-

Morning News: June 29, 2017

Posted by Eddy Elfenbein on June 29th, 2017 at 7:10 amThe Pound and the Euro Jump as Carney and Draghi Appear Hawkish

Robocalypse Now? Central Bankers Argue Whether Automation Will Kill Jobs

OPEC, Oil Prices and Disruptive Innovation

‘Hammer, Hammer, Hammer’: Canada Lobbies U.S. Before NAFTA Talks

Banks Unleash Surprisingly Big Payouts After Fed’s Stress Tests

Trump Attacks the ‘AmazonWashingtonPost’ Over Taxes

Amazon Is Bringing Back `Prime Day’ on July 11

Samsung Invests $1.9 Billion in U.S. Ahead of Trump-Moon Summit

Blue Apron Slashes Share Price For Its I.P.O.

Staples to Sell for $6.9 Billion, and Its New Owner Has an Uphill Battle

Buffett’s Berkshire on Verge of Becoming BofA’s Top Shareholder

China Is About to Bury Elon Musk in Batteries

Shkreli’s Lawyer Calls Him `Strange’ But Berates Fraud Case Against Him

Jeff Miller: What Are The Limits of Technical Analysis?

Josh Brown: Be Good…Just Not Too Good

Be sure to follow me on Twitter.

-

Atrion Update

Posted by Eddy Elfenbein on June 28th, 2017 at 3:23 pmIn January, I highlighted the stock of Atrion (ATRI). I said that it’s been a spectacular performer and that no one on Wall Street follows the stock.

They describe themselves as follows:

Atrion Corporation is a leading supplier of medical devices and components to niche markets in the health care and medical industry. Atrion’s proprietary products, ranging from cardiovascular and ophthalmology products to fluid delivery devices, are sold to end-users, distributors and other manufacturers worldwide. As a developer and manufacturer of a diverse range of products, Atrion stays on the forefront of technology and manufacturing with products that meet the needs of its targeted markets.

ATRI went from $4 per share in 1989 to $459 when I wrote about it in January.

-

Morning News: June 28, 2017

Posted by Eddy Elfenbein on June 28th, 2017 at 7:01 amRansomware Cyberattack Goes Global

Maersk Shuts Down Some Systems to Help Contain Cyber Attack

Greece on Target to Return to Markets, Exit Bailout

Google Faces Years of EU Oversight on Top of Record Antitrust Fine

Toshiba Slaps A Billion Dollar Lawsuit On Western Digital

Nvidia’s Automotive Domino Effect

Philips to Buy Cardiac Firm Spectranetics for $1.7 Billion

Nestle, Under Pressure, Plans Buyback and Perhaps Acquisitions

Turmoil Continues at Pandora Media as Chief Executive Resigns

Madoff Settlements Reach $12 Billion With New Accords

Cullen Roche: The Right Way to Use Economics as an Investing Tool

Howard Lindzon: Price, People, Patterns…Repeat!

Be sure to follow me on Twitter.

-

WaPo: Claire’s is ‘a complete train wreck’

Posted by Eddy Elfenbein on June 27th, 2017 at 11:56 amAt the Washington Post, Abha Bhattarai writes on the trouble at Claire’s. The retailer has reported 11 consecutive quarters of declining sales and racked up more than $2 billion in debt

So far this year, more than 300 retailers have filed for bankruptcy, including mall staples BCBG Max Azria, Rue21, Wet Seal and the Limited. Others, including Macy’s, Sears and Bebe have closed hundreds of stores.

“It’s mass destruction at American malls, and Claire’s is right in the middle of it,” said Howard Davidowitz, chairman of retail consulting and investment banking firm Davidowitz & Associates. “Claire’s, which at one time was the most profitable chain in the business, has become a complete train wreck.”

It’s been a confluence of bad news for the Chicago-based chain, which has long relied on groups of girls coming into its stores with their weekly allowances or birthday money. Fewer Americans are going to malls these days, and those who do increasingly are shopping at fast-fashion chains like H&M, Forever 21 and Zara, all of which have boosted their accessories sections in recent years.

And although Claire’s, which also owns the accessories brand Icing, has built up its website in recent years, analysts say online shopping is a tricky proposition for the company’s young shoppers, many of whom don’t have access to a credit card.

-

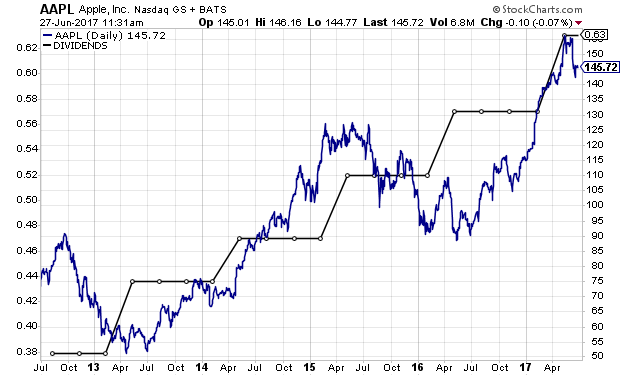

Buying Apple for Dividends

Posted by Eddy Elfenbein on June 27th, 2017 at 11:28 amFrom Jeff Reeves at US News and World Report:

Eddy Elfenbein, portfolio manager of the AdvisorShares Focused Equity ETF (CWS), says Apple can be a dividend play and that income investors don’t have to look solely for “old granny stocks” that offer income but little in the way of growth.

AAPL is a great alternative to traditional stocks that income-oriented investors buy, Elfenbein says, because it pairs dividends and growth – which means modest dividends now could become significantly larger over time.

“Too many investors ignore dividends, but they’re very important” in any investment, he says.

-

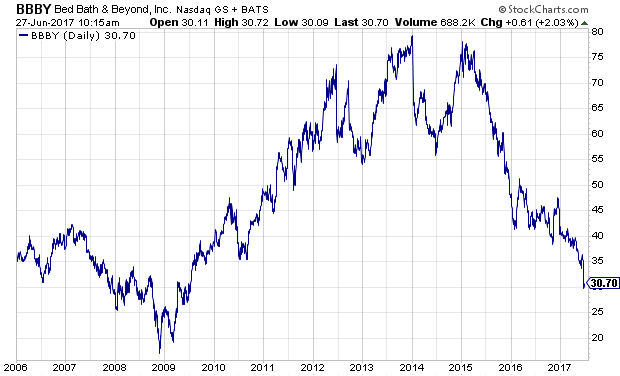

Bed Bath & Beyond Plunges

Posted by Eddy Elfenbein on June 27th, 2017 at 10:13 amLast Friday, shares of Bed Bath & Beyond (BBBY) dropped 12%. They missed earnings by a mile and same-store-sales growth was terrible. This is difficult for me to see. I try not to let my feelings get in the way of investing, but it’s hard to see a company I liked for such a long time fail so badly.

Bed Bath & Beyond was on our Buy List every year until I decided to drop it from this year’s list. It certainly looks like I made the right call. In fact, I probably held on too long.

This is especially hard for me because BBBY used to exhibit all the signs of the stocks I like. It was an Eddy stock if there ever were one. They had strong cash flow, low debt, solid margins and a consistent operating history.

The stock was actually a big winner for us for a few years. Starting in 2012, BBBY began lagging the market. At first, I dismissed the slide as a short-term move. I gave BBBY the benefit of the doubt. Then I saw that the problems were severe and eventually let it go.

The lesson for investors, especially me, is that good stocks can turn into bad ones very quickly. Selling a position should be completely unemotional.

-

Morning News: June 27, 2017

Posted by Eddy Elfenbein on June 27th, 2017 at 7:12 amChina’s Premier, Li Keqiang, Praises Free Trade, in Contrast to Trump

Hollywood is Auditing China’s Box Office for the First Time

Indian Technology Workers Worry About a Job Threat: Technology

Google Fined $2.7 Billion in E.U. Antitrust Ruling

Draghi Says Stimulus Still Needed Even as Euro Area Reflates

No, Fed Didn’t Make a Mistake by Hiking Rates

The Top Five Tech Rivals Join Forces to Shape Policy—and Fight the Government

Buffett Wants a Big Deal. Lately, He’s Settled for Small Ones

With Crowding in U.S. Market, Activist Investors Look to Europe

California Is Listing a Key Ingredient in Monsanto’s Roundup Weed Killer as Cancer-Causing

Sprint Enters Into Exclusive Talks With Charter, Comcast On Wireless Deal

Effects of Takata Bankruptcy to Extend Far and Wide

World’s First ATM Machine Turns to Gold on 50th Birthday

Ben Carlson: Playing All The Hands You’re Dealt

Roger Nusbaum: Central Bank Hedge Funds?

Be sure to follow me on Twitter.

-

Checking In On The 2/10 Spread

Posted by Eddy Elfenbein on June 26th, 2017 at 12:43 pmI like to take an occasional look at the spread between the two- and ten-year Treasuries. Over the last 35 years, negative 2/10 spreads have often preceded recessions. It’s not perfect, but the spread’s track record is better than a lot of economists’ track records.

Thanks to the Fed’s latest rate hike, the spread is down to about 80 points. It’s very close to a 10-year low.

We’re not in the danger zone just yet, but we’re getting closer. The futures market thinks the Fed will hold off doing anything for a few months. They currently see a 50-50 chance of another rate hike in December.

-

The Number of Stocks Has Dropped in Half

Posted by Eddy Elfenbein on June 26th, 2017 at 11:23 amIn the Wall Street Journal, Jason Zweig points out that the number of publicly traded stocks has dropped in half over the last 20 years. This, Zweig posits, may help explain why so many active managers have failed to beat the markets. The reasoning is that the stocks that went into making historically-attractive strategies are no longer around.

Small-caps work! But there are so few small-caps left.

Or, micro-caps work! But there are only a handful left.

As a result, active managers are plowing over the same fields. The effect has hit the small-cap arena especially hard. Twenty years ago, there were over 4,000 stocks that were too small for the Russell 2000. Today, there are less than 1,000.

I tend to be skeptical about claims that don’t make intuitive sense. For example, tobacco stocks have done very, very well historically. That’s great, but I don’t see it as a reason why that should continue. They’re for-profit companies just like so many others. But it does make sense for bonds to lag stocks over the long-term because they’re different kinds of instruments.

Whenever we hear that “value” or “momentum” has done well in the past, we have to remember that it’s likely that meant a very different group of stocks that we have to work with today.

-

Morning News: June 26, 2017

Posted by Eddy Elfenbein on June 26th, 2017 at 6:55 amOnly the World Can Stop Germany as Business Climate Hits Record

Italy Bank Deal Lifts Europe Shares, Dollar on Back Foot

Trump’s Anti-Nafta Stance Is on a Collision Course With Natural Gas

Texas Is Too Windy and Sunny for Old Energy Companies to Make Money

Corporate Tax Rate at 28% Seen as More Likely Than Historic Cut

Bankers Are Hiring Cyber-Security Experts to Help Get Deals Done

The Credit Card Rewards War Rages. Are You the Loser?

Takata’s Long Road Through Bankruptcy

Loeb’s Third Point Targets `Staid’ Nestle for Change

Shkreli Made Big-Money Brag to FBI and Now Faces His Reckoning

China Sentences 3 Australians to Prison for Promoting Gambling

Jeff Miller: Technical Danger Signals?

Michael Batnick: This Is Your Nightmare Scenario

Jeff Carter: The Human Crisis in Finance

Be sure to follow me on Twitter.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His