-

Is it Time for Bitcoin?

Posted by Eddy Elfenbein on July 25th, 2017 at 12:40 pmFrom MarketWatch:

Cullen Roche of Orcam Financial Group echoed much of Richter’s view.

“As a speculative instrument it’s an interesting bet on its widespread acceptance as a medium of exchange, but we should be very clear that we are speculating when we buy bitcoin,” he said. “In this sense it is more akin to something you might gamble on as opposed to something you prudently invest in. Not an inappropriate endeavor, but probably not one that should be an excessive portion of anyone’s asset allocation.”

Eddy Elfenbein of the Crossing Wall Street blog agreed on the idea of rolling the dice, and actually didn’t rule it out for himself.

“I’d buy bitcoin as a fun bet, but it still has a long way to go,” he said. “If a currency moves 15% a day, then it’s not a currency.”

-

Wabtec Misses and Guides Lower

Posted by Eddy Elfenbein on July 25th, 2017 at 10:33 amThis morning, Wabtec (WAB) became our latest stock to report earnings and it turned out to be our latest disappointment. For Q2, the freight services company earned 75 cents per share which included five cents per share due to the “net effect of the restructuring and transaction expenses and the interest expense benefit.” Wall Street had been expecting 94 cents per share.

For all of 2017, Wabtec now expects sales of $3.85 billion and EPS between $3.55 and $3.70. That’s a reduction from their April forecast of $3.95 to $4.15 per share.

Raymond T. Betler, Wabtec’s president and chief executive officer, said: “We remain confident in our future growth opportunities, even as we manage aggressively through our short-term challenges. In transit, we have a record and growing backlog, with significant projects in all major markets around the world, and we are making meaningful progress in the Faiveley integration, with margins improving during the year. In freight, our backlog has now increased for three consecutive quarters, and demand appears to be stable in our key markets. Finally, we continue to invest in our balanced growth strategies, including new products and acquisitions, around the world.”

The shares are down about 11% this morning.

-

Morning News: July 25, 2017

Posted by Eddy Elfenbein on July 25th, 2017 at 7:04 amFor China’s Global Ambitions, ‘Iran Is at the Center of Everything’

German Business Climate Hits Record as Economy Proves Robust

Alphabet Shares Tank as Wall Street Freaks Over Rising Traffic Costs

Michael Kors to Buy Jimmy Choo in $1.2 Billion Deal

LedgerX Just Gave Us Another Way to Bet Against Bitcoin

Halliburton Sees Drillers `Tap the Brakes’ on Shale Boom

SoftBank Reportedly Seeking Uber Stake Valued at Billions

Bill Gates Backs Uber Freight Rival

Johnson & Johnson’s Pricey Best-Selling Drug Will Have to Face a 35% Cheaper Rival

Sports Retailer Stocks Fall as Hibbett Posts Gloomy Outlook

The Chipotle Corporate Sabotage Theory Returns

Stada Board Recommends Acceptance of Improved Takeover Bid

DuPont Beats on Strong Demand in Agriculture Business

Michael Batnick: The Topic Is Gold

Roger Nusbaum: Markets Continue to Melt (Higher!)

Be sure to follow me on Twitter.

-

RPM International Earned $1.02 per Share

Posted by Eddy Elfenbein on July 24th, 2017 at 1:04 pmThis morning, RPM International (RPM) had a dud of an earnings report. The company made $1.02 per share for its fiscal Q4 which was 16 cents below Wall Street’s consensus. Quarterly net sales rose 4.6% to $1.49 billion.

“We took additional cost reduction measures in the fourth quarter to position RPM to a return to double-digit earnings growth in fiscal 2018. We were pleased with solid organic growth in both our industrial and specialty segments during the fourth quarter, which we expect to continue as we enter into fiscal 2018. Organic growth across our consumer businesses was down 1.0%, principally due to lower results at our Kirker nail enamel business, the negative impact of a very rainy start to the spring season for home improvement sales and a difficult comparison to our prior-year quarter in which organic growth across RPM’s core consumer product lines increased 9.9%,” stated Frank C. Sullivan, RPM chairman and chief executive officer.

“The consolidated revenue increase, particularly in a growth-challenged economic environment, was mitigated somewhat on leverage to the bottom line as a result of higher raw material costs during the quarter, including shortages and availability issues in a couple of key product lines. Also, a significantly higher tax rate in the fourth quarter this year versus last year reduced earnings per share on a comparative basis by $0.12.

Now for guidance:

“Based upon the growth expectations above, we anticipate earnings per share for fiscal 2018 to be in the range of $2.85 to $2.95 per share. Throughout the year, it will be important to keep in mind the variability of our year-over-year quarterly comparisons, in particular, our tax rate is estimated to be in line with fiscal 2017, but may fluctuate quarter-to-quarter. Related to this, in the first quarter of last year we had a very favorable tax adjustment, which is not expected to repeat, and which will negatively impact the first quarter of fiscal 2018 by approximately $0.03 per share. As outlined above, in the fiscal 2017 third quarter we identified, but did not adjust out, roughly $0.08 per share of non-operating, one-time items. These items should be added back to the fiscal 2017 base results for our fiscal 2018 third quarter. Given the higher-than-normal tax rate in the fiscal 2017 fourth quarter, we would anticipate $0.05 per share benefit in the fiscal 2018 fourth quarter.

“For the first quarter of fiscal 2018, in addition to the higher tax rate mentioned above, we expect higher raw material costs experienced in the fourth quarter to continue through the first quarter, as well as continued foreign currency headwinds, both translational and transactional. Also, most of our operating groups were on plan in the first quarter of fiscal 2017, before their results began to weaken, and our Brazilian operation benefited in the first quarter last year when Brazil hosted the summer Olympics. As a result, our EPS estimate for the first quarter of fiscal 2018 is $0.83 per share to $0.85 per share.

Wall Street had been expecting 89 cents per share for this quarter, and $3.00 per share for the year. Shares of RPM are down about 7% today.

-

Morning News: July 24, 2017

Posted by Eddy Elfenbein on July 24th, 2017 at 7:08 amTraders Fear Hard Landing in Emerging Markets

Oil Rises as Saudi Arabia Pledges Deep Cut to August Exports

Euro Zone Business Growth Slows at Start of Second Half

IMF Cuts U.K. Forecast as Brexit Inflation Knocks Consumers

IMF Sees U.S. Fading as Global Growth Engine

U.S. Inflation Remains Low, and That’s a Problem

U.S. Foresaw Better Return in Seizing Fannie and Freddie Profits

Sensing Weakness, Uber’s Asian Rivals Make $2.5 Billion Play

Blackstone Mortgage 7.9% Dividend Yield Is Not Good Enough

Quest for AI Leadership Pushes Microsoft Further Into Chip Development

Samsung Takes Aim at TSMC with Plans to Triple Chip Foundry Market Share

Direct Lending Funds’ Fading All-Weather Appeal

Howard Lindzon: StockTwits Adds Streams and Symbology for 100+ Cryptocurrencies and Tokens

Joshua Brown: Upside Surprises Hit a Five Year High

Ben Carlson: The Game Beyond the Game

Be sure to follow me on Twitter.

-

Three Quick Charts

Posted by Eddy Elfenbein on July 22nd, 2017 at 11:15 pmHere are some charts I wanted to show you.

First up, is Moody’s (MCO) recent performance. We got a nice response from the earnings report.

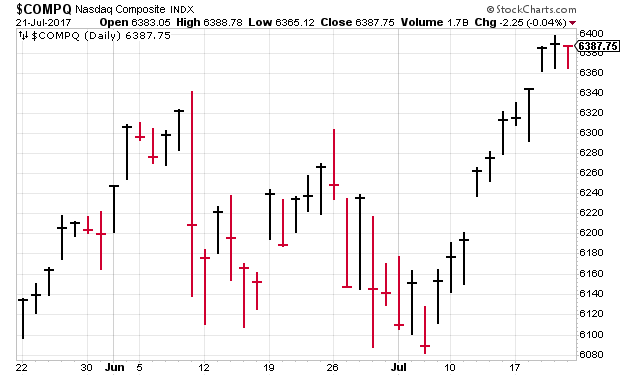

Second up, the Nasdaq Composite just snapped a 10-day winning streak.

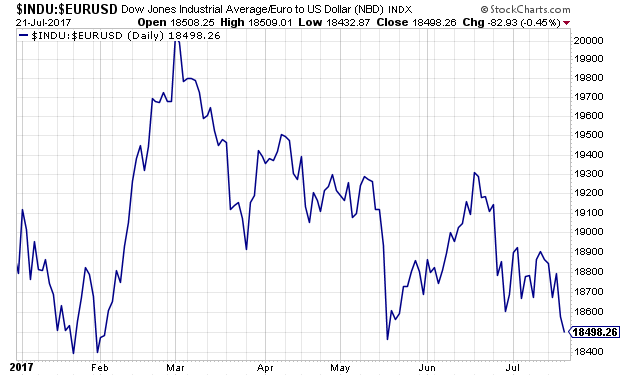

Om CNBC, I mentioned that the Dow is down for the year priced in euros. Here’s the chart:

-

Healthcare Breakout?

Posted by Eddy Elfenbein on July 21st, 2017 at 6:27 pm -

Trading the Dollar Decline

Posted by Eddy Elfenbein on July 21st, 2017 at 6:24 pm -

Moody’s Earns $1.51 per Share

Posted by Eddy Elfenbein on July 21st, 2017 at 8:20 amMoody’s (MCO) had a very good earnings report this morning, plus they raised guidance. For Q2, the ratings company earned $1.51 per share which is a 16% increase over last year. That also beat expectations by 17 cents per share. Quarterly revenues were up 8% to $1 billion, and operating income rose 12% to $457.5 million. Very good results.

More importantly, Moody’s raised their full-year earnings range to $5.35 to $5.50 per share. The previous range was $5.15 to $5.30 per share. Things are going well for Moody’s.

“In the second quarter, Moody’s recorded $1.0 billion in quarterly revenue, as well as double-digit EPS growth,” said Raymond McDaniel, President and Chief Executive Officer of Moody’s. “Given the strength of the first half and a supportive market environment, we are raising our full year 2017 diluted EPS and adjusted diluted EPS guidance ranges to $5.69 to $5.84 and $5.35 to $5.50, respectively.”

Mr. McDaniel added, “We continue to expect our previously announced acquisition of Bureau van Dijk to close in the third quarter of 2017 and look forward to further extending Moody’s position as a leader in risk data and analytical insight.”

This is a very good report.

-

CWS Market Review – July 21, 2017

Posted by Eddy Elfenbein on July 21st, 2017 at 7:08 am“Don’t confuse brains with a bull market.” – Humphrey B. Neill

Second-quarter earnings season kicked off this week for our Buy List stocks. Unfortunately, we’ve had a few poor reactions to the earnings reports even though the underlying fundamentals of our companies are still pretty strong.

We’ve had six Buy List stocks reports so far this week, plus Moody’s is due to follow later today. In a bit, I’ll go over all our earnings reports. I also have a few new Buy Below prices for you. Later on, I’ll preview six more earnings reports coming next week.

Overall, Wall Street has been in a buoyant mode. The S&P 500 has continued to make several new all-time highs. Volatility remains extremely low. Here’s an interesting stat: Only once in the last 14 trading days has the S&P 500 fallen by more than 0.1%. It’s almost as if every trading day, the market closes just a tiny bit higher. Now let’s take a look at what was a very busy week for earnings.

Signature Bank Earns $2.21 per Share

On Wednesday, Signature Bank (SBNY) started off the second-quarter earnings season for our Buy List. The New York-based bank reported quarterly earnings of $2.21 per share, which matched Wall Street’s consensus.

But there’s a big caveat to that number. It doesn’t include Signature’s “provision expense and write-downs for the taxi-medallion portfolio.” As we’ve seen, SBNY took a bath on those medallion loans. Uber, Lyft and others have knocked the entire cab industry for a loop. But as I’ve said, this is a known problem, and SBNY has been working on it.

“We did not, nor did any others, foresee the dramatic decline in taxi-medallion values caused by a combination of rapid radical disruption by app-based hailing systems and inaction by governmental authorities. We did, however, see the disruption coming in time to set an upper limit on loan amounts and to stop our lending earlier than most,” said Scott A. Shay, Chairman of the Board.

I was more concerned with net interest margin. That’s the key metric for any bank. For Signature, their net interest margin for Q2 was 3.11%. That’s pretty good. Overall, this was an OK quarter for Signature. It’s largely what I expected.

Traders were not pleased with the earnings reports. The shares have struggled lately, but I still like SBNY. Don’t let the downdraft scare you. This week, I’m dropping my Buy Below on Signature down to $144 per share.

Five Earnings Reports on Thursday

Thursday was a very busy day for us, as we had five Buy List stocks report earnings.

Leading off the group was Danaher (DHR). The diversified manufacturer said they made 99 cents per share for Q2. Danaher had previously told us to expect earnings to range between 95 and 98 cents per share.Thomas P. Joyce, Jr., President and Chief Executive Officer, stated, “During the second quarter, we delivered double-digit adjusted earnings per share growth, generated strong cash flow, and our two most recent large acquisitions – Pall and Cepheid – continued to perform very well.”

Joyce continued, “As we look to the second half of the year, we expect our core growth rate to accelerate compared to first half levels off of improving order trends and as recent acquisitions become part of our core revenue. We believe that the power of the Danaher Business System, significant opportunities across our portfolio, and a strengthening balance sheet position us well for the remainder of 2017 and beyond.”

Now for guidance. For Q3, Danaher said to expect earnings between 92 and 96 cents per share. Wall Street had been expecting 96 cents per share. The good news is that Danaher raised its full-year range. The old range was $3.85 to $3.95 per share. The new range is $3.90 to $3.97 per share.

Despite the higher guidance, the shares pulled 3% during Thursday’s trading. Frankly, the report looked just fine to me. The company is doing well. I’m keeping Danaher’s Buy Below at $90 per share.

Snap-on (SNA) said they made $2.60 per share for Q2. That was five cents better than expectations. Net sales rose 5.6% to $921.4 million. Diluted EPS rose by 10.2% over last year’s Q2.

The CEO said, “Our year-over-year improvement in operating margin before financial services reflects ongoing progress through our Snap-on Value Creation Processes. At the same time, these results also demonstrate continued advancement along our strategic runways for growth, as indicated by the notable increase in activity in the quarter. Despite some sales headwinds in the quarter for the Snap-on Tools Group, we believe the vehicle-repair markets in which we operate remain robust and afford significant ongoing opportunity. Furthermore, our acquisition of Norbar Torque Tools in the second quarter adds to our expanding product offering to customers in critical industries. Finally, these results would not have been possible without the dedication and capability of our franchisees and associates worldwide; I thank them for their extraordinary commitment and ongoing contributions.”

SNA was also punished by traders. On Thursday, the shares closed 4.7% lower. I don’t understand how a five-cent beat can result in a $7.37 falloff in the share price, but that’s Wall Street for you. This week, I’m dropping my Buy Below on Snap-on down to $161 per share.

Alliance Data Systems (ADS) was the ugly one this week. The loyalty-solutions people said they pulled in $3.84 per share for Q2. That was 11 cents more than expectations. Quarterly revenue rose 4% to $1.8 billion.

However, the big news is that ADS is lowering its full-year guidance from $18.50 to $18.10 per share. ADS said its brand-loyalty business “produced soft results.” But ADS is actually bumping up its revenue guidance from $7.7 billion to $7.8 billion.

The company also said it’s “comfortable” in giving initial 2018 guidance of $21.50 per share in core earnings. The consensus on Wall Street was for earnings of $21.42 per share. Still, Wall Street was not pleased with Thursday’s report. Shares of ADS dropped by 9.5%. I’m lowering my Buy Below to $252 per share.

Sherwin-Williams (SHW) had a big earnings miss. The company only made $3.80 per share last quarter. Wall Street had been expecting $4.57 per share. The reason for the earnings shortfall was costs assoicated with the recent merger with Valspar.

Sherwin said they see Q3 earnings coming in between $3.70 and $4.10 per share. That includes a charge of $1.10 per share related to the acquisition. Wall Street had been expecting Q3 earnings of $4.91 per share.

For all of 2017, Sherwin now expects earnings to range between $12.30 and $12.70 per share. That will include $2.50 in charges related to the acquisition. Wall Street had been expecting $14.76 per share.

Shares of SHW got clobbered early Thursday. At one point it was down more than 6.1%. But the stock recovered some lost ground and closed down 2.5%.

After the closing bell on Thursday, Microsoft (MSFT) reported fiscal-Q4 adjusted earnings of 98 cents per share. But that figure includes a tax benefit of 23 cents per share. Excluding that, MSFT earned 75 cents per share which was four cents more than Wall Street’s consensus.

Revenue in MSFT’s Intelligent Cloud unit rose 11% to $7.4 billion. The company said that Azure revenue rose by 97%, while Office 365 revenue jumped by 43%. The CFO even said that Azure was the primary catalyst for the earnings beat. Microsoft said that LinkedIn brought in $1.07 billion in revenue, and had an operating loss of $361 million.

The software giant also gave upbeat guidance for the current quarter. The company expects Intelligent Cloud revenue to rise by between 8% and 11%. They see Productivity and Business Processes revenue rising by 21% to 24%. Overall, Wall Street seemed pleased by Microsoft’s results. The shares gapped higher during the after-market session, but that’s never a guarantee of what will happen on Friday. For now, I’m going to raise our Buy Below on Microsoft to $76 per share.

Six Buy List Earnings Reports Next Week

Now for next week’s earnings. On Monday, RPM International (RPM) is due to report. This is the odd-man out this earnings season because RPM’s fiscal Q4 ended in May. The other added wrinkle is that usually around 40% of RPM’s annual earnings come during their fourth quarter. The company said it expects full-year earnings to range between $2.57 and $2.67 per share. That implies a Q4 range between $1.13 and $1.23 per share.

Wabtec (WAB) is due to report on Tuesday. The freight-services company has been in the midst of an impressive turnaround. Only recently has it started to falter. In April, WAB said they see full-year numbers ranging between $3.95 and $4.15 per share. Wall Street expects Q2 earnings of 94 cents per share.

Express Scripts (ESRX) follows on Wednesday. The pharmacy-benefits manager has been a headache for us this year. I’ll be curious to hear any updates on the Anthem saga. Fortunately, regular business seems to be going well. Express told us they expect Q2 earnings to come in between $1.70 to $1.74 per share. That’s a pretty optimistic forecast, but I think they can do it.

Next Thursday will be another crowded day for us. We have three more Buy List earnings reports. AFLAC (AFL), the duck stock, said that if the yen averages between 105 and 115 for Q2, then they see earnings coming in between $1.55 and $1.70 per share. The yen has mostly been between 110 and 115 for the last few months.

Cerner (CERN) has been an excellent stock for us this year. The healthcare-IT folks pegged Q2 earnings between 60 and 62 cents per share. That’s a narrow range. I wanted to add that Cerner’s founder, Neal Patterson, recently died. You can read here about his extraordinary contribution to business.

Last is Stryker (SYK). For Q2, Stryker expects EPS between $1.48 and $1.52. The orthopedics firm has a full-year forecast of $6.35 to $6.45 per share. They should be able to achieve both.

Before I go, I wanted to mention that Smucker (SJM) raised its dividend by 4%. The quarterly payout will rise from 75 to 78 cents per share. This is their sixteenth annual dividend increase. The new dividend will be paid on Friday, September 1 to shareholders of record at the close of business on Friday, August 11. Smucker remains a buy up to $131 per share.

Next week will be dominated by earnings reports. There’s actually a Federal Reserve meeting on Tuesday and Wednesday, but don’t expect much in the way of headlines. It’s highly doubtful the Fed will make any move on interest rates. The policy statement will come out on Wednesday afternoon. The big economic report for next week will come on Friday when the government releases its first estimates for Q2 GDP growth. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His