-

DC Vs. Wall Street

Posted by Eddy Elfenbein on July 25th, 2011 at 10:54 amAll weekend, there were worries that the debt ceiling standoff would lead to a major sell-off on Monday. So far, the market is down but not nearly as much as was feared.

If the markets get even more nervous, that would probably be a catalyst for the folks in Washington to reach a deal. A similar reaction happened when Congress initially shot down the first TARP proposal on September 29, 2008 (also a Monday). The Dow plunged 777 points. The bill passed a few days later. In other words, Wall Street’s reaction to Congressional action can act like a virtual veto.

I often see articles that show how the market has performed under different presidents. I think they get the relationship backward. It assumes the politicians are like players on the field on the markets are the scoreboard. It’s more interesting to see the markets as the players and what the policy makers do as reflecting the changes in the markets.

I haven’t commented much on the political standoff because I’ve assumed that some sort of deal will be reached once all the grandstanding is done. I honestly don’t know what will happen but I see that the financial sector is especially weak today. The market opened lower today, but it’s slowly been climbing higher.

-

Morning News: July 25, 2011

Posted by Eddy Elfenbein on July 25th, 2011 at 7:41 amMoody’s Cuts Greek Rating, Warns on Precedent

Top China IPO Arranger Guosen Challenges Goldman With Hong Kong Expansion

Swiss Franc Strengthens to a Record Against Dollar on U.S. Debt-Ceiling Impasse

Allied Irish Banks H1 Loss Up on Nonperforming Loans

Republicans, Democrats Prepare Rival Debt Plans

Oil Falls in New York After U.S. Lawmakers Fail to Reach Debt Agreement

With Washington at Impasse, Worry Over Investor Reaction

Apple, Coke Defy Economy to Lead Earnings

Toyota Moves Closer to Prequake Output Levels

Canon Lifts Forecast After Rapid Quake Recovery

ING to Sell Latin America Insurance Arm

E*Trade to Explore Sale After Citadel’s Criticism

Jeff Miller: Weighing the Week Ahead: Time for a Debt Ceiling Deal

Phil Pearlman: Making the Case for Default

Be sure to follow me on Twitter.

-

John Coltrane 1963

Posted by Eddy Elfenbein on July 22nd, 2011 at 4:03 pm -

25 Years of No Gains

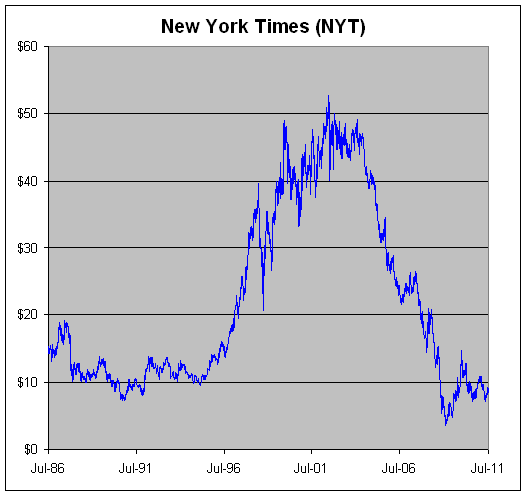

Posted by Eddy Elfenbein on July 22nd, 2011 at 10:48 amThe New York Times’ ($NYT) closing price on July 21, 1986: $14.83

The New York Times’ closing price on July 21, 2011: $9.14

Ten years ago, the stock was at $46. The company suspended its dividend in 2008.

NYT just reported earnings of 14 cents per share which was five cents more than expectations. Quarterly revenues dropped by 2.2%. Print advertising fell by 6.4%. The shares are down below $9 in today’s trading.

-

Reynolds American Earns 67 Cents Per Share

Posted by Eddy Elfenbein on July 22nd, 2011 at 10:15 amIn this week’s CWS Market Review, I said that Wall Street’s earnings estimate for Reynolds American ($RAI) was probably too high. The company just reported second-quarter earnings of 67 cents per share, four cents below estimates.

Cigarette maker Reynolds American says its second-quarter profit fell more than 10 percent on charges related to a legal case and costs related to plant closings.

Excluding those charges, the nation’s second-biggest tobacco company said its profit rose 2 percent as higher prices and smokeless tobacco gains offset cigarette volume declines.

The maker of Camel, Pall Mall and Natural American Spirit brand cigarettes says its net income fell to $304 million, or 52 cents per share, for the period ended June 30. That’s down from $341 million, or 58 cents per share, a year ago.

Adjusted earnings were 67 cents per share. Analysts expected 71 cents per share.

Revenue excluding excise taxes rose less than 1 percent to $2.27 billion, beating analyst estimates for the Winston-Salem, N.C., company.

The stock gapped down this morning which brought the yield close to 6%, but it’s starting to recover.

-

CWS Market Review – July 22, 2011

Posted by Eddy Elfenbein on July 22nd, 2011 at 8:03 amGet ready! Earnings season is stepping into high gear and so far, Wall Street likes what it sees. Truthfully, this shouldn’t be much of a surprise but traders have been so overwhelmed by reasons to be fearful this summer.

The financial media bears much of the blame. Every day we’ve been bombarded with panicked headlines: “Debt Ceiling! Greece! Default! Spain! Ireland!” Meanwhile, I’ve been quietly counseling investors to focus on the most important word, “Earnings!” So far, the earnings have been quite good. It’s still early but earnings growth for this quarter is running at 17%, and 86% of the companies have topped Wall Street’s estimates. As I said in last week’s CWS Market Review, this earnings season may be an all-time record.

So much of successful investing is nothing more than tuning out the short-term noise and concentrating on fundamentals. Remember, it was only a month ago that Oracle ($ORCL), one of the stocks on our Buy List, dropped 4% on a good earnings report. Since then, the stock has rallied and is higher now than before the earnings report (as of Thursday’s close). Jos. A. Bank Clothiers ($JOSB) has also gained back much of what it lost after it missed Wall Street’s estimate by the frightening amount of one penny per share.

I’m very pleased to see renewed strength in the financial sector. On Thursday, the financials had their best day of the year. Since JPMorgan Chase ($JPM) reported earnings earlier this month, the stock is up nearly 7%. I’m also happy to see AFLAC ($AFL) showing a little life. Their earnings are due out this Wednesday and I’m expecting very good news. I’ll have more on that in a bit.

Between Tuesday and Thursday of this week, the S&P 500 rallied nearly 3%. We’re now within striking distance of our April 29th high of 1,363.61. If we were to break that, we would set a new three-year high for the stock market. The fact is that the metrics continue to lean heavily towards equities. Bloomberg noted that return-on-equity for the S&P 500 is running at 24% while borrowing costs are running at 3.61%. That’s stunning. This wide spread will probably lead to more M&A activity and you can be sure that that will help the small-stock and value sectors.

Let’s recap some of our recent earnings reports from our Buy List.

First up is Stryker ($SYK). After the close on Tuesday, the company reported earnings of 90 cents per share which matched Wall Street’s forecast. Stryker also reaffirmed its full-year forecast of $3.65 to $3.73 per share. Despite what I thought were good numbers, traders brought down the stock by 3.8%. The problem is that sales of orthopedics weren’t as strong as analysts predicted. This is to be expected since these are pricey procedures and the recession is still hurting many folks. However, I’m not at all concerned. Stryker continues to be a very compelling buy.

On Wednesday morning, Abbott Labs ($ABT) reported quarterly earnings of $1.12 per share. That makes for seven quarters in a row that Abbott has beaten Wall Street’s forecast by a penny per share. The best news is that the company raised its full-year earnings forecast. The previous EPS range was $4.54 to $4.64, and the new range is $4.58 to $4.68. True, it’s not a huge increase but it’s still good to see. The CEO said, “Abbott is well-positioned for a strong second half of the year as we remain on track for double-digit EPS growth in 2011.”

Shares of Abbott initially sold off on Wednesday morning, but they eventually gained much of it back. In fact, ABT isn’t too far from making a new 52-week high. Going by Thursday’s close, the stock yields 3.62%, which is pretty impressive considering that the dividend has grown by 128% over the past decade. This is another solid stock and I’m keeping my buy price at $54.

On Tuesday, Johnson & Johnson ($JNJ) reported Q2 earnings of $1.28 per share. Wall Street had been expecting $1.24 per share, and I thought it could have been as high as $1.30. The results were hampered somewhat by the sluggish economy and by generic rivals. JNJ also reiterated its full-year EPS forecast of $4.90 to $5. I would have liked to see the company raise guidance as ABT had. Even though they didn’t, I think they’ll have little trouble hitting their guidance. The shares have been pretty steady lately. Based on Thursday’s close, the stock yields 3.43%. JNJ is about as blue chip as you can get.

The coming week is going to be very busy for our Buy List. Reynolds American ($RAI) reports on Friday. Then on Tuesday, Ford ($F), Fiserv ($FSV) and Gilead Sciences ($GILD) report. AFLAC ($AFL) follows on Wednesday, and Deluxe ($DLX) reports on Thursday.

I’ll only make some brief comments here but you can check the blog for more details. Reynolds is expected to earn 71 cents per share which may be slightly too high. Still, they should show an earnings increase. The company has already said to expect full-year earnings between $2.60 and $2.70 per share and that seems very doable. Reynolds is already an 18% winner on the year for us. The stock currently yields 5.5% which makes it a very good buy.

Three months ago, AFLAC said to expect second-quarter operating earnings to range between $1.51 and $1.57 per share. Despite the problems in Japan and Europe, AFLAC should report very good numbers. My analysis shows earnings coming in between $1.60 and $1.65 per share. The company has been benefiting from favorable exchange rates. For the full-year year, the company sees earnings between $6.09 and $6.34 per share. That means AFLAC is currently going for less than eight times earnings. I don’t see why AFLAC isn’t at least $10 higher.

I’ll be very curious to see what Fiserv and Gilead have to say. Fiserv missed earnings last quarter, but they kept their full-year forecast unchanged. Gilead is an odd case because the last earnings report was a complete dud. The stock, however, has been doing very well lately and it just broke out to a new 52-week high. Even though Gilead’s earnings were poor, the stock was so cheap that it apparently limited our downside. Ford has had a lot of trouble this year, but the company seems to have righted itself. Wall Street currently expects Q2 earnings of 60 cents per share. My numbers say Ford can hit 70 cents per share.

That’s all for now. Be sure to keep visiting the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

-

Morning News: July 22, 2011

Posted by Eddy Elfenbein on July 22nd, 2011 at 7:30 amEarly Signs Show Positive Reaction to Greek Deal

Europe’s Biggest Banks Face $30 Billion Greek Writedown

After a Deal, Only More Challenges

Oil Tops $100 For First Time Since Early June

Frank Says Cutting Funds to Regulators Is ‘Worst of All Worlds’

Obama, Boehner Press for Broad Debt Deal

Venture Funding for Social Media Jumps in Q2

Antitrust Hurdles Seen for Merger of Drug Benefit Managers

Morgan Stanley Comes Up Golden

Microsoft 4Q Profit Climbs, Windows Revenue Dips

Express Scripts, Medco Bankers May Receive $120 Million

TomTom Hit by Shrinking Demand

Stone Street: Robert Schiller: A Lot of What Happens in Markets is Driven by Pure Stupidity

James Altucher: Life Tastes Best When You Eat What You Kill

Be sure to follow me on Twitter.

-

Flowers Foods +20,000%

Posted by Eddy Elfenbein on July 21st, 2011 at 2:02 pmI like to talk about little-known stocks that have done incredibly well for investors. Last June, I highlighted Flowers Foods ($FLO).

Now let’s look at some results. Thirty years ago, you could have picked up one share of FLO for about 17 cents (that’s adjusted for ten, yes ten, 3-for-2 splits). Today the stock is going for about $25 so that’s a gain of over 14,000% or more than 18% a year. That doesn’t include a dividend which usually yields between 2% and 4%.

Speaking of which, the company just raised its quarterly dividend by 14%, raising it from 17.5 cents a share to 20 cents a share. Going by the new dividend, the stock now yields about 3.2%.

In February, Flowers said that it expects 2010 EPS to increase by 10% to 15% over 2009’s total which came in at $1.38. That translates to a target of $1.52 to $1.59. They reaffirmed this guidance last month as well.

I don’t think Flowers is a take-it-to-the-bank buy right here, but I’d love to see it drop to around $20 a share. This is definitely one to watch.

What do I know? The stock never pulled back to $20, though in August it dipped below $23. From there, the stock surged. It split 3-for-2 last month and is currently at $23 again — meaning that’s a 50% gain in a little over a year. The stock also raised its dividend by another 13%. That brings the 14,000% that I mentioned last year to over 20,000% today.

Here’s a description of the company from Hoovers:

Look for Flowers Foods in your breadbox, not your garden. The company is one of the largest wholesale bakeries in the US. Flowers Foods produces, markets, and distributes fresh breads, buns, rolls, corn and flour tortillas, and sweet bakery goodies to retail food and foodservice customers in the western, southern, and northeastern US. The company’s brand names include BlueBird, Cobblestone Mill, and Nature’s Own. Flowers Foods makes snack cakes, pastries, donuts, and frozen bread products for retail, vending, and co-pack customers nationwide. It also rolls out hamburger buns for national fast-food chains. Building on its brand portfolio, Flowers Foods acquired Tastykake pastry maker Tasty Baking in mid-2011.

-

Larry Summers on Tech Valuations

Posted by Eddy Elfenbein on July 21st, 2011 at 11:39 amLarry Summers can be called many things. Dumb ain’t one of them. This is what he says of tech valuations:

If you look at the price earnings ratio for technology companies relative to the price earnings ratios for all industrial companies, you take that ratio, PE technology divided by PE industrial, you can plot that ratio over the last 40 years, and it is at the lowest point that it’s ever been.

This is what he has to say of his portrayal in the movie, The Social Network:

One of the things you learn as a college president is that if an undergraduate is wearing a tie and jacket on Thursday afternoon at three o’clock, there are two possibilities. One is that they’re looking for a job and have an interview; the other is that they are an asshole.

(Via Arnold Kling)

-

Buy List Earnings Calendar

Posted by Eddy Elfenbein on July 21st, 2011 at 11:27 amHere’s a look at some of the upcoming earnings reports for our Buy List stocks. I haven’t included Nicholas Financial ($NICK) or Leucadia National ($LUK) since they’re not currently followed on Wall Street.

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His