-

Morning News: June 26, 2017

Posted by Eddy Elfenbein on June 26th, 2017 at 6:55 amOnly the World Can Stop Germany as Business Climate Hits Record

Italy Bank Deal Lifts Europe Shares, Dollar on Back Foot

Trump’s Anti-Nafta Stance Is on a Collision Course With Natural Gas

Texas Is Too Windy and Sunny for Old Energy Companies to Make Money

Corporate Tax Rate at 28% Seen as More Likely Than Historic Cut

Bankers Are Hiring Cyber-Security Experts to Help Get Deals Done

The Credit Card Rewards War Rages. Are You the Loser?

Takata’s Long Road Through Bankruptcy

Loeb’s Third Point Targets `Staid’ Nestle for Change

Shkreli Made Big-Money Brag to FBI and Now Faces His Reckoning

China Sentences 3 Australians to Prison for Promoting Gambling

Jeff Miller: Technical Danger Signals?

Michael Batnick: This Is Your Nightmare Scenario

Jeff Carter: The Human Crisis in Finance

Be sure to follow me on Twitter.

-

CWS Market Review – June 23, 2017

Posted by Eddy Elfenbein on June 23rd, 2017 at 7:08 am“Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.” – Peter Lynch

The stock market easily survived the Federal Reserve’s recent rate hike. In fact, the S&P 500 touched a new all-time high as recently as Monday. However, aside from the new high, the chief characteristic of the market continues to be its very low volatility.

Simply put, the market ain’t doing a whole lot of moving around lately. This seems at odds with so many of the headlines we see coming from around the world. Here’s a remarkable stat: seven times in the last eleven trading sessions, the S&P 500 has closed up or down by less than 0.1%. That’s a very small move.

If the market were to average daily changes of 0.1%, that would mean the Volatility Index (VIX) should be less than 2. The takeaway is clear—we’re living in a volatile world with extremely chill financial markets.

Frankly, we’re in the midst of a lull period for the stock market. I don’t expect much action from the markets until the second-quarter earnings season begins in another few weeks. While there hasn’t been a great deal of action for the overall market, there have been some growing currents underneath the surface.

As the second quarter wraps up, Wall Street is experiencing a pronounced sector rotation. The tech sector is getting wobbly. Healthcare stocks are finally coming to life, and oil is dropping like a stone. Also, many retail stocks are in full retreat. I’ll tell you what it all means. I’ll also run down several of our Buy List stocks. Plus, I have several new Buy Below prices for you. But first, let’s take a closer look at where the economy and markets stand at the middle of the year.

The Stock Market’s Quiet Sector Rotation

The market continues to be quiet and upward. In the last 43 trading says, the VIX has closed over 11 just four times. The S&P 500 has already set 23 new highs this year, and we’re not even at the midway point yet. By historic standards, that’s a high pace.

But not all stocks are equally calm. Two weeks ago, the Tech Sector got dinged for a 2.5% loss. Actually, the selloff on June 9 wasn’t that big by historic standards, but it was gigantic by 2017 standards. Tech stocks are starting to settle down, but there could be another move down for them. Fortunately, Microsoft (MSFT), our large-cap tech position on the Buy List, is holding up well. I’m going to keep our Buy Below for Microsoft at $70 per share. This has been a very solid performer for us. I’m looking forward to another good earnings report next month.

The healthcare sector badly lagged the overall market from the middle of 2015 until the early part of this year. Since then, healthcare has become increasingly popular. In fact, the Healthcare Sector ETF (XLV) has now beaten the overall market for seven days in a row. A lot of this, naturally, surrounds the debate about healthcare reform. I won’t speculate on the political debate, but the U.S. Senate has moved forward with a bill of its own. The bill in its current form probably won’t go very far, but it could serve as the starting point for a negotiation. In any event, many healthcare stocks are acting much better.

On our Buy List, the healthcare rally has been good news for Express Scripts (ESRX). If you recall, the pharmacy-benefits manager dropped more than 10% after they said they’re losing their largest customer. The shares have gained back more than 8% since then. This week, I’m raising my Buy Below on Express Scripts to $69 per share.

I think it’s interesting that healthcare is improving while retail is falling. Perhaps rising premiums are taking a bite about out of shopping plans.

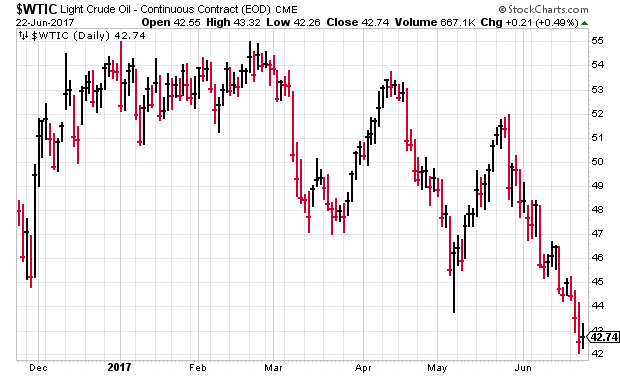

Perhaps one of the more surprising moves lately has been the downward spiral for oil. Many traders had assumed that OPEC had finally wrested control of oil from the bears. Not so. Since May 23, the price for spot West Texas crude has fallen from $51.47 per barrel to $42.74 per barrel. This week, oil touched a 10-month low. This is especially bad news for OPEC because it took a lot of arm-twisting to get all the members on board for the production cuts. Now prices are lower than when they started.

This has been especially difficult for energy stocks. The Energy Sector ETF (XLE) broke $76 per share late last year. This was part of the Trump Rally. This week, the XLE broke below $64 per share. Fortunately, we don’t have any major energy stocks on our Buy List. This wasn’t a prediction on the macro economy from me. Rather, I just didn’t see any energy stocks I liked at the moment.

Amazon’s (AMZN) surprising move to purchase Whole Foods (WFM) has shaken up many consumer and retail stocks. The market apparently thinks this is bad news for stocks like Hormel Foods (HRL) and JM Smucker (SJM). I don’t see why, but the market doesn’t always think these things though.

Shares of SJM have dropped for the last seven days in a row to reach a new 52-week low. The shares now yield 2.5%. This looks to be a good buying opportunity for SJM. I’m going to lower my Buy Below on Smucker to $131 per share.

The real loser in the retail sector of late has been Ross Stores (ROST). I still like Ross a lot, but the stock has been a dud lately. In the last three weeks, ROST has lost over 12%. The deep discounter has proven itself to be one of the few “Amazon resistant” retailers out there. Let’s also remember that Ross has recently raised its full-year guidance, plus they increased their dividend by more than 18%. I’m going to drop my Buy Below on Ross down to $59 per share this week. The next earnings report is due out in mid-August.

Since the beginning of June, the Consumer Discretionary Sector (XLY) and Consumer Staples (XLP) have both been laggards. I’m not sure if this trend will last. I noticed, for example, that this week, we got a very good existing-home sales report. For May, existing-home sales rose 1.1%. This was the third–highest report in the last 10 years. On a year-over-year basis, housing inventory has dropped for 24 straight months. That’s probably a decent sign for consumer spending. I should also note that initial jobless claims have now been below 300,000 for 120 straight weeks.

Buy List Updates

Shares of Alliance Data Systems (ADS) have drifted higher recently. The stock rallied after its earnings report in April, but lately gave most of it back. ADS has now climbed for the last six days in a row. This week, I’m raising my Buy Below to $264 per share.

Cerner (CERN) has been a big winner for us this year. It’s currently up 42% YTD. This week, I’m going to bump our Buy Below up to $68 per share.

CR Bard (BCR) isn’t slowing down since the acquisition was announced. The stock just touched another 52-week high this week (see below). The merger with Becton, Dickinson seems to be going well, and both stocks are drifting higher. I’m keeping my Buy Below on BCR at $330 per share.

This week, Stryker (SYK) announced that it’s buying Novadaq Technologies for $701 million. Novadaq is a Canadian fluorescence-imaging technology manufacturer. The deal is expected to dilute Stryker’s earnings by three to five cents per share, but it will have no impact of their full-year adjusted earnings. Stryker’s current guidance for this year is $6.35 to $6.45 per share. I’m raising Stryker’s Buy Below to $145 per share.

That’s all for now. Next week is the final week of trading for the first half of the year. It also marks the three-quarters mark for the decade. On Monday, we’ll report on orders for durable goods. Then on Tuesday is consumer confidence. On Thursday, the government will give its second revision for Q2 GDP. Last month, the government revised Q2 growth from 0.7% to 1.2%. That’s not very good. On Friday, we’ll get the personal-income and spending data for May. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 23, 2017

Posted by Eddy Elfenbein on June 23rd, 2017 at 4:57 amChina Bulls, Don Your Hard Hats

The $100 Billion City Next to Singapore Has a Big China Problem

U.S. Suspends Beef Imports From Brazil

Big Banks Clear First Phase of Federal Reserve Stress Tests

`Nobody Is Perfect’: Some Uber Employees Balk at Travis Kalanick’s Exit

Tesla in Talks to Set Up Electric Car Factory in Shanghai

Why Nvidia and AMD Continue to Ride the Cryptocurrency Mining Wave

Grocery Aisles and E-Commerce Collide With Whole Foods-Amazon Deal

In Qatar Airways, American Airlines May Have an Unwanted Suitor

Toshiba Asks Regulators for Extension on Annual Statement Deadline to Aug. 10

Martin Shkreli, `Pharma Bro,’ Prepares for Trial: `I’m So Innocent’

Miami Man Faces $120 Million Fine For $96-Million Robocall Spree

Ben Carlson: Patience Exemplified

Jeff Miller: Are Traders Joining the Yield Chase?

Cullen Roche: Walk it Back, Random Walker

Be sure to follow me on Twitter.

-

DryShips Reverse Splits Again

Posted by Eddy Elfenbein on June 22nd, 2017 at 9:18 amThis morning, shares of DryShips (DRYS) are having another reverse stock split. This will be their 1-for-5 and it’s DRYS’s seventh reverse in the last 15 months.

The reverse splits add up to 1 to 1.68 million. At Seeking Alpha, a writer notes that the stock would have to rise by nearly 18 billion percent to reach its previous all-time high.

Adjusting for today’s split, the 2007 high is around $30 million.

-

Morning News: June 22, 2017

Posted by Eddy Elfenbein on June 22nd, 2017 at 7:08 amUS, EU Urge China to Limit Food Import Control

MSCI Forgets Its Doubts About China

Saudi Prince’s Elevation Will Have Far-Reaching Consequences in Energy

Inside Travis Kalanick’s Resignation as Uber’s C.E.O.

Kalanick’s Ouster Shows Founder Control Doesn’t Mean Job Security

Why Nike May Start Selling Directly on Amazon

Ebay’s New Price Match Guarantee Makes Sure Shoppers Get Lowest Prices On New Products

Oracle Surges 10%: Well On Our Way to Passing Salesforce, Says Ellison

Tesla Is Shaking Up Its Entire Autopilot Team At a Critical Time for the Program

Tesla Reaches Pact With Shanghai for China Production

Takata to File for Bankruptcy Monday, SMFG to Provide Bridge Loan

Airbus Concedes Defeat to Boeing in Paris Order Race

A Kansas Investment Firm Spurring Change on Wall Street

Roger Nusbaum: The Crash That Will Bring Down The Entire Galaxy

Joshua Brown: What Investors Need to Know About MSCI’s Historic China Decision

Be sure to follow me on Twitter.

-

Morning News: June 21, 2017

Posted by Eddy Elfenbein on June 21st, 2017 at 7:02 amLiquor Titans to Coal Miners: the Chinese Stocks in MSCI’s Club

OPEC Should Heed Lessons From Achnacarry Agreement: Kemp

The Fed Rate Hike And Gold – Precious Metals Supply And Demand

I Know Why Mutual Funds Fail to Perform

Ford’s Big Bet: Americans, and Trump, Are Ready for Chinese Cars

ExxonMobil Lends Its Support to a Carbon Tax Proposal

Uber Founder Travis Kalanick Resigns as C.E.O.

Uber and Lyft Messed With Texas – And Won

Amazon Bites Off Even More Monopoly Power

Amazon Will Let Customers Try On Clothes Before Buying

Toshiba Picks Preferred Bidder for Microchip Business

Apple Tells Court Qualcomm Chip Licenses Are Invalid

Adobe Notches Beat Again With Sales Outlook on Cloud Demand

Cisco’s Next Big Bet Is Years in the Making

Jeff Miller: Fed Balance Sheet Unwind? No Reason to Worry!

Ben Carlson: Money Manager Cliches

Be sure to follow me on Twitter.

-

Morning News: June 20, 2017

Posted by Eddy Elfenbein on June 20th, 2017 at 7:08 amBarclays and Former Executives Charged Over Qatar Fund-Raising

Lockheed Signs Pact With Tata to Make F-16 Planes in India

Hammond, Carney Fight for City of London as Brexit Talks Start

Trump May Have A Lot Of Money, But Documents Show He Owes A Lot, Too

Millennials Are Helping America Save More Money

Texas Is Too Windy and Sunny for Old Energy Companies to Make Money

UPS to Add Delivery Surcharges for Black Friday, Christmas Orders

Amazon and Whole Foods Could Revolutionize Grocery Delivery. But Do Shoppers Want It?

Blue Apron Pursues I.P.O. as Amazon Looms Over Industry

Boeing Lifts 20-Year Industry Demand Forecast to $6 Trillion

To Prevent Fantasy Monopoly, FTC Blocks DraftKings-FanDuel Merger

Time Warner Signs $100 Million Deal With Snap for Shows and Ads

Samsung Electronics Plans Galaxy Note 8 Launch Event for August

Roger Nusbaum: The Hike Everyone Was Expecting

Cullen Roche: Discipline vs. Knowledge

Be sure to follow me on Twitter.

-

Morning News: June 19, 2017

Posted by Eddy Elfenbein on June 19th, 2017 at 6:49 amChinese State Oil Giants Take Petrol Price Battle To The Pumps

Bitcoin Is Digital Gold. But Will You Buy a Sandwich With It?

Banks Were Told to Keep Skin in Game. They Securitized That, Too

Western Union Built Its Business on Migrants. Can It Survive the Backlash Against Them?

YouTube Sets New Policies to Curb Extremist Videos

Whole Foods Deal Shows Amazon’s Prodigious Tolerance for Risk

Is Spotify Ready for the Big Time?

Lockheed Nears $37 Billion-Plus Deal to Sell F-35 Jet to 11 Countries

The Last Hurrah of Airbus’s Trillion-Dollar Man

Breweries Worry About Anheuser-Busch InBev’s Stake in RateBeer Stite

The Decline of the Baronial C.E.O.

Jeff Miller: Is The Housing Rally Over?

Josh Brown: Flattening is Not Threatening

Michael Batnick: These Are The Goods

Be sure to follow me on Twitter.

-

CWS Market Review – June 16, 2017

Posted by Eddy Elfenbein on June 16th, 2017 at 7:08 am“If you’ve followed my forecasts, you’ve probably lost a lot of money.”

– St. Louis Fed President James BullardWell…it happened. As expected, the Federal Reserve raised interest rates again this week. I don’t like it, but we can’t always choose the ideal environment to invest in. If you wait for things to be perfect, then you’d never be in the market.

This was an important meeting for the Fed because they also explained what they intend to do with their enormous balance sheet. This has been a big concern on Wall Street. I’ll explain what it all means. Additionally, the central bankers updated their economic projections. I should explain that the Fed has a pretty dismal track record of predicting where things will go, but it’s still useful to look at their outlook for the economy.

Fortunately, the stock market continues to hold up well. The S&P 500 closed at another all-time high on Tuesday. However, there’s been a significant weak link in the market recently, and that’s big-cap tech stocks. Don’t feel too bad for these guys. They’ve been running up the score lately, so I can’t say it’s not wholly surprising to see them face a little pain. Outside of Microsoft, this recent trend hasn’t had a big impact on our Buy List. In fact, our Buy List has been doing quite well of late. Before I get to all that, let’s look at what the Fed did this week.

The Federal Reserve Raises Interest Rates

On Wednesday afternoon, the Federal Reserve released its latest policy statement. The central bank said they raised their range for the Fed funds rate to between 1% and 1.25%. That’s an increase of 0.25%. This was the second rate hike this year, and the fourth of this cycle.

As I’ve said before, I think this move is a mistake, and I won’t belabor the arguments against the increase. It happened, and we have to move on. I’ll note that there was one dissenting voice, Neel Kashkari of the Minneapolis Fed, who agrees with me.

On Wednesday morning, just hours before the Fed’s statement, the government released the inflation report for May. The report again showed that there’s absolutely no threat of inflation on the horizon. If anything, the rate of inflation has fallen off sharply over the last three months. It’s hard to justify rate increases to fight off an inflation threat that doesn’t exist.

During May, the headline rate of inflation fell by 0.1%. Economists had been expecting no change. Some of that was due to falling prices for gasoline. That’s why we also want to look at the “core rate,” which excludes volatile food and energy prices. But the core rate for May only rose by 0.1%. There’s simply not much inflation out there.

You may recall that March was the weakest month for core inflation in over 30 years. As with all stats, we don’t want to be fooled by one-point trends. There are always outliers, so we want to see more evidence. Indeed, that evidence came in the last two months. Core inflation for April and May were the second- and third-weakest of the last three years, trailing only March. So it’s not only that inflation is low: it’s actually going lower.

More troubling is that we’ve seen a swift reaction in the bond market. On Tuesday, the yield on the 10-year Treasury dropped to 2.1%. That’s the lowest point all year. After the election last year, Treasury yields soared on economic optimism, but that’s largely faded in recent weeks. The spread between the two-year and ten-year Treasuries is now less than 80 basis points.

In the Fed’s policy, they acknowledge the recent weakness in the economy, but they seem to feel that it will soon pass. I hope they’re right, but I just don’t see the evidence just yet. In fact, this week’s retail-sales report was another dud. Economists had been expecting a gain of 0.1%. Instead, retail sales fell 0.3% in May. This was the biggest drop in 16 months.

But the Fed thinks they’ve only started raising rates. According to the latest Fed projections, they expect to raise rates one more time this year. After that, the outlook becomes a lot less clear (the blue dots get much more dispersed). The Fed sees three more hikes in 2018, and possibly three more in 2019. That means it’s possible that the 2/10 spread could be negative as early as next year. Still, I don’t want to be too alarmist. By the Fed’s own projections, they see real interest rates staying negative for another 18 months. My point is that we’re not in the danger zone just yet, but we can see it on the horizon.

The Fed also unveiled its plans for what they intend to do with their $4.2 trillion balance sheet, or as the Fed calls it, their “normalization plans.” The Fed said they plan to stop reinvesting the proceeds of their bonds in gradually increasing increments. It will be a long, long time before the balance sheet gets back to normal. But the key point is that the Fed intends to raise rates at the same time they address their balance sheet. That point wasn’t always so clear.

The Great Tech Stock “Crash” of 2017

What’s happening with tech stocks? The tech sector has fallen four times in the last five sessions, and some of those drops have been pretty sharp. The stock market had been so placid for so long that a fairly minor bump in the road for large-cap tech stocks has rattled a lot of investors.

Let’s add some context here: tech stocks had been leading an already powerful rally. In fact, the rally hasn’t even affected the whole sector. A huge part of the gains have fallen on just five major stocks; Facebook, Apple, Amazon, Microsoft and Google. That’s right: the latest acronym hitting Wall Street is FAAMG.

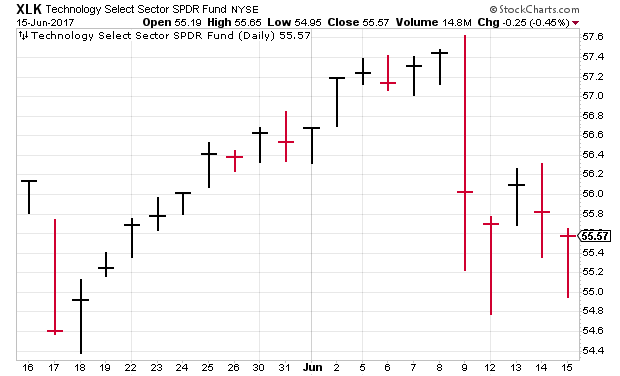

At one point, Facebook, Amazon and Apple were all up over 30% for the year. That was more than three times the rest of the market. Not anymore! In the last week, the Tech Sector ETF (XLK) has dropped from $57.44 to $55.57.

I want to stress that the damage we’re seeing in tech is hardly unprecedented. What’s been unusual is the exceedingly low volatility visible until now. It’s the change from very, very low volatility to normal behavior that’s jarred Wall Street. Frankly, the current losses are very normal.

Our Buy List has largely side-stepped the FAAMG phenomenon, with the exception of Microsoft (MSFT). Shares of MSFT just pulled back below our $70 Buy Below price. Again, that’s following an impressive run-up. Of all the FAAMG stocks, Microsoft is the one I’m least worried about. The last few earnings reports have been quite good. Also, I’m expecting another dividend hike in September. For now, I’m not worried about Microsoft, but I think we’ll see more losses in the tech sector for a few more weeks. Now let’s look at some of our Buy List stocks.

Buy List Updates

There hasn’t been a lot of news impacting our Buy List stocks this week. The good news is that our performance versus the rest of the market continues to be strong.

This week, I want to make a few adjustments to some of our Buy Below prices. As always, please bear in mind that these are not price targets. Instead, they’re guidance for current entry into a stock.

First up is AFLAC (AFL). I’m lifting my Buy Below on the duck stock to $80 per share. AFL has gapped up recently. Paul Amos, the current president and CEO’s son, said he’ll be leaving the company. That probably takes him out of the running to be the next CEO.

I’m also raising our Buy Below on Fiserv (FISV) to $131 per share. This stock is as strong and steady as it’s ever been. I’m looking forward to another good earnings report next month.

I’m dropping my Buy Below on Ross Stores (ROST) to $66 per share. I still like Ross a lot, but the stock has been caught up in a poor environment for retail. I’m not worried about Ross. This will be a real bargain if you can get Ross below $60 per share.

Finally, I’m lowering my Buy Below on Snap-on (SNA) to $168 per share. This is another good stock caught in a downtrend.

That’s all for now. There’s not much in the way of economic news next week. On Wednesday, we’ll get the existing-home sales report for May. Then on Friday will be the new-home sales report. For now, the housing sector is a bright spot in the economy, while consumer spending looks tired. We’ll see how long this can last. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 16, 2017

Posted by Eddy Elfenbein on June 16th, 2017 at 7:03 amBOJ Upgrades View on Consumption, Rules Out Early Exit From Stimulus

The Housing Recovery Is Leaving Out Most of America

Major Changes Are Coming to the U.S. Grocery Industry

Google Faces Record EU Antitrust Fine

At Last, Jeff Bezos Offers a Hint of His Philanthropic Plans

Dow Chemical and DuPont Have Won U.S. Antitrust Approval to Merge

Nestle’s ‘Quiet Man’ Shows Hand in Move to Sell U.S. Sweets

Nike to Cut Jobs Amid Struggle Against Adidas

Snapchat’s Stock Just Dipped to Its IPO Price for the First Time

Booz Allen Hamilton Says It Is Under Federal Investigation

Air Bag Maker Takata To File For Bankruptcy This Month

Anbang’s Sales Dry Up In New Challenge For Chinese Insurers

Jeff Miller: Can Psychology Be Applied to Market Behavior?

Cullen Roche: The Era of Irrational Apathy

Jeff Carter: Sunk Costs and Investing

Be sure to follow me on Twitter.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His