posted by Eddy Elfenbein on August 8th, 2017 at 4:13 pm -

Disney Reports after the Close

Posted by Eddy Elfenbein on August 8th, 2017 at 1:02 pmDisney (DIS) is set to report earnings after today’s closing bell. In addition to being a Dow component, Disney is an important media conglomerate:

Disney is set to report its quarterly earnings Tuesday after the closing bell, and one portfolio manager said it could have far-reaching implications for the market given the media giant’s many different properties both in the U.S. and abroad.

“This is kind of a bellwether for so much of the U.S. economy,” said Eddy Elfenbein, portfolio manager at AdvisorShares, referring to Disney’s vast array of assets, which include broadcast, cable, movies and theme parks. “But what I’m going to be looking for is in their cable subsidiaries, [such as] ESPN,” Elfenbein said Monday on CNBC’s “Trading Nation.”

ESPN has traditionally proved quite profitable for Disney, Elfenbein said, but has not fared well recently.

“They’ve been bleeding subscribers recently, and that’s caused a lot of attention from Wall Street. So, I want to see how those numbers are, and how the ESPN business is shaking out,” he said.

-

Morning News: August 8, 2017

Posted by Eddy Elfenbein on August 8th, 2017 at 7:05 amChina Takes Away the Punch Bowl

Chinese Trade Data Misses and Export and Import Growth Slows

Drop In German Trade Activity Feeds Into Global Stimulus Debate

Hedge Fund Sues to Have Puerto Rico’s Bankruptcy Case Thrown Out

Trump’s Stalled Trade Agenda Leaves Industries in the Lurch

Gundlach, Wary of Pricey Market, Sets Cap on DoubleLine’s Growth

Tesla Seeks $1.5 Billion Junk Bonds to Fund Model 3 Production

Mazda Announced Breakthrough in Long-Coveted Engine Technology

Avis, Stung by Falling Used-Car Prices, Reports Disappointing Results

Wells Fargo, Awash in Scandal, Faces Violations Over Car Insurance Refunds

Pizza Vending Machines at Little Caesars

Time Inc Misses Revenue Estimates as Advertising Sales Slip

If Retail is Dying, Why is Money Pouring Into Malls?

Michael Batnick: If This Is 1929…

Jeff Carter: Should Valuation Be A Disqualifier For Investment?

Be sure to follow me on Twitter.

-

The Dow Logs Ultra-Rare Winning Streak

Posted by Eddy Elfenbein on August 7th, 2017 at 5:56 pm -

The Bull Case for Financials

Posted by Eddy Elfenbein on August 7th, 2017 at 4:17 pm -

The Decline and Fall of Value

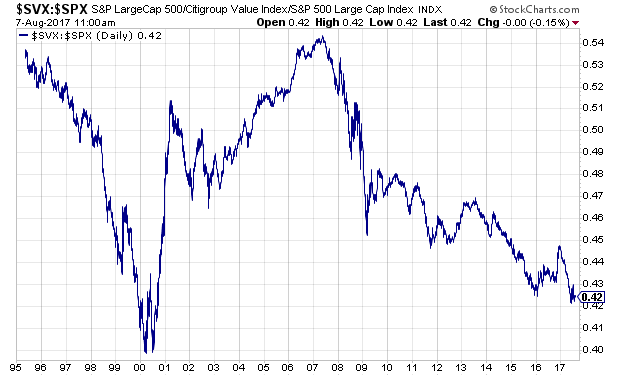

Posted by Eddy Elfenbein on August 7th, 2017 at 10:56 amSteven Russolillo has an interesting article in today’s WSJ on the poor performance of value stocks. Value isn’t in a typical underperformance cycle. Rather, it’s been in a very long stretch of lagging the market.

Stocks that look cheap relative to traditional fundamental metrics such as profit or cash flow have fallen so far out of favor that Goldman Sachs in June questioned whether the markets are witnessing the death of value investing. With value investments in Europe and Asia also struggling, value funds globally are on track to post their worst performance this year relative to growth funds since before the financial crisis.

The struggle for value stocks over such a prolonged period contradicts the popular investment approach coined by financial analyst Benjamin Graham, known as the father of value investing, and since popularized by Warren Buffett. The billionaire investor and Berkshire Hathaway Inc. chairman has attracted a legion of followers who remain confident that value investing will never go out of style.

(…)

Over the past decade, the performance of U.S. growth stocks has been almost three times better than that of value stocks, contributing to what index fund giant State Street Global Advisors calls “the longest period of underperformance for value since the late 1940s.”

One of the problems, I suspect, is that the composition of value has changed. Since the financial crisis, many banks have been pushed into the value bin since they have very low price-to-book ratios. Properly speaking, I doubt many of these beaten-down financials behave as what I think of as value, meaning high-dividend yields. I can’t be positive this is what’s happening, but I’m guessing it’s an issue.

Here’s the S&P 500 Value divided by the S&P 500. Note that the cycle peaked in 2007 right with financial stocks.

-

Morning News: August 7, 2017

Posted by Eddy Elfenbein on August 7th, 2017 at 7:06 amGerman Industrial Output Unexpectedly Falls First Time This Year

Renault Forms New Joint Venture Company in Iran

BlackRock, Vanguard Say Bond Market’s Got This Trade All Wrong

The World’s Most Feared Investor

Countering West Coast Pull, by Helping Finance Start-Ups Sell in New York

How This U.S. Tech Giant Is Backing China’s Tech Ambitions

Higher-Cost Crude Could Squeeze Margins at U.S. Refiners

SoftBank Profit Tops Estimates on Shift to Deals, Investing

Sprint, Looking to Get Bigger to Survive, Weighs Deal-Making

Where Are all These Electric Cars Going to Charge?

Bitcoin Soars to Record as Buyers Look Beyond Miners’ Split

Shkreli Sentence Turns on Antics, Investor Impact of Crime

Jeff Miller: Weighing the Week Ahead: Time to Raise Price Targets?

Roger Nusbaum: James Montier Is Still Bearish

Cullen Roche: Let’s Talk About “Maximizing Shareholder Value”

Be sure to follow me on Twitter.

-

“Somewhat Less Famous Twitter User”

Posted by Eddy Elfenbein on August 4th, 2017 at 10:08 amFrom Investopedia:

Almost exactly a year ago, then-candidate Donald Trump said of the stock market that “It’s all a big bubble,” as CNBC then reported. Earlier today, President Trump cheered a new market high and “business enthusiasm at record levels,” suggesting between the lines that he deserves credit for both, per one of his tweets. Indeed, the Dow Jones Industrial Average (DJIA) has risen by a remarkable 40% during the last 18 months, well before Trump graced the White House steps, as pointed out by a somewhat less famous Twitter user, Eddy Elfenbein.

-

Cinemark Earns 44 Cents per Share

Posted by Eddy Elfenbein on August 4th, 2017 at 9:23 amThis morning, Cinemark (CNK) said they earned 44 cents per share last quarter. That was a penny below estimates. The stock dropped yesterday after AMC completely bombed their earnings report. Whatever’s hurting AMC isn’t plaguing CNK. Here are some numbers:

Cinemark Holdings, Inc.’s total revenues for the three months ended June 30, 2017 increased 0.9% to $751.2 million from $744.4 million for the three months ended June 30, 2016. For the three months ended June 30, 2017, admissions revenues were $449.9 million and concession revenues were $262.3 million. Concession revenues per patron increased 8.9% to $3.78 and average ticket price increased 3.7% to $6.48 for the three months ended June 30, 2017.

(…)

“We continue to be pleased with the consistency of our financial performance, including our second quarter’s global revenue growth, record food and beverage per caps, and year-over-year box office results that again exceeded the North American industry,” stated Mark Zoradi, Cinemark’s CEO. “We remain optimistic about film content for the remainder of the year, as well as the future growth potential that our strong foundation and strategic initiatives provide for our Company.”

Cinemark’s screen count is up to 5,926.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His