-

The Car Recession

Posted by Eddy Elfenbein on July 5th, 2017 at 3:00 pmThe American auto industry is not in a good way. That last sales report was not very good. Sales were down for the fourth month in a row.

Industry consultant Autodata put the industry’s seasonally adjusted annualized rate of sales at 16.51 million units, which was the lowest rate since February 2015. It came in below Wall Street expectations of 16.6 million vehicles and 2 percent lower than the June 2016 figure.

U.S. consumers continued to shun passenger cars in favor of larger pickup trucks, SUVs and crossovers. Passenger car sales were also hurt as some automakers, including GM, have moved to reduce relatively low-margin sales to rental agencies.

The U.S. auto industry has been bracing for a downturn after hitting a record 17.55 million new vehicles sold in 2016. A glut of nearly new used vehicles poses competition for new vehicle sales and automakers have relied increasingly on consumer discounts and loosened lending terms.

Car shopping website Edmunds said the average length of a car loan reached a record high of 69.3 months in June.

There’s even talk of how the auto financing boom was this decade’s version of the housing boom last decade. That’s probably pushing things too far.

Ford Motor Co said its June sales were hit by lower fleet sales to rental agencies, businesses and government entities, which fell 13.9 percent, while sales to consumers were flat.

Wall Street analysts worry that the millions of low mileage, off-lease vehicles poised to hit the market between now and the end of 2019 will weigh on future new vehicle sales.

Ford vice president for U.S. marketing, sales and service Mark LaNeve said on a conference call that the automaker has seen little evidence that its competitors are reducing their reliance on leasing to clinch a sale.

With OPEC losing their war against oil supplies, it appears that gasoline prices will head lower and lower. That’s good news for trucks and SUVs.

-

June Fed Minutes

Posted by Eddy Elfenbein on July 5th, 2017 at 2:27 pmHere are the minutes from the Fed’s June meeting. The FOMC decided to raise interest rates. There was one dissenting vote.

Here’s a key passage:

Several participants indicated that the reduction in policy accommodation arising from the commencement of balance sheet normalization was one basis for believing that, if economic conditions evolved broadly as anticipated, the target range for the federal funds rate would follow a less steep path than it otherwise would. However, some other participants suggested that they did not see the balance sheet normalization program as a factor likely to figure heavily in decisions about the target range for the federal funds rate. A few of these participants judged that the degree of additional policy firming that would result from the balance sheet normalization program was modest.

Participants generally reiterated their support for continuing a gradual approach to raising the federal funds rate. Several participants expressed confidence that a series of further increases in the federal funds rate in coming years, along the lines implied by the medians of the projections for the federal funds rate in the June SEP, would contribute to a stabilization, over the medium term, of the inflation rate around the Committee’s 2 percent objective, especially as this tightening of monetary policy would affect the economy only with a lag and would start from a point at which policy was still accommodative. However, a few participants who supported an increase in the target range at the present meeting indicated that they were less comfortable with the degree of additional policy tightening through the end of 2018 implied by the June SEP median federal funds rate projections. These participants expressed concern that such a path of increases in the policy rate, while gradual, might prove inconsistent with a sustained return of inflation to 2 percent.

Several participants endorsed a policy approach, such as that embedded in many participants’ projections, in which the unemployment rate would undershoot their current estimates of the longer-term normal rate for a sustained period. They noted that the longer-run normal rate of unemployment is difficult to measure and that recent evidence suggested resource pressures generated only modest responses of nominal wage growth and inflation. Against this backdrop, possible benefits cited by policymakers of a period of tight labor markets included a further rise in nominal wage growth that would bolster inflation expectations and help push the inflation rate closer to the Committee’s 2 percent longer-run goal, as well as a stimulus to labor market participation and business fixed investment. It was also suggested that the symmetry of the Committee’s inflation goal might be underscored if inflation modestly exceeded 2 percent for a time, as such an outcome would follow a long period in which inflation had undershot the 2 percent longer-term objective. Several participants expressed concern that a substantial and sustained unemployment undershooting might make the economy more likely to experience financial instability or could lead to a sharp rise in inflation that would require a rapid policy tightening that, in turn, could raise the risk of an economic downturn. However, other participants noted that if a sharp rise in inflation or inflation expectations did occur, the Committee could readily respond using conventional monetary policy tools. With regard to financial stability, one participant emphasized the importance of remaining vigilant about financial developments but observed that previous episodes of elevated financial imbalances and low unemployment had limited relevance for the present situation, as the current system of financial regulation was likely more robust than that prevailing before the financial crisis.

I know the Fed’s language is dull as dirt but that’s how central bankers write. Basically, the Fed looks to continue with gradual rate hikes. We’ll probably get one more this year.

This issue of contention is the balance sheet. Some folks on the FOMC want to start paring back the Fed’s gigantic balance sheet this year. Others aren’t so sure.

Reading the Fed’s minutes is a study in indefinite pronouns; some said this, others said that while many others said something entirely different.

-

Morning News: July 5, 2017

Posted by Eddy Elfenbein on July 5th, 2017 at 7:01 amChina Can Seize Opportunity to Lead Global A.I. Development, Baidu Executives Say

Qatar Seeks to Retain Its LNG Crown Despite Saudi-Led Boycott

Italian Banks Hit Reset as Taxpayer Billions Bail Out Lenders

U.K. Services Slow as Economy Shows Signs of Losing Momentum

HSBC Said in Talks With U.S. to End Crisis-Era Mortgage Probe

After Years of Growth, Automakers Are Cutting U.S. Jobs

Hamburg Is Ready to Fill Up With Hydrogen. Customers Aren’t So Sure.

Geely’s Volvo to Go All Electric With New Models From 2019

Will Tesla Disrupt Long Haul Trucking?

Tencent Shrugs Off Market Concerns After Rationing Game Time for Chinese Kids

Samsung Electronics to Steal Intel’s Crown

Roger Nusbaum: Jawboning Works?

Cullen Roche: Factor Picking Is The New Sector Picking

Ben Carlson: Stock Market Yields Are Higher Than You Think

Be sure to follow me on Twitter.

-

Happy Fourth of July

Posted by Eddy Elfenbein on July 4th, 2017 at 10:30 am -

Morning News: July 4, 2017

Posted by Eddy Elfenbein on July 4th, 2017 at 7:18 amQatar to Boost LNG Output by 30%, Flouting Saudi-led Boycott

Turkey Secures Laptop Ban Exemption

Trump to Promote U.S. Natgas Exports in Russia’s Backyard

Beware The Predictions Of ‘Experts’ Like Janet Yellen

SUVs Save the Day Again in June as Total U.S. Car Demand Softens

Nasdaq Stocks Show Wild Swings; Exchange Cites Third Parties

More Factory Problems as Elon Musk’s Tesla Starts Producing the Model 3

China Targets Tencent’s Top Earner in Game Addiction Warning

Total Signs Deal With Iran, Exposing It to Big Risks and Rewards

ExxonMobil Has a Secret Weapon Against Electric Cars

GE’s Oilfield Giant Is Ready to Prosper, If the Crude Recovery Cooperates

The World’s Largest Producer of Memory Chips Is Investing $18 Billion to Produce More of Them

Uber Is Dealt a Fresh Blow in European Legal Case

Cullen Roche: Factor Picking is the New Sector Picking

Be sure to follow me on Twitter.

-

The Barron’s Effect

Posted by Eddy Elfenbein on July 3rd, 2017 at 10:20 amNice open for HEICO (HEI):

-

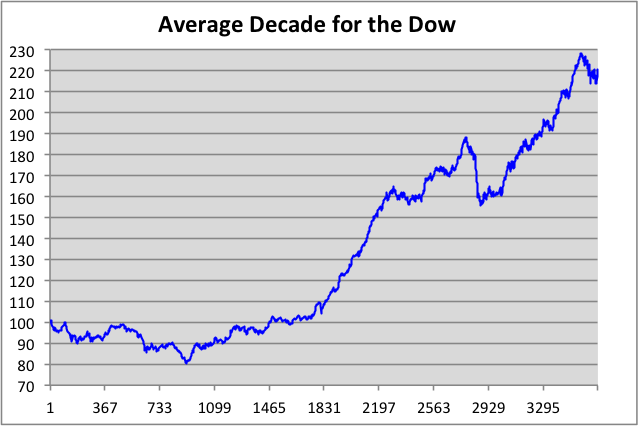

The Average Decade for the Dow

Posted by Eddy Elfenbein on July 3rd, 2017 at 10:12 amWe’re now three-quarters of the way through the decade. Here’s what the average decade looks like for the Dow. I set the y-axis at a base of 100. The x-axis is number of days.

For the most part, the latter part of the decade has been better than the first half. Bear in mind that even 121 years of the Dow isn’t a large sample size for a decade.

I found that the best five-year run has been from July 23 of the third year (meaning ending in 2) to July 23 of the eighth year (ending in 7). The Dow has gained 129.4% in that time.

The rest of the time, the Dow has lost -3.8%.

In three weeks, we’re coming up on the end of the bullish period. To be clear, I don’t see any of this as advice. I just think it’s interesting.

-

Sector Returns YTD

Posted by Eddy Elfenbein on July 3rd, 2017 at 9:58 amHere’s a look at S&P 500 sector return (w divs) for 2017:

Tech 17.23%

Health Care 16.07%

Discretionary 11.00%

Industrials 9.51%

S&P 500 9.34%

Material 9.21%

Utilities 8.75%

Staples 8.03%

Financials 6.88%

Real Estate 6.40%

Telecom -10.74%

Energy -12.61%It’s interesting that only four of the 11 sectors beat the S&P 500 YTD. In fact, we came very close to only seeing three beat the market.

-

Morning News: July 3, 2017

Posted by Eddy Elfenbein on July 3rd, 2017 at 7:07 amEuro-Area Unemployment Holds at 8-Year Low as Recovery Proceeds

Iran to Sign Gas Deal With France’s Total and China’s CNPC

China Stocks Retreat as Financial Shares Lead Large Caps Lower

China’s New Heavy-Lift Rocket Launch Fails in Flight

American Companies Still Make Aluminum. In Iceland.

Tesla’s First Mass-Market Car, the Model 3, Hits Production This Week

Facebook’s Small Print Might Be Next Big Antitrust Target

Pinterest Wants to Show Advertisers It Can Run With the Big Dogs

SeaWorld CEO Struggles to Gain Wall Street’s Faith in Turnaround

France’s Danone to Sell Stonyfield to Lactalis for $875 Million

Okada Sues Family in Bid to Regain Control of Gambling Empire

Jeff Miller: How Strong is the Labor Market?

Roger Nusbaum: Meir Statman Says Time Diversification Is Hokum

Jeff Carter: What Do You Think of ICOs?

Michael Batnick: The Financial Nutrition Labels

Be sure to follow me on Twitter.

-

Bobby Bonilla Day

Posted by Eddy Elfenbein on July 2nd, 2017 at 9:10 pmThis here’s a story about baseball and the new present value of money:

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His