-

Morning News: August 10, 2011

Posted by Eddy Elfenbein on August 10th, 2011 at 7:30 amChina’s Interest-Rate Swaps Snap Six-Day Decline on Fed Pledge

China Trade Surplus Widens In July, But Outlook Cloudy

Swiss National Bank’s Action Fails to Cool Franc

Central Bank Props Up Spain and Italy, for Now

European Stocks Advance as Fed Pledges Low Interest Rates; Nestle Gains

Bank of England’s King: Dangerous To Commit To Rate Moves

Commerzbank Profit Drops 93% on Greek Debt

Gold Steadies Near Lifetime High, Econ Worries Linger

Its Forecast Dim, Fed Vows to Keep Rates Near Zero

Goldman Says QE3 Likely After Dovish Fed Statement

Cost of Insuring U.S. Debt Against Default Falls

Technology Investors Turn Wary on Ventures

Europe’s HSBC to Reap $2.4 Billion Gain From Sale of U.S. Card Division

PepsiCo Joins Watchmaker Fossil Bracing for Weak Demand

Phil Pearlman: Far From The Maddening Crowd

Jeff Miller: The Fed Decision and the Market Reaction

Be sure to follow me on Twitter.

-

Dissecting Today’s Market

Posted by Eddy Elfenbein on August 9th, 2011 at 7:38 pmConsider these two facts:

1. In the last year, the S&P 500 is up 3.97%.

2. That entire gain come during the last 45 minutes of trading today.

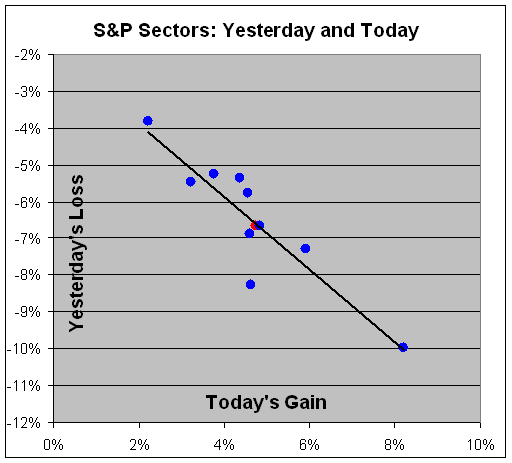

Today was a classic “snap-back” rally. What did the worst on Monday did the best today. What did the best yesterday did the worst today.

Basically, whatever your stocks did yesterday, you probably made about two-thirds of it back today.

Below is a look at the 10 S&P Sectors listed by percent change yesterday (vertical) and today (horizontal). Look at how well they line up.

The red dot is the S&P 500. From left to right, the sectors are Staples, Utilities, Healthcare, Telecom, Tech, Industrials, Energy, Discretionary, Materials and Financials.

The one dot that’s closest to being an outlier is the Energy Sector which gained back about 55% of its loss from Monday.

-

The Market Digests Today’s News

Posted by Eddy Elfenbein on August 9th, 2011 at 3:26 pmHere’s a good example of the market’s reaction to today’s Fed news. I got this from the Wall Street Journal site. It shows the futures for the Fed funds rate for June 2013.

Just a few weeks ago, the market expected the Federal Reserve to have raised rates a few times within the next two years. Now it doesn’t. Note the big jump for today.

-

Today’s Fed Statement

Posted by Eddy Elfenbein on August 9th, 2011 at 3:06 pmThis is actually a surprising statement. The key is the new language: “The Committee currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.”

In other words, the economy is going to be sluggish up to, at least, Election Day.

Information received since the Federal Open Market Committee met in June indicates that economic growth so far this year has been considerably slower than the Committee had expected. Indicators suggest a deterioration in overall labor market conditions in recent months, and the unemployment rate has moved up. Household spending has flattened out, investment in nonresidential structures is still weak, and the housing sector remains depressed. However, business investment in equipment and software continues to expand. Temporary factors, including the damping effect of higher food and energy prices on consumer purchasing power and spending as well as supply chain disruptions associated with the tragic events in Japan, appear to account for only some of the recent weakness in economic activity. Inflation picked up earlier in the year, mainly reflecting higher prices for some commodities and imported goods, as well as the supply chain disruptions. More recently, inflation has moderated as prices of energy and some commodities have declined from their earlier peaks. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee now expects a somewhat slower pace of recovery over coming quarters than it did at the time of the previous meeting and anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, downside risks to the economic outlook have increased. The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee’s dual mandate as the effects of past energy and other commodity price increases dissipate further. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To promote the ongoing economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013. The Committee also will maintain its existing policy of reinvesting principal payments from its securities holdings. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ these tools as appropriate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen.

Voting against the action were: Richard W. Fisher, Narayana Kocherlakota, and Charles I. Plosser, who would have preferred to continue to describe economic conditions as likely to warrant exceptionally low levels for the federal funds rate for an extended period.

There were three dissensions which is unusually high for a Fed meeting. Yields are soaring and the stock market has given back much of its gains.

-

Q2 Earnings Summary from Zacks

Posted by Eddy Elfenbein on August 9th, 2011 at 1:26 pmDirk Van Dijk breaks it down:

Almost done with earnings season, with 433 or 86.6% of S&P 500 second quarter results in. Total earnings growth low at 11.2%, but mostly due to one stock (BAC). Ex-Financials, growth is 20.9% year over year. Total revenue growth 12.15%, 12.73% ex-Financials. Median earnings surprise 3.13% and median sales surprise 2.06%. Remaining firms (67) expected to grow 8.9%, 5.4% growth expected excluding Financials.

If remaining firms all report in line, then 87.9% of earnings are now in. Final growth to be 10.95%, 18.80% ex-Financials. At start of earnings season 9.65% growth expected, 12.18% ex-Financials.

Earnings beats top misses by a 3.42 ratio, sales beats top misses by 2.81 ratio, 69.5% of all firms report positive earnings surprise, 72.1% beat on revenues.

Full-year total earnings for the S&P 500 jumps 45.6% in 2010, expected to rise 16.0% further in 2011. Growth to continue in 2012 with total net income expected to rise 11.5%. Financials major earnings driver in 2010. Excluding Financials, growth was 27.7% in 2010, and expected to be 18.8% in 2011 and 10.8% in 2012.

Total revenues for the S&P 500 rose 7.78% in 2010, expected to be up 6.72% in 2011, and 6.54% in 2012. Excluding Financials, revenues up 9.16% in 2010, expected to rise 11.14% in 2011 and 5.96% in 2012.

Annual Net Margins marching higher, from 5.88% in 2008 to 6.40% in 2009 to 8.65% for 2010, 9.34% expected for 2011 and 9.83% in 2012. Margin Expansion major source of earnings growth. Net margins ex-Financials 7.79% in 2008, 7.07% in 2009, 8.27% for 2010, 8.84% expected in 2011, and 9.25% in 2012.

Revisions ratio for full S&P 500 at 1.61 for 2011, at 1.41 for 2012, both bullish readings. Up from last week and driven by new increases, not old estimates falling out. Ratio of firms with rising-to-falling mean estimates at 1.44 for 2011, 1.30 for 2012 — bullish readings. Total revisions activity still climbing, but should peak soon.

The S&P 500 earned $546.5 billion in 2009, rising to $795.4 billion in 2010, expected to climb to $922.2 billion in 2011. In 2012, the 500 are collectively expected to earn $1.028 trillion.

S&P 500 earned $57.20 in 2009: $83.16 in 2010 and $96.47 in 2011 expected, bottom up. For 2012, $107.53 expected. Puts P/Es at 14.4x for 2010 and 12.4x for 2011 and 11.2x for 2012, very attractive relative to 10-year T-note rate of 2.56%. Top-down estimates: $96.26 for 2011 and $105.44 for 2012.

-

Greg Mankiw & Bill Poole Talk Fed

Posted by Eddy Elfenbein on August 9th, 2011 at 12:20 pm -

Great News! A Very, Very Modest Bounce

Posted by Eddy Elfenbein on August 9th, 2011 at 11:21 am -

Morning News: August 9, 2011

Posted by Eddy Elfenbein on August 9th, 2011 at 7:42 amECB Buys Up Spanish and Italian bonds, Yields Fall

FTSE Enters Bear Market Joining European Index Peers

Swiss Franc Surges to Record Highs on Slump Worries

China Again Faces Growth vs. Inflation Conundrum

South Korea Regulator Bans Short-selling for 3 Months

Gold Tops $1,770 in Biggest Three-day Rally Since 2008

A Wave of Worry Threatens to Build on Itself

Behind S.&P.’s Downgrade, a Committee That Acts in Private

Freddie Mac Swings to Loss, Seeks $1.5 Billion in Aid

Bank of America Shares Plummet Monday After Lawsuit, US Debt Downgrade

Dish Reports Quarterly Profit That Trails Estimates on Customer Losses

MGM Resorts Beats Estimates on Macau Boom

Tepco Suffers US $7.4 Billion Quarterly Loss

Brian Shannon: VWAP From 2009 Low – Chart & Comments

Todd Sullivan: “Davidson” on S&P 500

Be sure to follow me on Twitter.

-

The Market’s 6.66% Plunge: The Devil Is in the Details

Posted by Eddy Elfenbein on August 8th, 2011 at 10:21 pmThe stock market plunged again today and the numbers are mind-boggling. The S&P 500 lost 79.92 points to close at 1,119.46. That’s a loss of 6.66% which is the biggest one-day loss since 2008. It also eerily evokes the market’s March 2009 bottom of 666. Today clocks in as the 25th-worst one-day loss for the market since 1932 (that’s as far as my records go back). For the first time in 15 years, every single stock in the S&P 500 lost money today. If you’re scoring at home, that’s Bears 500, Bulls 0.

The S&P 500 first closed at this level on April 2, 1998 which was more than 13 years ago. As badly as the S&P 500 performed, the Nasdaq did even worse. That index lost 174.72 points today to close at 2,357.69. Down volume led Up volume by a ratio of 151-to-1. The $VIX jumped exactly 50% today—from 32 to 48. It’s tripled in a matter of days.

Once again, the cyclicals bore the brunt of the loss. I know I must sound like a broken record, but this is very important in understanding what’s going on. The Morgan Stanley Cyclical Index (^CYC) dropped 81.22 points today to close at 820.64. That’s a loss of 9.01%. Today was the 17th time in the last 18 sessions that the CYC has trailed the overall market. (Read that sentence again for full effect.)

What happened today is that cyclical stocks and small stocks (which tend to be disproportionately cyclical) did especially poorly. The larger stocks did better, meaning somewhat less terribly. The Dow, for example, “only” lost 634.76 points or 5.55%. That’s more than 1.1% better than the S&P 500. The Russell 2000 ($RUT), which is a small-cap index, lost 8.91% today. Only three months ago, that index was at an all-time high.

Among the S&P 500 Sectors today, the Financials did the worst, dropping 9.98%. Bank of America ($BAC) was down more than 20%. The bank faces many significant challenges, not the least of which is that they suck. After the Financials, the Energy Sector was the second-biggest loser with a loss of 8.27%. Then another cyclical group, Materials, lost 7.28%. The Industrials came in fourth-worst with a loss of 6.87%.

The top-performing group was, not surprisingly, Consumer Staples which lost 3.87%. Next was Healthcare which lost 5.25%. The Healthcare and Staples sectors often track each other. This makes sense since these are areas that will be least-impacted by an economic slowdown. Folks generally don’t cut back on their medical needs or food during a recession, at least not like they do with non-staples.

Here’s what’s happening: The S&P downgrade of the U.S. isn’t so much impacting Treasury yields. Those are as popular as ever. Instead, what we’re seeing is the impact on everything else. For example, the downgrade is leading investors to think that the government won’t rely as heavily on fiscal policy to get the economy moving again. That implies that there will be more monetary accommodation from the Federal Reserve which means low rates for a longer time.

As I’ve written before, buying gold is the equivalent of shorting real short-term T-bills. As a result, gold continues to soar. The element broke $1,700 today, and in after-hours trading, gold got as high as $1,723.40.

I’m at a loss to comment on the stocks on the Buy List. Except for Ford ($F), I like them all. At this price, Ford isn’t looking so bad either. There hasn’t been one single bit of information that’s come out in the last two weeks that could possible make anyone change their mind on any of the Buy List stocks. The earnings reports were very good, and a few stocks raised their full-year ranges.

This year highlights an important fact about investing: The stock market is not symmetrical and it’s subject to “fat tails.” I’ll explain that again but this time in English. The stock market has a tendency to rise slowly and fall back sharply. Bull markets are long and boring. Bear markets are quick and deadly. In fact, most of the debate about a bear market comes after the low. It moves so fast that folks don’t realize its over.

By “fat tails,” I mean that the market builds on its own momentum. People start selling because everyone else is selling. That, in turn, causes even more selling. As a result, these awful market days tend to pile on top of each other. Consider that the three worst days of the past year have come in the past week.

The lesson from this is that we don’t know when the market’s downward momentum will end. Since it builds on itself, it’s like it has become its own monster. The selling will stop, but I have no idea when. These bottoms are often a process. Sometime, like in 2009, it’s a sharp bounce off the bottom. But even that came a few months after the most dramatic news of September 2008.

In economics, there a division between the financial economy, which is the stuff we mostly talk about here (crazy traders in New York and London moving massive amounts of colored paper around) and the real economy (real people buying and producing real things). These two economies have a troubled relationship, and they don’t always move together. The problem is that problems in one can easily tip over into the other.

In 1987, the stock market tanked, but if you looked at broader economic data from that time, you’d hardly know anything went wrong. In 2000, the markets soared above and beyond anything that was happening in reality. What we’ve seen over the past few days is a panic of the financial economy. As of now, we haven’t seen conclusive evidence that the real economy is in recession. I don’t mean it won’t happen, but as of now, the solid evidence isn’t there. What we do have is bits and pieces that the economy is slowing down.

Until there’s more evidence that the economy is headed back in the basement, I continue to like stocks a lot. Bond yields are very low and stock valuations are cheap. This panic will pass.

-

The 10-Day View

Posted by Eddy Elfenbein on August 8th, 2011 at 1:57 pmThe market sinks even lower. The S&P 500 just broke below 1,150. The market is lower than where it was in July 1998. To put that in context, that was a few weeks before Google ($GOOG) was founded.

The Morgan Stanley Cyclical index (^CYC) is now down to 838. That’s an amazing loss. The $VIX has been as high as 41 today. That’s more than double where it was two weeks ago.

S&P downgraded both Fannie Mae and Freddie Mac. Also, Bank of America ($BAC) is getting hammered after news broke that AIG ($AIG) is going to sue them over the mortgage debacle.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His