-

Bloomberg: JPMorgan May Show Record Profit

Posted by Eddy Elfenbein on January 12th, 2012 at 10:14 amJPMorgan Chase ($JPM) will release its Q4 earnings tomorrow. Wall Street expects the bank to report earnings of 91 cents per share. This would be the first earnings drop since Q2 of 2009.

Here’s an outlook from Bloomberg:

JPMorgan, the biggest U.S. bank by assets, will probably report a 23 percent slump in fourth-quarter adjusted profit from the same period in 2010 to $3.74 billion, or 90 cents a share, according to the survey. Analysts lowered their estimates after Chief Executive Officer Jamie Dimon, 55, said at a Dec. 7 investor conference that trading would be “essentially flat” from the third quarter.

Banking Units

Revenue at the company’s investment-banking unit slid this year from $8.2 billion in the first quarter to about $4.5 billion in the third after backing out a $1.9 billion one-time accounting gain as concern mounted that Greece would default and U.S. lawmakers would fail to raise the debt ceiling. JPMorgan told investors in October that the division would face similar market conditions for the rest of the year.

Trading results got a lift in the third quarter as the price of bank debt fell, resulting in a so-called debt-valuation adjustment that boosted profits for JPMorgan, Goldman Sachs and Citigroup. The accounting adjustment probably hurt banks in the fourth quarter as price of their debt rose, resulting in the opposite effect on earnings.

“Trading and investment-banking revenue has been weak and volatile, especially over the last two quarters, but really the last two years,” Najarian said. Investment-banking results will be worse for the fourth quarter than in the third quarter, he said.

Revenue Declines

Overall revenue at JPMorgan is expected to drop 13 percent for the quarter and 4 percent for the year, to $98.9 billion. Fixed-income trading revenue at U.S. banks may fall 12 percent from the third quarter, minus accounting adjustments, while equities revenue drop 10 percent and investment-bank revenue remains unchanged, David Trone, an analyst at JMP Securities, wrote in a Dec. 16 report.

Markets showed little improvement in the fourth quarter, as trading remained subdued, corporate and institutional clients stayed out of the markets and the holidays slowed deal and trading traffic.

Lenders will continue to face pressure from persistently low interest rates, which have compressed profit margins on lending. They’ll also have to contend with new restrictions on fees.

The so-called Durbin amendment, which limits what lenders can charge merchants on debit transactions, took effect on Oct. 1, affecting almost all U.S. banks and costing the top 25 about $1.5 billion, according to Jason Goldberg, a senior bank analyst at Barclays Capital in New York.

-

Stocks Against Bonds

Posted by Eddy Elfenbein on January 12th, 2012 at 9:49 amStocks and bonds have acted in near-perfect opposition for the last few years. Since the middle of last year, bonds have soared while stocks have had trouble going anywhere. The S&P 500 is still below its high from April.

As I’ve said, I think the run in Treasuries has come to an end. The bond bull may have other ideas. Just yesterday, the yield on the five-year Treasury came very close to its lowest yield ever.

I think the next move that’s most likely is a falloff in Treasuries while stocks rise. That’s similar to what we saw in late 2010.

-

Morning News: January 12, 2012

Posted by Eddy Elfenbein on January 12th, 2012 at 5:35 amFor Europe, Few Options in a Vicious Cycle of Debt

Hedge Funds Try to Profit From Greece as Banks Face Losses

European Stocks Up; Economic News Key To Momentum

Crisis Respite Gives ECB Room to Pause Cuts

Spain Doubles Target in Debt Auction, Yields Down

Royal Bank of Scotland to Cut 3,500 Jobs as it Exits Mergers

Geithner Prods China, Japan on Iran Oil Imports

Fed Officials Split Over Easing as They Prepare Interest Rate Forecasts

Foreclosure Filings Hit Four-year Low in 2011

Holiday Sales Keep Recovery on Track

A Blend of Politics and Pragmatism at the Auto Show

Chevron Sees 4Q Earnings Well Below 3Q

Raymond James Said to Near $930 Million Purchase of Broker Morgan Keegan

TheAcsMan: As If Yesterday Never Happened

Joshua Brown: Meanwhile, at the Treasury Auction

Phil Pearlman: Is Cisco Systems the Next of the Original NASDAQ Four Horsemen To Run?

Be sure to follow me on Twitter.

-

CA Technologies Up 6% After Hours

Posted by Eddy Elfenbein on January 11th, 2012 at 11:38 pmShares of one of our newbies, CA Technologies ($CA), got a nice boost after the close when Taconic Capital said they took a 5% stake in the company.

According to a filing with the Securities and Exchange Commission, Taconic owns 5.14 percent, or about 25.4 million shares, of CA as of Jan 6, which it acquired for about $563.5 million.

Taconic said the company needed to increase margins in its enterprise business segment and implement a senior management compensation structure that is based mainly on total shareholder returns rather than on absolute growth metrics.

“The Reporting Persons recognize management’s recent efforts to begin addressing these issues, but they emphasize the importance of taking substantial and timely action in pursuit of these objectives,” Taconic said.

The stock was up about 6% after hours.

Oh….one more thing, Taconic is absolutely right.

-

The Buy List Is Beating the Market

Posted by Eddy Elfenbein on January 11th, 2012 at 5:37 pmIt’s very early. Or really, it’s very VERY early, but our Buy List already has a lead over the S&P 500.

Through seven days of trading in 2012, the S&P 500 is up 2.77% while our Buy List is up by 3.38%.

Here’s a look at how the Buy List is doing:

Stock Symbol YTD AFLAC AFL 2.20% Bed Bath & Beyond BBBY 4.88% CA Inc. CA 3.56% C.R. Bard BCR 0.39% DIRECTV DTV 2.17% Fiserv FISV 1.67% Ford Motor F 12.17% Harris HRS 5.74% Hudson City Bancorp HCBK 16.16% Johnson & Johnson JNJ -0.69% Jos. A. Bank Clothiers JOSB -3.69% JP Morgan Chase JPM 10.26% Medtronic MDT 2.46% Moog MOG-A -2.82% Nicholas Financial NICK 0.62% Oracle ORCL 4.83% Reynolds American RAI -1.16% Stryker SYK 6.66% Sysco SYY -0.34% Wright Express WXS 2.45% The Cyclicals Strike Back

Posted by Eddy Elfenbein on January 11th, 2012 at 1:38 pmIn last week’s CWS Market Review, I wrote that the underperformance of cyclical stocks is probably over.

The Morgan Stanley Cyclical Index (^CYC) is well on its way to beating the S&P 500 for the ninth day in a row. It’s not even close today. The CYC is up by more than 1% while the S&P 500 is slightly negative.

Check out the 10-day view:

Stock Market Quietly Sneaks Up on All-Time High

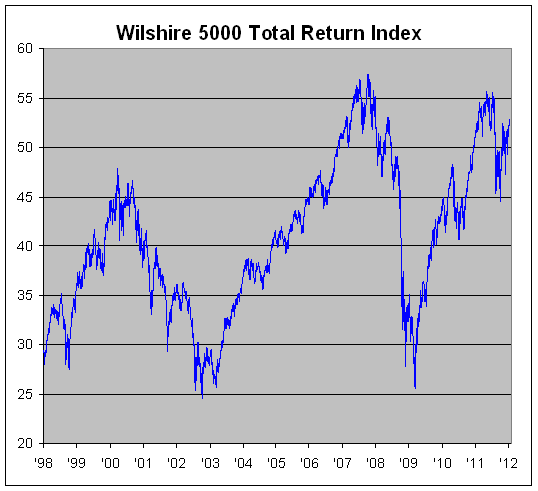

Posted by Eddy Elfenbein on January 11th, 2012 at 12:23 pmThe total return version of the broadest measure of the stock market, the Wilshire 5000 Total Return Index, is quietly approaching an all-time high. “Total return” means it includes dividends.

We have to remember that small-cap stocks have done much better than the large-cap indexes over the past nine years. That’s why the Wilshire 5000 Total Return Index is nearing its high while the S&P 500 is still far away.

Yesterday, the Wilshire 5000 Total Return Index closed at 52.95 which is the highest level since July 28th. If we get another 5% rally, we’ll eclipse the post-crash high which was 55.54 on April 29, 2011. And we need another 8.4% rally to break the all-time peak of 57.39 from October 9, 2007.

Of course, these aren’t very good returns — but they are positive!

Stryker Gives 2012 Guidance

Posted by Eddy Elfenbein on January 11th, 2012 at 11:40 amIt’s a fairly quiet morning on Wall Street. The major indexes are down but only slightly.

I’m happy to see DirecTV ($DTV) up about 3% thanks to an upgrade from Bernstein. The firm now rates DTV as “outperform” and they raised their target price from $48 to $52. The stock is currently at $44.

Hudson City ($HCBK) is pulling back some today but that’s after its big day yesterday.

Stryker ($SYK) won’t report its Q4 earnings until January 24th, but yesterday the company released some early details. The company said that quarterly sales rose by 11% to $2.2 billion.

Stryker also narrowed its full-year forecast from $3.70 – $3.74 per share to $3.72 – $3.74 per share. Remember that for much of last year, Stryker said that they would earn between $3.65 and $3.73 per share, so they were certainly on track.

The company isn’t hiding much here since we already know that they earned $2.70 per share for the first three quarters. That means they expect to report between $1.02 and $1.04 for Q4.

For 2012, the company said that it expects “double digit” earnings growth over 2011. If we assume that means 10% on the nose and we take the midpoint of their range, $3.73 per share, as our guide, that gives us 2012 earnings of $4.10 per share. Wall Street had been expecting $4.11 per share but this can hardly be called lower guidance.

Also, last month Stryker raised their dividend by 18%.

Morning News: January 11, 2012

Posted by Eddy Elfenbein on January 11th, 2012 at 5:18 amMonti Warns of Italy Protests as He Meets With Merkel in Berlin

EU Banks Resist Draghi Bid to Avert Credit Crunch

German Growth Slowed From Record in 2011

Google Wins Biggest Enterprise Deal in Spain

Europe’s $39 Trillion Pension Threat Grows as Economy Sputters

India Lets Starbucks, Ikea Open Stores

Nigeria Shuts Down as Unions Defy Jonathan Over Fuel Subsidy

NYSE-Deutsche Boerse Hangs in Balance

Materials Companies Lift Indexes to 5-Month High

Oil Trades Near a One-Week High as Iran Tension Counters European Economy

Fed Turns Over $77 Billion in Profits to the Treasury

Treasury Secretary Appeals to China Over Iran

As Romney Advances, Private Equity Becomes Part of the Debate

Urban Outfitters CEO Resigns, Stock Falls 15%

Twinkies Maker Preparing for Chapter 11 Filing

Jeff Miller: My Bespoke Roundtable Answers

Stone Street: A Few Coincident Indicators

Be sure to follow me on Twitter.

Correction on the Mankiw Model

Posted by Eddy Elfenbein on January 10th, 2012 at 1:53 pmI have to apologize. I made a mistake in a post from last week in calculating the interest rate based on Professor Greg Mankiw’s interest rate model.

His model for where the Fed funds rate ought to be is:

Federal funds rate = 8.5 + 1.4 (Core inflation – Unemployment)

In my original post, I said that the model finally indicated that the Fed should have positive interest rates. A reader caught my error. The corrected model is below and it shows that interest rates according to the Mankiw model are still negative, although they’ve risen considerably in the past few months.

The model is the blue line and the actual rate from the Fed is the red line. At the current inflation rate, the unemployment rate needs to drop to 8.3% from the current 8.5% for the model to signal positive rates. We’re getting close.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His